An Alabama tax power of attorney form 2848A is mainly for accountants and attorneys to file taxes on someone else’s behalf and to their benefit. The document is only valid for that tax year. It does not need to be notarized like the other forms and needs the signature of the person filing and the principal to be complete.

- Create the POA Using a Statutory Form, Software, or Attorney. ...

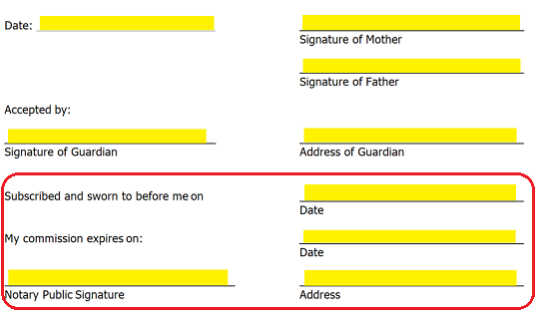

- Sign the POA in the Presence of a Notary Public. ...

- Store the Original POA in a Safe Place. ...

- Give a Copy to Your Agent or Attorney-in-Fact. ...

- File a Copy With the Land Records Office.

How do you obtain power of attorney in Alabama?

Execution: This power of attorney must be in writing, signed by the principal, dated and notarized. The Principal should sign the power of attorney in the presence of the notary or other person taking the acknowledgment. Recording: This Power of Attorney must be recorded to be valid in Alabama. Section 35-4-28.

What are the requirements to be a power of attorney?

Jun 02, 2021 · How To Get an Alabama Power of Attorney Form. You have two options for completing a power of attorney: hire an estate planning attorney or find a form and fill it out yourself. Findlaw offers state-specific power of attorney forms. Once you find your form, proceed with these steps: 1. Choose an agent

What are the new rules for power of attorney?

1 It is important to remember that a power of attorney may not preclude the need for the appointment of a guardian or conservator.2 However, the principal may nominate an individual to serve as guardian or conservator in the power of attorney and the Probate Court must appoint that nominee except for good cause or disqualification.3

How to become an attorney in Alabama?

An Alabama limited power of attorney lets allows someone to assign someone else, known as the agent or attorney-in-fact, to handle a SPECIFIC responsibility to the benefit of the Principal. Complete and have at least two non-blood related witnesses or a notary public view the signatures to make the form valid.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Does a power of attorney need to be recorded in Alabama?

The laws governing PoA forms vary in each state; however, in Alabama, your Power of Attorney will require notarization. If your agent will have the ability to handle real estate transactions, the Power of Attorney will need to be signed before a notary and recorded or filed with the county.

Can I do power of attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

What ID do you need for power of attorney?

Name documents: biometric residence card. national identity card. travel document. birth or adoption certificate or certificate of registry of birth.

How much does it cost to get power of attorney in Alabama?

How Much Does an Alabama Power of Attorney Cost? An estate planning attorney charges $150 to $400 an hour to draft and finalize a power of attorney. If you wish to pay less, fill out an online form and arrange for an attorney to review it for statutory compliance.Jun 2, 2021

Does a durable power of attorney need to be notarized in Alabama?

Power of Attorney and Health Care – General – Alabama Execution: This power of attorney must be in writing, signed by the principal, dated and notarized. The Principal should sign the power of attorney in the presence of the notary or other person taking the acknowledgment.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How do you obtain power of attorney?

Here are the basic steps to help a parent or loved one make their power of attorney, and name you as their agent:Help the grantor decide which type of POA to create. ... Decide on a durable or non-durable POA. ... Discuss what authority the grantor wants to give the agent. ... Get the correct power of attorney form.More items...•Jun 14, 2021

How long does it take for a power of attorney to be registered?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Jan 13, 2022

Who can be a certificate provider for lasting power of attorney?

Who can be a certificate provider for my LPA? A Certificate Provider must be independent of the application, not related to the donor or attorney(s), over the age of 18 and have known you well for at least two years.Aug 26, 2021

What is a power of attorney?

The power of attorney is an extremely flexible planning tool that allows an individual (the principal) to authorize another (the agent or Attorney-in-Fact) to deal with his or her property. Although the power of attorney is most often thought of in terms of a planning tool for the elderly or disabled, it should not be limited to this segment of society, but should also be considered by those who are young and in good health in planning for the possibility of incapacity or unavailability. Because of the possibility of incapacity, it is recommended that all powers of a attorney be made durable pursuant to Ala. Code §26-1-2 (1992).

Is the principal the client?

The drafting attorney must remember that the principal is the client, and it is the principal’s interest that must be protected. While a third party may approach you to create a power of attorney, this person is not the client.

What are the advantages of a power of attorney?

power of attorney has many advantages. It is an inexpensive, flexible planning tool and is easier to implement in comparison to the other options which afford similar powers over the principal’s property —conservatorships and trusts.1 It is important to remember that a power of attorney may not preclude the need for the appointment of a guardian or conservator.2 However, the principal may nominate an individual to serve as guardian or conservator in the power of attorney and the Probate Court must appoint that nominee except for good cause or disqualification.3

Can an attorney in fact make decisions for the principal?

