Here are some of the powers you’re able to grant a financial POA to do for you:

- Collect retirement benefits

- Invest

- Log into financial accounts

- Manage real estate

- Operate a business

- Pay bills

- Pay medical expenses

- Pay taxes

- Purchase insurance

- Sell assets

What are the duties of the financial power of attorney?

What do I need to do next?

- Don’t panic. Do start reading. ...

- Figure out what you are in charge of. Make a list of the principal’s assets and liabilities. ...

- Protect the principal’s assets. Make sure the principal’s home is secure. ...

- Pay bills as necessary. ...

- Pay the taxes. ...

- Estate planning. ...

- Keep excellent records. ...

- Act in the principal’s best interest. ...

Why do I need a financial power of attorney?

Three Main Roles of a POA (Power of Attorney)

- Making decisions on the behalf of someone who has lost their mental capacity

- Handling legal and financial matters on behalf of the principal

- Making medical decision on behalf of the principal

Who needs a financial power of attorney?

Powers of attorney are very important, especially when an individual becomes incapacitated. If an individual becomes incapacitated and does not have a financial power of attorney, then a family member will need to file an application to be appointed as the loved one's guardian at the probate court in the county where the loved one was residing.

What is a general financial power of attorney?

A general (financial) power of attorney is usually used by people who wish to have someone manage their financial affairs on their behalf. These could be businessmen who are caught up with too much work or retirees who wish to enjoy retirement on other things.

What are the disadvantages of power of attorney?

What Are the Disadvantages of a Power of Attorney?A Power of Attorney Could Leave You Vulnerable to Abuse. ... If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ... A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.More items...•

What responsibility comes with power of attorney?

A general power of attorney allows the agent to act on behalf of the principal in any matters, as allowed by state laws. The agent under such an agreement may be authorized to handle bank accounts, sign checks, sell property, manage assets, and file taxes for the principal.

Can a power of attorney transfer money to themselves UK?

Can a Power of Attorney gift money to themselves (UK) or family? Yes, however, as one might expect, there are a number of rules which must be complied with and strict limits to observe if you have appointed either an attorney or a deputy.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

Can I withdraw money if I have power of attorney?

So, a property and financial Power of Attorney can give themselves money (with your best interests in mind). But you may be concerned about them borrowing money from you, or giving themselves a loan. The answer is a simple no. Your interests clearly aren't best served with someone borrowing money from your estate.

Can a POA transfer money to their own account?

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself. Most, if not all, states have laws against this kind of self-dealing. It is generally governed as a fraudulent conveyance (that is, theft by fraud).

Can I sell property with power of attorney?

A person given power of attorney over a property cannot sell the asset unless there is a specific provision giving him the power, the Supreme Court has held in a judgment.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a POA in estate planning?

Understanding Power of Attorney is key to setting up an Estate Plan that has all your bases covered. Having a Financial Power of Attorney (POA) in place ensures you’re establishing a way for your affairs to be managed when it matters most - when you can’t do it yourself.

Is a durable power of attorney the same as a living will?

A Durable Power of Attorney and a Living Will are similar in nature but have distinct differences. When you’re talking about POA in this sense, you are talking about Medical Power of Attorney (not financial). The main difference between the two follows.

Do you need a POA?

Determine need. Do you actually need a Financial POA? If you’re married and have joint assets, this may not always be necessary right now. Likewise, if you have a Living Trust holding your assets, and you’ve appointed a Trustee to act on your behalf, a Financial POA may not be a great need at this time. That said, a Durable Financial POA can still be a good idea, and they can be the same person as your Trustee.

Is it natural to choose a POA?

From the trust aspect, it probably seems natural to select a family member who is close to you. But sometimes the POA you choose actually isn’t the person closest to you, as emotions can become a factor and the responsibilities could be burdensome. At the end of the day, as long as you’re placing a person you trust in the role, you'll be more confident in your decision.

Does POA last after death?

Two last points - note that some states will automatically see a Financial POA as “Durable,” meaning it lasts even if you’re suddenly incompetent. Also, the role dissolves upon your death unless you’ve written in specific language noting otherwise elsewhere in your Estate Plan (such as your POA could then become Trustee of your Trust or Executor of your Will).

What is a financial power of attorney?

