What happens to a power of attorney after 5 years?

This type of power of attorney lasts for the duration of your life and only ends on your death or declaration of incapacitation. But, of course, you can rescind it when you want to. Durable power of attorney: This type of power of attorney is flexible as it can be general or limited in scope. However, it does remain in effect after you are declared incapacitated.

How often do power of attorney documents expire?

Mar 03, 2015 · 8:27 am on October 2, 2019. Divya, Some states like California have laws which limit a durable power of attorney life to like five years and say it needs to be redone. Banks and other institutions have a harder time accepting older durable power of attorney papers, so it is good to redo them every five years or so.

Can I take my durable power of attorney to the bank?

Aug 05, 2016 · These days most of the information is available online, so you shouldn't need to save more than seven years of records -- and five years should be fine. If your siblings want more, perhaps you could send the statements that are more than five years old to them to review before they discard them if they choose. Last Modified: 08/05/2016

How long does a minor child power of attorney last?

Aug 01, 2016 · Power of Attorney (POA) This question has been closed for answers. ... It really is none of my business, but since you asked. I would keep records for a very long time, at least 10 yrs. Just in case there is a problem. Why be so eager to throw stuff away. 08/01/2016 16:10:42. Helpful Answer (0) Report. X.

How long does a power of attorney last?

First, the legal answer is however long you set it up to last. If you set a date for a power of attorney to lapse, then it will last until that date. If you create a general power of attorney and set no date for which it will expire, it will last until you die or become incapacitated.

What happens if you don't have a power of attorney?

If you don’t have a durable power of attorney in place when you become incapacitated, then your family will have to go to the court and get you placed in conservatorship so that they can manage your affairs. Conservatorships are a big mess and should be avoided.

Can a durable power of attorney kick in?

Usually, a durable power of attorney is set up to kick in only if you become incapacitated. This allows someone to manage your affairs while you can’t. If you don’t have a durable power of attorney in place when you become ...

What is the duty of an agent under a power of attorney?

The Agent under a Power of Attorney has a fiduciary relationship with the principal that includes the duty to: 1) Exercise the powers for the benefit of the principal; 2) Keep separate the assets of the principal from those of an agent; 3) Exercise reasonable caution and prudence;

What was the agent's testimony about her husband paying back the loan?

The Agent testified that her husband was paying back the loan, which did not bear any interest, by cleaning for and giving medicine to Mrs. Bitschenauer.

How many hours did the Bitschenauer estate work?

This meant that the Agent claimed to have worked 20 hours per week for Mrs. Bitschenauer while she was working 50 hours per week as a financial advisor and raising two children. The Agent couldn’t support this incredible statement with any records, and was ordered to return $87,505 to the Estate.

Does a power of attorney give a gift?

Further, the power of attorney document did not provide the Agent with any gifting authority . It is a well-established law that a power of attorney document must provide for gifting authority to authorize the Agent to make gifts . As such, the Court ordered the Agent to return $48,000 to the Estate.

Do all agents have to sign a Power of Attorney in Pennsylvania?

Indeed, Agents in Pennsylvania are required to sign a document when they accept the appointment as Agent in which they expressly agree to uphold these principles.

Do you read a power of attorney before acting?

–Always read and understand the Power of Attorney document before acting under it, and comply strictly with all of its terms. For example, unless the Power of Attorney authorizes gifting, then the Agent can make no gifts of any size without the risk of liability.

Did Agent Tucker keep receipts?

However, Agent Tucker admitted that she lacked any documentation of the purpose of those cash withdrawals. She had kept no receipts, and could not even prove that the principal received those funds. As a result of Agent Tucker’s complete lack of recordkeeping, Judge Herron ordered her to return $27,875 to the Estate.

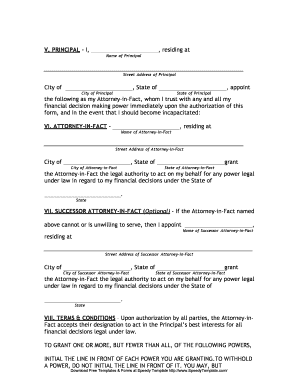

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

Does power of attorney matter in which state?

A: The power of attorney must be tailored for the state in which your parent resides. It does not matter which state you live in, as long as the power of attorney is applicable to the principal’s state of residence, which in this case is your parent, is what matters.

Popular Posts:

- 1. where to find attorney john lawler

- 2. how much is john alexander, attorney at law worth

- 3. who is mark zuckerberg's attorney

- 4. what to write in an attorney payout vendor letter

- 5. when do you ask for a court appointed attorney

- 6. client recording a meeting when attorney not present and other party has an attorney

- 7. who plays attorney fisk on all rise

- 8. how much fee is an attorney entitled to for a ny state estate?

- 9. duty of attorney to say what the law is

- 10. how much is the attorney fee for 911 compensation fund