Why do you have to notify someone of a power of attorney?

A power of attorney is a legal document that appoints a person, known as an agent, to have rights to make legal and/or financial decisions on your behalf. If you're mentally competent and no longer wish to have someone appointed as your power of attorney, you can cancel it by submitting a formal revocation form, as well as notifying the individual and other relevant third parties, in …

What is a power of attorney form?

4. Notify interested parties of the revocation and new power of attorney. Finally, give or mail the notice of revocation to the previous agent(s) and to any bank, credit union, investment firm, or other institution that had a copy of the old power of attorney form. Provide the new POA to your financial institutions and to your new agent(s).

How to activate a power of attorney?

To revoke the power of attorney, notify your attorney-in-fact in writing that the power has been revoked, and ask your attorney-in-fact to return any copies of the power of attorney document to you. You should also send written notification to any business or person that may have received a copy of the document, telling them that you have revoked the power of attorney.

What should my notice of revocation of a power of attorney include?

You don’t have to choose anyone to notify. If you do, that person has the right to see the LPA before it is registered, and to object to it. If no objections are made before registration, it would be difficult for them to be made afterwards. Including people to notify is therefore a way of reducing the chance that the person might object later.

Who needs to be notified about a lasting power of attorney?

A 'person to notify' is someone a person who makes an LPA (the 'donor') chooses to inform about the registration of their LPA. They don't have to choose anyone to notify, so if that section of the LPA is blank, you don't need to fill in this form.

How do you activate power of attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.Apr 16, 2021

What happens after a power of attorney is registered?

A property and financial affairs LPA will come into effect as soon as it is registered. This means that the attorney will be able to start making decisions about your property and financial affairs straight away, even if you are still capable of making your own decisions.

How do I activate a power of attorney in Ontario?

You can make a power of attorney document yourself for free or have a lawyer do it. To make a power of attorney yourself, you can either: download and complete this free kit. order a print copy of the free kit online from Publications Ontario or by phone at 1-800-668-9938 or 416-326-5300.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How do I notify DWP of power of attorney?

If you want to become an appointee you need to notify your relatives local Department for Work and Pensions (DWP) office and fill in form BF56. The DWP may say they have to visit you and your relative before deciding if you can be an appointee.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

Does next of kin override power of attorney?

No. The term next of kin is in common use but a next of kin has no legal powers, rights or responsibilities.

Does a power of attorney in Ontario need to be notarized?

Similar to a legal last will and testament, you do not need to have your power of attorney documents notarized for them to be legal. This applies to power of attorney documents in all provinces in Canada. However, there are a couple instances where you may want to include a notary.

How much does a power of attorney cost in Ontario?

The legal fees of a power of attorney in Ontario are usually calculated based on the document you want to authorize to a lawyer. The price can range anywhere from $100 to $300 per document.

Does a power of attorney need to be notarized?

Does my power of attorney need to be notarized? ... It is not a legal requirement for your power of attorney to be notarized, but there are very good reasons to get it notarized anyway. First, notarizing your power of attorney assures others that the signature on the document is genuine and the documents are legitimate.May 16, 2019

What does POA mean in estate planning?

When you create a power of attorney, or POA, you give someone else legal authority to act on your behalf and manage your financial affairs. They are common estate planning tools, but they have other uses as well, such as authorizing someone to handle a specific transaction in your absence.

How to change your agent?

Changing your agent may mean you want to also change the types of transactions you want your agent to handle. Talk to the person (s) you want to name as your agent (s) to be sure they understand their potential responsibilities and are willing to act on your behalf. 2. Prepare a new power of attorney. When you know what you want to change, create ...

Can you change the scope of authority of a POA?

Changing a Power of Attorney. After creating a POA, you may need to make changes to it. Whether you change your mind about the person to whom you gave the authority, called the agent, or you want to change the scope of authority granted under the form, you can revoke the existing document and create a new one. 1.

