How do I get a durable power of attorney in Texas?

The forms listed below are PDF files. They include graphics, fillable form fields, scripts and functionality that work best with the free Adobe Reader. While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader. 01-137, Limited Power of Attorney (PDF)

Do I need to file a power of attorney?

Limited Power of Attorney. Purpose – This form satisfies specific statutory requirements for taxpayers to designate agents to represent them before the Texas Comptroller of Public Accounts. See Texas Tax Code Section 111.023. You may use this form to grant authority to an attorney, accountant or other representative to act on your

Can a lawyer represent you before the Texas Comptroller of Public Accounts?

· General powers of attorney are used to allow someone to act for you in a wide variety of matters. For example, general powers of attorney are often used in business dealings to allow an employee to enter into contracts, sell property, spend money, and take other actions on behalf of their client. You may wish to create a general power of ...

What is a power of attorney for tax purposes?

· A durable power of attorney is generally used to make plans for the care of your finances, property, and investments in the event that you can no longer handle your financial affairs yourself. The Durable Power of Attorney: Health Care and Finances. This article from legal publisher Nolo explains the advantages of durable powers of attorney.

Where do I file Form 05 102 in Texas?

The 05-102 Form is filed by a director, competent officer, or authorized person. All of the Texas franchise tax public information reports are to send to one addressee: Texas Comptroller of Public Accounts, PO Box 149348, Austin, TX 78714-9348.

How do I contact the Texas comptroller's office?

Questions? Find your subject matter expert below or call us at 800-531-5441.

Are Texas comptroller offices open?

Modified Hours and Locations for Walk-in Taxpayer Service As always, services continue to be provided over the telephone at all of our offices 8 a.m. – 5 p.m., Monday thru Friday and online 24/7. The offices listed are open to the public during the following days and times: Monday 9 a.m. - 4 p.m.

How do I file a certificate of status with the Texas Secretary of State?

Copies and CertificatesOnline using SOSDirect. Instructions for ordering using SOSDirect.By phone: (512) 463-5578.By email: [email protected] mail: Certifying Team. Secretary of State. P. O. Box 13697. Austin, Texas 78711-3697.

How do I report to the Texas Comptroller?

Reporting FraudPhone: 800-531-5441, Ext. 3-8707.Email.Mail: Attn: Criminal Investigations Division. P.O. Box 13528. Austin, Texas 78711-3528.

How do I find my Texas Comptroller Webfile number?

Your Webfile number is your "access code" to Webfile issued by the Comptroller's office. It is printed in the upper left corner of the tax report we mail to each taxpayer and on most notices. It is two letters followed by six numbers (Example: RT666666).

What is the Texas comptroller's office?

The Comptroller's office serves virtually every citizen in the state. As Texas' chief tax collector, accountant, revenue estimator, treasurer and purchasing manager, the agency is responsible for writing the checks and keeping the books for the multi-billion-dollar business of state government.

What is Chapter 171 of the Texas Tax Code?

171.001. TAX IMPOSED. (a) A franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state. (b) The tax imposed under this chapter extends to the limits of the United States Constitution and the federal law adopted under the United States Constitution.

Who is Harris County comptroller?

Glenn Hegar Prior to Comptroller, Hegar was in the Texas Senate where he oversaw state and local revenue matters during the 83rd legislative session and was instrumental in cutting $1 billion in taxes for Texas taxpayers and businesses.

What is TX SOS CPA filing number?

The Texas SOS File number is the number assigned to an entity registered with the Texas Secretary of State.

What is a Texas Secretary of State file number?

The filing number is the unique 10-digit number assigned by the secretary of state to each business organization, name registration, or name reservation filed with the secretary of state.

