If you are granted power of attorney, you may be able to sign loan agreements on behalf of the person who granted you that power. However, whether you have this right or not depends entirely on factors such as the power of attorney document itself and when you want to enter into the agreement.

Full Answer

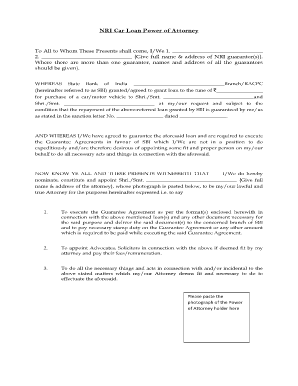

What is a power of attorney for buying a car?

Feb 28, 2022 · “It’s highly dependent on what state you’re in, but in most cases, you should be able to buy a car with it. Be prepared to have a ton of extra paperwork and to get plenty of things notarized in regard to the purchase. Your state may also have a motor vehicle power of attorney form that you may have to fill out to complete the transaction.

Can a power of attorney sign a loan agreement?

Nov 18, 2014 · This means that the lender would have the authority to transfer title to the car. The practical reality is that the lender would have the authority to "sell" the loan to another bank/finance company to administer the loan, and would transfer the title documents along with the loan. the other practical piece is that it allows the lender to complete all of the title …

How does a power of attorney affect refinancing a car?

Mar 30, 2012 · When you purchase a car from a dealer a "limited Power of Attorney" is signed in all that paperwork. Generally a limited Power of Attorney allows the lender (dealer) to do the title, the lien, mileage statements, etc. I would of course read the documents and if you have questions ask, but generally a limited Power of Attorney is part of an auto loan/purchase settlement - no …

What happens if you sign a power of attorney form?

Jul 02, 2014 · Posted on Jul 8, 2014. This is actually a very common and I believe some states even require a limited POA to be granted to the dealership so they can take the necessary steps to legally transfer the property to you. It is used for such things as execute a bill of sale, title, odometer statement, request for release of liens and other documents. You just need to be …

How do you sign car payments over to someone else?

There is a process to transfer a vehicle loan to another borrower.Contact the original lender. Know going in that you'll need the permission of the auto lender to complete the deal. ... Check your auto loan contract. ... Have your borrower check the contract. ... File the new loan paperwork. ... Make a title change.Jul 7, 2021

Can you add someone to a car loan after signing?

Yes, you can add a cosigner to a car loan you already have – you just need to refinance it! It may sound simple, but not everyone qualifies for auto loan refinancing. You and the cosigner have to meet the lender's requirements individually if you want to add them to the loan.Jul 1, 2019

How do I get a lien release from Capital One?

Capital One will notify the DMV to release the lien. If you would like a physical copy of the title, please contact the DMV. There is no further action required by Capital One. The registered owner should already have a title on hand and a lien release letter will be sent by Capital One.Oct 17, 2020

How do I access my Capital One auto loan?

How can I access my auto loan online? As a new or current customer, simply enroll in Online Banking to access your auto loan account online. You'll need your last name, social security number, and date of birth. If you have questions, please contact us.

Can you transfer a bank loan to another person?

Is personal Loan Transferable? The answer to this is, yes, you can transfer your personal loan to another person. There are some Banks or Non-Banking Financial Companies that provide such facilities.

Can I pay off someone else's car loan?

You can definitely make the payments to the car loan: the lender doesn't care who makes them as long as they are completed on time. If you trust your friend, you could give him the money to pay in his name.

How Long Will Capital One finance a car?

24 to 72 monthsCapital One Auto Loan DetailsAPRDepends on credit profileLoan Term Length24 to 72 monthsPrepayment PenaltyNoneApplication FeeNone1 more row•Mar 25, 2022

How many car payments can you missed before repo Capital One?

Two or three consecutive missed payments can lead to repossession, which damages your credit score.

Does Capital One have a grace period for car payments?

The Capital One grace period lasts 25 days. It is the time between the close of a billing cycle and when your bill is due. And you won't be charged interest during the grace period if you pay your balance in full by the due date every month.Jan 25, 2020

Will my Capital One auto loan show up on the app?

