What is a power of attorney in Florida?

According to Section 709.2105, in order for the power of attorney to be valid, you must sign the Florida power of attorney in the physical presence of two (2) witnesses and must be acknowledged by a notary. You must all sign in the presence of each other when executing the power of attorney. This is one requirement that often gets overlooked.

Does Florida allow durable power of attorney forms to cross state lines?

Consumer Pamphlet: Florida Power of Attorney. Unless otherwise specified, the information in this pamphlet applies to powers of attorney signed on or after Nov. 1, 2014. Consult a lawyer regarding use and enforceability of powers of attorney executed before Oct. 1, 2011.

What is an attorney-in-fact’s authority under Florida law?

Jan 20, 2021 · In Florida, the effectiveness of a power of attorney requires the authorization to be signed by the principal and two witnesses. Plus, the document must be notarized. If the principal is unable to sign it due to physical inability, the notary public may sign the principal’s name on …

What are the different types of power of attorney?

Jan 20, 2022 · Before starting a Florida Power of Attorney it is critical to know what type of POA to create. There are many different varieties of these legal instruments and each grants different kinds of powers from a Principal to an Agent or Attorney-in-Fact.. The most common types of Power of Attorney legal documents include the following:. General: General Power of Attorney …

Can you have more than one power of attorney in Florida?

Termination and revocation of the Florida Power of Attorney Beware that creating a new power of attorney without expressly revoking the prior power of attorney will not revoke the previous power of attorney. You may have more than one agent acting on your behalf.

Can more than one person have power of attorney?

Yes, you can name more than one person on your durable power of attorney, but our law firm generally advise against it under most circumstances. With multiple named attorneys-in-fact, there is always the ability for people to conflict on decisions. ...

How many witnesses are needed for a power of attorney in Florida?

two witnessesComplete the form, sign it, and have it notarized or witnessed. If you create a medical POA, you need to sign the form in the presence of two witnesses, who must also sign. If you create any other type of POA, you need two witness signatures plus the acknowledgement and signature of a notary public.Sep 27, 2021

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How many power of attorneys do you need?

How Many Attorneys Should I Appoint? Technically you can have as many attorneys as you like but it is common to appoint between one and four attorneys. It's advisable not to have too many attorneys, as it can cause issues if lots of people are trying to act on your behalf at once.Mar 6, 2020

Does next of kin override power of attorney?

No. The term next of kin is in common use but a next of kin has no legal powers, rights or responsibilities.

Do you need a lawyer for power of attorney in Florida?

A power of attorney must be signed by the principal and two witnesses. For the document to be legally binding under Florida law, a notary must acknowledge the principal's signature. ... A power of attorney may also call upon a third party like a bank, doctor or lawyer.Jul 20, 2020

Does a power of attorney need to be recorded in Florida?

Your agent must keep records. Under the new law, agents must keep records of all receipts, disbursements, and transactions made on behalf of the principal.

How long is a power of attorney good for in Florida?

One question we often get is, “When does a power of attorney expire?” The answers largely depends on how the power of attorney is drafted. But as a general rule, a durable power of attorney does not have a fixed expiration date.Dec 6, 2019

How many powers of attorney are there?

Generally speaking, there are three main types of POA: Ordinary power of attorney. Lasting power of attorney. Enduring power of attorney.Jun 4, 2019

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

How many kinds of power of attorney are there?

There are two key types of power of attorney (POA), one with general powers and one with limited powers.

How to determine if a power of attorney is valid?

The authority of any agent under a power of attorney automatically ends when one of the following things happens: 1 The principal dies. 2 The principal revokes the power of attorney. 3 A court determines that the principal is totally or partially incapacitated and does not specifically provide that the power of attorney is to remain in force. 4 The purpose of the power of attorney is completed. 5 The term of the power of attorney expires.

What is a power of attorney?

A power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the power of attorney (the “principal”) grants the right to act on the maker’s behalf as that person’s agent. What authority is granted depends on the specific language of the power of attorney.

Do you have to understand the power of attorney?

Yes. The principal must understand what he or she is signing at the time the document is signed. The principal must understand the effect of a power of attorney, to whom the power of attorney is being given and what property may be affected by the power of attorney.

What happens if an agent dies?

