Eligibility Requirements for Using a Power of Attorney

- The lender obtains a copy of the POA.

- The name (s) on the POA match the name (s) of the person on the relevant loan document.

- The POA is dated such that it was valid at the time the relevant loan document was executed.

- The POA is notarized.

- The POA must reference the address of the subject property.

Why should I have a power of attorney?

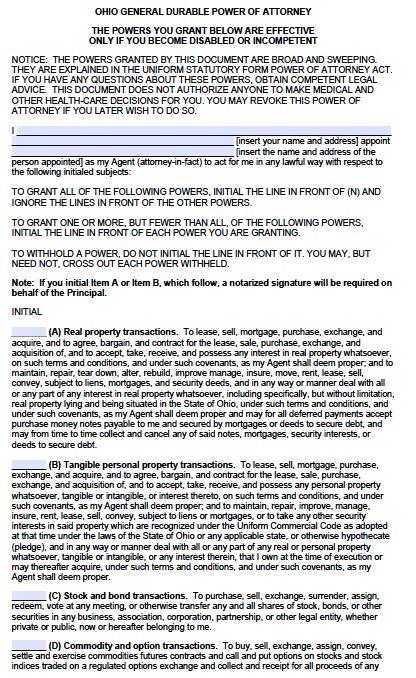

An important part of lifetime planning is the power of attorney. A power of attorney is accepted in all states, but the rules and requirements differ from state to state. A power of attorney gives one or more persons the power to act on your behalf as your agent. The power may be limited to a particular activity, such as closing the sale of your home, or be general in its application.

What is the procedure for establishing power of attorney?

Oct 01, 2021 · A California POA can only be created by a principal who is 18 years of age or older. The principal must also have the legal capacity to enter into a contract. A general or limited POA must be signed by the principal and two witnesses or a notary.

What are the rules for power of attorney?

5 different types of power of attorney. A durable power of attorney. A DPOA (durable power of attorney) becomes effective right after you made your power of attorney and your agent signs it. A non-durable power of attorney. Medical Power of Attorney. A general power of attorney. Limited power of ...

What is reasonable compensation for power of attorney?

Apr 06, 2022 · Eligibility Requirements for Using a Power of Attorney *A borrower’s relative includes any person defined as a relative in this Guide, or a person who is a fiancé, fiancée, or in a legally recognized mutual relationship with the borrower (however denominated under applicable local law). Additional Conditions

When does a POA become effective?

A POA becomes effective upon your signing of the document. If you want it to become effective only later if/when you become incapacitated (a "Springing Power of Attorney"), you must define how you must be judged incapacitated and grant permission for physicians to pronounce you so.

What is a limited POA?

Limited or special POA forms which can be used for finances and tax returns, the buying / selling or managing of real estate, empowering your agent to buy/sell a vehicle, boat or motorcycle on your behalf; Medical POA; Revocation form, etc.

Can you name more than one agent?

The person you appoint as your Agent must be a legal adult. You can name more than one Agent but you must specify whether they must make the decisions: Jointly - Neither can act without agreement from the other (this can create practical and/or legal problems).

What are the requirements for a POA?

The legal requirements for POA witnesses are: They must be of legal age. They must not be related by blood, marriage, adoption or in childcare of either the Principal or Agent. The Agent can not sign as witness. The document must be notarized by a notary public or commissioner of oath.

Why do you need a power of attorney?

Another important reason to use power of attorney is to prepare for situations when you may not be able to act on your own behalf due to absence or incapacity. Such a disability may be temporary, for example, due to travel, accident, or illness, or it may be permanent.

What is a springing power of attorney?

The power may take effect immediately, or only upon the occurrence of a future event, usually a determination that you are unable to act for yourself due to mental or physical disability. The latter is called a "springing" power of attorney.

How long does a power of attorney last?

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

Who is Michael Douglas' wife?

Assume Michael Douglas appoints his wife, Catherine Zeta-Jones, as his agent in a written power of attorney. Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas. If you are ever called upon to take action as someone’s agent, ...

Can a power of attorney be revoked?

A power of attorney may be revoked, but most states require written notice of revocation to the person named to act for you. The person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact.". With a valid power of attorney, your agent can take any action permitted in the document.

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

Can an attorney in fact make gifts?

Gifts are an important tool for many estate plans, and your attorney-in-fact can make gifts on your behalf, subject to guidelines that you set forth in your power of attorney. For example, you may wish to permit your attorney-in-fact to make "annual exclusion" gifts (up to $14,000 in value per recipient per year in 2013) on your behalf ...

What is a power of attorney in California?

A power of attorney allows someone else to handle financial or healthcare matters on your behalf, and California has specific rules about types and requirements.

How old do you have to be to get a POA in California?

A California POA can only be created by a principal who is 18 years of age or older. The principal must also have the legal capacity to enter into a contract. A general or limited POA must be signed by the principal and two witnesses or a notary.

