Here are some of the state’s power of attorney requirements:

- The POA must be created in writing.

- The principal must be of sound mind and at least 18 years of age.

- One or more witnesses must sign the power of attorney form.

- A notary public must also witness the signing of the document.

- The POA does not go into effect without the agent's signature.

What is power of attorney (POA)?

A power of attorney allows you to choose who will act for you and defines his or her authority and its limits, if any. In some instances, greater security against having a guardianship imposed on you may be achieved by you also creating a revocable living trust. Who Should Be Your Agent? You may wish to choose a family member to act on your behalf.

What are the benefits of a general power of attorney?

Nov 25, 2003 · Power of attorney (POA) is a legal authorization that gives a designated person, termed the agent or attorney-in-fact, the power to act for another person, known as the principal. The agent may be...

What is the scope of an agent's power of attorney?

These may include but are not limited to any of the following: Managing real estate and businesses Paying bills Investing assets Filing taxes Collecting government benefits Handling legal matters Make medical decisions

What should I know before I create a power of attorney?

Dec 10, 2021 · Before you create a power of attorney, you should know your options and which ones your home state allows. Specific powers of attorney limit your agent to handling only certain tasks, like paying bills or selling a house, and generally on a temporary basis. General powers of attorney give your agent broad authority. They can step into your shoes and handle all your …

What are the three basic types of powers of attorney?

The three most common types of powers of attorney that delegate authority to an agent to handle your financial affairs are the following: General power of attorney. Limited power of attorney. Durable power of attorney.

What is the best power of attorney to have?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

What is principle in power of attorney?

The term for the person granting the POA is the "principal." The individual who receives the power of attorney is called either the "agent" or the "attorney-in-fact." Check whether your state requires that you use specific terminology.

What is the most common power of attorney?

We break down some of the most common varieties for you below.Durable power of attorney. ... Springing power of attorney. ... General power of attorney. ... Financial power of attorney. ... Medical power of attorney.Jun 11, 2021

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Mar 7, 2022

What are the disadvantages of power of attorney?

What Are the Disadvantages of a Power of Attorney?A Power of Attorney Could Leave You Vulnerable to Abuse. ... If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ... A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.More items...•Sep 4, 2018

How long can a power of attorney last?

Once an LPA has been validly executed, it will last indefinitely unless revoked by the donor, the attorney, the Court of Protection or by operation of law.May 25, 2021

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

Does power of attorney need to be notarized?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

Can a family member override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

What is a durable power of attorney?

You might also sign a durable power of attorney to prepare for the possibility that you may become mentally incompetent due to illness or injury. Specify in the power of attorney that it cannot go into effect ...

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

What is a fiduciary?

A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing. Someone who violates those duties can face criminal charges or can be held liable in a civil lawsuit.

When should a power of attorney be considered?

A power of attorney should be considered when planning for long-term care. There are different types of POAs that fall under either a general power of attorney or limited power of attorney . A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state.

Why do you need a power of attorney?

There are many good reasons to make a power of attorney, as it ensures that someone will look after your financial affairs if you become incapacitated. You should choose a trusted family member, a proven friend, or a reputable and honest professional.

Why does a power of attorney end?

A power of attorney can end for a number of reasons, such as when the principal dies, the principal revokes it, a court invalidates it, the principal divorces their spouse, who happens to be the agent, or the agent can no longer carry out the outlined responsibilities. Conventional POAs lapse when the creator becomes incapacitated.

What is Durable POA?

A “durable” POA remains in force to enable the agent to manage the creator’s affairs, and a “springing” POA comes into effect only if and when the creator of the POA becomes incapacitated. A medical or healthcare POA enables an agent to make medical decisions on behalf of an incapacitated person.

How to start a power of attorney?

A better way to start the process of establishing a power of attorney is by locating an attorney who specializes in family law in your state. If attorney's fees are more than you can afford, legal services offices staffed with credentialed attorneys exist in virtually every part of the United States.

Who is Julia Kagan?

Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance.

Why do parents need POAs?