The agent dies. The agent resigns or is removed by a court. The agent becomes incapacitated. There is a filing of a petition for dissolution of marriage if the agent is the principal’s spouse, unless the power of attorney provides otherwise.

Can a person with a power of attorney be a guardian?

Yes. If the incapacitated person executed a valid durable power of attorney before the incapacity, it may not be necessary for the court to appoint a guardian, since the agent already has the authority to act for the principal. As long as the agent has all necessary powers, it may not be necessary to file guardianship proceedings and, even when filed, guardianship may be averted by showing the court that a durable power of attorney exists and that it is appropriate to allow the agent to act on the principal’s behalf.

Can a power of attorney be suspended?

If a court proceeding to determine the principal’s incapacity has been filed or if someone is seeking to appoint a guardian for the principal, the power of attorney is automatically suspended for certain agents, and those agents must not continue to act. The power to make health care decisions, however, is not suspended unless the court specifically suspends this power.

How old do you have to be to be a trust agent in Florida?

As provided by the state’s lay, an agent must be either a person that is over 18 years of age or a financial institution with specific requirements, including “trust powers,” a place of business in Florida and is authorized to conduct trust business in the state. In any case, the agent should be a trustworthy person that will act in ...

Who is Romy Jurado?

Business & Immigration Lawyer to Entrepreneurs, Start-ups, Small Business and Foreign Investors. Romy Jurado grew up with the entrepreneurial dream of becoming an attorney and starting her own business. And today, she is living proof that dreams really do come true. As a founder of Jurado & Farshchian, P.L., a reputable business, real estate, and immigration law firm, Romy’s practice is centered primarily around domestic and international business transactions – with a strong emphasis on corporate formation, stock and asset sales, contract drafting, and business immigration. In 2011, Romy earned her Juris Doctor degree from the Florida International University College of Law. She is fluent in two languages (English and Spanish) and is the proud author of Starting a Business in the US as a Foreigner, an online entrepreneurial guide. Call for a Consultation 305-921-0440.

Does Florida have a power of attorney?

Florida law does not permit a springing power of attorney. It also does not provide an authorized form for financial power of attorney.

What is a power of attorney?

A power of attorney is a legal document giving one person (the agent or attorney-in-fact) the power to act on behalf of a third-party (the principal). Hence, the agent in question can have a broad or limited legal authority to make legal decisions about the principal’s property, finances, or medical care. Commonly, powers of attorney are used in ...

Is a durable power of attorney effective?

In terms of time limitation and effectiveness, there is the durable power of attorney and the springing power of attorney. In the first case, the power of attorney is not terminated by the principal’s incapacity. Meanwhile, a springing power of attorney does not become effective unless/until the principal becomes incapacitated mentally ...

What is a surrogate in health care?

A Health Care Surrogate is a person (agent) authorized via a Designation of Health Care Surrogate form to make medical decisions on behalf of a third-party (principal), in case of physical or mental incapacity to make sound decisions.

How to create a POA in Florida?

First of all, when creating a Durable document it must contain specific phrasing about how the powers cannot be revoked by incapacity unless the situation falls under Chapter 709 of Florida Statutes. The POA document also must be fully and correctly completed with all the necessary details such as: 1 The name and address of both the Principal and Agent 2 The date that the document will become effective 3 The powers and responsibility that are being granted to the Agent

What is limited power of attorney?

Limited: Limited Power of Attorney is used by Principals to delegate decision-making powers to trusted individuals for a limited amount of time.

When does a power of attorney expire?

They expire as soon as the Principal becomes incapacitated for any reason. Durable: A Durable Power of Attorney is often used by Principals to prepare for advanced age, serious illness, or disability.

What happens if you don't sign a POA?

If they are not fully conscious of what they are signing then it will invalidate the POA. Furthermore, the document must be signed in front of 2 witnesses and a registered notary public. This is again to ensure that the Principal is fully aware and in agreement with the powers that are to be granted.

What does it mean to give someone a power of attorney?

By granting Power of Attorney to someone you allow them to hold a large amount of responsibility for your financial or even bodily wellbeing. An Agent therefore must be someone you know will take the actions that serve these interests best.

What is a POA in Florida?

A power of attorney ( POA) is a powerful form of estate planning that grants broad power to a person you choose, called an agent. The agent is granted control of your assets on your behalf if you're unable to control them yourself. Florida Power of Attorney rules changed in 2011 legislation. If you had a POA created before this time, it's still ...

