A: If the power of attorney document authorizes the Agent to make changes to beneficiary designations, and if it does not prohibit the Agent from listing themselves as a beneficiary, then it is likely they can list themselves as a beneficiary on a life insurance policy. Can a power of attorney be a beneficiary on a bank account?

Can a power of attorney change the beneficiary of a will?

Nov 28, 2018 · Even if the power of attorney has the authority to make gifts, an agent may not make a gift to herself of the money or property of the principal. Such a gift carries with it a presumption of impropriety. The agent under the power of attorney cannot use the gifting power to alter the principal’s testamentary intent. In your situation, this means that if your mother’s …

What is the difference between a PoA and a beneficiary?

When a POA is a general POA, if there's nothing in it, giving the agent the right to change bank account beneficiaries, the agent cannot do so. Even if the agent can deposit checks in the bank, changing beneficiaries of a bank account is a special power which the POA instrument must specifically list. Without it, an agent doesn't have the right to change beneficiaries, even if they …

Can I Change my beneficiary designation after I sign?

May 21, 2017 · Legally, the power of attorney or POA can let the person given power by the POA (called the "agent" or "attorney-in-fact") make changes to insurance documents, including beneficiaries. He had to act in your mother's best interest and in accordance with her wishes, however: the agent is given power to help the principal (the person granting the power; your …

Can a power of attorney change your best interests?

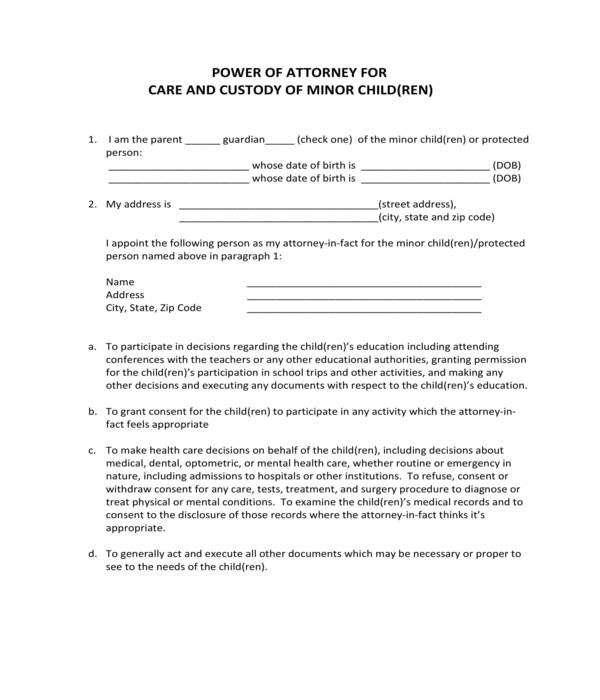

Jan 26, 2018 · A Power of Attorney (POA) is a document that grants a person or organization certain powers over your affairs if you become incapacitated for some reason. This person or organization to whom you bestow power is called an attorney-in-fact or agent.

Can you change beneficiary as POA?

The courts have held that the act of making a beneficiary designation or changing an existing designation is a testamentary disposition and exceeds the authority of an attorney. As such, generally your attorney cannot make a beneficiary designation on your behalf.

Can you change beneficiary?

Requesting a change of beneficiary is simple. In most cases, you'll just need to request the proper forms from your insurance company and provide basic information on the new beneficiary. If you're wondering, “Can my spouse change the beneficiary on my policy?,” the answer is no, in most cases.

When can a beneficiary change occur?

Such last-minute beneficiary changes happen when the insured is gravely ill, in the hospital or nursing home, or of diminished mental capacity. Most of the time they occur a day or two before the insured's death.Jan 9, 2020

Is power of attorney and beneficiary the same thing?

Can a Power of Attorney Also Be a Beneficiary? Yes. In many cases, the person with power of attorney is also a beneficiary. As an example, you may give your power of attorney to your spouse.Jun 26, 2019

Can you change your beneficiary with Social Security?

Even if your payee was appointed for you, you may request a new payee (though you must give adequate reason for changing). When you want to change your rep payee, go to your Social Security Administration field office and request a change of payee.

What can a policyowner change a revocable beneficiary?

With a revocable beneficiary designation, the policyowner may change the beneficiary at any time without notifying or getting permission from the beneficiary.

What can override a beneficiary?

An executor can override a beneficiary if they need to do so to follow the terms of the will. Executors are legally required to distribute estate assets according to what the will says.

What statement regarding the change of beneficiary provision is true?

Which statement regarding the Change of Beneficiary provision is true? A policyowner would like to change the beneficiary on a Life insurance policy and make the change permanent. Which type of designation would fulfill this need?

Can a beneficiary be added after death?

To be effective, a disclaimer must meet certain requirements: it must be in writing, it must be made before you accept the gift or any of its benefits, and it must be made not later than nine months after the person's death.Oct 26, 2020

Can POA change beneficiary on IRA?

Generally, a POA does not grant the power to change the beneficiary designation on an IRA account. Moreover, general POA rules would not allow an agent under the POA to change it to themselves.Oct 5, 2012

What does a beneficiary do?

A beneficiary is the person or entity that you legally designate to receive the benefits from your financial products. For life insurance coverage, that is the death benefit your policy will pay if you die. For retirement or investment accounts, that is the balance of your assets in those accounts.

Who are beneficiaries?

A beneficiary is any person who gains an advantage and/or profits from something. In the financial world, a beneficiary typically refers to someone eligible to receive distributions from a trust, will, or life insurance policy.

What is a beneficiary in a will?