An Attorney-in-Fact may make health care decisions for the principal if, in the opinion of the attending physician the principal cannot give directions to health care providers.18 Unless limited in the durable power of attorney, an Attorney-in-Fact make any health care decision that the principal could have made except decisions regarding (i) psychosurgery, (ii) sterilization, (iii) abortion (unless necessary to preserve the principal's life) or (iv) involuntary commitment.

What is the role of an attorney in fact?

As an agent, the Attorney-in-Fact must act in the principal’s best interest in dealing with the principal’s property . The following pronouncement from the Supreme Court of Alabama in Sevigny v. New South Federal Savings and Loan Association sets forth the agent’s obligations to the principal:

Can an attorney in fact delegate powers?

It may be appropriate to allow the Attorney-in-Fact the right to delegate his or her powers. This would allow the Attorney-in-Fact to have another act on his or her behalf if necessary (i.e., if the Attorney-in-Fact were out of town).

Does a power of attorney need to be reviewed?

It is recommended that the principal periodically review the power of attorney with their attorney to make sure that the power of attorney continues to meet the principal’s objectives and ensure that appropriate Attorneys-in-Fact are named.

What is an advance directive in Alabama?

An Alabama advance directive, which includes a medical power of attorney and a living will, which allows a person to handle another’s health care decision making in the chance the Principal cannot do so for themselves.

What is durable power of attorney?

The term “durable” refers to the designation that if the principal can no longer make decisions for themselves that their selected agent will be able to act on their behalf.

What is a power of attorney in Alabama?

An Alabama real estate power of attorney allows someone else to handle responsibilities related to their property. This is most commonly used when selecting an attorney to handle a real estate closing but may also be used to refinance or manage tenants on a property.

What is a 2848A?

An Alabama tax power of attorney form 2848A is mainly for accountants and attorneys to file taxes on someone else’s behalf and to their benefit. The document is only valid for that tax year. It does not need to be notarized like the other forms and needs the signature of the person filing and the principal to be complete.

What is the power of attorney act in Alabama?

The Alabama Uniform Power of Attorney Act governs the creation of power of attorney documents.

How old do you have to be to be an agent in Alabama?

The person to whom you give authority to manage your affairs is known as your "agent" or "attorney in fact.". The age of majority in Alabama is 19, so make sure that your designated agent is at least 19 years old.

What is a power of attorney?

A power of attorney is an important estate planning document. It authorizes a person to make decisions on your behalf, and can be drafted so that your agent can continue to make decisions about your finances and healthcare if you are no longer able to make those decisions yourself. There are several types of powers of attorney to consider.

How long does a power of attorney last?

For example, you can specify that the document authorizes your agent to handle a specific business transaction, and that the power expires after 3 days. Consider a durable power of attorney. A durable power of attorney lasts after you become unable to make decisions ...

When does a durable power of attorney end?

A durable power of attorney ends upon your death, or the death of your agent, if there is no successor agent. If your agent is your spouse, the document will be revoked if either of you file for separation, annulment, or divorce, unless the document states otherwise.

What is a power of attorney for health care?

A health care power of attorney authorizes your agent to provide or withhold medical care, including the withdrawal of life-sustaining treatment. You can also specify your wishes for end-of-life care in the document. A financial power of attorney authorizes your agent to manage your finances, write checks, and sell property on your behalf.

How to protect original documents?

You can keep the original or ask your attorney to keep it on file. Take care that your original will be safe in the event of a fire or flood.

What is Durable Power of Attorney?

Section 104 establishes that a power of attorney created under the Act is durable unless it expressly states otherwise. This default rule is the reverse of the approach under the Uniform Durable Power of Attorney Act and based on the assumption that most principals prefer durability as a hedge against the need for guardianship. See also Section 107 Comment (noting that the default rules of the jurisdiction’s law under which a power of attorney is created, including the default rule for durability, govern the meaning and effect of a power of attorney).

What is the purpose of the Uniform Power of Attorney Act?

One of the purposes of the Uniform Power of Attorney Act is promotion of the portability and use of powers of attorney. Section 106 makes clear that the Act does not affect the validity of pre-existing powers of attorney executed under prior law in the enacting jurisdiction, powers of attorney validly created under the law of another jurisdiction, and military powers of attorney. While the effect of this section is to recognize the validity of powers of attorney created under other law, it does not abrogate the traditional grounds for contesting the validity of execution such as forgery, fraud, or undue influence.

Popular Posts:

- 1. how to report spectrum to ny attorney general

- 2. how to find attorney bar number

- 3. what is the average price for a dui attorney in gwinnett county ga

- 4. texas attorney what to do when stopped by police

- 5. how to obtain an original will in iowa from a retired attorney

- 6. how to get a power of attorney legalized for brazil

- 7. in illinois what is an attorney in fact?

- 8. can i get power of attorney of my uncle who is incapacitated

- 9. how much does it cost for an attorney to set up an llc

- 10. who does a district attorney report to