A financial power of attorney is just a document you need when you want to grant someone else the power to make money decisions for you. And it’s usually created alongside your will. This kind of POA is written specifically to let someone else act as your legal rep for financial matters. Much like other powers of attorney, ...

What is a financial POA?

Just as a medical POA only applies to medical choices someone makes for you, the financial POA extends no further than the right for someone else to make money decisions if and when you’re unavailable to do so yourself. (In case you’re wondering, you need both kinds of POA to have full protection.)

How to make a POA?

A number of things can make a financial POA kaput: 1 The death of the principal 2 The principal choosing to revoke the power at any time 3 A court ruling it invalid 4 The principal’s agent becoming unable to fulfill their duties as financial POA (this can be avoided by naming a successor agent in the document) 5 In some states, when the principal has both 1) named their spouse as the agent, and 2) later divorced their spouse 6 And generally speaking, if the principal becomes incapacitated unless the POA is worded to say that the agent’s authority should continue anyway

What is a POA in financial planning?

With a financial POA, your agent can keep everything moving smoothly with your money. Like most legal docs, the main purpose for creating a financial POA is to protect you and your family from a preventable legal battle.

When is a POA effective?

Effective only when a certain event happens. On the other hand, many people want to keep the option of making financial decisions for themselves for as long as possible. If you’d like to name one of your children or someone more distantly related to serve as your agent, creating a springing power of attorney is a great option. The event that would most often trigger a financial POA into action is if the principal became incapacitated. Hopefully that’s not something you or your family ever have to deal with, but it’s within the realm of possibility.

When to use POA?

The most common use for a financial POA is during a medical emergency. When you’re in a situation like that, your daily financial needs might not be top of mind. But do those needs just disappear because you’re in a hospital bed? Unfortunately, they don’t. Your bills still need to be paid, accounts need to be managed—like paying your rent or house payment and insurance premiums.

Can you name a child as a power of attorney?

If you’d like to name one of your children or someone more distantly related to serve as your agent, creating a springing power of attorney is a great option. The event that would most often trigger a financial POA into action is if the principal became incapacitated.

What Is a Financial Power Of Attorney?

A financial power of attorney (POA) is a legal document that grants a trusted agent the authority to act on behalf of the principal-agent in financial matters. The former is also referred to as the attorney-in-fact while the principal-agent is the person who grants the authority. This kind of POA is also referred to as a general power of attorney.

When does a power of attorney end?

A financial power of attorney letter is automatically extinguished upon the principal's death.

What is the authority of a POA?

The authority outlined in the POA can be fairly broad or, in some cases, restrictive, limiting the agent to very specific duties. Agents named in POAs are legally able to make decisions about the principal's finances, property, and/or medical health.

What is a limited POA?

A limited POA gives the agent very limited power and normally gives a specific end date for the agreement. For example, someone may appoint a family member or friend as a limited POA if they are not available to sign important paperwork themselves at a specific time. In other cases, this POA may give the agent the ability to make cash withdrawals from the bank for the principal. A limited POA is also a type of nondurable power of attorney.

What is POA in real estate?

This POA gives the agent the power to manage the financial life of the principal when that person is unable to do so . The agent can legally manage the principal's finances and property, make all financial decisions, and conduct all financial transactions that are within the scope of the agreement. The individual granted POA is limited to ...

When does a POA go into effect?

A springing POA only goes into effect once the principal becomes incapacitated and cannot make decisions on their own. In order to be effective, the document should outline the exact definition of incapacity so there is no confusion as to when the agent can begin acting on the principal's behalf.

How to make someone your financial agent?