Ask parents to create POAs for the sake of everyone in the family—including the children and grandchildren— who may be harmed by the complications and costs that result if a parent is incapacitated without a durable POA in place to manage the parent’s affairs.

What is a general power of attorney?

General Power of Attorney. The general power of attorney is a broad mandate that gives an agent a lot of power to handle the affairs of a principal. The agent or the person designated to act on behalf of the principal is charged with handling several tasks. The tasks include buying or disposing of real estate.

What is a POA?

Power of Attorney, or POA, is a legal document giving an attorney-in-charge or legal agent the authority to act on behalf of the principal. The attorney in charge possesses broad or limited authority to act on behalf of the principal. The agent can make decisions regarding medical care. HMO vs PPO: Which is Better?

When does a power of attorney lapse?

The power of attorney lapses when the creator dies, revokes it, or when it is invalidated by a court of law. A POA also ends when the creator divorces a spouse charged with a power ...

What is a POA in medical?

Medical or health care POA authorizes the agent to make decisions on behalf of the principal in case of a life-threatening illness. Most health POAs fall under the durable kind because they take into consideration the fact that the principal may be too sick to make their own decisions.

What is real estate?

Real Estate Real estate is real property that consists of land and improvements, which include buildings, fixtures, roads, structures, and utility systems. Property rights give a title of ownership to the land, improvements, and natural resources such as minerals, plants, animals, water, etc. or even entering into contractual relationships on ...

What are the duties of a power of attorney?

What Are the Duties of Power of Attorney? What Are the Duties of Power of Attorney? A power of attorney is a legally enforceable document that grants one person, the agent, the ability to act on behalf of another person, the principal, in specific matters ranging from health care to the management of personal property and finances.

What powers does a principal have?

A principal may execute a limited power of attorney for a specific purpose, such as for the purchase or sale of property or handling a certain bank account. A principal can also grant an agent powers to make health care decisions on the principal's behalf.

What are the duties of an agent?

Through one or more powers of attorney, the principal can authorize an agent to manage numerous tasks, including entering into contracts, dealing with real and personal property, handling the principal's financial and tax affairs, and arranging for the principal's housing and health care. The agent's primary duty is ...

What to do after signing a power of attorney?

After you sign it, you should immediately get a physician's statement that certifies that you were sound of mind when you created the power of attorney. It may also be wise to video record the signing of the document so that there is visual record of your competence.

How long does a power of attorney stay in effect?

A durable power of attorney immediately transfers power to the agent as soon as it is signed and stays in effect until the grantor revokes it or passes away.

How old do you have to be to get a power of attorney?

To create a power of attorney, the government requires that an individual must be an adult, meaning he or she is at least 18 years of age. The person must also be in sound mental capacity when he or she creates the power of attorney.

What is a power of attorney?

A power of attorney names a person who can act on your behalf; this person is called your “agent” or “attorney-in-fact.” Before you create a power of attorney, you should know your options and which ones your home state allows.

Who is Amanda Singleton?

Amanda Singleton is a recipient of CareGiving.com's national Caregiving Visionary Award and serves caregivers across their life span through her law practice. Follow her on Twitter and Facebook.

Can a durable power of attorney be used for health care?

Sometimes, medical decision-making is included in a durable power of attorney for health care. This may be addressed in a separate document that is solely for health care, like a health care surrogate designation. Some states recognize "springing" durable powers of attorney, which means the agent can start using it only once you are incapacitated.

What is a financial power of attorney?

When you are ill or incapacitated — either for the short- or long-term — you'll need someone to pay your bills, make investment decisions and handle other financial matters. This person is known as your agent. You will specify your agent and your wishes in a document called your financial power of attorney. There are several types of financial powers of attorney to consider:

