The most common power of attorney types are:

| Type of Power of Attorney | Details |

| General POA | A general POA allows the agent to act in ... |

| Durable POA | In most states, a POA is considered dura ... |

| Limited POA | An attorney-in-fact who signed a limited ... |

| Springing POA | A springing POA comes into effect when o ... |

Why should I appoint a power of attorney?

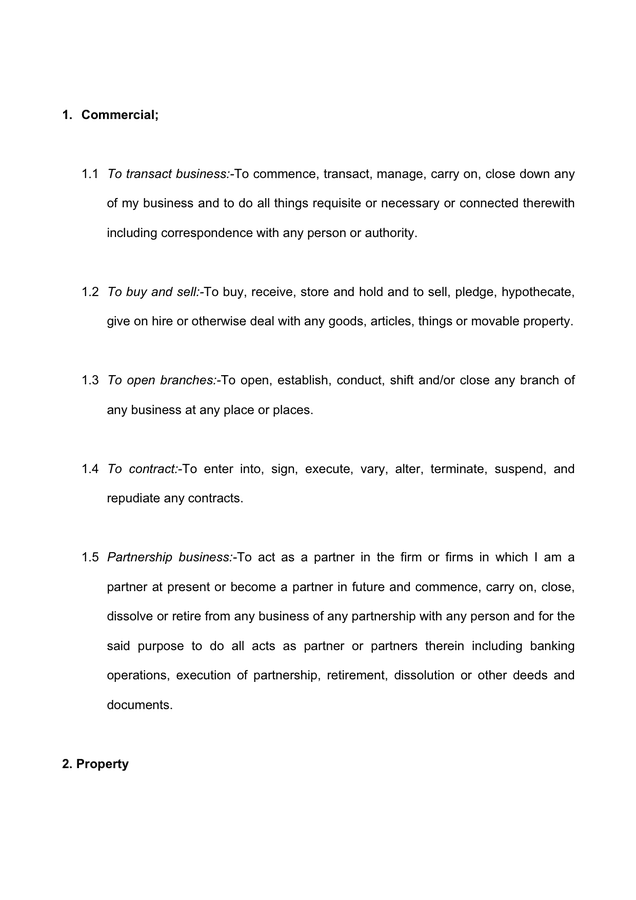

Oct 11, 2021 · Some of the responsibilities and transactions you may execute on as power of attorney include: Property (real or personal) Investments and banking transactions Operations and dealings of an unincorporated business LLC ownership or voting business stock Interests …

What is a power of attorney responsible for?

Sep 22, 2021 · According to s.19, the underlying principles and philosophies an attorney must adhere to are to: Act honestly and in good faith, Exercise the care, diligence and skill of a reasonably prudent person, Act within the authority given in the enduring power of attorney …

Why should I have a power of attorney?

5 rows · Power of Attorney Duties—The Basics. A power of attorney is a legal document that grants one ...

Should a power of attorney be responsible for?

The responsibilities of power of attorney vary according to the situation. A grant of power of attorney legally gives a person the authority to perform acts for another person in business …

What responsibility comes with power of attorney?

What does it mean to give someone your power of attorney?

What three decisions Cannot be made by a legal power of attorney?

Can a family member override a power of attorney?

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

Is a power of attorney valid if you are mentally competent?

A power of attorney is valid only if you are mentally competent when you sign it and, in some cases, incompetent when it goes into effect. If you think your mental capability may be questioned, have a doctor verify it in writing.

What is a POA?

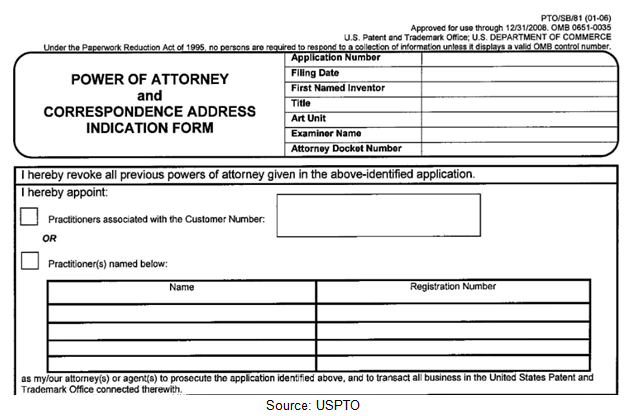

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

Why do you need multiple agents?

Multiple agents can ensure more sound decisions, acting as checks and balances against one another. The downside is that multiple agents can disagree and one person's schedule can potentially delay important transactions or signings of legal documents. If you appoint only one agent, have a backup.

What is the power of attorney?

A grant of power of attorney legally gives a person the authority to perform acts for another person in business dealings, legal matters and other issues. The person who is authorizing the other individual to act on his behalf is known as the principal.

Can a power of attorney be revoked?

When people go out of the country for an extended period of time, or are bedridden, they often bestow power of attorney on a son, daughter or close friend. When the power of attorney is no longer required, it can be revoked with a document called the Revocation of Power of Attorney. There are a few types of responsibilities of power ...

What is an authorization?

Authorization can be used for any number of reasons; common uses are: to handle business or financial transactions, act on estate planning issues or collect debts. Typically, the power is granted only for a short period of time to complete a specific act.

Can a guardian be appointed by the court?

Generally, there is a provision that states that the principal has to be certified as mentally incapacitated for the power to go into effect. If you do not have a durable power of attorney, if you are unable to make decisions on your behalf, a guardian or conservator can be appointed by the courts. References.

Who is John Landers?

Writer Bio. John Landers has a bachelor's degree in business administration. He worked several years as a senior manager in the housing industry before pursuing his passion to become a writer. He has researched and written articles on a wide variety of interesting subjects for an array of clients.

What degree does John Landers have?

John Landers has a bachelor's degree in business administration. He worked several years as a senior manager in the housing industry before pursuing his passion to become a writer. He has researched and written articles on a wide variety of interesting subjects for an array of clients.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

What is a power of attorney?

A Power of Attorney is a written document by which an individual (the grantor) appoints someone (the Attorney) to act on their behalf concerning financial and/or personal care matters.

What can a professional do for a grantor?

A professional can work with you to ensure that the grantor’s investments are managed with the degree of care, skill and diligence required. They can: Assist you with customized asset allocation appropriate to the circumstances Work with you to develop a viable investment policy statement Keep accounts of all transactions

Popular Posts:

- 1. who is the roanoke county virginia commonwealth attorney

- 2. under which category can i place attorney fees for tax purposes

- 3. who is the district attorney for the lost hills station in malibu

- 4. what happens if you don't pay attorney fees criminal trial

- 5. what to write in a power of attorney letter

- 6. how to appeal a disability verdict without an attorney'

- 7. how to get power of attorney from usa

- 8. what is the difference between attorney and lawer ?

- 9. who should use a consumer complaint form at the office of attorney general

- 10. how many employees in california attorney general office