Do I need to file a Texas franchise tax return?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

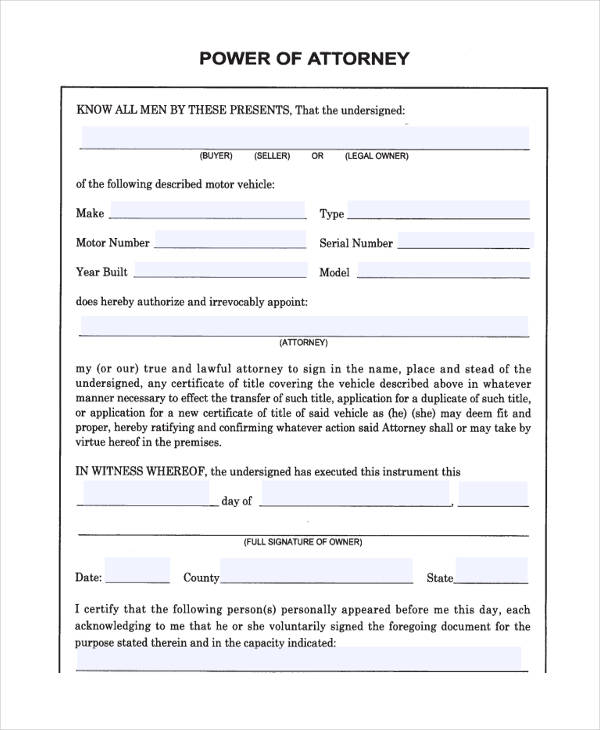

What is a power of attorney in Texas?

A “power of attorney” is a written document that authorizes someone (referred to as the agent) to make decisions or take actions on someone else's (known as the principal ) behalf. In Texas, there are several kinds of powers of attorney that will grant the agent the right to accomplish different things on the principal's behalf.

What is a general power of attorney?

General powers of attorney are used to allow someone to act for you in a wide variety of matters. For example, general powers of attorney are often used in business dealings to allow an employee to enter into contracts, sell property, spend money, and take other actions on behalf of their client. You may wish to create a general power ...

What is a durable power of attorney?

A durable power of attorney is generally used to make plans for the care of your finances, property, and investments in the event that you can no longer handle your financial affairs yourself. The Durable Power of Attorney: Health Care and Finances.

What is a guardian in Texas?

A guardian is appointed for the principal. If a spouse was appointed as the agent and the couple divorces or the marriage is annulled or declared void, Section 751.132 of the Texas Estates Code states that their authority as agent terminates.

Can you file a motion for correction of a clerical error?

You may file a motion for the correction of a clerical error, multiple appraisals, including property on the appraisal roll that should not have been included, or an error of ownership. This type of late hearing may include the current year and the five previous tax years.

What are the rights of a taxpayer?

One of your most important rights as a taxpayer is your right to protest to the appraisal review board (ARB). You may protest if you disagree with the appraisal district value or any of the appraisal district's actions concerning your property. If you are dissatisfied with the ARB's findings, you have the right to appeal the ARB's decision.

What happens after you file a protest?

After filing your protest, you will receive written notice of the date, time, place and subject matter for a formal hearing with the ARB. At the formal hearing, the ARB listens to both the taxpayer and the chief appraiser. You may discuss your objections about your property value, exemptions and special appraisal in a hearing with the ARB.

How long does it take to get an ARB order?

Within 60 days of receiving the ARB's written order (when you sign for the certified mail), you must file a petition for review with the district court.

How long do you have to protest an appraisal?

In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered — whichever date is later. After filing your protest, you will receive written notice of the date, time, place and subject matter for a formal hearing with the ARB.

Popular Posts:

- 1. how can i become power of attorney for my mother's financial needs?

- 2. how to file a grievance against an attorney dayton ohio

- 3. how to determine attorney fees for chapter 13

- 4. who is the states attorney in mclean county

- 5. who is the current attorney general of kentucky

- 6. what is attorney notice of leave absence in a divorce hearing

- 7. ‘trump tells obana 'get a powerful attorney’ after what his investigators just

- 8. when does a judge decide to award attorney fees

- 9. how can i get power of attorney for my 37 y/o son

- 10. why does the attorney generals office put holds on payments