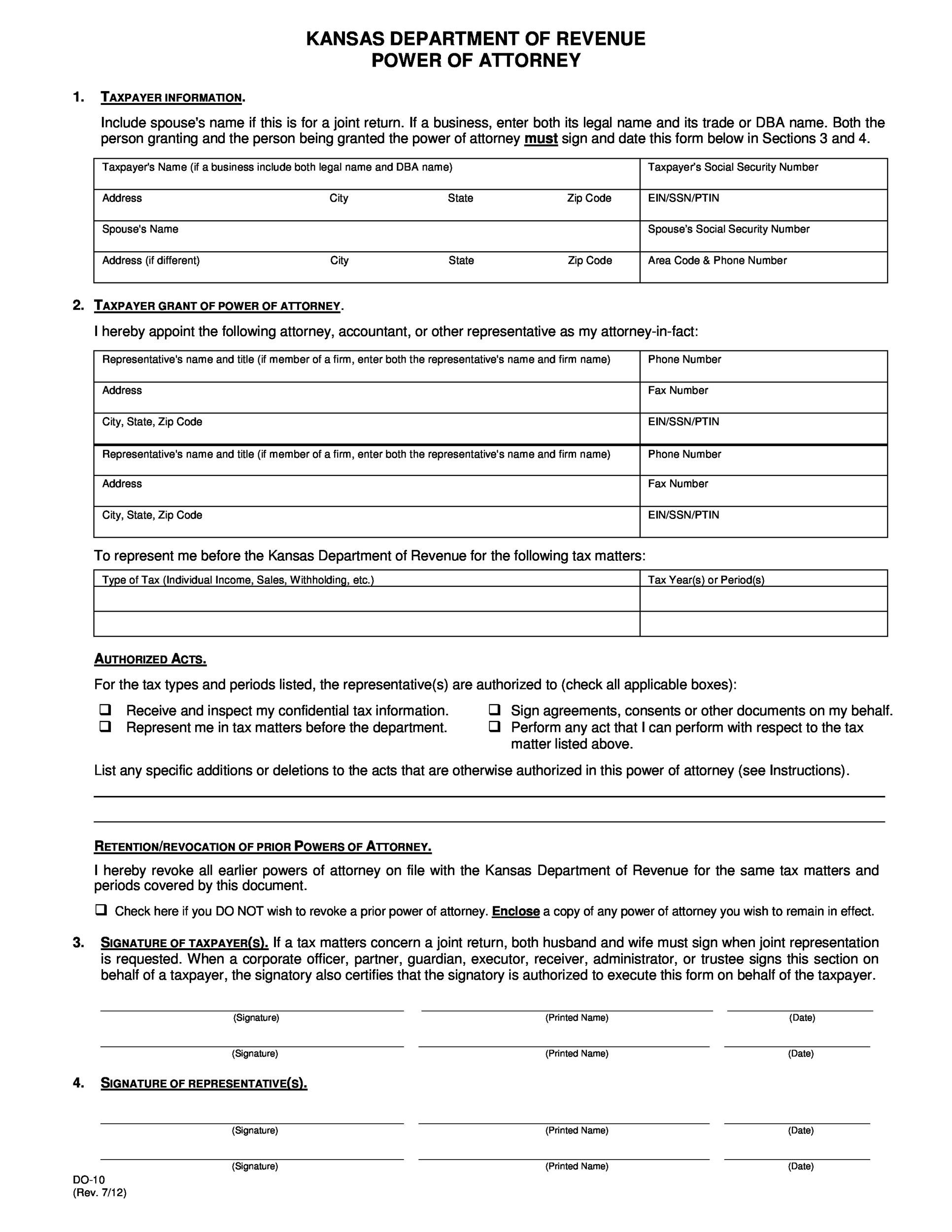

What is a power of attorney for IRS?

A tax power of attorney is for communications with the Internal Revenue Service (IRS). If you want someone — like your accountant — to act on your behalf in dealings with the IRS, you’ll need to fill out IRS Form 2848, Power of Attorney and Declaration of Representative. Note that this form only affects dealings with the IRS.

When to use limited power of attorney?

It's often used when you can't handle certain affairs due to other commitments or short-term illness.

What is advance directive?

An advance directive essentially combines a living will and a health care power of attorney into one document. This document will indicate your health care preferences as well as an agent to make additional health care decisions for you and is often the strongest option if you have strong preferences regarding end-of-life care as well as someone ...

Is it good to be proactive in life?