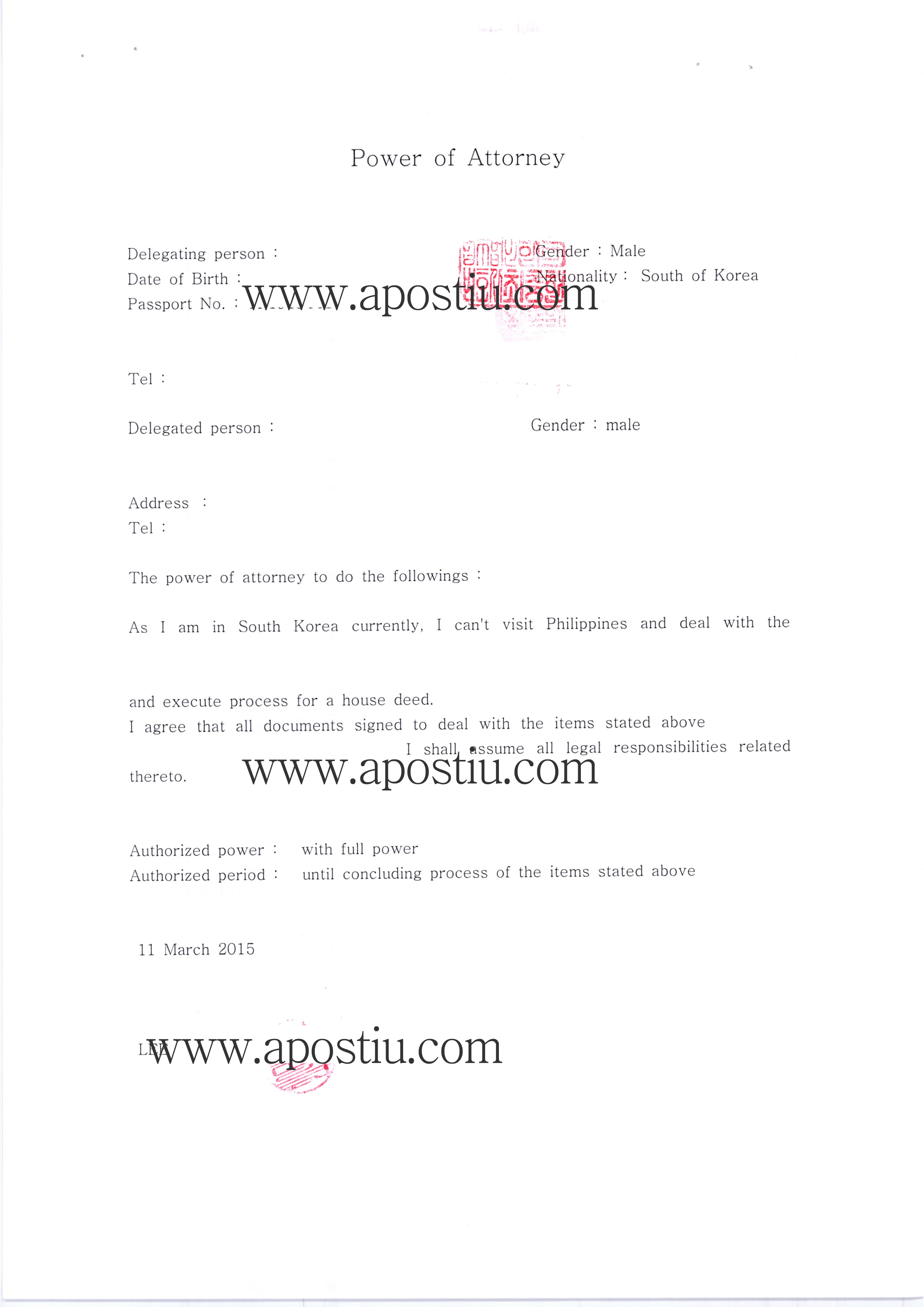

What is a power of attorney?

A power of attorney document allows someone that you select (your “attorney-in-fact” or “agent”) to act on your behalf in financial matters.

Can you revoke a power of attorney?

Revoking the power of attorney. When you no longer need an attorney-in-fact, for example, after returning from deployment, you can revoke the power of attorney.

What is the third safeguard?

The third safeguard is the option to notify people that the LPA has been made. You don’t have to choose anyone to notify. If you do, that person has the right to see the LPA before it is registered, and to object to it. If no objections are made before registration, it would be difficult for them to be made afterwards.

Is Net Lawman a power of attorney?

Net Lawman has an online lasting of power of attorney service that it runs in conjunction with Unforgettable.org, a leading dementia products retailer. The basic service – making either type of LPA – is free to use. If you would like your forms to be checked by a professional will writer to give you peace of mind that they will be registered by the OPG, there is a small fee to pay.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

Who is Diana's representative on W-2?

Diana authorizes John to represent her in connection with her Forms 941 and W-2 for 2018. John is authorized to represent her in connection with the penalty for failure to file Forms W-2 that the revenue agent is proposing for 2018.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

What is a LPA donor?

When a donor is creating a Lasting Power of Attorney (LPA), they have the option to name people to be notified. These are often referred to as ‘people to notify’, ‘people to be told’ or ‘named people’. This week’s article will cover who can be a named person, what their purpose is and what they can do.

Is a LPA legal?

The LPA is not legally valid. The donor cancelled the LPA when they had mental capacity. Fraud or undue influence was used to pressure the donor into making the LPA. An attorney is acting, or intends to act, above their authority or against the donor’s best wishes.

Can an attorney be an attorney?

An attorney lacks the capacity to be an attorney. An attorney has disclaimed their appointment. Where the ground is that an attorney can no longer act, the OPG will still register the LPA as long as there is still another attorney able to act (unless they are appointed jointly) or there are replacement attorneys appointed.

When is a power of attorney activated?

The rules on when you can start activating a lasting power of attorney vary depending on what type of LPA it is.

Your duties as an attorney

It’s not easy, being someone’s attorney. You may need some support as time goes on. You might find the links below helpful:

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What is an advance directive?

An advance directive, referred to as a “living will” or “medical power of attorney”, lets someone else handle health care decisions on someone else’s behalf and in-line with their wishes. These powers include: Everyday medical decision-making; End-of-life decisions; Donation of organs;

How many witnesses do you need to be a notary public?

In most cases, a Notary Public will need to be used or Two (2) Witnesses.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Popular Posts:

- 1. is when you hired an attorney discoverable

- 2. how long before the attorney gets the discovery?

- 3. the right of an attorney to say what she wants in court even if it is normally defamation, is an

- 4. how to file chapter 7 bankruptcy in pa without an attorney

- 5. what makes a good attorney

- 6. what degree you get to be a district attorney

- 7. when was bruce ohr us asscoiate deputy attorney

- 8. ellen quote there is a difference between how i am known by my friends and the processing attorney

- 9. how do you get a power attorney for

- 10. when you make a grievance against an attorney what is the process to investigate