Is a power of attorney entitled to compensation in Pennsylvania?

But the Medicaid agency may still object to the amount, arguing that there is no obligation on your mother’s part to make the payments in the absence of a service agreement. You may draw up a written agreement, but if you’re signing as both parties – on your mother’s behalf under the power of attorney and on your own as the service ...

Does a power of attorney have a salary?

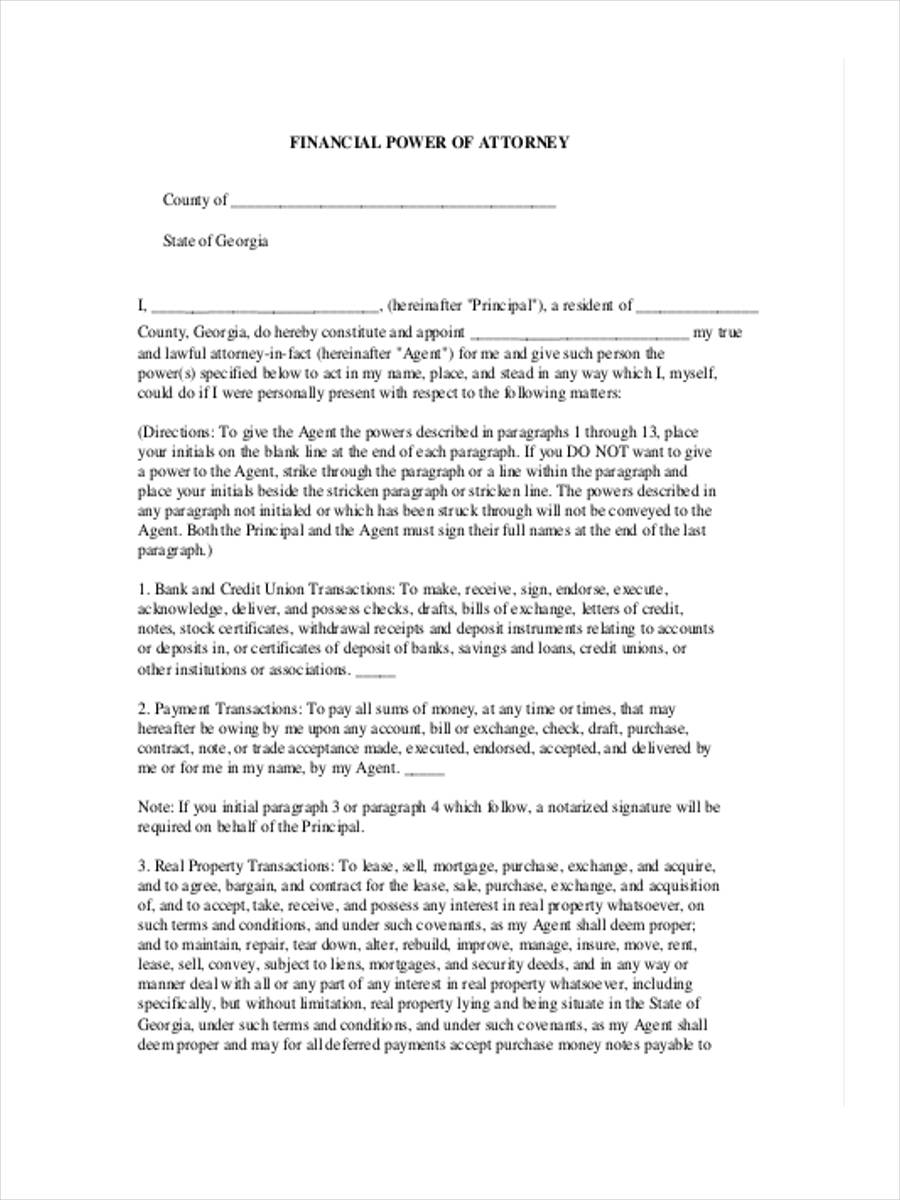

The Average Salary of Compensation for Power of Attorney. A power of attorney is nothing more than a special kind of legal document that grants someone else the legal authority to act on your behalf. A power of attorney is not a job, a position or a career. Rather, it describes the relationship between two people.

What is reasonable compensation for a trustee in Michigan?

Florida Statutes 733.617, titled “Compensation of personal representative” and Florida Statute 733.6171, titled “Compensation of attorney for the personal representative”, set forth amounts presumed reasonable and factors for court’s to consider when determining whether compensation paid to the personal representative and his attorney are reasonable. Both …

Can a trustee or attorney-in-fact be compensated?

Apr 13, 2017 · I most commonly see hourly rates for family members acting as Agent in the $20.00 to $40.00 range. Typically, a son or daughter will be the person acting as Agent under a power of attorney document on behalf of their parents.

What is considered reasonable compensation for a trustee in Florida?

On average, trustee fees can range from 1% to 3% of the trust assets. For example, a 3% fee can be considered a reasonable fee for large and complex assets that can take years to administer.Mar 24, 2011

What is reasonable compensation for an executor in Florida?

According to 2014 Florida Statutes, "reasonable compensation" for an executor involved in formal administration of an estate is as follows: 3 percent for the first $1 million of an estate's value, 2.5 percent from $1 million to $5 million, 2 percent from $5 mission to $10 million, and 1.5 percent for anything above $10 ...

Does a power of attorney get paid?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

Is POA compensation taxable?

Compensation paid to attorneys is taxable income. It must be reported on the attorney's income tax return. There are other income tax obligations that the attorney must comply with. As an executor, you are entitled to obtain this information.Jun 23, 2017

How long does an executor have to settle an estate Florida?

