Can sale deed be signed by power of attorney?

In 2011, the Supreme Court ruled that property sale through power of attorney (PoA) is illegal and only registered sale deeds provide any legal holding to property transactions.Nov 9, 2021

Can a PoA holder sell property?

NEW DELHI: In a big warning to property owners who intend to sell their assets through a power of attorney (PoA) holder, the Supreme Court has ruled that the PoA holder can sell the property and register the sale by merely producing a copy of the PoA and that the original was not mandatory for registration of the sale.Jan 31, 2022

How do you sign as power of attorney in Texas?

Here are the basic steps to make your Texas power of attorney:Decide which type of power of attorney to make. ... Decide who you want to be your agent. ... Decide what powers you want to give your agent. ... Get a power of attorney form. ... Complete your POA form, sign it, and execute it.More items...•Oct 5, 2021

Can a power of attorney holder transfer property in his own name?

You can transfer the property as power holder to your self.It is Legal. Nothing is wrong and nothing is illegal.Sep 30, 2011

Can I sell my dad's house with power of attorney?

Answer: Those appointed under a Lasting Power of Attorney (LPA) can sell property on behalf the person who appointed them, provided there are no restrictions set out in the LPA. You can sell your mother's house as you and your sister were both appointed to act jointly and severally.Apr 2, 2014

Can a power of attorney holder execute a sale deed?

An attorney holder may however execute a deed of conveyance in exercise of the power granted under the power of attorney and convey title on behalf of the grantor.

How do I notarize power of attorney?

A power of attorney needs to be signed in front of a licensed notary public in order to be legally binding. The notary public is a representative of the state government, and their job is to verify the identity of the signer, ensure they are signing under their own free will, and witness the signing.Jul 16, 2018

How do you sign a check as POA?

If you need to sign a check for her, the usual procedure is to write her name on the top line and then add your name and title underneath, Mr. Rubenstein says. For example, you would write your mother's name on the main line. Underneath it, you would write: "By (insert your own name), as attorney in fact."Oct 3, 2010

How do I legally sign for someone else?

The proper way to sign as an agent is to first sign the principal's full legal name, then write the word “by,” and then sign your name. You may also want to show that you are signing as an agent by writing after the signature: Agent, Attorney in Fact, Power of Attorney, or POA.

Can a power of attorney deed property to himself in Texas?

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself.Sep 21, 2021

Can a GPA holder gift the property to himself?

A. A GPA holder can sell the property to himself, as a principal owner and buy the same property in the capacity of a buyer. This is completely legal.

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

What is a power of attorney in Texas?

Texas has some unique requirements for granting power of attorney that you need to know before setting yours up. A power of attorney or POA can enable you to engage in financial transactions when you can't be present to sign documents.

What is a general power of attorney?

