The New Hampshire Power of Attorney is a legally binding agreement to issue one person’s specified controls to another for a predetermined period. The powers granted authorize the “agent” to act on behalf of the “principal” in defined areas outlined in the paperwork.

What is power of attorney and how does it work?

A power of attorney allows a person you appoint -- your "attorney-in-fact" or agent -- to act in your place for financial or other purposes when and if you ever become incapacitated or if you can't act on your own behalf. The power of attorney document specifies what powers the agent has, which may include the power to open bank accounts ...

What are the responsibilities of a power of attorney?

What Are the Duties of Power of Attorney?

- Powers of an Agent. With this authority, the agent steps into the shoes of the principal and makes important decisions for the principal.

- Duties of an Agent. ...

- End of an Agent's Duties. ...

Who needs a power of attorney?

Lasting power of attorney allows people to appoint someone they trust, usually a family member or friend, to take control of their affairs if they fall ill.

How responsible is the power of attorney?

On balance he feels being regulated while hard work gives those who earn the credentials a sense of respect. Labour has recently drawn attention to the flaws in current lasting powers of attorney regulations. Alison Morris who is a partner with Moore Kingston Smith has taken off from where Labour has left off and examined the issue in more detail.

What is the purpose of getting power of attorney?

A power of attorney is a legal document that allows a principal to appoint an agent to act for them should they become incapacitated. The agent is expected to place the principal's interests ahead of his or her own, which is why it is important for you and your loved one to pick a trusted individual.

What are the three basic types of powers of attorney?

The three most common types of powers of attorney that delegate authority to an agent to handle your financial affairs are the following: General power of attorney. Limited power of attorney. Durable power of attorney.

What is power of attorney and how does it work?

A power of attorney (POA) is a legal document giving one person (the agent or attorney-in-fact) the power to act for another person, the principal. The agent can have broad legal authority or limited authority to make decisions about the principal's property, finances, or medical care.

What does it mean to give someone your power of attorney?

A power of attorney (POA) is a legal document that allows you to give another person the authority to handle your affairs. A power of attorney can be flexible. You can assign your POA to a trusted party for general, special, or limited purposes.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

Does power of attorney override a will?

A will protects your beneficiaries' interests after you've died, but a Lasting Power of Attorney protects your own interests while you're still alive – up to the point where you die. The moment you die, the power of attorney ceases and your will becomes relevant instead. There's no overlap.

What type of power of attorney covers everything?

With a general power of attorney, you authorize your agent to act for you in all situations allowed by local law. This includes legal, financial, health, and business matters. General POAs can be durable or non-durable, depending on your preferences.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

Can a power of attorney transfer money to themselves?

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself. Most, if not all, states have laws against this kind of self-dealing. It is generally governed as a fraudulent conveyance (that is, theft by fraud).

Can two siblings have power of attorney?

Generally speaking, while it is good to include your spouse or siblings, consider the fact that they may not be around or have the inclination to sort out your wishes when the time comes. If possible, include two attorneys as standard and a third as a back-up should one of the attorneys not be able to act.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.

Durable Power of Attorney New Hampshire Form – Adobe PDF

The New Hampshire durable power of attorney form enables an individual to transfer management privileges concerning financial matters (business and/or personal) to another person. This person (attorney-in-fact) will be handed the task of acting on the individual’s (principal’s) behalf.

General Power of Attorney New Hampshire Form – Adobe PDF

The New Hampshire general power of attorney form serves to authorize a transfer of power from a principal (individual authorizing the transfer) to an attorney-in-fact (person to which power is transferred).

Limited Power of Attorney New Hampshire Form – Adobe PDF

The New Hampshire limited power of attorney form is designed to enable a principal (individual authorizing the form) to grant specific legal powers to an agent/attorney-in-fact (individual appointed to exercise powers). The attorney-in-fact should be someone trustworthy, preferably a close friend, relative, or the principal’s spouse.

Medical Power of Attorney New Hampshire Form – Adobe PDF

The New Hampshire medical power of attorney form, or advance directive form, is a dual-purpose document consisting of a durable power of attorney for health care and a living will. A person can choose to execute both sections of the advance directive, or they may choose only to complete one or the other.

Minor (Child) Power of Attorney Form New Hampshire – PDF

The New Hampshire minor power of attorney form can be used by parents to give another individual the temporary rights to make decisions regarding a child’s health care, education, and any other matters that may require parental permission.

