The most common power of attorney types are:

| Type of Power of Attorney | Details |

| General POA | A general POA allows the agent to act in ... |

| Durable POA | In most states, a POA is considered dura ... |

| Limited POA | An attorney-in-fact who signed a limited ... |

| Springing POA | A springing POA comes into effect when o ... |

Why should I appoint a power of attorney?

· According to s.19, the underlying principles and philosophies an attorney must adhere to are to: Act honestly and in good faith, Exercise the care, diligence and skill of a reasonably prudent person, Act within the authority given in the enduring power of attorney and under any enactment, and Keep ...

Why should I have a power of attorney?

5 rows · Financial Responsibilities of a Power of Attorney Agent. An agent that signed a financial POA ...

What can a person with power of attorney do?

· A financial power of attorney can have the authority to perform some or all of these tasks: Pay everyday expenses for you and your family with your assets Maintain, pay taxes on, sell, buy, and mortgage real estate and other property Collect government benefits including Medicare, Social Security, ...

What is power of attorney and how does it work?

· In general, the law provides that a Power of Attorney owes a fiduciary duty to the principal to act solely within their best interests. In addition, the statute provides that the Power of …

When is Updating My Estate Plan Important?

Once you have gone through the entire process of creating an estate plan, there are important dates that you must keep in mind moving forward. You...

What is Elder Law?

Many people may not understand what elder law is or even know that they are looking for its services. Elder Law is a legal term used that covers a...

Who should have an estate plan?

Estate Planning is not only for retired and older individuals or for people with a large estate or large house, it is for everyone! Unfortunately,...

What is an enduring power of attorney?

The enduring power of attorney agreement gives the appointed attorney the abilities of a power of attorney in the case that the person becomes incapable of doing so. If the person never becomes mentally incapable, the power of attorney agreement essentially does nothing.

What is a POA?

As people get older, it is generally recommended that they appoint a power of attorney (POA). Without fully understanding the extent of the duties and responsibilities, people often accept the role, intending to be as helpful as possible during difficult times in their loved one’s life. Generally speaking, the power of attorney is responsible for making financial and legal decisions on the person’s behalf, in the case where they become incapable of doing so themselves. Usually, the attorney can make any financial or legal decision the person could have made themselves. Before accepting the role of the Power of Attorney, it is important to understand the role (what you might be expected to do) and the rights you have available to you as the person’s attorney.

What is the job of a prescribed record?

Keep prescribed records and produce the prescribed records for inspection and copying at the request of the adult.

Can a power of attorney make a will?

The power of attorney is sometimes in a position where they must do a lot of the estate planning for the incapable person and often times this means gift giving before their death. It’s important to understand that a power of attorney does not have any authority to make a will or change an existing will on the incapable person’s behalf, though the attorney can handle some estate related financial tasks.

Can an adult invest in power of attorney?

Unless the enduring power of attorney states otherwise, invest the adult’s property only in accordance with the Trustee Act;

Is it hard to have a power of attorney?

In the end, the role of a power of attorney can be a difficult task at times. It can be stressful managing one’s own financial and legal affairs, let alone a second person’s. If you are unclear of the role/responsibilities of a power of attorney, contact an experienced estate lawyer today. We can help ensure that you are properly prepared to take on the position as a person’s power of attorney.

Can an attorney resign as a power of attorney?

In some cases, the attorney no longer wishes to continue in this position as the person’s attorney. At any time, the attorney is able to resign as the power of attorney and relieve themselves of all the duties of the power of attorney. To do so, a letter of resignation must be given to the person and any other people acting as a power of attorney.

What is a power of attorney?

A power of attorney is a legal document that grants one person (the agent) powers to act in another person’s (the principal’s) stead. The type of responsibilities an agent has depends on whether they signed a financial or medical power of attorney. Solve My Problem.

What is a POA?

A general POA allows the agent to act in the principal’s name on all matters as long as the state laws allow for it. The agreement ends automatically in case the principal becomes mentally incapable of making decisions for themselves. Durable POA. In most states, a POA is considered durable unless stated otherwise.

How long does a POA last?

A springing POA comes into effect when one or more physicians determine that the principal is incapacitated. It lasts until it’s revoked or the principal dies

What happens if an agent fails to do their job as a fiduciary?

In case the agent fails their job as a fiduciary, they may be prosecuted both civilly and criminally.