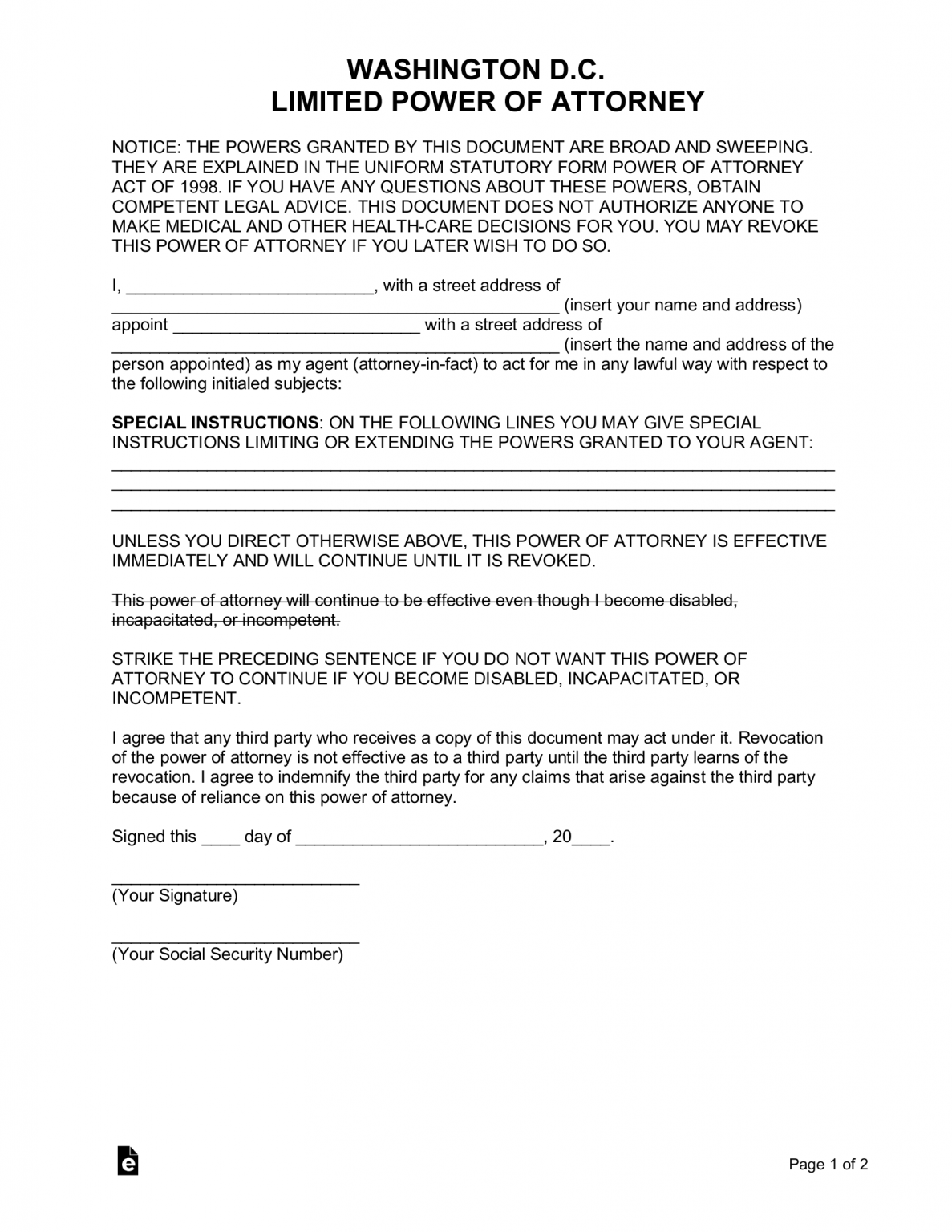

General power of attorney. This gives the agent authority to act in a broad range of matters. Limited or special power of attorney. This gives the agent authority to act in a limited way, such as to engage in a specific transaction or for a limited period of time. Durable power of attorney.

Is a springing power of attorney durable?

By its very nature, a springing power of attorney is also a durable power of attorney. Medical power of attorney. This gives the agent the authority to make medical treatment decisions for you if you become mentally or physically unable to make your own decisions. By its very nature, a medical power of attorney is both durable and springing.

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

Who is Mollie Moric?

Mollie Moric is a staff writer at Legal Templates. She translates complex legal concepts into easy to understand articles that empower readers in their legal pursuits. Her legal advice and analysis...

What is a power of attorney in Texas?

A “power of attorney” is a written document that authorizes someone (referred to as the agent) to make decisions or take actions on someone else's (known as the principal ) behalf. In Texas, there are several kinds of powers of attorney that will grant the agent the right to accomplish different things on the principal's behalf.

What is a general power of attorney?

General powers of attorney are used to allow someone to act for you in a wide variety of matters. For example, general powers of attorney are often used in business dealings to allow an employee to enter into contracts, sell property, spend money, and take other actions on behalf of their client. You may wish to create a general power ...

What is a power of attorney in Texas?

A Power of Attorney is a written document in which an individual, called the Principal, gives authority to another individual, called the Agent, to act on the Principal’s behalf. In Texas, Power of Attorney used in a real estate transaction must be recorded in the Real Property Records of the county where the property is located.

Who drafts a power of attorney?

The specific Power of Attorney is typically drafted by an attorney, for a fee, and is specific to the transaction being handled by the title company. Because it is drafted specifically for the transaction at hand, there are no other powers that can inadvertently be granted, and a termination date can be included in the document.

