What does durable mean in power of attorney?

What is the advantage to executing a durable power of attorney?

What are the disadvantages of a durable power of attorney?

You will not have direct control over your agent's actions because he or she will have the authority to enter into transactions for you, without you being present.Jul 7, 2014

What three decisions Cannot be made by a legal power of attorney?

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

When is a power of attorney terminated?

A power of attorney generally is terminated when the principal dies or becomes incompetent, but the principal can revoke the power of attorney at any time . A special type of power of attorney that is used frequently is the "durable" power of attorney. A durable power of attorney differs from a traditional power of attorney in ...

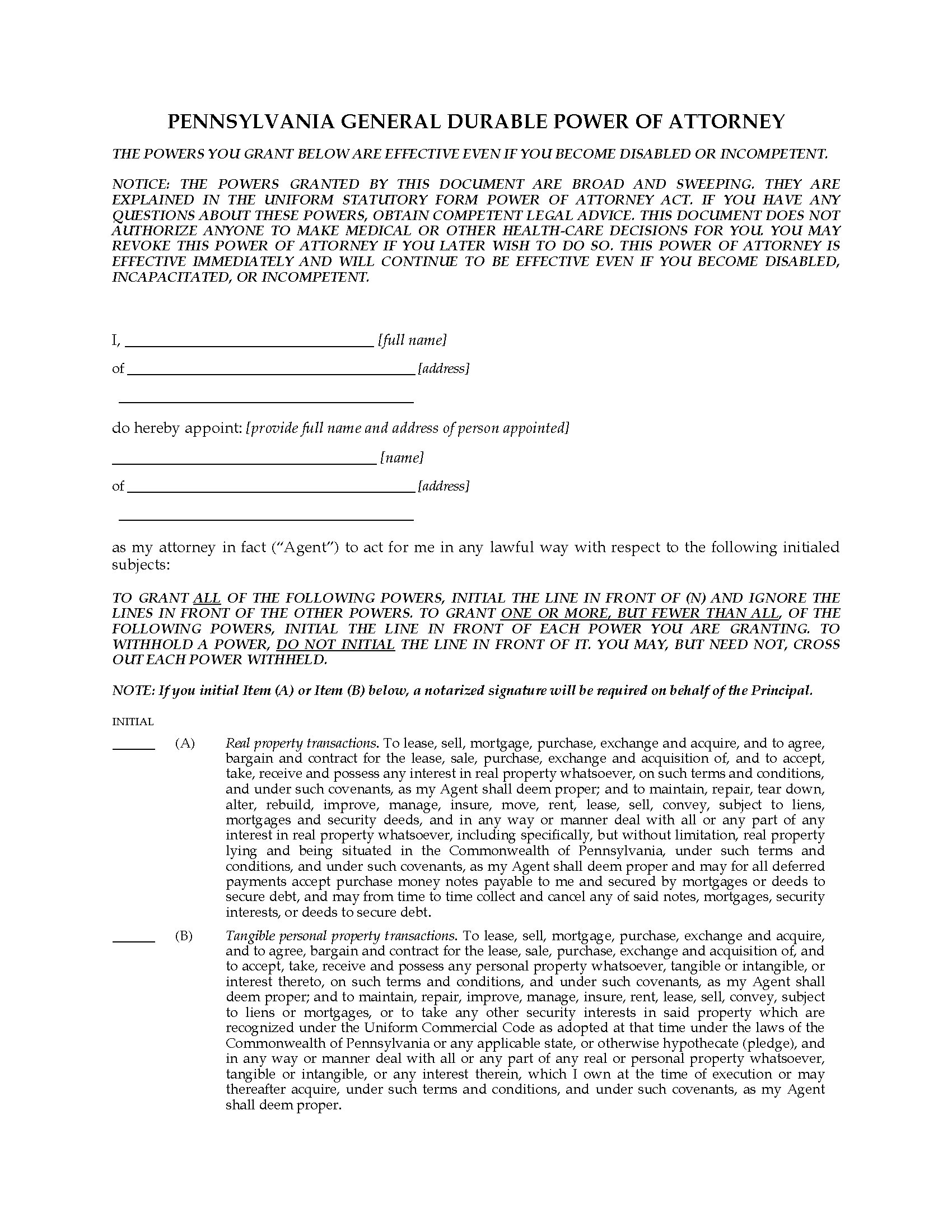

What is a durable power of attorney?

A special type of power of attorney that is used frequently is the "durable" power of attorney. A durable power of attorney differs from a traditional power of attorney in that it continues the agency relationship beyond the incapacity of the principal. The two types of durable power of attorney are immediate and "springing.".

Why are durable powers of attorney important?

Durable powers of attorney have become popular because they enable the principal to have her or his affairs handled easily and inexpensively after she or he has become incapacitated.

Can a principal appoint a power of attorney?

With a durable power of attorney, on the other hand, a principal can appoint someone to handle her or his affairs after she or he becomes incompetent, and the document can be crafted to confer either general power or power in certain limited circumstances.

What are the different types of advance directives?

Most states recognize four types of advance directives: living wills, durable power of attorney(DPA) for health care, do-not-resuscitate orders and organ donation. Your will be done: advance directives can help your family honor your wishes and lessen their grief in the worst of times.

What is a springing power of attorney?

With a springing power of attorney, the authority to act on your behalf only kicks in after a doctor certifies that you’re incapacitated. (One drawback to keep in mind: That extra step can sometimes create delays.)

What happens if you are unable to manage your own affairs?

So if you are unable to manage your own affairs for any reason—for example, you’re unconscious in the hospital, or you develop severe dementia—your agent can step in and pay your bills or file your taxes, deposit checks in your bank account, manage your investments, handle insurance issues, and make many other important decisions. ...

What is durable power of attorney?

In short, a general durable power of attorney is about your ability to have your property, legal affairs, business dealings and financial matters handled effectively, conveniently and quickly in the event of difficult or unforeseen personal circumstances.

Can a power of attorney be broad?

A power of attorney can be prepared in such a way so as to be as narrow or as broad as you would like. For example, an individual could sign a power of attorney granting to someone else authority to manage one particular piece of property for a limited period of time.

What is a power of attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.

What happens if you don't have a durable power of attorney?

If you haven't made durable powers of attorney and something happens to you, your loved ones may have to go to court to get the authority to handle your affairs. To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances.

What does a health care agent do?

Your health care agent will work with doctors and other health care providers to make sure you get the kind of medical care you wish to receive. When arranging your care, your agent is legally bound to follow your treatment preferences to the extent that he or she knows about them.

What is a financial power of attorney?

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf. Some financial powers of attorney are very simple and used for single transactions, such as closing a real estate deal.

Popular Posts:

- 1. what is a domestic attorney domestic attorney what is it

- 2. how much does higher counsel make of document review attorney

- 3. who is the district attorney of alameda county

- 4. how to know if your attorney took a settlement without your knowledge bcrc already has been paid

- 5. how to pay an of counsel attorney

- 6. who is ahmaud arbery attorney

- 7. what does "of counsel" mean for an attorney

- 8. what was scott pruitt attitude towards the epa as attorney general of oklahoma

- 9. who is the county attorney in owensboro ky

- 10. when a judge obliges willfully knowing the attorney fraudulently won a defaulted judgment violation