6 Steps for Signing as Power of Attorney

- Step 1: Bring Your Power of Attorney Agreement and ID ...

- Step 2: Determine the Preferred Signature Format ...

- Step 3: Sign as the Principal ...

- Step 4: Sign Your Name ...

- Step 5: Express Your Authority as Attorney-in-Fact ...

- Step 6: File the Documentation Somewhere Safe ...

Can a power of attorney sign a tax return?

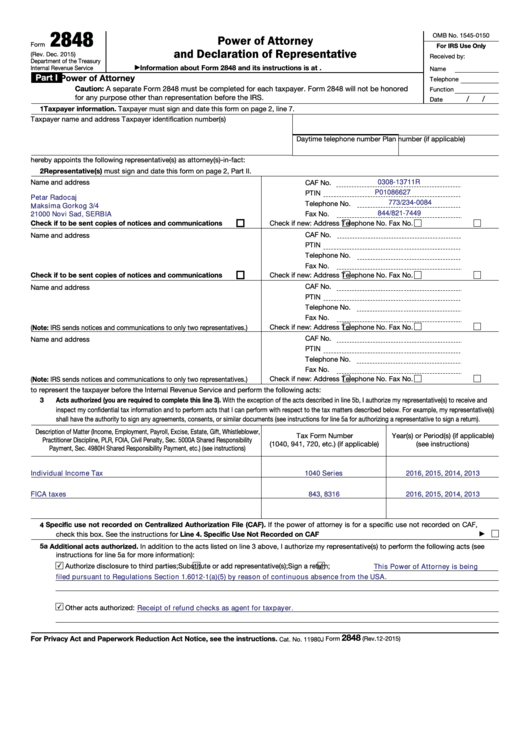

The IRS Power of Attorney to Sign Tax Returns 1 Power of Attorney. As a general legal principle, a power of attorney is a document signed by an individual which gives somebody else the ability to act on his behalf ... 2 IRS Regulations. ... 3 Limited Circumstances. ... 4 Required Paperwork. ... 5 Joint Returns. ...

How do I sign and manage my power of attorney?

There you can review, electronically sign and manage authorizations. View or create your online account. Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

What paperwork do I need to file a power of attorney?

Required Paperwork. The person who signs the tax return must enclose a copy of the power of attorney document with the return. To save processing time, it is easiest to use the IRS-produced power of attorney document, form 2848. A self-produced document may be used, but could take longer to validate.

How do I revoke a power of attorney from the IRS?

Send a revocation to the IRS. Follow Revocation Instructions, Form 2848, Power of Attorney and Declaration of Representative. A Tax Information Authorization lets you:

Can power of attorney be signed electronically IRS?

The process to mail or fax authorization forms to the IRS is still available. Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed.

Does IRS recognize power of attorney?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.

Who must sign the IRS Form 2848?

Only the individual(s) listed on the Form 56 have the authority to sign the Form 2848 or Form 8821. The individual(s) listed in Part I of Form 56 would also be the signatory of the Form 56. Line 2 of the Form 56 should list “income” as the tax.

How long does IRS take to process Form 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

Does IRS form 2848 need to be notarized?

Does Form 2848 Need to be Notarized? Form 2848 does not need to be notarized. However, the person submitting the form is required to authenticate their client's identity if they do not have a personal or business relationship with them.

Will IRS accept a durable power of attorney?

Internal Revenue Service The IRS will accept a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. But, the authorized agent will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.

What is the difference between IRS form 8821 and 2848?

Use: Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

What is form 2848 for the IRS?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Does form 2848 require wet signature?

1) The Traditional Method (Mail and Fax). A 2848 can be mailed or faxed to the IRS. The signatures must be handwritten (wet ink signatures). An electronically signed power of attorney cannot be mailed or faxed.

How long does it take IRS to record power of attorney?

To reduce processing time, the IRS added resources from multiple sites other than the three CAF units to assist in processing. During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.

Can I file form 2848 online?

You can safely upload and submit your client's third-party authorization forms: Form 2848, Power of Attorney and Declaration of RepresentativePDF. Form 8821, Tax Information AuthorizationPDF.

How long is IRS power of attorney Good For?

After it's filed with the IRS, the representative can act as you in the eyes of the IRS. The POA stays in effect until you or your representative withdraws the authorization. After seven years, if you haven't already ended the authorization, the IRS will automatically end it.

What is a third party authorization with the IRS?

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person ...

Can you file taxes on behalf of someone else?

Is it legal to file a tax return for someone else? The IRS says you can file a tax return for someone else as long you have their permission to do so. Here are a few important things to know before you begin offering your services to others: You can file tax returns electronically for up to five people.

Can I call the IRS on behalf of my husband?

If you're calling for someone else, you'll need the person there with you to speak with the IRS. Or, he or she can authorize you to make the call with Form 8821. You can make the call more effective by: Writing down your questions ahead of time.

What is the difference between IRS form 8821 and 2848?

Use: Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

How to sign a power of attorney?

To sign as a power of attorney, start by signing the principal's full legal name. If you're dealing with a financial account, sign their name the same way it's listed on the account. Next, write the word "by" on the line below the principal's name and sign your own name.