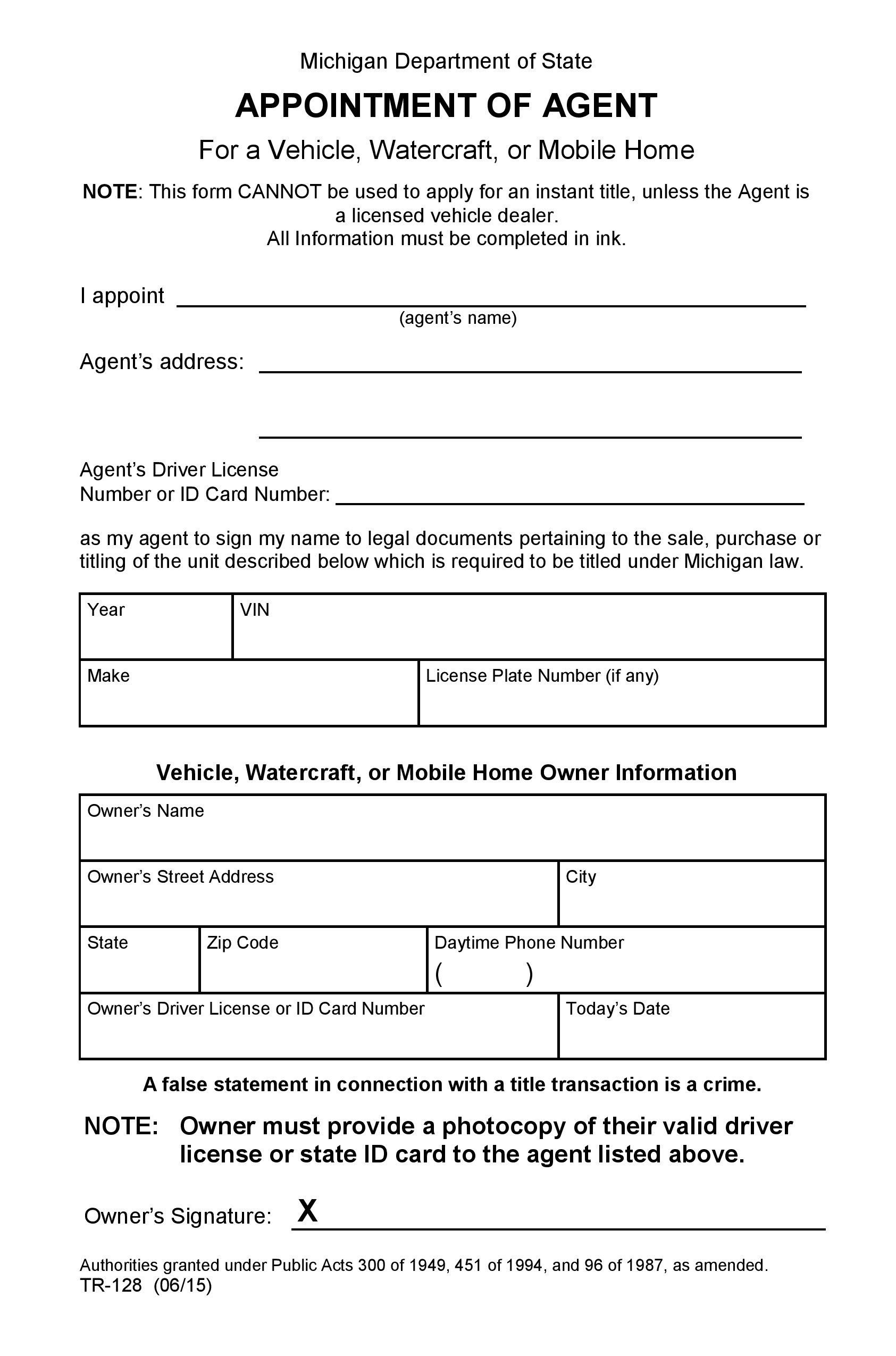

Most states have simple forms to fill out to make someone your financial agent. Generally, the document must be signed, witnessed, and notarized .

Financial Power of Attorney Explained in Less Than 5 Minutes

Jessica Walrack is a personal finance writer who has written hundreds of articles about loans, insurance, banking, mortgages, credit cards, budgeting, and general personal finance over the past five years. Her work has appeared on The Simple Dollar, Bankrate, and Supermoney, among other publications.

Definition and Example of Financial Power of Attorney

When an individual puts a financial power of attorney in place, they are permitting someone else to act on their behalf in financial matters. The person giving the power is called the “principal” while the person receiving the power is called the “agent” or “attorney-in-fact.”

How Financial Power of Attorney Works

If a person is in a situation where they want to assign financial power of attorney to someone they trust, they will need to find the power of attorney form that’s required by their state.

General Power of Attorney vs. Limited Power of Attorney

If you are assigning financial power of attorney to someone, you can decide how much authority they will have over your affairs. General power of attorney gives the broadest powers, where the agent will be able to pretty much do anything you can do.