Why is guardianship important?

Guardianship plays an important role and can be highly beneficial when judicial oversight is desired, but usually, it takes a long time and is expensive. Most of the time guardianship is a necessary evil that most would prefer to avoid.

What does POA mean in real estate?

If you have assets, bank accounts, retirement accounts, or real estate, a POA can ensure that these assets are protected if you're incapacitated. This may mean giving access to your checking account to pay your mortgage or to make vital estate planning decisions.

Can a POA be granted to a family member?

If you're unable to make your own medical decisions, you can grant a POA to a trusted family member, loved one, or spouse to make decisions on your health care. The agent will not be able to make medical decisions on your behalf if you are able to communicate your wishes.

What is a comprehensive estate plan?

A comprehensive estate plan will prevent the risk of financial abuse claims against the agent chosen. A POA can be extensive, and allow for gifts to be issued and proper asset protection plans to be carried out. If an extensive POA is in place, this allows for: Protection against financial abuse claims.

Can a durable power of attorney be used on an incapacitated person?

But, be aware that a durable power of attorney is not a one-size-fits-all document. You cannot just say "my agent can do everything on my behalf....".

What happens if a POA is not drafted properly?

If a POA isn't drafted properly, the agent may not have the power to protect certain assets, leading to significant financial loss. Proper planning will ensure that all of your assets are properly protected.

What is a durable power of attorney?

Durable powers of attorney have become increasingly important instruments in estate and Medicaid planning in recent years, particularly since the substantial revision to the law made in 1995. Recently the law was amended to permit “springing” durable powers of attorney, which should further enhance the use of these instruments. Now that estate planners in Florida have had sufficient time to become acquainted with the law relating to durable powers of attorney, maybe it is time to examine some of the limitations that may apply with these documents.

What is the power of attorney to make gifts?

One of the most important provisions that should be discussed with any client for inclusion in a durable power of attorney is the power to make gifts. In a larger estate this power is important as a way of reducing the principal’s estate subject to federal estate taxes upon death.

Who is the attorney in fact?

Since usually the attorney-in-fact is either the principal’s spouse, a child, or someone else who is an object of the principal’s bounty, the principal will in most cases want to include the attorney-in-fact as one of the permissible recipients of any gifts made.

Is a revocable trust a testamentary disposition?

The problem with this approach, however, is that a revocable trust is a testamentary disposition and F.S. §709.08 (7) (b)5 specifically prohibits an attorney-in-fact from modifying or revoking any document or other disposition effective at the principal’s death.

What is a power of attorney?

A power of attorney is a substantial legal document that allows you—as a principal—to appoint an agent (attorney-in-fact) to make certain decisions on your behalf. Whether it’s out of convenience or mental or physical illness, an agent has a responsibility to handle your medical, financial, or personal matters.

Can a principal be a power of attorney?

A principal can select one person to be their power of attorney agent and the other one to be that agent’s successor. Having a successor agent provides security in case the POA agent dies, resigns, or becomes incapacitated. The successor doesn’t have any authority over the principal’s assets and decisions if the agent is alive and capable ...

What is an attorney in fact?

The attorney-in-fact is expected to put your interests before their own and act in good faith and according to your expectations. The given powers, duration of the agreement, and other specifics of a power of attorney depend on your preferences and the POA type.

Can an agent act on your behalf?

One agent can always act on your behalf if the other one is out of town. Agents can divide the responsibility in the selling process. Agents can split duties. Possibility of disputes is always present. It can trigger fraud concerns with third parties (banks or credit card companies) It can cause logistical problems.

Why do people need a power of attorney?

The power of attorney is frequently used to help in the event of a principal’s illness or disability, or in legal transactions where the principal cannot be present to sign necessary legal documents.

What is a power of attorney?

The power of attorney gives legal authority to another person (called an agent or attorney-in-fact) to make property, financial and other legal decisions for the principal. The word attorney here means anyone authorized to act on another’s behalf. Its not restricted to lawyers.

Can a power of attorney be abused?

Yes. A power of attorney can be abused, and dishonest agents have used powers of attorney to transfer the principal’s assets to themselves and others. That is why it is so important to appoint an agent who is completely trustworthy.

What powers can a power of attorney grant?

