A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: managing banking transactions buying and selling property paying bills entering contracts

What is power of attorney and how does it work?

A power of attorney allows a person you appoint -- your "attorney-in-fact" or agent -- to act in your place for financial or other purposes when and if you ever become incapacitated or if you can't act on your own behalf. The power of attorney document specifies what powers the agent has, which may include the power to open bank accounts ...

What are the requirements to be a power of attorney?

Powers of attorney fall under state laws, so the requirements for creating a power of attorney differ from state to state. You can find links to most states’ laws, or simply Google the power of attorney law for your state. Keep in mind the power of ...

What are the three types of power of attorney?

Types of Power of Attorney

- General Power of Attorney (GPA)

- Special Power of Attorney (SPA)

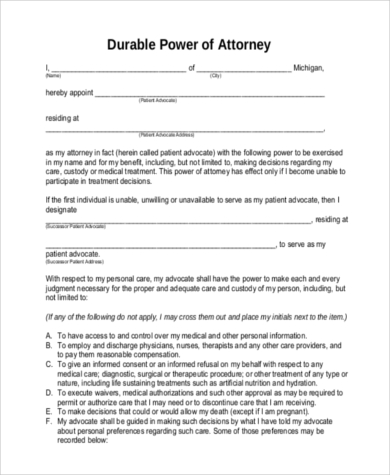

- Durable Power of Attorney

What are general powers of attorney?

The scope of the power assigned to the attorney is generally straightforward, as it requires only a detailed definition of the actions to which the attorney is allowed. The documents must be presented to verify that the person who gave such powers is authorized to represent the company.

What responsibility comes with power of attorney?

It normally allows the attorney-in-fact to pay the principal's bills, access his accounts, pay his taxes, buy and sell investments or even real estate. Essentially, the attorney-in-fact steps into the shoes of the principal and is able to act for the principal in all matters as described in the document.

What are the three basic types of powers of attorney?

The three most common types of powers of attorney that delegate authority to an agent to handle your financial affairs are the following: General power of attorney. Limited power of attorney. Durable power of attorney.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

What is a general power of attorney?

General Power of Attorney. The general power of attorney is a broad mandate that gives an agent a lot of power to handle the affairs of a principal. The agent or the person designated to act on behalf of the principal is charged with handling several tasks. The tasks include buying or disposing of real estate.

What is a POA?

Power of Attorney, or POA, is a legal document giving an attorney-in-charge or legal agent the authority to act on behalf of the principal. The attorney in charge possesses broad or limited authority to act on behalf of the principal. The agent can make decisions regarding medical care. HMO vs PPO: Which is Better?

What is a POA in medical?

Medical or health care POA authorizes the agent to make decisions on behalf of the principal in case of a life-threatening illness. Most health POAs fall under the durable kind because they take into consideration the fact that the principal may be too sick to make their own decisions.

What powers can a principal not delegate?

While the durable POA is widely accepted, there are powers the principal cannot delegate, such as amending or making a will, contracting a marriage, or casting a vote.

What is the legal process that occurs after the death of an individual?

To keep advancing your career, the additional CFI resources below will be useful: Probate. Probate Probate is the legal and financial process that occurs after the death of an individual and specifically deals with the individual’s will, property, and. Retainer Fee.

When does a power of attorney lapse?

The power of attorney lapses when the creator dies, revokes it, or when it is invalidated by a court of law. A POA also ends when the creator divorces a spouse charged with a power ...

Do you need to notarize a witness' signature?

In many states, it is mandatory to get the principal’s signature notarized. In some cases, the witness’s signature must also be notarized. In addition, there are some legal provisos that are not generally applicable. For example, there is no standardized POA principal form.

Who can execute a power of attorney?

The Power of Attorney Law provides that any "natural person having the capacity to contract may execute a power of attorney."

How many witnesses are needed to sign a power of attorney?

The power of attorney is signed and acknowledged before a notary public or is signed by two witnesses.

What is the difference between durable and non-durable power of attorney?

The main differences between a durable and non-durable power of attorney is that a durable power of attorney continues to be effective upon the incapacitation of the principal while the non-durable power of attorney does not. A power of attorney template or POA form can be used to nominate a power of attorney to represent an individual ...

When was the power of attorney established?

The current laws regarding power of attorney were established in 2006 when the Uniform Power of Attorney Act was implemented. This basically ensured that there would be a uniform standard for power of attorney law in every state, and that there would be basic legal elements that had to be adhered to when implementing a power of attorney, regardless of what state you live in.

Can a power of attorney be affected by incapacity?

This power of attorney shall not be affected by subsequent incapacity of the principal.

What is a power of attorney?

A power of attorney is a legal document that grants one person (the agent) powers to act in another person’s (the principal’s) stead. The type of responsibilities an agent has depends on whether they signed a financial or medical power of attorney. Solve My Problem.

What is a POA?

A general POA allows the agent to act in the principal’s name on all matters as long as the state laws allow for it. The agreement ends automatically in case the principal becomes mentally incapable of making decisions for themselves. Durable POA. In most states, a POA is considered durable unless stated otherwise.