The app has the following features: View and manage your Capital One accounts from one place, including home and auto loans, banking accounts, credit card statements, etc. Navigate through transactions and payments and organize them by category to help track your spending.Jul 8, 2015

What is Capital One Auto Navigator?

Want to shop for cars online: Capital One Auto Navigator enables car buyers to find a vehicle online, pre-qualify and present that offer when at the car dealership, speeding up the car buying process. Pre-qualifying is not a commitment to finance with Capital One if the dealership finds a lower-rate loan offer.Apr 11, 2022

What credit agency does Capital One use?

Capital One is unlike other banks in that there isn't one credit bureau that it is most likely to use when looking at a credit card application. It uses Experian (36%), Equifax (32%) and TransUnion (32%) roughly equally. In some cases, it will check two or three credit bureaus when making a lending decision.Mar 24, 2022

What happens if you sell a car without a power of attorney?

If you were to sell the car on someone else’s behalf without the power of attorney, the actual owner of the car could turn around and claim you didn’t have the right to sell the car. In that case, there becomes a huge legal issue. The seller can claim they didn’t want their car sold and the buyer can claim ...

What is a notary?

What’s a notary? A notary is a government employee responsible for witnessing the signing of legal documents. Once you have the power of attorney for your loved one, you have the right to sell their vehicle for them. By signing the document, they entrusted you with this process.

What is the most important piece of information you need to provide for a car sale?

One of the most important pieces of information you need to provide is the VIN ( vehicle identification number) for the car. Without this, there’s no way to prove which vehicle was signed over and which vehicle you had the right to sell.

What is a power of attorney?

In short, a power of attorney is when a person signs over some of their rights to another person to allow them to act on their behalf. For the most part, a power of attorney can involve managing finances or selling property like cars and homes for another person. When a person is given a power of attorney, it’s usually because ...

Why do people need power of attorney?

When a person is given a power of attorney, it’s usually because the other person is unable to act on their own behalf. They may be too sick, mentally incompetent, physically disabled, or just too old. They need someone close to them to help them sell their vehicle.

Can a seller claim a car they didn't want to sell?

The seller can claim they didn’t want their car sold and the buyer can claim the car as their own since they have the title. Legally speaking, you didn’t have the right to transfer the title. It’s a mess and it’s a situation you don’t want to find yourself in.

Is it legal to sell a car title in your name?

The biggest issue is that, when the title is in your name, you technically don’t owe them the money you make from selling their car.

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

Who is Mollie Moric?

Mollie Moric is a staff writer at Legal Templates. She translates complex legal concepts into easy to understand articles that empower readers in their legal pursuits. Her legal advice and analysis...

Auto Loan - Power of Attorney

I filled out an Auto Refinance App through LendingTree. The first response sent me the loan documents and I saw forms for limited Power of Attorney. Is this a scam? I don't remember seeing that on my original paperwork and wanted to make sure this was something legit.

Re: Auto Loan - Power of Attorney

I filled out an Auto Refinance App through LendingTree. The first response sent me the loan documents and I saw forms for limited Power of Attorney. Is this a scam? I don't remember seeing that on my original paperwork and wanted to make sure this was something legit.

Re: Auto Loan - Power of Attorney

I guess I'm confused becasue I didn't see the same form on the refiance documents I got from Cap One...

Re: Auto Loan - Power of Attorney

Hello - I realize this it a bit older but stumbled across it with my own questions. I applied for a loan and the power of attorney form is very vague. It states Appoint xxx as attorney to execute... any and all papers to transfer and assign the following vehicle.

William Edward Scully Jr

This is not unusual. The purpose of the power of attorney is to enable the dealership to apply for a title in your name. It's not uncommon for the dealership not to have a title in their hands when they sell the car to you. The power of attorney allows them to take care of the title transfer without you having to be present. More

Summer Gomillion Walker

This is actually a very common and I believe some states even require a limited POA to be granted to the dealership so they can take the necessary steps to legally transfer the property to you. It is used for such things as execute a bill of sale, title, odometer statement, request for release of liens and other documents.

