Do you collect debt from your law firm clients?

Collecting debt from your law firm clients is not a pleasant task, however it may be vital to the sustainability of your law practice. By being proactive, many routine debt collection issues can be avoided, while more serious debt issues can be resolved in a prompt manner.

What are the laws for debt collection?

Debt Collection Laws. Although collectors are legally entitled to attempt to collect all owed debts, they are restricted in the methods they can employ by the Fair Debt Collection Practices Act. The law passed Congress in 1977 as an amendment to the Consumer Credit Protection Act of 1968.

When is a real estate attorney considered a debt collector?

Stated otherwise, if the purpose of an activity taken in relation to a debt is to obtain payment of the debt, then the activity is properly considered debt collection under the FDCPA. This holding, which is echoed in several recent opinions from the 3rd and 4th Circuits, places real estate attorneys squarely in the path of the FDCPA.

Can a debt collector say anything to get you to pay?

Some debt collectors will say or do anything to get people to pay them, whether the debt is legitimate or not. If a debt collector is contacting you, you should know that you have federal and state-protected rights. Don’t let a debt collector abuse you or scare you into paying money you don’t owe.

What does the Fair Debt Collection Practices Act prohibit?

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

What constitutes a false and misleading debt collection practice?

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

How do I respond to a collection letter from a lawyer?

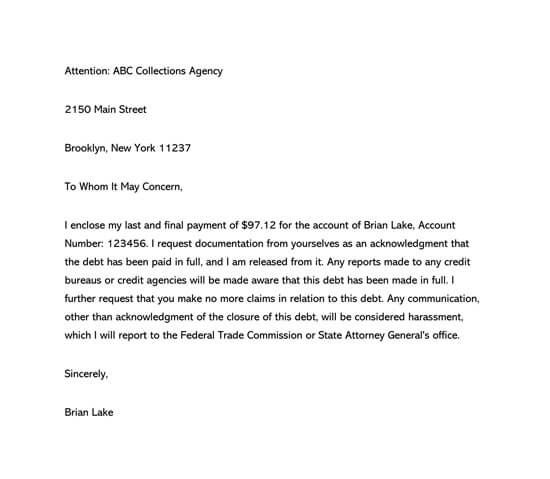

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Which action may a debtor take if a debt collector violates the law?

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

What are unfair collection practices?

Unfair practices are prohibited Deposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Which of the following is considered an unfair debt collection practice?

Misrepresentations about the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney. Threats to have you arrested. Threats to do things that cannot legally be done, or threats to do things that the debt collector has no intention of doing.

What do you say when disputing a collection?

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been ...

What happens when someone sues you and you have no money?

You can sue someone even if they have no money. The lawsuit does not rely on whether you can pay but on whether you owe a certain debt amount to that plaintiff. Even with no money, the court can decide that the creditor has won the lawsuit, and the opposite party still owes that sum of money.

How do I dispute a debt and win?

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

How many times can a debt be sold?

Answer: An unpaid collection account can be sold and re-purchased over and over again by junk debt buyers. Often, a junk debt buyer will purchase a collection account, attempt collection for a few months, then re-sale the account to a new junk debt buyer. This can occur repeatedly until the debt is paid.

When was the Fair Debt Collection Practices Act?

March 1978The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

Who enforces the Fair Debt Collection Practices Act?

The FTCMany consumers pay collectors money they do not owe and fall deeper into debt, while others suffer invasions of their privacy, job loss, and domestic instability. The FTC enforces the Fair Debt Collection Practices Act (“FDCPA”), which prohibits deceptive, unfair, and abusive debt collection practices.

What is the FTC law on debt collection?

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts. Here are some answers to frequently asked questions to help you know your rights.

How to dispute a debt?

If you don’t recognize a debt, send the debt collector a letter, and ask for verification of the debt. Once you get the validation information, if you don’t recognize a debt, or don’t think the debt is yours, send the debt collector a dispute letter saying you don’t owe some or all of the money, and ask for verification of the debt. Make sure to send the dispute letter within 30 days. Once the collection company receives the letter, it must stop trying to collect the debt until sending you written verification of the debt, like a copy of the original bill for the amount you owe. Consider sending your letter by certified mail and requesting a return receipt to show that the collector got it. Keep a copy of the letter for your records.

What happens when you miss a payment on a debt?

If a debt is time-barred, a debt collector can no longer sue you to collect it.

What happens if the statute of limitations runs out?

If the statute of limitations has run out, your unpaid debt is considered to be time-barred. When asking about your debt, remember that in some states, if you acknowledge in writing that you owe the debt, the clock resets and a new statute of limitations period begins.

How to avoid debt collector scam?

To avoid debt collection scammers, be careful about sharing your personal or financial information, especially if you’re not already familiar with the collector.

How long does it take for a debt collector to give you validation information?

