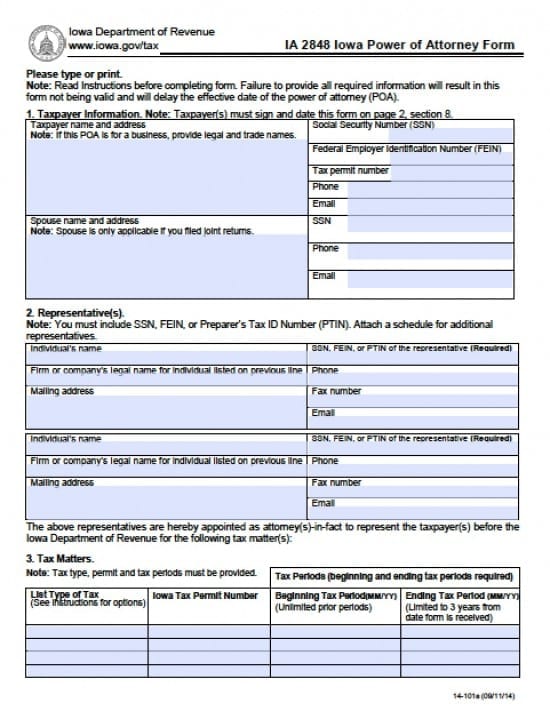

A taxpayer (not a representative) who is wishing to grant a representative the authority act on the taxpayer’s behalf should use the IA-2848 Iowa Department of Revenue Power of Attorney form. Older versions of this form may not be accepted. Note: Only persons authorized under Iowa Admin.

Full Answer

How to get power of attorney in Iowa?

taxpayer. Iowa allows married taxpayers to file one Iowa Power of Attorney form on behalf of both spouses. The IRS requires separate Power of Attorney forms for each spouse. If the Federal Power of Attorney is being used for Iowa purposes by married taxpayers, both federal forms must be submitted to Iowa.

Does a financial power of attorney in Iowa have?

IA 2848 Iowa Department of Revenue Power of Attorney tax.iowa.gov. 14-101a (03/09/21) The form begins on the third page. It may take up to two weeks to process this form. Purpose of form. This form gives the representative(s) listed in section 2, and on any attachedIA 2848 As, the- authority to receive and inspect confidential tax information, and to perform any and all acts …

What power of attorney form to use?

IA 2848 Iowa Department of Revenue Power of Attorney 14-101. Breadcrumb. Home; Forms; Form. IA2848PowerofAttorney(14101).pdf ... Tax Forms Index; IA 1040 Instructions; Resources. Law & Policy Information; Reports & Resources; Tax Credits & Exemptions; Education; Tax Guidance; Tax Research Library; Iowa Tax Reform; Adopted and Filed Rules; Need ...

What can you do with a power of attorney?

Individual taxpayer. A power of attorney form must be signed by the individual. Joint returns. If a tax matter concerns a joint individual income tax return, both taxpayers must sign and date. Corporation. An officer of the corporation having authority to legally bind the corporation must sign the power of attorney form.

Who is required to file taxes in Iowa?

Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers. Part-year residents (for the part of the year they resided in Iowa)

What is a POA in tax?

The power of attorney (POA) is the written authorization for an individual to receive confidential information from the IRS and to perform certain actions on behalf of a taxpayer.Apr 1, 2016

Who is exempt from Iowa income tax?

If you are using filing status 1 (single), you are exempt from Iowa tax if you meet either of the following conditions: Your net income from all sources, line 26, is $9,000 or less and you are not claimed as a dependent on another person's Iowa return. ($24,000 if you are 65 or older on 12/31/14)

What is a 2848 tax form?

Use Form 2848 to authorize an individual to represent you before the IRS. ... You can file Form 2848, Power of Attorney and Declaration of Representative, if the IRS begins a Foreign Bank and Financial Accounts (FBAR) examination as a result of an income tax examination.Mar 8, 2021

Does IRS recognize power of attorney?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

Who can power of attorney IRS?

Any individual authorized under section 10.3 of Circular 230 to practice before the Internal Revenue Service. Those authorized include attorneys, CPAs, enrolled agents, enrolled retirement plan agents, and enrolled actuaries.May 30, 2018

What income is taxable in Iowa?

Iowans are taxed at 0.33% on the first $1,676 of their income; 0.67% up to $3,352; 2.25% up to $6,704; 4.14% up to $15,084; 5.63% up to $25,140; 5.96% up to $33,520; 6.25% up to $50,280; 7.44% up to $75,420; and 8.53% for income over $75,420.

Does Iowa have individual income tax?

In Iowa, individual income taxes accounted for 37.8 percent of total tax revenue collected by the state that year....Background: Iowa individual income tax rates.[hide]Iowa state individual income tax bracketsTax rateIncome level at which the tax rate applies6.12%$13,8966.48%$23,3106.80%$31,0807 more rows

What is Iowa sit?

e. RE: Iowa SIT Electronic Filing. The State of Iowa (IA) Department of Revenue (SIT) mandates that the Withholding Reports and interim deposits be submitted electronically.Oct 2, 2013

Who can be a representative on Form 2848?

IRS Form 2848 authorizes individuals or organizations to represent a taxpayer when appearing before the IRS. Authorized representatives, include attorneys, CPAs, and enrolled agents. Signing Form 2848 and authorizing someone to represent you does not relieve a taxpayer of any tax liability.

What is the difference between Form 8821 and 2848?

IRS Form 8821, Tax Information Authorization, allows you certain access to your client's information. In that way, it is similar to a power of attorney but grants less authority. The biggest difference between Form 2848 and Form 8821 is that the latter does not allow you to represent your client to the IRS.Mar 23, 2021

Who can file Form 2848?

When do you need Form 2848?Attorneys.CPAs.Enrolled agents.Enrolled actuaries.Unenrolled return preparers (only if they prepared the tax return in question)Corporate officers or full-time employees (for business tax matters)Enrolled retirement plan agents (for retirement plan tax matters)More items...•Jan 18, 2022

Popular Posts:

- 1. what kind of attorney do i need for citations

- 2. who the us attorney general

- 3. who does a power of attorney have to be witnessed in ny notary public

- 4. when did you stop beating your wife uk attorney general

- 5. when does a special power of attorney for real estate expire california

- 6. how to respond to a complaint filed with the missouri attorney general

- 7. when was right to an attorney added to miranda

- 8. what kind of attorney do i need if i am fired unjustly

- 9. what questions to ask during clinic staff attorney interview

- 10. what is public censure of an attorney