What is a POA?

A power of attorney (POA) gives someone you name the authority to handle legal or financial matters for you under specific circumstances. When you create a POA, you are called the principal, and the person you choose to act for you is called your attorney-in-fact or your agent.

How to complete a POA?

Keep the form in a safe place. Give a copy to your agent. For healthcare POAs, be sure to give a copy to your healthcare provider. Complet ing a POA gives you the peace of mind that someone can handle things for you if you are unable to do so. Ensure your loved ones and property are protected START MY ESTATE PLAN.

Can a POA be notarized?

If the POA gives your agent the right to handle real estate transactions, the document must be notarized so that it can be recorded with your county. The agent listed in the POA cannot be a witness to the document. The principal and two witnesses must sign a healthcare POA.

What is a general POA?

General POA. This is the broadest kind of POA and gives your agent the right to handle a wide variety of financial matters for you. Limited POA. This is sometimes called a specific POA. This is a very narrow POA that gives your agent the authority to act for you only in specific situations you list in the document.

What is a durable POA?

In addition to the types of matters the POA covers, when the POA will become effective can also vary. Durable POA. A general or limited POA can be durable, which means it goes into effect when you sign it and remains in effect until you destroy or revoke it. Springing POA.

What is a special power of attorney?

Some states call it a special power of attorney that will expire at a certain time or the specific task mentioned in the state form completed. States allow several limited power of attorneys to be made for different situations to grant different powers to agents on the principal’s behalf.

When does a DPOA become effective?

A DPOA (durable power of attorney) becomes effective right after you made your power of attorney and your agent signs it. It allows your agent to take control of your decisions and act on your behalf immediately when you become debilitated. For example, if you get paralyzed and unable to perform certain tasks, then your agent will take your financial and healthcare decisions for you. Every state allows DPOA to become effective after such a situation occurs.

What is a POA loan?

A power of attorney (POA) is a legal document giving one person (described below as the “agent”) the power to legally bind another person. Loans with documentation executed by an agent on behalf of the borrower under a POA are eligible for delivery to Fannie Mae if all requirements referenced in this Guide are met.

What is an affiliate title insurance company?

Affiliate of the title insurance company or its employee (including, but not limited to, the title agency closing the loan) Lender (or employee of lender) None. Property seller, or any person related to the property seller, including a relative or affiliate.

How does a POA work?

The lender obtains a copy of the POA. The name (s) on the POA match the name (s) of the person on the relevant loan document. The POA is dated such that it was valid at the time the relevant loan document was executed. The POA is notarized. The POA must reference the address of the subject property.

Do you have to include a POA in a loan?

In such cases, the lender must include a written statement in the loan file that explains that determination. Such written statement must be provided to the document custodian with the POA.

What is POA in mortgage?

The POA expressly states an intention to secure a loan not to exceed a stated amount from a named lender on a specific property. The POA expressly authorizes the agent to execute the required loan documents on behalf of the borrower. reaffirm their agreement to the execution of the loan documents by the agent.

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

What is a durable power of attorney?

You might also sign a durable power of attorney to prepare for the possibility that you may become mentally incompetent due to illness or injury. Specify in the power of attorney that it cannot go into effect ...

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

What is a fiduciary?

A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing. Someone who violates those duties can face criminal charges or can be held liable in a civil lawsuit.

How old do you have to be to get a power of attorney in Illinois?

The basic requirements for a power of attorney in Illinois for financial matters are that it must: For both financial and healthcare POAs, agents and witnesses must be at least 18 years of age. There are limitations as to who may be a witness.

What is a POA in financial terms?

A financial POA giving the agent broad powers to represent the principal in just about any matter is called a "general" POA. A "limited" or "special" POA is one that limits the agent's authority in some way, such as limiting it to a single transaction, a certain type of transaction, or to a limited amount of time.

What is a POA in Illinois?

Let's look at the state of Illinois requirements for granting Power of Attorney. A legal document called a power of attorney ( or POA) can assure that your financial and healthcare matters are taken care of in the event you can't be present to sign documents, or if you become incapacitated.

When does a POA end?

Traditionally, a POA ended if the principal became mentally incapacitated, and became effective as soon as it was signed. Under Illinois law, you can have a POA that continues in effect after incapacity (called a "durable" POA) or one that does not go into effect unless the principal becomes incapacitated (called a "springing" POA).

Popular Posts:

- 1. what has to be done to give someone power of attorney

- 2. what to write in a christmas card to an attorney

- 3. who is las cruces attorney general?

- 4. what is it like to be a foreclosure attorney

- 5. how to host ace attorney online server

- 6. what dies it mean staff attorney social security disability

- 7. my first time in court, what do i say+attorney

- 8. how much does closing attorney cost in illinois

- 9. who has more power the living will or the power of attorney

- 10. what are the primary roles of a defense attorney