How long does a POA last?

A springing POA comes into effect when one or more physicians determine that the principal is incapacitated. It lasts until it’s revoked or the principal dies

What happens if an agent fails to do their job as a fiduciary?

In case the agent fails their job as a fiduciary, they may be prosecuted both civilly and criminally.

Can you refuse to sign a POA?

Being an agent is not an obligation, so you can refuse to take on POA-related responsibilities. Anyone who wants to be appointed as an attorney-in-fact needs to consider whether they’re available and ready for that sort of duty before signing the POA document.

Is a POA durable?

In most states, a POA is considered durable unless stated otherwise. The responsibilities that an agent has must be clearly specified in the document. The agreement stays in effect even after the principal becomes physically or mentally incapacitated. Limited POA.

What is a general power of attorney?

General power of attorney can also include insurance decisions and investment decisions, including those regarding your 401(k)or IRA. Special power of attorney: This gives specific authority to the agent.

What are the responsibilities of a POA?

They can handle business transactions, settle claims or operate your business.

How does a POA work?

The key to making a POA work is finding the right agent to make decisions on your behalf. Your choice may depend on which type of POA you are signing. For a POA related to business, for example, you probably want to find someone with business experience. For legal matters, an attorney may make sense.

How to create a POA?

Creating your own POA is not difficult. Here are the steps you’ll need to take: Determine which type you need and choose your agent , which we discuss in more detail below. Buy or download the proper form. The form will depend on the state you are in, so make sure you are getting the correct one.

What is a POA?

The power of attorney (POA) authorizes another person to sign legal documents and otherwise act on your behalf in the eyes of the law. This power, however, does not apply to making changes to a will. It ends when you die — or earlier. It can never be invoked after your death. You can limit the power in scope or to a certain timeframe or event (such as your becoming incapacitated). You can also revoke it. Whether you’re planning your estateor simply planning ahead, here’s what you need to know when giving or assuming POA. If you need more help sussing out the nuances of power of attorney and how it can apply to financial documents and decisions in your life, consider enlisting the help of a financial advisor.

Who is the person who gives power?

The person who is giving his or her power is known as the principal, the grantor or the donor. The person taking on the power is known as the agent or the attorney-in-fact. The grantor can choose which rights to give the agent.

Can you invoke a POA after death?

It can never be invoked after your death. You can limit the power in scope or to a certain timeframe or event (such as your becoming incapacitated). You can also revoke it. Whether you’re planning your estateor simply planning ahead, here’s what you need to know when giving or assuming POA.

What is the Power of Attorney?

It is a legal document that is used to pass the legal authority from one person to another person to take the financial or personal decision. The agent has the full authority to complete the given task. The agent will be considered as the principal is giving its assent to do the work.

Why the Power of Attorney (POA) is required?

There are various types of reasons in which we need the power of attorney, such as:

Types of Power of Attorney

The GPA assigned by the principal gives unlimited powers to the agent. The agent becomes the virtual owner. For example, if the principal gives the GPA to the agent of a property, it means the agent has the full powers to sell that property, take the loan or mortgage the property and do all other things which can be done with that property.

The elements of Power of Attorney

Detail of executor – there should be the full details of a person who is executing the POA

Difference

There is only one between GPA and SPA is that SPA is granted only for specific purposes whereas in the GPA the agent has broader powers given by executor.

The drawback of Power of Attorney

The only drawback of POA is Misuse by agents. It can be possible in case of a GPA that the agent has the power to make a decision. There are chances that he takes the wrong decision which you never wanted to do. For example, an agent sells the property of the principal in 10 lakhs because he had the GPA of principal.

What is a power of attorney?

A general power of attorney gives the agent the authority to handle almost any type of legal, financial, or tax matter that may arise. The point of a power of attorney is almost always to empower someone to act on your behalf in the event of some future unknown emergency.

Why do adults need a power of attorney?

Especially now, with the worries of the coronavirus and the risk that you might fall ill and be unable to handle financial and legal matters, every adult should have one. “Go See a Lawyer” is Not Realistic for Many: Bottom line is ...

How to name an agent?

Naming your Agent: This is one of the most important decisions. You want to name someone you can trust and who won’t take advantage. You do not need someone who is a legal or financial expert, they can hire experts. You would like someone who is smart enough to seek help when they need it, and honest enough to do right by you. Do not name a person because you feel obligated to do so (e.g. you have to name your oldest child before your youngest - why?). Name the person you think will do the best job and have the most integrity.

How to be proactive in planning?

The real answer is that you have to be proactive, approach your planning in a comprehensive and deliberate manner, whichever option you choose. There are a bunch of things to keep in mind as you decide on a course of action that fits your needs and as you implement that plan.

Is a power of attorney durable?

In many cases you might opt for a general (bro ad) power of attorney, that is durable (effective even if you become disabled), and that is effective as soon as you sign it (i.e., not a springing power that only becomes effective on your death).