A beneficiary is basically a recipient of something. It can be a person, multiple people, a charity, a trustee, or even your estate. Beneficiaries are typically designated on life insurance policies, annuities, and certain retirement plans – like 401 (k)s and IRAs. They are also named in wills and trusts.

Why is it important to name beneficiaries?

Naming beneficiaries is an integral part of estate planning for same-sex couples. It is important to dictate who should receive what benefits, and when. Beneficiaries do not have any legal authority, though, which means that preparing a power of attorney (POA) document is also crucial – especially for partners who choose not to marry.

What is a POA?

What is a Power of Attorney? A Power of Attorney (POA) is a document that grants a person or organization certain powers over your affairs if you become incapacitated for some reason. This person or organization to whom you bestow power is called an attorney-in-fact or agent.

Do beneficiaries get taxed?

reaching a certain age or getting married). The funds or property that a beneficiary receives may also be subject to taxes, depending on the nature of the disbursement.

What is a power of attorney?

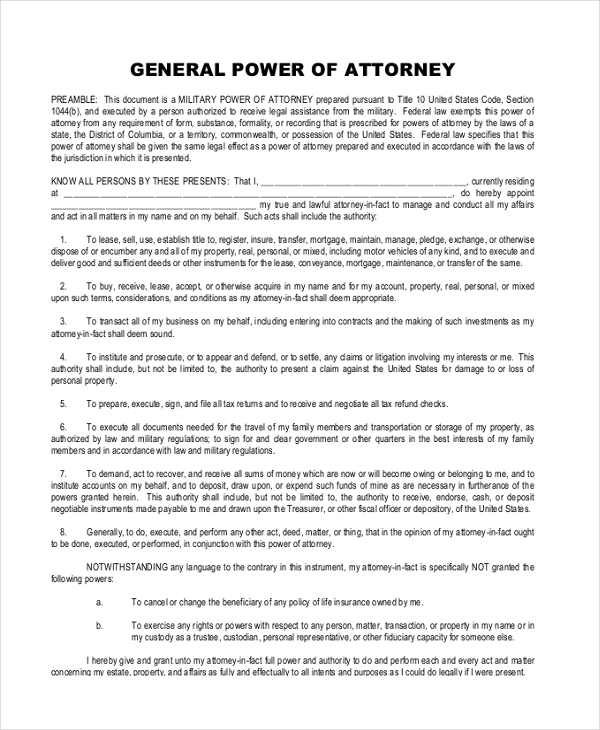

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a convicted felon have a power of attorney in Texas?

Can a Convicted Felon Have Power of Attorney? Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they want to serve as their power of attorney.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What is a durable power of attorney?

You might also sign a durable power of attorney to prepare for the possibility that you may become mentally incompetent due to illness or injury. Specify in the power of attorney that it cannot go into effect ...

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

What is a fiduciary?

A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing. Someone who violates those duties can face criminal charges or can be held liable in a civil lawsuit.

What is a power of attorney?

A power of attorney gives another individual the legal right to make financial decisions on your behalf should you become physically or mentally unable to do so for yourself. You can execute a general power of attorney giving an individual the authority to represent you in making financial decisions until you revoke the power of attorney. A limited power of attorney restricts your representative to making decisions relating to only certain matters that you detail in the power of attorney document.

What happens to life insurance when you die?

When you die, the person you name as your power of attorney loses all rights and therefore is unable to make decisions about who receives your life insurance proceeds or other assets. Although most insurance companies require a beneficiary designation form, if you do not name a beneficiary on your form, the insurance company may pay the benefits to your estate. The money then becomes subject to probate. State laws regarding probate vary. In some states, as long as you have a will, the proceeds of your life insurance will be distributed according to the directions you leave in your will. If you leave no will, the court will appoint an executor. Once your debts, probate costs and burial costs are paid, the court usually distributes any remaining assets to your spouse and children.

How does life insurance work?

A life insurance company pays benefits to the person or persons you list on your beneficiary designation form. Naming a beneficiary of your life insurance benefits in your will does not take priority over the person you choose as your beneficiary on the beneficiary designation form. For this reason, it’s important to update your beneficiary information following major life changes such as marriage, divorce, the birth of a child or the death of your spouse or partner. You can change your beneficiary designation any time you want except if you name an irrevocable beneficiary. In that case, you can't change the beneficiary unless the current beneficiary consents.

Why is it important to protect your assets when you die?

Knowing how to protect your assets helps guarantee that your heirs will have money to live on when you die. Estate planning might not seem like a top priority when you’re young, but it matters if something happens to you and you leave behind a spouse and young children.

What happens if you leave no will?

If you leave no will, the court will appoint an executor.

Can a NJDPB change beneficiary designation?

However, be advised that the NJDPB has the responsibility to deny changes to beneficiary designations that may violate a court order. If a court order exists, you may be required to furnish further documentation to the NJDPB to determine whether or not we can accept your Designation of Beneficiary form.

Is NJDPB accepting paper designation of beneficiary forms?

Paper Designation of Beneficiary forms are no lon-ger accepted by the NJDPB for active members of the Public Employees’ Retirement System (PERS), Police and Firemen’s Retirement System (PFRS), Teachers’ Pensionand Annuity Fund (TPAF), or State Police Retirement System (SPRS).

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

Popular Posts:

- 1. when does a district attorney get involved child support

- 2. what oath does the attorney general

- 3. how long before an attorney makes calls

- 4. how to become a student attorney in wisconsin

- 5. which amendment guarantees the right to an attorney?

- 6. printable power of attorney form free

- 7. what do you call someone that you are the power of attorney for?

- 8. when does an attorney get notified of ca st bar complaint

- 9. who was hawaii's attorney general in 1976

- 10. what is needed if selling car as the power of attorney