Being proactive in life is a good thing — especially if you’ve taken the time to prepare a will or trust to reflect how you want personal and financial matters handled after death.

Can you name someone as executor of a will?

If you want the same agent to manage your financial affairs after your death, you should name that person as the executor of your will. Your power of attorney will generally otherwise remain in effect unless you later revoke it.

What is a general power of attorney?

General power of attorney can also include insurance decisions and investment decisions, including those regarding your 401(k)or IRA. Special power of attorney: This gives specific authority to the agent.

What are the responsibilities of a POA?

They can handle business transactions, settle claims or operate your business.

Can a power of attorney make decisions?

Your agent can make decisions regarding your medical care if you are unconscious or otherwise unable to make your own choices. If you are going into a risky surgery where there is a chance you will end up in a coma, for instance, signing a healthcare power of attorney could be a good decision.

Is a power of attorney a legal document?

The Bottom Line. A power of attorney is a legal document that passes a person’s decision-making power to another person, known as an agent.

How to create a POA?

Creating your own POA is not difficult. Here are the steps you’ll need to take: Determine which type you need and choose your agent , which we discuss in more detail below. Buy or download the proper form. The form will depend on the state you are in, so make sure you are getting the correct one.

Can you change a will with a power of attorney?

The power of attorney (POA) authorizes another person to sign legal documents and otherwise act on your behalf in the eyes of the law. This power, however, does not apply to making changes to a will. It ends when you die — or earlier. It can never be invoked after your death.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

When does a power of attorney go into effect?

A springing (or conditional) power of attorney only goes into effect if a certain event or medical condition (typically incapacitation) or event specified in the POA occurs. For example, military personnel may draft a springing power of attorney that goes into effect when they’re deployed overseas.

What is POA in estate planning?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent. Related Resource: What is Power of Attorney?

What happens to a non-durable power of attorney?

Non-Durable Power of Attorney. A non-durable power of attorney expires if you become incapacitated or die. For instance, if you fall into a coma, your agents will lose any authority previously granted. After that, only a court-appointed guardian or conservator will be able to make decisions for you.

Can a power of attorney be restricted?

The powers granted under a general power of attorney may be restricted by state statutes. Who can legally override your power of attorney depends on which type of POA you select. 4. Limited (Special) Power of Attorney.

Types of Powers of Attorney

- 1. General Power of Attorney

The general power of attorney is a broad mandate that gives an agent a lot of power to handle the affairs of a principal. The agent or the person designated to act on behalf of the principal is charged with handling several tasks. The tasks include buying or disposing of real estateReal Es… - 2. Limited or Special Power of Attorney

An individual looking to limit how much the agent can do should choose limited or special power of attorney. Before signing to notarize a limited power of attorney, a person needs to be as detailed as possible about how much the agent should handle. If an individual is not clear what …

How Power of Attorney Works

- The principal can either download or buy POA templates. In the event the template is acquired through either one of the two methods, the principal should ensure they belong to the state of residence. POA documents are very important, and the principal should not assume that the documents acquired are of the correct kind. Verification of the POA documents is necessary bef…

Summary

- A power of attorney (POA) is an authority imposed on an agent by the principal allowing the said agent to make decisions on his/her behalf. The agent can receive limited or absolute authority to act on the principal’s behalf on decisions relating to health, property, or finances. A POA is common when a person is incapacitated and unable to make their own decisions.

Additional Resources

- CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™Become a Certified Financial Modeling & Valuation Analyst (FMVA)®CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today!certification program, designed to help anyone become a world-clas…

Popular Posts:

- 1. what do the women hide from the county sheriff and attorney in trifles

- 2. how much is to ask attorney for j-1 waiver application

- 3. how can an oklahoma doc inmate pay their attorney from their account

- 4. washington attorney general's office 1099 2016 when

- 5. how difficult is it to get power of attorney for friend in a coma

- 6. how many doctors need to sign for durable power of attorney in arkansas

- 7. how do you know if your attorney sucks

- 8. what is sufficient contemporaneous documentation attorney billing

- 9. how to contact robert meadows, attorney, vero beach

- 10. what term describes an attorney who works for a law firm?