Can you refuse to sign a POA?

Being an agent is not an obligation, so you can refuse to take on POA-related responsibilities. Anyone who wants to be appointed as an attorney-in-fact needs to consider whether they’re available and ready for that sort of duty before signing the POA document.

Is a POA durable?

In most states, a POA is considered durable unless stated otherwise. The responsibilities that an agent has must be clearly specified in the document. The agreement stays in effect even after the principal becomes physically or mentally incapacitated. Limited POA.

What is the power of attorney?

A grant of power of attorney legally gives a person the authority to perform acts for another person in business dealings, legal matters and other issues. The person who is authorizing the other individual to act on his behalf is known as the principal.

What is a power of attorney for a health care provider?

The health care power of attorney is useful if a principal is under anesthesia while undergoing surgery, rendered comatose or mentally incompetent. The principal's voice can still be heard and her wishes and preferences regarding her health care can be carried out as she desires.

What does a principal agent do?

The principal may also require the agent to enter into contractual agreements, handle government benefit issues, file federal tax returns or make transfers to irrevocable trusts. The agent is basically authorized to oversee and act on a range of affairs in the principal's absence.

What is an authorization?

Authorization can be used for any number of reasons; common uses are: to handle business or financial transactions, act on estate planning issues or collect debts. Typically, the power is granted only for a short period of time to complete a specific act.

Can a power of attorney express wishes?

Some states allow the principal to express her choice concerning life-sustaining procedures. A provision of the health care power of attorney is more effective than the living will, which only permits a person to express her "wish" regarding life-sustaining procedures.

Who is the person who authorizes the other person to act on his behalf?

The person who is authorizing the other individual to act on his behalf is known as the principal. Other names are donor or grantor. The individual who receives the power to do something on the part of another person is called the agent, or attorney-in-fact. It is not necessary for the person to be a lawyer.

Can a power of attorney be revoked?

When people go out of the country for an extended period of time, or are bedridden, they often bestow power of attorney on a son, daughter or close friend. When the power of attorney is no longer required, it can be revoked with a document called the Revocation of Power of Attorney. There are a few types of responsibilities of power ...

Why do you need a power of attorney?

Appointing a power of attorney is essential when planning for the possibility that you may become incapacitated and need a trusted agent to manage your affairs. The power of attorney legal documents can grant broad authority to one or more agents to transact business or make medical decisions based on your behalf.

What to consider when appointing a power of attorney?

When appointing a power of attorney, the agent you select is a personal decision. There are things to consider, such as if your adult children are trustworthy and mature in handling finances and medical decisions on your behalf. Some adult children move away or lose touch and are not necessarily suitable candidates simply because they are your children. You may select a contemporary friend who becomes disabled themselves or pre-deceases you, so you must have a backup agent in the documentation. Always make the decisions regarding your power of attorney selection while you are in good mental and physical health.

What states do power of attorney end in?

Take note that if your spouse is your power of attorney, this designation does not automatically end when you finalize a divorce between you unless you live in these twelve states: Alabama, California, Colorado, Illinois, Indiana, Kansas, Minnesota, Missouri, Ohio, Pennsylvania, Texas, Washington, or Wisconsin.

What happens if a power of attorney fails to keep records?

As a result, he/she could be found liable to the principal or other parties for the full value of the unsubstantiated transactions. This could be disastrous to a person who acted as a Power of Attorney, however, failed to maintain accurate books and records. This may result in substantial liability to either the Estate of the principal who may have passed away, the principal himself, or other interested parties .

Is a power of attorney a duty?

As such, the duty of account of a Power of Attorney is essential and cannot be taken lightly.

What is a power of attorney?

A power of attorney is a legal document that allows a person, the agent, to act on behalf of the person who signed the power of attorney, who is also known as the principal. These documents do not grant unlimited powers to the agent.

What is the purpose of picking a power of attorney?

Picking the proper agent is an important consideration when preparing your power of attorney documents. After all, the agent will have an important responsibility to ensure that you are taken care of when you can no longer take care of yourself. Often, people will select a family member – a sibling, an adult child or a grandchild – ...

What is the role of a health care agent in a power of attorney?

An agent in a health care power of attorney document has the duty to act responsibly towards their principal’s health wishes. Even if the parties have different moral stances, the agent’s actions must align with the principal’s wishes. The health care agent also determines when to pull the plug. You can give your health care agent guidance by signing a living will.