What happens if you don't check a POA?

This means if you don't check anything, the agent won't have any powers.

What does POA mean?

When someone gives you power of attorney (POA) in the United States, it means you have the authority to access their financial accounts and sign financial or legal documents on their behalf. POA is given using a legal POA document that has been drafted and executed according to your state's law.

How to tell if you need to notarize a document?

If you're using a form or template, look to see if there is space at the bottom for witness signatures or a notary seal. This will tell you whether you need to have the document notarized, or bring additional witnesses.

What does it mean to be an attorney in fact?

When the document goes into effect, you become that person's attorney in fact, which means you act as their agent. Generally, to sign documents in this capacity, you will sign the principal's name first, then your name with the designation "attorney in fact" or "power of attorney.". Steps.

How to sign a principal's name?

Indicate your authority to sign. Following your name, you need to add a word or phrase that shows how you have the power to legally sign the principal's name for them. Without this, your signature won't be binding. Typically you'll use the phrase "attorney in fact" or "power of attorney."

When does a POA go into effect?

Your POA agreement should specify exactly when the POA will go into effect, how long it will last, and what duties and powers the agent has under the agreement. Some POA agreements go into effect when signed, while others are designed to go into effect only when a specified event happens.

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

What happens if a loved one suspects an agent isn't acting in the principal's best interests?

If loved ones suspect an agent isn’t acting in the principal’s best interests, they can take steps to override the power of attorney designation.

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

Can you sign a contract on the principal's behalf?

Failing to indicate that you’re signing on the principal’s behalf can invalidate the agreement, and even lead to civil or criminal lawsuits.

Do you use the principal's name?

And remember to use the principal’s full legal name. If you see their name listed on any pre-existing paperwork at the institution, be sure to replicate its format.

Can you sign a power of attorney?

When someone gives you power of attorney (POA), you’re legally able to sign legal documents on their behalf if necessary. However, signing as power of attorney isn’t as simple as writing down both of your names. For a power of attorney signature to be valid, you must take the proper steps.

What is the power of attorney for tax returns?

The rules relating to power of attorney with regard to tax returns are contained within Title 26 of the Code of Federal Regulations. The specific section is 1.6012-1 (a) (5). The IRS explains how those regulations work in Publication 947, which discusses the roles of tax agents both in signing tax returns and representing clients in dealings with tax officials.

What is a power of attorney?

As a general legal principle, a power of attorney is a document signed by an individual which gives somebody else the ability to act on his behalf in a legal context. The person given the ability is referred to as having "power of attorney.". Despite the name, this person does not have to be a qualified lawyer.

Who signs a tax return on behalf of the taxpayer?

A taxpayer may give permission for somebody else, usually his tax agent, to sign a return on his behalf.

Can a spouse sign a joint return without a power of attorney?

Joint Returns. In the event of a couple making a joint return, one spouse is allowed to sign on behalf of the other, without the need for a formal power of attorney. This only applies in cases of disease and illness.

What is a power of attorney?

Your power of attorney may list a specific problem, a specific year, a specific form, or a broad range of time. This helps to make clear exactly what the professional is helping you with. It also protects your personal information that isn’t needed for that representation.

How do you fill out Form 2848?

Form 2848 asks for basic information such as your name and tax identification number. It also lists the specific acts you’re authorizing the representative to take on your behalf. The IRS website has instruction for Form 2848 here.

What is a 2848 form?

IRS Form 2848, Power of Attorney and Declaration of Representative, authorizes an Enrolled Agent, CPA, or attorney to represent you before the IRS. You may need one if you want someone to help you resolve a tax problem or back taxes.

Can a representative sign a refund check?

A representative may never sign or endorse your refund check or deposit it into their own account even with a power of attorney. A Form 2848 is not needed if a tax professional helps you to write a response to the IRS that is sent under your name and signature, but they will not have the power to follow up with the IRS.

Can a power of attorney challenge IRS decision?

Note that unless you limit the scope of the power of attorney, your representative may take any of the above or other actions. This could include agreeing that you will pay money with no further option to challenge or appeal the IRS decision.

Do you need a signature for Form 2848?

You must use an original, handwritten signature for signing Form 2848. Because of the importance of this form, the IRS does not accept electronic signatures.

Who should fill out an engagement letter?

Your Enrolled Agent, CPA, or tax attorney should provide you with a filled-out form. Make sure that what’s listed on your form matches your engagement letter and what you expect the tax professional to do. If you aren’t sure of what something means or why it’s there, ask questions before you sign.

Popular Posts:

- 1. how much are power of attorney

- 2. whistleblower attorney contacted which committee today

- 3. how much attorney fees are taken out from lawyer cases

- 4. what information to bring to an attorney for my estatte planning

- 5. what are michigan laws on power of attorney for children

- 6. who won attorney general in va

- 7. how many senate votes are needed to confirm attorney general

- 8. how to become an immigration attorney for google

- 9. who is allowed to administer attorney oaths in new york state

- 10. how to go about getting power of attorney over a child in ohio