The order provides as follows: The following sentence shall be added to the end of Rule 1.15 (f): “A lawyer shall subject all client trust accounts to a reconciliation process at least quarterly, 1 and shall maintain records of the reconciliation as mandated by this rule.” This rule becomes effective on April 1, 2015.

Full Answer

How often should a lawyer perform a trust reconciliation?

Jul 11, 2017 · Every state bar association requires that an attorney reconcile their trust bank statement to their clients’ individual balances either monthly or quarterly. This reconciliation process is one of the more important rules in trust account management. It’s also one of the rules that attorneys most often overlook, invoking unfortunate consequences.

What is the NC State Bar’s reconciliation requirement for trust accounts?

Feb 01, 2016 · Reconciliation Step One. Make a list of your Client Trust Ledger transactions: Reconciliation Step Two. Compare your Client Trust Ledger to your Bank Statement. Draw a line through every transaction that appears on both. Reconciliation Step Three. List the items that appear on the Bank Statement but not the Client Trust Ledger (shown in green for clarity):

How do I complete a trust account reconciliation?

NY IOLA Attorney Trust Account – Requirements and Enhancements; Accounting for attorneys: Why hiring an accountant with knowledge of the Rules of Professional Conduct can save you money and your reputation. NJ Attorneys Are Your Electronic Transfers and Wire Transfers Deficient? You may be violating the Record-Keeping Rule.

What is a client Ledger in trust reconciliation?

Jul 11, 2017 · Every state bar association requires that an attorney reconcile their trust bank statement to their clients’ individual balances either monthly or quarterly. This reconciliation process is one of the more important rules in trust account management. It’s also one of the rules that attorneys most often overlook, invoking unfortunate consequences.

How often should the trust account be reconciled?

For trust fund record keeping purposes, two reconciliations must be made at the end of each month: 1. reconciliation of the bank account record (RE 4522) with the bank statement; and, 2. reconciliation of the bank account record (RE 4522) with the separate beneficiary or transaction records (RE 4523).

How do you do a trust account reconciliation?

5 Easy Steps of Trust ReconciliationStep 1: Make sure your deposit records are complete. ... Step 2: Locate any uncleared deposit transactions. ... Step 3: Confirm your disbursement records. ... Step 5: Account for uncleared transactions.

What is the purpose of a trust reconciliation?

Reconciliation is the accounting procedure that proves your trust transactions were recorded accurately and provides proof that there are sufficient funds in trust.Jun 15, 2021

What is 3 way trust account reconciliation?

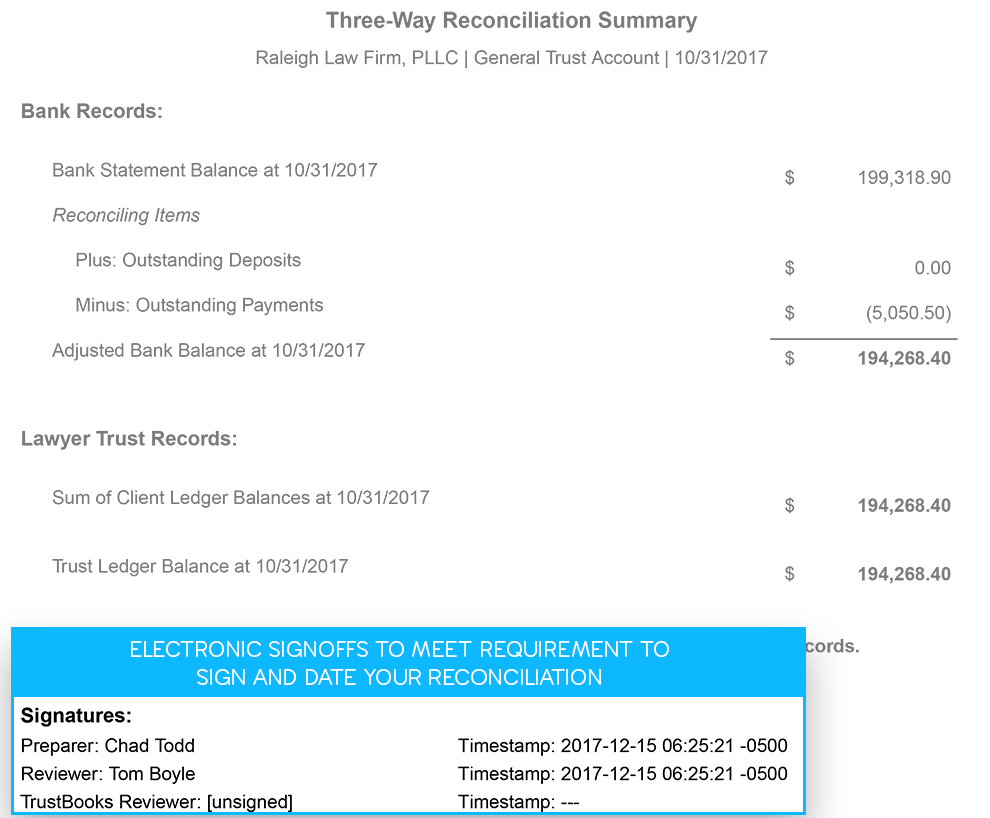

What is Three-Way Trust Reconciliation? A Three-Way Reconciliation compares your bank balance to your trust ledger balance to the sum of your individual client ledger balances. This report gives you confidence that your internal records (trust ledger and client ledgers) reconcile back to your bank statement.

What are the 5 steps for bank reconciliation?

Here are the steps for completing a bank reconciliation:Get bank records.Gather your business records.Find a place to start.Go over your bank deposits and withdrawals.Check the income and expenses in your books.Adjust the bank statements.Adjust the cash balance.Compare the end balances.Mar 9, 2021

What is the deadline to complete a trust reconciliation listing and comparison?

Remember that Rule 5-43(2) requires that the monthly reconciliation must be completed “no later than the end of the following month ”, so for example, the reconciliation report for the month of October must be completed on or before November 30th.

How do you maintain trust accounts?

Handling of fundsKeep trust account funds and matter funds separate, including proper management of retainer funds, earned fees and settlement monies.Never move funds to the operating account which are unearned.Ensure credit cards payments are deposited correctly and no fees are charged to the trust account.More items...•Dec 23, 2019

What might trust transactions include?

Trust records may include: account balance statements. account sales. bank reconciliation statements.

What is the purpose of Bre Form 4522?

Form RE 4522 is used to record all trust funds received and deposited into the trust fund bank account and the disbursements from such account.

What is 2 way reconciliation?

You have probably performed a two-way bank reconciliation at some point in your life when you balanced your checkbook. You compare the latest bank statement (the “bank balance”) to your check register (the “book balance”), correcting for checks or deposits that have not cleared yet.

What are the 3 forms of bank reconciliation?

There are three steps: comparing your statements, adjusting your balances, and recording the reconciliation.Aug 10, 2021

What is n way reconciliation?

Electra's n-way reconciliation allows users to compare multiple unique data sets within the same view, and to compare large volumes of data quickly and seamlessly.Sep 26, 2016

Popular Posts:

- 1. what did the attorney general say on 1/30/17?

- 2. local attorney from newport, vt. who is being disciplined

- 3. what is the best college to be an attorney

- 4. who ia authorised to issue special power of attorney

- 5. who appoints attorney generals

- 6. who is kenneth williams attorney

- 7. how to be a consumer protection attorney

- 8. where did attorney mona lisa wallace go to law school

- 9. how to fire a client attorney

- 10. divorce cases where one party has to pay both sides attorney fees