What is a mental health power of attorney?

A mental health power of attorney allows the agent, in conjunction with mental health providers, to determine whether the principal should be admitted to a psychiatric medical facility.

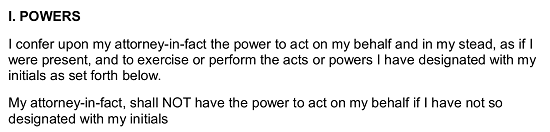

What is the duty of an agent?

The most important duty of an agent is the duty to act, and to continue to act, with the best interests of the principal in mind and in accordance with the principal’s wishes. The agent may not use the principal’s bank account or other financial assets purely for his or her own gain. The agent has a fiduciary duty to act only on behalf ...

What to discuss with an estate planning attorney?

When you meet with your estate planning attorney, discuss the specific authorities, duties, and limitations that your agent will be bound to when the documents go into effect. Have a serious conversation with your future agent so they understand your wishes and the responsibilities they are agreeing to take on.

Can an agent draw from a health care power of attorney?

The agent is allowed to draw a reasonable amount of funds from the account to compensate him or herself for the time and efforts spent managing the principal’s accounts. However, the principal’s bank account is not the agent’s personal bank account. An agent in a health care power of attorney document has the duty to act responsibly ...

Why is a power of attorney important?

Power of attorney is essential in the event that you're incapacitated or not physically present to make decisions on your own behalf. Learn more in our in-depth guide.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

When do POAs take effect?

Some POAs take effect immediately after they're signed, and others only kick in after you're incapacitated.

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

Is a power of attorney binding?

No power of attorney document is legally binding before it's signed and executed according to the laws of your state. This means that no agent can make decisions on your behalf before the POA document goes into effect. You must also be of sound mind when you appoint an agent. You can view more about the creation of a power of attorney in the infographic below.

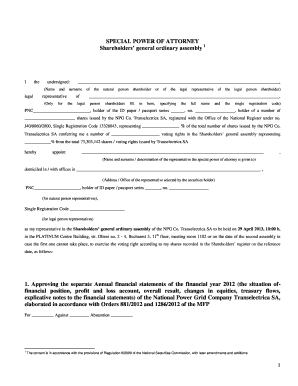

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

What happens if you don't have a power of attorney?

If you don’t have a medical power of attorney and become incapacitated, your health care providers need to act according to your state laws. In most states, this means that a spouse or a close family member will be called in to make decisions on your behalf while consulting with doctors.

Can a power of attorney be used in a medical situation?

A medical power of attorney can be used in any medical situation, not only in end-of-life circumstances. It also goes by other names, such as a health care proxy (note that some states recognize subtle differences between these documents ).

Is DoNotPay a good power of attorney?

If you are looking for a simple and budget-friendly way of creating a medical power of attorney, DoNotPay is the right choice. Unlike advance directive forms you can find online, our app will generate a rock-solid document that abides by your state laws and includes the instructions you provide.

What is a power of attorney?

A Power of Attorney is a written document by which an individual (the grantor) appoints someone (the Attorney) to act on their behalf concerning financial and/or personal care matters.

What can a professional do for a grantor?

A professional can work with you to ensure that the grantor’s investments are managed with the degree of care, skill and diligence required. They can: Assist you with customized asset allocation appropriate to the circumstances Work with you to develop a viable investment policy statement Keep accounts of all transactions

Do grantors know the duties of an attorney?

Grantors are sometimes not aware of the extensive duties involved for the Attorney. On the other hand, Attorneys can be surprised by the extent of what they must undertake . In some cases, they have accepted not anticipating that the Power would ever be activated.

Popular Posts:

- 1. attorney who writes poa hastings ne

- 2. how to find a cps attorney san joaquin county

- 3. who is the states attorney of cook county in illinois

- 4. durable power of attorney how long does it las

- 5. who has power of attorney if incapacitated

- 6. which organization do you file a complaint to about attorney

- 7. which case granted citizens’ rights to an attorney in all felony cases? quizlet

- 8. how much $ for attorney in virginia

- 9. recovering attorney fees in a divorce when the respondent refuses to cooperate

- 10. what should an attorney do to prepare for court trial for eviction of tenant