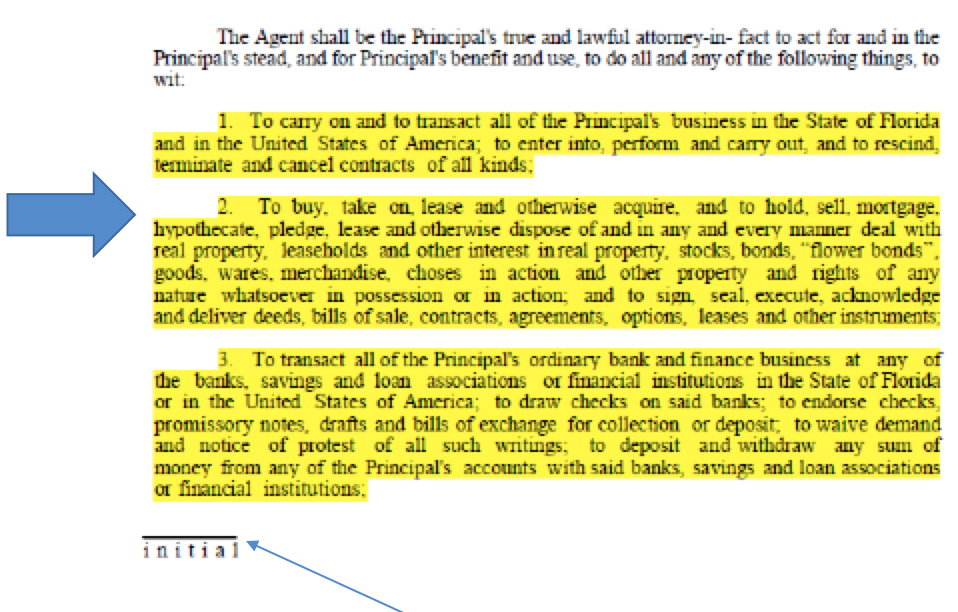

A power of attorney can be used to grant any, or all, of the following legal powers to an agent: Buy, sell, maintain, pay taxes on and mortgage real estate. Manage your property. Conduct your banking transactions. Invest, or not invest, your money in stocks, bonds and mutual funds. Make legal claims and conduct litigation.

Do banks have durable powers of attorney?

Some banks and brokerage companies have their own durable power of attorney forms . If you want your attorney-in-fact to have an easy time with these institutions, you may need to prepare two (or more) durable powers of attorney with your own form and forms provided by the institutions with which you do business.

What is a statutory power of attorney?

A statutory power of attorney copies the language in a state statute which includes an example of a form that may be used. State laws vary, but the states that have adopted a statutory form of power of attorney typically allow for other language to be used as long as it complies with the state law. A power of attorney may be created ...

Is a power of attorney a durable power of attorney?

A general power of attorney grants the agent broad powers to act in regard to the principal’s assets and property while the principal is alive and not incapacitated. A durable power of attorney will remain effective even if the principal becomes incapacitated.

Do estate plans have powers of attorney?

A lot of estate plans include different types of powers of attorney. While these documents are very useful, there are some practical limitations you should know about before you make a decision about the agent you choose through your power of attorney.

Can you have more than one power of attorney?

It’s ok to choose more than one agent when you create multiple powers of attorney as long as you realize that each agent should have a particular responsibility. For example, if you create healthcare and financial powers of attorney, naming a different agent under each is fine. In fact, it’s probably a good idea in some situations because different people may be better at, for example, making financial decisions than others.

Can you name alternate agents in a power of attorney?

It’s also a very good idea to name alternate or replacement agents in each power of attorney you create. A replacement agent will take over the original agent’s responsibilities if the original agent is no longer able or willing to serve. In fact, choosing two or more replacement agents is something you’ll probably want to do for each power of attorney you create .

Popular Posts:

- 1. who is the #1 rated realestate attorney in hernando, fl

- 2. what information do you need to give someone power of attorney

- 3. what power of attorney is needed when husband leaves on country colorado

- 4. district attorney how to decide

- 5. why would attorney take probono cases from same client

- 6. where did eddy held attorney ny go to school

- 7. how attorney can use my ssn against me

- 8. how to cc a letter to the attorney at law

- 9. attorney who drew poa of helen hoffman, mckinney, tx, for mark hoffman

- 10. how much for attorney to file patent