When does a financial power of attorney end?

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of attorney for each other in case something happens to one of them -- or for when one spouse is out of town.) You should specify that you want your power of attorney to be "durable." If you don't, in most states, it will automatically end if you later become incapacitated.

What happens if you don't have a power of attorney?

If you don't, in most states, it will automatically end if you later become incapacitated. Or, you can specify that the power of attorney does not go into effect unless a doctor certifies that you have become incapacitated. This is called a "springing" durable power of attorney. It allows you to keep control over your affairs unless ...

What is a durable power of attorney?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

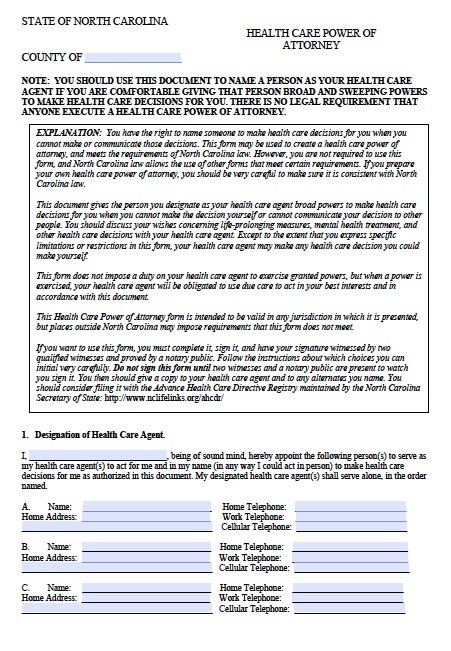

Where do you sign a power of attorney?

You must sign the document in front of a notary public. In some states, witnesses must also watch you sign. If your agent will have authority to deal with your real estate, you must put a copy of the document on file at the local land records office. (In two states, North and South Carolina, you must record your power of attorney at the land records office for it to be durable.)

What do you do with your money?

buy, sell, maintain, pay taxes on, and mortgage real estate and other property. collect Social Security, Medicare, or other government benefits. invest your money in stocks, bonds, and mutual funds. handle transactions with banks and other financial institutions. buy and sell insurance policies and annuities for you.

Can you revoke a power of attorney?

As long as you are mentally competent, you can revoke a durable power of attorney at any time. You get a divorce. In a handful of states, if your spouse is your agent and you divorce, your ex-spouse's authority is automatically terminated. In other states, if you want to end your ex-spouse's authority, you have to revoke your existing power ...

Can you give your power of attorney to someone after you die?

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your death, such as paying your debts, making funeral or burial arrangements, or transferring your property to the people who inherit it. If you want your agent to have authority to wind up your affairs after your death, use a will to name that person as your executor.

What Is Power of Attorney?

Yet, these essential tools enable aging adults and their families to create a solid plan for addressing future care needs and offer invaluable peace of mind.

What is POA in banking?

POA documents allow a person (the principal) to decide in advance whom they trust and want to act on their behalf should they become incapable of making decisions for themselves. The person who acts on behalf of the principal is called the agent. From there, it is important to distinguish between the two main types of POA: medical and financial.

What is POA in healthcare?

A financial POA gives an agent the ability to make financial decisions on behalf of the principal. It is common to appoint one person to act as an agent for both financial and healthcare decisions, but in some cases it may be wise to separate the two. Browse Our Free.

Why is POA important?

According to geriatric care manager and certified elder law attorney, Buckley Anne Kuhn-Fricker, JD, this provision is important because it gives a principal the flexibility to decide how involved they want their agent to be while they are still in possession of their faculties. For example, a financial agent could handle the day-to-day tasks of paying bills and buying food, while the principal continues to make their own investment and major purchasing decisions.

How to change a principal's will?

Change a principal’s will. Break their fiduciary duty to act in the principal’s best interest. Make decisions on behalf of the principal after their death. POA ends with the death of the principal (The POA may also be named the executor of the principal's will or if the principal dies without a will, the agent may then petition to become ...

How many states have a power of attorney?

According to the Uniform Law Commission, as of 2021, a total of 29 states have enacted versions of the Uniform Power of Attorney Act, including Alabama, Arkansas, Colorado, Connecticut, Georgia, Hawaii, Idaho, Iowa, Kentucky, Maine, Maryland, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin and Wyoming. Adoption of this legislation is pending in the District of Columbia and Massachusetts.