A collector has to give you “validation information” about the debt, either during the collector’s first phone call with you or in writing within five days after first contacting you. The collector has to tell you four pieces of information. how much money you owe. the name of the creditor you owe it to.

How to stop a collection company from contacting you?

Mail a letter to the collection company and ask it to stop contacting you. Keep a copy for yourself. Consider sending the letter by certified mail and paying for a “return receipt.” That way, you’ll have a record the collector got it. Once the collection company gets your letter, it can only contact you to confirm it will stop contacting you in the future or to tell you it plans to take a specific action, like filing a lawsuit. If you’re represented by an attorney, tell the collector. The collector must communicate with your attorney, not you, unless the attorney fails to respond to the collector’s communications within a reasonable time.

When did attorneys become subject to the debt collectors act?

Attorneys, originally exempt from the purview of the Act, became subject to the Act in 1986 if they otherwise satisfied the definition of a debt collector (15 U.S.C. §1692a (6)) and did not qualify for one of the six statutory exemptions:

Who collects debts?

any person who uses any instrumentality of interstate commerce or the mails in any business the principal purpose of which is the collection of any debts, or who regularly collects or attempts to collect, directly or indirectly, debts owed or due or asserted to be owed or due another.

What is Glazer v. Chase?

Glazer v. Chase brings the application of the Act against attorneys into stark relief. It involved a claim under the FDCPA against a mortgage servicing company and the law firm it hired to foreclose on property Glazer inherited. While the 6th Circuit upheld the district court’s dismissal of the FDCPA claims against the servicer – because the proof showed the servicer entered on the scene when the debt was still current, which qualified for one of the FDCPA exceptions to the “debt collector” definition – it reversed the dismissal against the lawyers. The claim against the lawyers was that they violated the Act by falsely stating that Chase owned the note and mortgage in the foreclosure complaint (apparently, FNMA owned the debt pursuant to an unrecorded assignment, and Chase was solely the servicer), improperly scheduling a foreclosure sale (which was ultimately canceled) and refusing to verify the debt upon the debtor’s request.

Can a lawyer be a debt collector?

As a result, there are certain instances in which attorneys will be considered debt collectors and subject to compliance with the Act (which, among other things, may require lawyers to include in their correspondence with debtors specific language and recitations of debtor’s rights to obtain further information and/or copies of the underlying documentation of the debt).

What to do if you don't owe debt?

If you really don't owe the debt, there are steps you can take. Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you. A 2014 incident in Georgia shows exactly what debt collectors are not supposed to do.

How long does it take for a debt collector to contact you?

Within five days of first contacting you, a debt collector must send you a written notice stating how much you owe, to whom, and how to make your payment.

What are sample letters to debt collectors?

5. Harass You. The law lists specific ways in which debt collectors are not allowed to harass you.

What is the FDCPA?

The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law. Here are five tactics that debt collectors are specifically forbidden from using. Knowing what they are can help you stand up for yourself with confidence.

What happens if you don't show up for court?

That said, if you receive a legitimate order to appear in court on a matter related to a debt and you don’t show up, the judge could issue a warrant for your arrest. And, if you fail to pay a court fine related to your debt, or refuse to pay taxes or child support, you could go to jail. 1:52.

How to check if summons is accurate?

If you get a summons, look up the court’s contact information online (not on the notice you were sent) and contact the court directly to confirm that the notice is accurate. Don't use the address or phone number on the document you receive.

Can a debt collector collect money you don't owe?

Try to Collect Debt You Don’t Owe. Some debt collectors will knowingly or unknowingly rely on incorrect information to try to get money out of you. The creditor you originally owed money may have sold your debt to a collection agency, which in turn may have sold it to another collection agency.

When was the Fair Debt Collection Practices Act passed?

The law passed Congress in 1977 as an amendment to the Consumer Credit Protection Act of 1968.

What happens if you don't repay your debt?

At this point, the debt is still owned by, and owed to, the original creditor. If the third-party agency is successful in recovering all or part of the debt, it will earn a commission from your creditor, which can either be in the form of a fee, or a percentage of the total amount owed.

What happens in the third phase of a debt collection?

In the third phase of the process, your original creditor writes off your debt and sells it — often for pennies on the dollar — to an outside collection agency, sometimes known as a debt buyer. Your creditor is no longer involved. The collection agency is still trying to recoup as much of the debt as it can, in order to turn a profit on its purchase.

How long does it take for a debt collector to send a notice?

If the debt collector does not provide verification information on the first communication with you, he must send written notice with that information within five days of the initial contact.

What happens if a third party recovers a debt?

If the third-party agency is successful in recovering all or part of the debt, it will earn a commission from your creditor, which can either be in the form of a fee, or a percentage of the total amount owed. In the third phase of the process, your original creditor writes off your debt and sells it — often for pennies on ...

