Full Answer

Where can I get free power of attorney forms?

Jul 18, 2021 · You can request Power of Attorney or Tax Information Authorization online with Tax Pro Account, Submit Forms 2848 and 8821 Online, or forms by fax or mail. You have these options to submit Power of Attorney (POA) and Tax Information Authorization (TIA).

Where can I get the forms for power of attorney?

Mar 22, 2022 · Submit Forms 2848 and 8821 Online Before You Get Started. Ensure you have authenticated the identity of your client. Make sure the form is signed by all... Submit Your Form. Log in with your username, password, and multi-factor authentication. Answer a few questions about the... After You Submit. ...

Where can I get durable power of attorney forms?

How to Submit a Power of Attorney | Georgia Department of Revenue. The .gov means it’s official. Local, state, and federal government websites often end in .gov. State of Georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address. Before sharing sensitive or personal information, make sure you’re on an official state website.

Where can I get a power attorney form?

Mar 09, 2022 · Download: Adobe PDF, MS Word (.docx), OpenDocument. Minor Child Power of Attorney – Allows a parent to give the full responsibility of their son or daughter to someone else (except adoption rights). Valid for a temporary period of time, usually between six (6) months to one (1) year, which is dependent on the State’s laws.

Where do I send my 2848?

Your representative must sign the new Form 2848 on your behalf, and submit it to the appropriate IRS office with a copy of your written permission or the original Form 2848 that delegated the authority to substitute or add another representative.Sep 2, 2021

Where do I send my federal power of attorney?

Power of Attorney - Form 2848THEN use this address...Fax number*Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows

Where do you file and withdraw forms 2848 and 8821?

Where to File Forms 2848 and 8821. Practitioners must mail or fax their authorization forms to the applicable CAF unit (Ogden, Utah; Memphis, Tenn.; or Philadelphia) unless they check the box on line 4 of Form 2848 or 8821 (specific use not recorded on the CAF).Jun 30, 2015

Where do I send form 3520?

Send Form 3520 to the Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409. Form 3520 must have all required attachments to be considered complete. Note.

Does IRS recognize power of attorney?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Feb 11, 2020

What is a 940 form?

More In Forms and Instructions Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax.Jul 9, 2021

How do I send documents to the IRS?

Visit www.taxpayeradvocate.irs.gov or call 877-777-4778. Complete this form, and mail or fax it to us within 30 days from the date of this notice.

Can I upload documents to IRS?

Depending on the situation, the acceptable types of documentation may include copies of pay statements or check stubs. You take a picture of your documentation and the Documentation Upload Tool enables you to upload the image. And just like that, the IRS can access the data and continue working the case.Aug 26, 2021

Should I use form 2848 or 8821?

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.Aug 26, 2021

What happens if you don't file Form 3520?

The IRS requires a U.S. person receiving a gift from a foreign individual, corporation, partnership, or estate to report by filing Part IV Form 3520. Failure to file or late, incorrect, or incomplete filing is subject to a severe penalty. A penalty of 5% of the amount of the gift for each month not reported is given.May 26, 2021

Can I file Form 3520 electronically?

While Form 3520 must be printed and paper filed, by mail (it cannot be e-filed), there is no reason that this should interfere with your regular income tax return preparation and filing.Jun 7, 2019

Who fills out form 3520?

Form 3520 for U.S. recipients of foreign gifts You're only required to file this form if you received: A gift of more than $100,000 from a foreign person or estate. A gift of more than $15,601 from a foreign partnership or corporation.