When was the POA created?

Created in 2006 by the Uniform Law Commission, this law aims to create universal default rules for POA contracts across states. It determines which powers are included in the document by default and which must be explicitly addressed in order to be bestowed on an agent.

What is a power of attorney?

A power of attorney is a legal document that allows you to name someone to make financial and legal decisions for you if you can’t. You might need someone to make financial decisions for you if an injury or other health emergency leaves you temporarily unable to make decisions on your own. You might need someone to manage your finances for you if you develop dementia. Or you might simply need someone to make a one-time financial transaction for you if you’re overseas and can’t access your accounts.

How much does a power of attorney cost?

The cost of these estate planning documents can be up to $1,000 – or more, depending on the complexity of your situation.

What is a durable POA?

Durable POA: A durable power of attorney can be general or limited . However, it remains in effect when you become incapacitated. For example, if you develop dementia, you would need to have a durable power of attorney to make financial decisions for you. Springing POA: This type of power of attorney springs into effect under certain circumstances ...

What is the problem with a springing POA?

The problem with a springing power of attorney is that your agent might not be able to act on your behalf without jumping through hoops – such as getting documentation from doctors – to prove you’re no longer competent. Even more troublesome is defining in a springing POA document at what point you are incapacitated.

How to make sure someone only uses that power once you’re no longer able to make financial decisions on your own?

If you want to make sure that person only uses that power once you’re no longer able to make financial decisions on your own, put the POA document some place safe and spell out under what conditions you’re comfortable with that person accessing the document.

What is a POA?

General POA: A general power of attorney gives someone broad powers – essentially the right to make any sort of financial decision if you are temporarily unable to do so yourself. It’s no longer valid if you become incapacitated or when you die. Durable POA: A durable power of attorney can be general or limited.

What is a limited POA?

Limited POA: A limited power of attorney gives someone the right to make only certain financial decisions for you or one-time transactions. For example, you might have a limited POA to close a real estate deal for you. General POA: A general power of attorney gives someone broad powers – essentially the right to make any sort ...

Why Do I Need A Financial Power Of Attorney?

The most common need for a power of attorney is potential incapacity. If you are incapacitated and cannot pay your bills or deal with your personal affairs, you need someone to take care of those tasks to transact in your name. Allowing someone to deal with your personal affairs will ensure that these affairs are taken care of when you are not able to perform certain tasks.

Why is a power of attorney important?

A power of attorney is an important legal document that offers powerful protection for you. Because it grants so much authority to another person, it is important that you choose your agent, the powers they will be granted, and the details of your power of attorney very carefully.

When Does a POA Take Effect?

This depends on your state and your document. Each state has different POA laws. In some states, it may be at the time of incapacity. In other states, it may be upon signing. Check your local laws to determine which it is, then make sure your document is tailored to begin at the time you want.

When Does a POA End?

Generally, POAs run until the time of death. But once again, POAs can be limited to your specific needs and revoked at any time (as long as you are legally competent to revoke legal documents ).

What is a financial POA?

Most often, the term financial power of attorney is referring to a full financial power of attorney, sometimes called a durable power of attorney or power of attorney for finances , a document that allows a person to transact personal business on someone else’s behalf. Generally, a financial POA allows a person to allow another to “step ...

What is a POA?

Generally, powers of attorney (POA) are very flexible documents that allow someone to give another person “power” over a certain task or tasks. These documented powers of attorney can be shaped in many ways.

Can you be incapacitated and still have bills?

If you have bills, finances, and responsibilities, yes. If you are temporarily or permanently incapacitated, this allows a person of your choosing to handle your finances and day-to-day personal business.

Popular Posts:

- 1. in what section of a closing disclosure should an attorney fee be disclosed

- 2. how to get ex to pay attorney fees

- 3. should i get an attorney when accepting a job engineer

- 4. what is the difference between durable power of attorney and power of attorney in missouri

- 5. man who killed two district attorney

- 6. who is the us attorney general 2015

- 7. what is the ace attorney anime on

- 8. how do i file complaint against attorney in nc

- 9. how do i find an attorney near st francis, kansas who helps people get on medicaid?

- 10. where is the attorney general