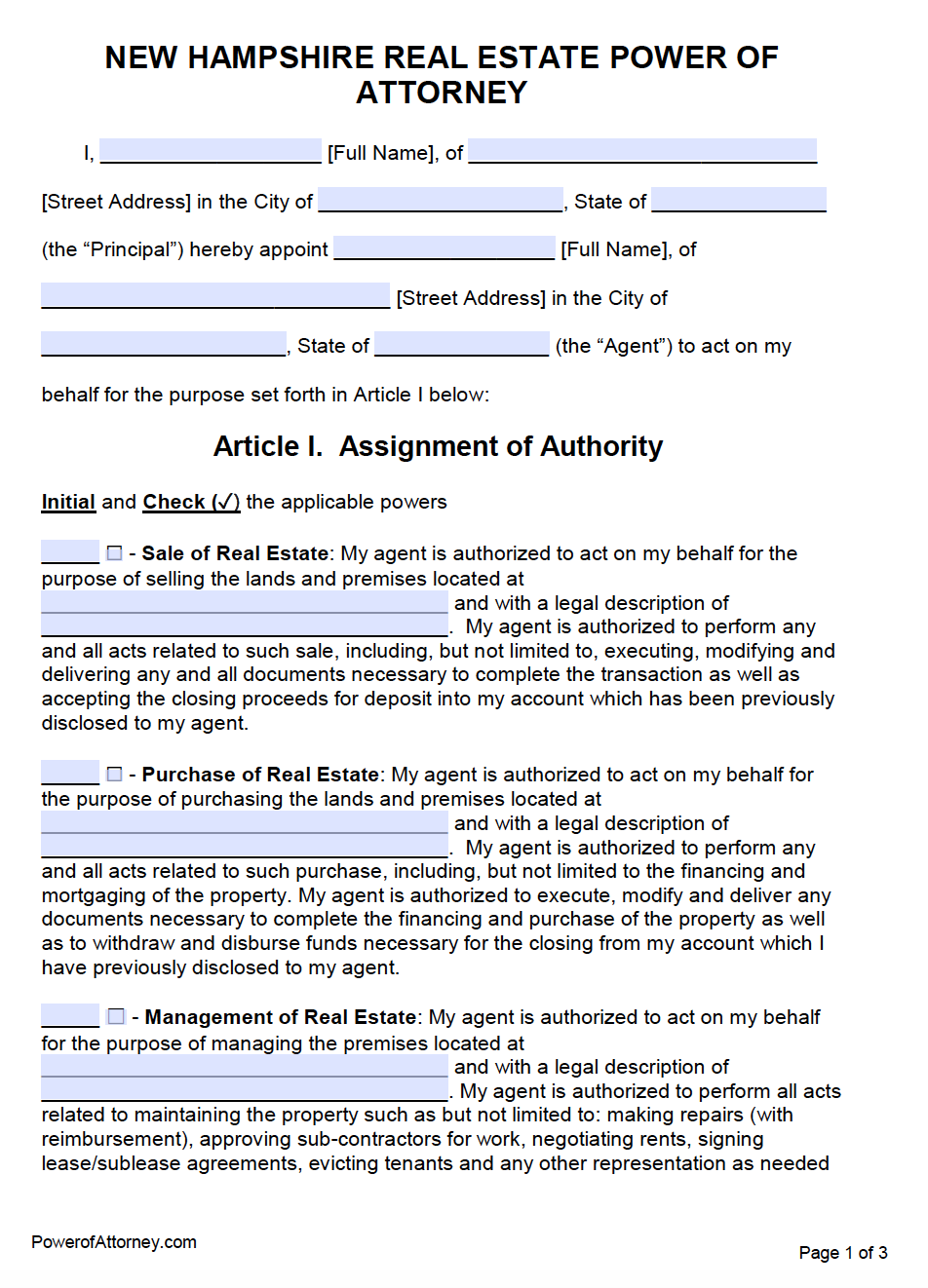

Real Estate Power of Attorney New Hampshire Form – PDF – Word

The New Hampshire real estate power of attorney allows individuals to appoint an agent to make certain real estate decisions on their behalf.

Tax Power of Attorney New Hampshire Form – Adobe PDF

The New Hampshire tax power of attorney form, also known as DP-2848, is furnished by the New Hampshire Department of Revenue Administration and allows a person to appoint an authorized individual to handle their taxes and associated matters.

What Types of Power of Attorneys Are Available in New Hampshire?

You can make several different types of POAs in New Hampshire. In particular, many estate plans include two POAs:

What Are the Legal Requirements of a Financial POA in New Hampshire?

For your POA to be valid in New Hampshire, it must meet certain requirements.

Steps for Making a Financial Power of Attorney in New Hampshire

New Hampshire offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your POA. For a more user-friendly experience, try WillMaker, which guides you through a series of questions to arrive at a POA (and estate plan) that meets your specific aims and is valid in your state.

Who Can Be Named an Attorney-in-Fact (Agent) in New Hampshire?

Legally speaking, you can name any competent adult to serve as your agent. But you'll want to take into account certain practical considerations, such as the person's trustworthiness and geographical location. For more on choosing agents, see What Is a Power of Attorney.

When Does My Durable Financial POA Take Effect?

Your POA is effective immediately unless it explicitly states that it takes effect at a future date.