Francine Denise Ward

Be that as it may, I would be VERY careful that the Power of Attorney (POA) is specific and limited to just this one issue and transaction. You don't want to sign away your rights in a broad and sweeping POA to a car dealer. As always, I say read and understand everything you sign your name to...

What is an agent in a contract?

An agent is simply someone you authorize to perform acts that otherwise only you would have the right to perform. He does not have to be an attorney. Your authorization must be in writing, but you may revoke it at any time as long as you are mentally competent and able to communicate. Your agent may sign a purchase contract on your behalf by ...

What is a power of attorney?

A Power of Attorney for Buying a Vehicle. You can authorize someone else to purchase a car for you while you are out of town. A power of attorney form is a document that authorizes someone else to perform legal acts on your behalf. You may authorize an agent, for example, to purchase a vehicle in your name. If you do, you will be legally bound ...

What happens if your agent is too specific?

If your statement is too specific, your agent might lack the authority to complete the transaction. For example, if you grant your agent only the authority to sign a purchase contract, he will be unable to transfer title to the car into your name.

Can you authorize an agent to buy a car in your name?

You may authorize an agent, for example, to purchase a vehicle in your name. If you do, you will be legally bound to the purchase as soon as the agent signs the purchase contract in your name. Advertisement.

Can a power of attorney bind you?

The danger of a written power of attorney is that your agent can bind you as long as another party with whom he is dealing has reason to believe the agent has legitimate authority, even if he doesn't. For example, if you sign a power of attorney form, deliver it to your agent and later dismiss her without demanding return of the power ...

Do you need a power of attorney form?

Some states offer standardized power of attorney forms, but most don't require you to use them -- you can draw up your own form as long as you include all of the required elements. State laws differ somewhat, but at the minimum the document must include the name of your agent, a statement granting the agent authority and your signature.

What happens to a power of attorney if the principal loses her mental faculties?

If the principal loses her mental faculties, the power of attorney is automatically rescinded unless the principal granted a durable power. Durable powers continue to let the agent act even if the principal is incapacitated.

How long does an attorney in fact last?

Your ability to act as attorney-in-fact lasts only as long as the principal desires. A principal can only grant power of attorney when she is of sound mind, and as long as she remains of sound mind, she can terminate the agreement at will.

What is the scope of a power of attorney?

Scope of Powers. Powers of attorney can convey as limited or as broad a power as the person granting them desires. A person who grants power of attorney, called the principal, can grant the person or organization receiving the power, known as the attorney-in-fact or the agent, any powers he so chooses, including the right to enter ...

Do powers of attorney end when the principal dies?

No matter what powers are granted and no matter what conditions or limitations are imposed on the agent, an agent's powers of attorney terminate automatically on the death of the principal. Even durable powers do not allow the agent to continue acting after the principal dies. However, loans or agreements the agent enters into on behalf of the principal after the principal dies but before the agent learns of his death are binding, though they are binding on the principal's estate and not the principal himself.

Who decides when a power of attorney becomes effective?

A principal also decides when a power of attorney becomes effective and can revoke it at any time. For example, principals often grant springing powers of attorney, powers that do not come into effect until a specific date or on the occurrence of a certain condition.

Is a loan binding on the principal?

However, loans or agreements the agent enters into on behalf of the principal after the principal dies but before the agent learns of his death are binding, though they are binding on the principal's estate and not the principal himself. Roger Thorne is an attorney who began freelance writing in 2003.

Can a power of attorney override a will?

Does Power of Attorney Override a Will? Temporary Medical Power of Attorney. If you are granted power of attorney, you may be able to sign loan agreements on behalf of the person who granted you that power. However, whether you have this right or not depends entirely on factors such as the power of attorney document itself ...

Popular Posts:

- 1. who do i file a complaint with against an attorney

- 2. how to get qvc power of attorney for elderly mother

- 3. what is the medical power of attorney

- 4. what do i do if attorney withdraws from my bankruptcy case prior to trial

- 5. what if you can t afford a divorce attorney

- 6. how to bill someone who is acting with power of attorney

- 7. where to mail power of attorney form to irs

- 8. how much can be deductible for attorney fee awards

- 9. what is without cap attorney fees mean

- 10. how much does it cost to certified power of attorney in mn