What does the slur law do?

Limits the times of day collectors can call you. Prohibits the use of slurs, obscenities, insults or threats. Provides remedies for consumers who wish to stop collection agencies from all contact. Requires collectors to verify all debts and end collection procedures if verification is not forthcoming.

How much can you get for a statutory violation?

The burden of proof is on you, but if the judge rules in your favor, you can be awarded $1,000 in statutory damages plus attorney’s fees. If you take this route, it is best to hire an attorney to represent you. If you take the case to state court, you must do so within one calendar year from the date of the violation.

How to collect a debt?

Using fraudulent collection tactics, including: 1 using a false name or identification 2 misrepresenting the amount of the debt or its judicial status 3 sending documents to a debtor that falsely appear to be from a court or other official agency 4 failing to identify who holds the debt 5 misrepresenting the nature of the services rendered by the collection agency or the collector 6 falsely representing that the collector has information or something of value in order to discover information about the consumer 7 Trying to collect more than the amount originally agreed upon. (But remember: your debt can grow by the addition of fees — e.g., collection fees, attorney fees, etc.).

What to do if you owe a debt?

If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment plan. Usually, creditors will help you catch up.

How to stop a debt collector from harassing you?

If you are being subjected to harassing, abusive, or fraudulent debt collection tactics by professional debt collectors — and you want to stop further contact with you — notify the collector in writing. Keep a copy of your letter and send the original to the debt collector by certified mail.

How long does it take for a debt collector to change a report?

The debt collector must notify anyone who has already received a report containing the incorrect item. If, at the end of 30 days, the debt collector has not been able to determine whether the item is correct or not, they must make the change you requested and notify anyone who received a report containing the incorrect item.

What to do if you dispute a debt collector's file?

If you dispute the legitimacy of something in your debt collector's file, you must give the collector written notice. Simply calling the collector won't cease collection activities.

What happens if you don't pay your debt?

But if it looks like you won't pay, they will. The creditor will sell your debt to a collection agency for less than face value, and the collection agency will then try to collect the full debt from you. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation ...

What happens if you violate the Texas debt collection act?

If you think you have been harassed or deceived, you can even seek injunctions and damages against debt collectors.

What happens if a law firm does not collect debt?

If your firm does not regularly collect debt as part of your practice, this law would most likely not impact your efforts to collect debt from a delinquent client.

What is the Fair Debt Collection Practices Act?

Thank you for subscribing! The Fair Debt Collection Practices Act (FDCA) prohibits debt collectors from using unfair, abusive or deceptive practices to collect a debt. However the FDCA only applies to "debt collectors", defined as those who regularly collect debts. If your law firm is regularly engaged in ...

How to dispute a client's nonpayment?

Remember, you're trying to continue the relationship (in most cases). Ask the client to explain the reason for non-payment. Does the client have a reasonable basis for nonpayment? Is there anything reasonable you can do to assuage the client? Again, be sure to have a pen and paper to make notes. Put the notes in the client file for future reference. If possible, stay flexible and try to take the high road. If the client is being unreasonable, reiterate the payment dispute procedure outlined in your fee and representation agreement.

How to address client collections?

Address the issue of client collections before it even becomes a problem by clearly structuring your fee and representation agreements. When signing the fee agreement, make clear to the client all details of your payment terms. Describe the types of payment you accept (cash, check, credit card). Outline when you expect to be paid (net 30, net 45, net 60).

What does it mean when a client fails to pay a bill?

Scenarios. A client's failure to pay a bill does not necessarily mean that there is a dispute or bad relations with the client. When thinking about collecting debt, keep in mind that clients often simply forget to pay your bills. In this first instance, a polite reminder is all that is needed to get the client to pay.

What to do if all else fails?

If All Else Fails. If the client demonstrates further unreliability, either by additional failure to pay or return your calls, you should send a final demand letter that outlines: your rights as a creditor; their rights as a debtor; the specific time they have to make payment; and the actions you will take if they do not remit payment. Most often, these actions can include commencing an action to collect the debt, or turning their account over to a debt collection agency, both of which may negatively impact their personal credit.

When past due debt ventures into the third category, where clients believe there are valid reasons for non-payment, do?

When past due debt ventures into the third category -- where clients believe there are valid reasons for non-payment -- you will have to reach out and discuss the issue with the client. Here are some things to keep in mind as you do so:

Popular Posts:

- 1. who pays attorney fees in divorce?

- 2. who to vote for in nyc attorney general primary

- 3. how to write a letter to an attorney requesting a file

- 4. when to get an attorney for a car accident in oklahoma city

- 5. maine durable power of attorney who signs

- 6. is when you retained an attorney discoverable florida

- 7. what is a privelage attorney

- 8. how to give wife power of attorney

- 9. who does trump support for fl attorney general

- 10. how to update cook county attorney address