When Does My Financial Power of Attorney End?

Any power of attorney automatically ends at your death. A durable POA also ends if:

How does a power of attorney work?

How a Power of Attorney Works. A power of attorney is used to assign authorization to an agent under a variety of different circumstances, including, but not limited to: Making financial decisions (buying or selling) Managing business. Collecting debts. Filing lawsuits.

What is a durable power of attorney?

The durable power of attorney allows someone else to make legal decisions about things such as your property and your finances. A separate document called the “durable health care power of attorney” is necessary to allow someone else to make medical decisions for you if you are incapacitated.

Can a power of attorney be used for an accident?

Although a power of attorney is most common in the event of illness, disability, or an accident, it can be useful in any situation where the principal can’t be present to make a legal decision or sign a document. You can authorize your agent to exercise as much or as little power as you want. A general power allows the agent to do anything ...

Can a power of attorney revoke a principal's power?

A power of attorney does not revoke the principal’s power to make decisions. In fact, if the agent and the principal happen to disagree, the principal’s decision rules, given that they are not mentally incapacitated.

What is a durable power of attorney in New Hampshire?

A New Hampshire durable statutory power of attorney form allows a person (“principal”) to transfer the handling of financial affairs to someone else (“agent”). The powers given can be limited or broad depending on the principal’s preference. The term “durable” refers to the fact that this power of attorney does not terminate if and when ...

What is a power of attorney?

Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used ( § 564-E:102 (15) ).

Who may delegate the representational powers needed to exert Principal Authority over his or her taxes?

The Principal may delegate the Representational Powers needed to exert Principal Authority over his or her Taxes in relation to the I.R.S., the Treasury Department, and other interested institutions to the Agent when he or she initials the seventh paragraph.

What does "durable" mean in power of attorney?

Definition of “Durable”. “Durable,” with respect to a power of attorney, means not terminated by the principal’s incapacity ( § 564-E:102 (4) ).

What is a power of attorney in New Hampshire?

A power of attorney is a legal document that allows you to give someone else legal authority to make decisions about your money, property, health care, or children's care. FindLaw has partnered with US Legal to provide low-cost New Hampshire power of attorney forms that can be completed at your convenience. Use our guided process to customize, print, and sign your legally-valid document, fast!

Why do we need a power of attorney?

Powers of attorney also are necessary if you need someone to make decisions for you when you are healthy. For example, many people use a limited power of attorney to allow a financial adviser to manage their investments.

What happens if you don't want your power of attorney to act?

If you do not want your agent to act when you are incapacitated, your power of attorney must state it will terminate if you become incapacitated. A nondurable power of attorney is a good choice if you want an agent to handle a specific transaction or limited transaction. 3.

What is a Durable Power of Attorney?

Durable power of attorney: remains effective when you are incapacitated. Nondurable power of attorney: terminates when you are incapacitated. Springing power of attorney: does not become effective until a future date or event, such as incapacity.

How to give power of attorney to agent?

Give your power of attorney to your agent and copies to necessary parties. After you sign your power of attorney, store a copy in a safe place and give the original to your agent. Your agent needs it to prove they have the authority to act on your behalf.

Can you edit a New Hampshire state form?

However, the form is not very flexible, and you should not edit it without the advice of an attorney. You may see other free forms online, but you should avoid these because they may not comply with current New Hampshire law.

Do I need a power of attorney if I am incapacitated?

You are not legally required to have a power of attorney, but creating one can ensure your wishes are met if you become incapacitated. If you want to choose the person who will make decisions about your finances and personal affairs, you need a power of attorney.

What is a Power of Attorney?

A power of attorney is a legal document that you create. You name someone to act as your agent. You can give your agent very limited authority, such as the authority only to sign a contract for a particular purpose.

Do I Need a Power of Attorney?

Virtually everyone needs a power of attorney. Whether you have a lot of assets or not, you want to ensure that what you do have is carefully managed and not lost if you become incapacitated. Likewise, you want to take control of your dignity and ensure you have someone you trust absolutely to make choices about medical assistance you’ll receive.

How can Beverly Power of Attorney Lawyers Help?

DeBruyckere Law Offices helps clients in both New Hampshire and Massachusetts to create a power of attorney, or to enforce a power of attorney that was created. We also provide representation during guardianship proceedings. Give us a call at our New Hampshire number, (603) 894-4141 or at our Massachusetts number, (978) 969-0331.

Popular Posts:

- 1. how to sign into awo attorney account

- 2. how to file for power of attorney in new jersey

- 3. who is the states attorney for mexico beach, fl

- 4. who is city of mequon, wi attorney

- 5. who is currently the 83 attorney general

- 6. how to stop foreclosure without an attorney

- 7. who is attorney for caballeros estates

- 8. can i hire someone who isnt an attorney to represent me

- 9. what is the difference between general power of attorney and durable power of attorney

- 10. who defense attorney