The formal probate administration usually takes 6-9 months under most circumstances - start to finish. This process includes appointing a personal representative (i.e., the "executor"), a 90 days creditor's period that must run, payment of creditor's claims and more.

How much does a personal representative get paid in Florida?

Personal Representatives are compensated up to 3% of the value of the probate assets up to 1 million dollars. The table pursuant to the Florida statute is below: (a) At the rate of 3 percent for the first $1 million. (b) At the rate of 2.5 percent for all above $1 million and not exceeding $5 million.Aug 28, 2018

What expenses can I claim as PoA?

The types of expenses that you can claim for are those that relate to your role as someone's attorney. They include products and services such as: Hiring a professional (e.g. a tax adviser) Phone calls and travel costs.Jan 1, 2022

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

Are PoA fees deductible?

If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly HOA fees, you cannot deduct the HOA fees from your taxes. ... If you use the rental property for personal use for a portion of the year, then you can only deduct a portion of HOA fees from your tax return.

Can a power of attorney be an executor of a will?

The person who had power of attorney may well be the executor or administrator of the estate. This is quite common, as often the person trusted to deal with someone's affairs during their lifetime is the person trusted to do the same after their death.

Can power of attorney lend money?

Can a power of attorney borrow money? So, a property and financial Power of Attorney can give themselves money (with your best interests in mind). But you may be concerned about them borrowing money from you, or giving themselves a loan. The answer is a simple no.Jun 18, 2021

What are the factors that determine a reasonable fee?

In 1958, the Supreme Court in West Coast Hospital Ass’n v. Florida National Bank of Jacksonville, 100 So.2d 807 (Fla. 1958), established factors for the court to consider in determining a reasonable fee. Some of the factors used in determining the reasonableness of a fee include: 1 The amount of capital income received and disbursed by the trustee 2 The wages or salary customarily granted to agents for performing light work in the community 3 The success or failure of the trustee’s administration 4 Any unusual skill or experience the trustee brought to the trust administration 5 The loyalty or disloyalty of the trustee to the beneficiaries 6 The amount of risk and responsibility assumed by the trustee 7 The time involved in administering the trust 8 The custom in the community as to compensation of trustees by settlors or courts and as to compensation paid trust companies and banks serving as trustees 9 The character of the work performed by the trustee 10 Any estimate the trustee has given of the value of his or her own services 11 Payments made or allowed by the beneficiaries to the trustee intended to be applied toward the trustee’s compensation

What is trustee loyalty?

The loyalty or disloyalty of the trustee to the beneficiaries. The amount of risk and responsibility assumed by the trustee. The custom in the community as to compensation of trustees by settlors or courts and as to compensation paid trust companies and banks serving as trustees.

Phillip William Gunthert

If you are indeed the Agent that has been named in the power of attorney you may or may not find this helpful for your circumstances. You cannot get a POA if she is mentally incapable of understanding what she is signing.

Carol Anne Johnson

What you are describing is not the functions of a POA. It sounds more like a Personal Services Contract, which basically will pay you to do the jobs that you have described and can be (and often is) used to reduce the assets of the disabled individual for the purposes of Medicaid qualification.

Joseph Michael Pankowski Jr

Thanks to you for being willing to step up to serve as your step-mother's attorney-in-fact. My concern here is that you are clearly operating without an experienced Florida attorney to advise you.

Question

I served as trustee and POA for a friend who was ill for over 4 years. The estimated assets were approximately $2 million at the time I assumed responsibilities for her 12 registered purebred horses and 4 purebred dogs (she was a breeder of both).

Response

This is a very difficult situation. You deserve to be compensated, but the question is how much. A big part of the problem is that you sit on both sides of the business deal. As trustee and agent under the durable power of attorney, you’re the payor. As the person who did so much work, you’re the payee.

What is Fair Compensation for Your Agent?

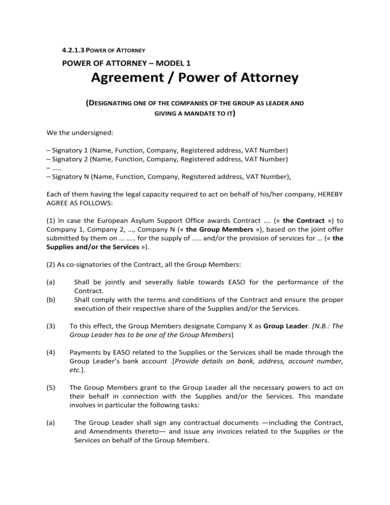

As a general rule, it's best to provide for compensation in the document creating the trust or agency relationship. Michigan law provides that a trustee or an agent is entitled to "reasonable compensation" if provided for in the trust or power of attorney documents.

How Payments to Family Could Affect Your Eligibility for Medicaid

You might not need Medicaid now. But if you ever need care in a nursing home, you probably will. Nursing home care is very costly, in some cases $100,000 per year or more. Few families can bear such an expense for long without help.

Popular Posts:

- 1. why record iowa statutory power of attorney

- 2. who is attorney mark richards

- 3. how much did you pay for a coop attorney nyc

- 4. if you win a lawsuit slapp who pays attorney fee

- 5. who was an attorney that defended the soldiers involved in hoston massacre

- 6. cache:http://www.acelsat.com/what-is-the-role-of-a-defense-attorney

- 7. who is the best father's rights attorney in northeast illinois?

- 8. power of attorney who needs one

- 9. how to set up power of attorney in utah

- 10. "what is an attorney"