Can an agent act on your behalf?

Information for the Agent” at the end of this document describes your agent’s responsibilities. Your agent can act on your behalf only after signing the Power of Attorney before a notary. public. You can request information from your agent at any time.

Can you revoke a power of attorney?

located. You can revoke or terminate your Power of Attorney at any time for any reason as long as you.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

When does a power of attorney go into effect?

A springing (or conditional) power of attorney only goes into effect if a certain event or medical condition (typically incapacitation) or event specified in the POA occurs. For example, military personnel may draft a springing power of attorney that goes into effect when they’re deployed overseas.

What is a POA?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent.

When does a durable power of attorney end?

A durable power of attorney ends automatically when you die. You can rescind a durable POA using a revocation of power of attorney form as long as you’re competent.

When does a medical power of attorney become effective?

A medical power of attorney becomes effective immediately after you’ve signed it, but can only be used if you’ve been declared mentally incompetent by physician (s). Once you’ve selected an agent, make sure they know how to sign as power of attorney on your behalf. 3. General Power of Attorney.

Can you use a power of attorney for a short period?

Given the extensive control it affords your agent, you may only want to use this kind of power of attorney for a short period when you physically or mentally cannot manage your affairs. For example, during an extended period of travel outside of the country.

Can powers of attorney be restricted?

The powers granted under a general power of attorney may be restricted by state statutes.

What is a power of attorney in California?

A power of attorney allows someone else to handle financial or healthcare matters on your behalf, and California has specific rules about types and requirements.

What is a POA?

A power of attorney (POA) gives someone you name the authority to handle legal or financial matters for you under specific circumstances. When you create a POA, you are called the principal, and the person you choose to act for you is called your attorney-in-fact or your agent.

What is a springing POA?

Springing POA. A general or limited POA can be written so that it takes effect only at a certain time or under certain conditions (so it "springs" into action only at that time). For example, you could create it so that it takes effect only if you are incapacitated or so that it is effective for one month.

What is a general POA?

General POA. This is the broadest kind of POA and gives your agent the right to handle a wide variety of financial matters for you. Limited POA. This is sometimes called a specific POA. This is a very narrow POA that gives your agent the authority to act for you only in specific situations you list in the document.

How to keep POA form in force?

As soon as you sign the POA form, it is in force. Keep the form in a safe place. Give a copy to your agent. For healthcare POAs, be sure to give a copy to your healthcare provider.

How old do you have to be to get a POA in California?

A California POA can only be created by a principal who is 18 years of age or older. The principal must also have the legal capacity to enter into a contract. A general or limited POA must be signed by the principal and two witnesses or a notary.

What is a healthcare POA?

Healthcare POA. Should you become incapacitated, this document gives your agent the right to make healthcare decisions on your behalf.

What is a power of attorney?

A power of attorney is a legal document that one person (known as the principal) can use to appoint another individual (known as the agent) to handle his or her personal, financial, and other affairs. This document allows the principal to transfer certain powers to their trusted agent in case they become incapacitated or unable to make decisions on their own.

Does DoNotPay generate POA?

And there you go! DoNotPay will generate your POA document instantly, and all that’s left is for both parties to read the notices and sign the document.

Types of Powers of Attorney

- 1. General Power of Attorney

The general power of attorney is a broad mandate that gives an agent a lot of power to handle the affairs of a principal. The agent or the person designated to act on behalf of the principal is charged with handling several tasks. The tasks include buying or disposing of real estateReal Es… - 2. Limited or Special Power of Attorney

An individual looking to limit how much the agent can do should choose limited or special power of attorney. Before signing to notarize a limited power of attorney, a person needs to be as detailed as possible about how much the agent should handle. If an individual is not clear what …

How Power of Attorney Works

- The principal can either download or buy POA templates. In the event the template is acquired through either one of the two methods, the principal should ensure they belong to the state of residence. POA documents are very important, and the principal should not assume that the documents acquired are of the correct kind. Verification of the POA documents is necessary bef…

Summary

- A power of attorney (POA) is an authority imposed on an agent by the principal allowing the said agent to make decisions on his/her behalf. The agent can receive limited or absolute authority to act on the principal’s behalf on decisions relating to health, property, or finances. A POA is common when a person is incapacitated and unable to make their own decisions.

Additional Resources

- CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™Become a Certified Financial Modeling & Valuation Analyst (FMVA)®CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today!certification program, designed to help anyone become a world-clas…

Popular Posts:

- 1. who is city attorney for lafayette colorado

- 2. how power of attorney works in india if owner is residing outside

- 3. how to file a complaint to the attorney general

- 4. do non citizens have a right to an attorney when questioned at the border

- 5. how could an attorney general prosecute hillary clinton

- 6. what does the federal attorney general control all federal courts

- 7. who was the attorney in the newdow case

- 8. how to find the representing attorney for a private company

- 9. florida state attorney pulled over what happened to cops

- 10. can attorney brodsky be made to tell where stacie peterson is, dead or alive?