Where is Fidelity National Title located?

Fidelity National Title, 1512 Heights Blvd., Houston, TX 77008 (713) 529-8800.

Can a durable power of attorney be revoked?

Because a Statutory Durable Power of Attorney can grant the Agent a multitude of powers and be valid until revoked, I typically recommend that persons considering using a Statutory Durable Power of Attorney consult and attorney prior to using the document.

What is power of attorney selling?

The power of attorney sell property is just one part of the authority that comes with a power of attorney. To get this there are some steps that one needs to go through.

Can you sell your home with a power of attorney?

You may decide with the power of attorney sell property authority to sell the home yourself . It is so it makes it easier on your parents. Meaning that instead of using a realtor you will do all the work. This presents extra stress and challenges for you. But, you may be thinking that it will be easier on your parents.

What is a POA in real estate?

“Power of attorney” (POA) is a flexible legal tool that grants permission for someone to act on another’s behalf on a temporary or permanent basis. In real estate, this can be an incredibly useful option for all sorts of situations, like if you had to sell your house but couldn’t be there due to a job relocation or deployment.

How to get a power of attorney?

How to get power of attorney if you need it 1 Understand the obligations of being an agent in a POA arrangement. 2 Evaluate that the principal has the capacity to sign a power of attorney agreement. 3 Discuss the issue with the financial institutions (mortgage holders) and physicians (whenever there may be questions about capacity). 4 Hire an attorney or contact a legal website like Legal Zoom, online on-demand legal services with a 100% satisfaction guarantee on all their filings. 5 Be supportive. Giving up control of a real estate transaction can be a hard adjustment for an elder family member. 6 Ask a lot of questions and make sure you understand the obligations for all parties under the document. 7 Make sure that the document outlines actions with as much detail as possible to avoid any gray areas that can be misinterpreted. 8 Get the final document notarized or witnessed — depending on your state’s requirements if they haven’t enacted the Uniform Power of Attorney act of 2006. 9 Record the power of attorney with the county clerk office where the home is located — depending on your state or county requirements. 10 Make authenticated copies of the document for safekeeping. 11 Always present yourself correctly as someone’s agent.

Why is a power of attorney important?

Because it’s limited in both time and scope, it’s a great tool when you want to give someone a very specific responsibility. A medical power of attorney gives an agent (often a family member) authority over someone’s medical care once a doctor determines they are unable to make decisions on their own.

What is an agent in fact?

The agent or attorney-in-fact is the person who receives the power of attorney to act on someone else’s behalf. The agent will have a fiduciary responsibility to always act in the best interest of the principal for as long as the power of attorney is valid. A fiduciary, according to the Consumer Financial Protection Bureau (CFPB), ...

How many people have a will?

According to a 2019 Report from Merrill Lynch and Age Wave, only 45% of Americans have a will, and just 18% have the recommended estate planning essentials: a will, a healthcare directive, and a durable power of attorney.

Can you be on the principal side of a POA?

Whether you anticipate that you’ll be on the principal or agent side of a POA agreement, you should be familiar with the different types of power of attorney, their uses and limitations, as well as any restrictions around when to set one up so that it’s ready when you need it. Otherwise, you or your loved ones could be leaving your assets — like the house — at risk.

What happens to a non-durable power of attorney?

Similarly, with a non-durable power of attorney, once the transaction is complete, or the time period ends, the power of attorney is revoked. A durable power of attorney is when an agent can take over all aspects of someone’s affairs, in case he or she were to become incapacitated. This type of power of attorney kicks in ...

Popular Posts:

- 1. if the attorney general took more money from me and it is on hold, when will i get my money back

- 2. when do children need an attorney

- 3. what attorney specialty for bankruptcy lift of stay in stockton, ca

- 4. who is kings county jail district attorney?

- 5. when questioning a minor criminally do you have to have an attorney or parent present

- 6. where can i buy an alabama durable power of attorney forms

- 7. who pays the presidents defense attorney

- 8. why are police afraif of state attorney

- 9. how to fire a client attorney

- 10. what is want of prosecution in attorney general