An agent with a valid power of attorney for health care may be able to:

- Decide what medical care the principal receives, including hospital care, surgery, psychiatric treatment, home health care, etc. ...

- Choose which doctors and care providers the principal uses.

- Determine where the principal lives. ...

- Dictate what the principal eats.

- Choose who bathes the principal.

Full Answer

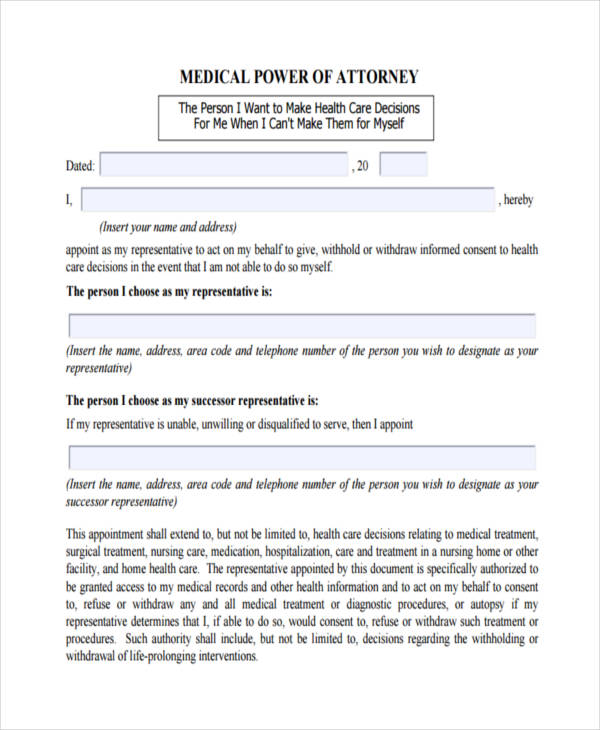

How to establish a medical power of attorney?

Jul 09, 2021 · Medical Power of Attorney allows an agent to make medical decisions for the principal should the principal be unable to... Directive to Physicians (aka living will) proactively tells doctors if the principal wants to receive artificial life... Global HIPAA Release permits a Medical Power of ...

Why do I need a medical power of attorney?

Oct 17, 2018 · The Responsibilities of Medical Durable Power of Attorney for the Elderly. By Larissa Bodniowycz, J.D. A durable medical power of attorney (POA) allows a person to appoint someone to make health care decisions on their behalf if they are unable to make the decisions for themselves. The responsibilities in this situation for an elderly person are the same as the …

Why do you need medical power of attorney?

A medical power of attorney enables you to designate a person to act as your health care agent. The agent is also known as a medical proxy, patient advocate, attorney-in-fact, or health care surrogate. This individual will be in charge of making medical decisions on your behalf when you can no longer do so yourself.

How do I create a medical power of attorney?

Mar 03, 2020 · What are the Responsibilities of a Healthcare Power of Attorney. Someone that is appointed as a healthcare power of attorney will be responsible for a person’s medical and health decisions if they become incapacitated. Some healthcare power of attorney documents will layout specific details for how the individual would like care administered.

What is a durable power of attorney?

A durable power of attorney form appoints someone to make health care decisions for you. However, it does not eliminate the need for a living will or other advance directives. If you do not have a power of attorney, an advance directive will instruct your physician as to the degree of care that you desire. If you do have a power of attorney, an ...

How long is a power of attorney valid?

The health care power of attorney is only valid during your lifetime or until you revoke it . As long as you remain competent you can ...

What is a power of attorney?

A power of attorney is a legal document that grants one person (the agent) powers to act in another person’s (the principal’s) stead. The type of responsibilities an agent has depends on whether they signed a financial or medical power of attorney. Solve My Problem.

What is a POA?

A general POA allows the agent to act in the principal’s name on all matters as long as the state laws allow for it. The agreement ends automatically in case the principal becomes mentally incapable of making decisions for themselves. Durable POA. In most states, a POA is considered durable unless stated otherwise.

What is the duty of an agent?

According to the law in most states, an agent has a fiduciary duty to the principal. This means that the attorney-in-fact has to: Act solely in the principal’s best interest. Maintain accurate records and history of all principal’s financial transactions.

Is a POA durable?

In most states, a POA is considered durable unless stated otherwise. The responsibilities that an agent has must be clearly specified in the document. The agreement stays in effect even after the principal becomes physically or mentally incapacitated. Limited POA.

What are the duties of a power of attorney?

What Are the Duties of Power of Attorney? What Are the Duties of Power of Attorney? A power of attorney is a legally enforceable document that grants one person, the agent, the ability to act on behalf of another person, the principal, in specific matters ranging from health care to the management of personal property and finances.

What are the duties of an agent?

Through one or more powers of attorney, the principal can authorize an agent to manage numerous tasks, including entering into contracts, dealing with real and personal property, handling the principal's financial and tax affairs, and arranging for the principal's housing and health care. The agent's primary duty is ...

What powers does a principal have?

A principal may execute a limited power of attorney for a specific purpose, such as for the purchase or sale of property or handling a certain bank account. A principal can also grant an agent powers to make health care decisions on the principal's behalf.

What is a medical power of attorney?

What is medical power of attorney? A medical power of attorney is a legal document that names one person the health care agent of another person.

What is a living will?

A living will specifies end-of-life care instructions such as if someone wants to be kept alive via machinery. By law, medical personnel must follow the requests listed in a living will. If the document states that the patient does not want a blood transfusion, the doctors may not give the patient a blood transfusion.

What is a backup agent?

Agents who understand the wishes of the patient are better prepared to carry out the desired wishes than someone with a cursory knowledge of the person. Many people also choose a backup agent who steps in if the first appointee does not want to or cannot do the work.

Is planning for end of life care a good idea?

Although discussing topics like end-of-life care is uncomfortable for some people, planning in advance for medical care is a good idea. It ensures that people receive the type of care they want and that no one violates their wishes by forcing them to undergo treatments they know they don’t want.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

Popular Posts:

- 1. how to register general power of attorney

- 2. what does a dui attorney do

- 3. who was trumps former attorney general

- 4. what law firm does susan piel attorney

- 5. what constotutes practice of law in california out of state attorney

- 6. how many latino attorney are in va

- 7. how do i remove an attorney from my case wisconsin

- 8. how do you get power of attorney , without a lawyer, i dont have the money

- 9. what do i do if my attorney did not file my dismissal

- 10. what is the five things to check on the military id for a power of attorney