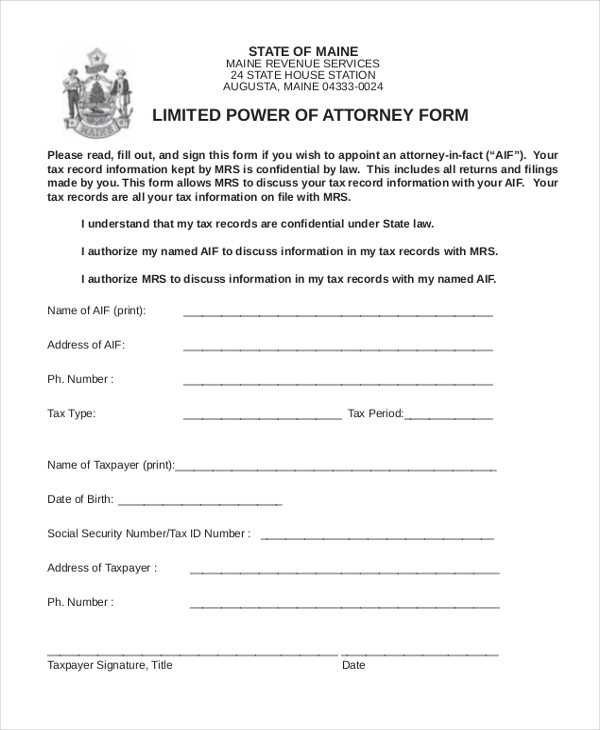

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

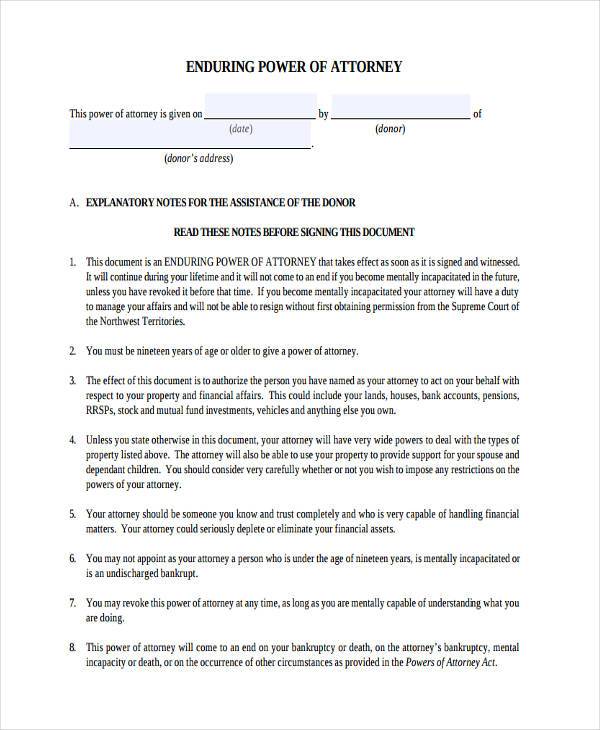

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

How to establish a power of attorney relationship?

To establish a power of attorney relationship, you must fill out and submit the correct FTB form. 1. Choose the correct form. 2. Fill out the form correctly. Representatives: Provide all available identification numbers: CA CPA, CA State Bar Number, CTEC, Enrolled Agent Number, PTIN.

Who can sign a business form?

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following: Printed name. Title (not required for individuals) Signature.

Who can sign FTB 3520-BE?

Examples: President. Vice President. Chief Financial Officer (CFO) Chief Executive Officer (CEO)

How to submit multiple forms?

To submit multiple forms, select “submit another form" and answer the questions about the authorization. If you are unable to establish a Secure Access account or submit the forms online, you can submit forms by fax or mail.

How to authenticate a taxpayer's identity?

To authenticate the taxpayer’s identity for remote transactions, take these steps: Inspect a valid government-issued photo identification (ID) of the taxpayer and compare the photo to the taxpayer via a self-taken picture of the taxpayer or video conferencing to compare.

What is an acceptable electronic signature?

It can be in many forms and created by many technologies. Acceptable electronic signature methods include: A typed name that is typed on a signature block. A scanned or digitized image of a handwritten signature that is attached to an electronic record. A handwritten signature input onto an electronic signature pad.

Can a tax professional request an authorization?

Tax professionals can initiate a request for authorization from their account and it will send to the client’s online account for an electronic signature. The client will access their account, electronically sign the authorization, and the system will send it to the CAF database.

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is an agent in law?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent.

Does power of attorney matter in which state?

A: The power of attorney must be tailored for the state in which your parent resides. It does not matter which state you live in, as long as the power of attorney is applicable to the principal’s state of residence, which in this case is your parent, is what matters.

Popular Posts:

- 1. an attorney who can help with selling time share property in hampton roads, va

- 2. how to file power of attorney for a minor in kentucky

- 3. how to make characters pop on screen on ace attorney online

- 4. who is the best family law attorney in brevard county

- 5. how much is ssdi for autism in oregon attorney

- 6. how to make extra money as an attorney in ny

- 7. https://www.google.my attorney hasnt asked for any money yet. when do you normally pay them

- 8. who is the los angeles city attorney

- 9. when is vdot liable for attorney fees in eminent domain cases

- 10. who helps to fund the attorney generals child support office