The North Carolina Durable Power of Attorney The durable power of attorney (DPOA) is an extremely important estate planning tool that is often overlooked. A durable power of attorney will appoint an agent to act on your behalf during a period of your incapacity.

How do you obtain power of attorney in NC?

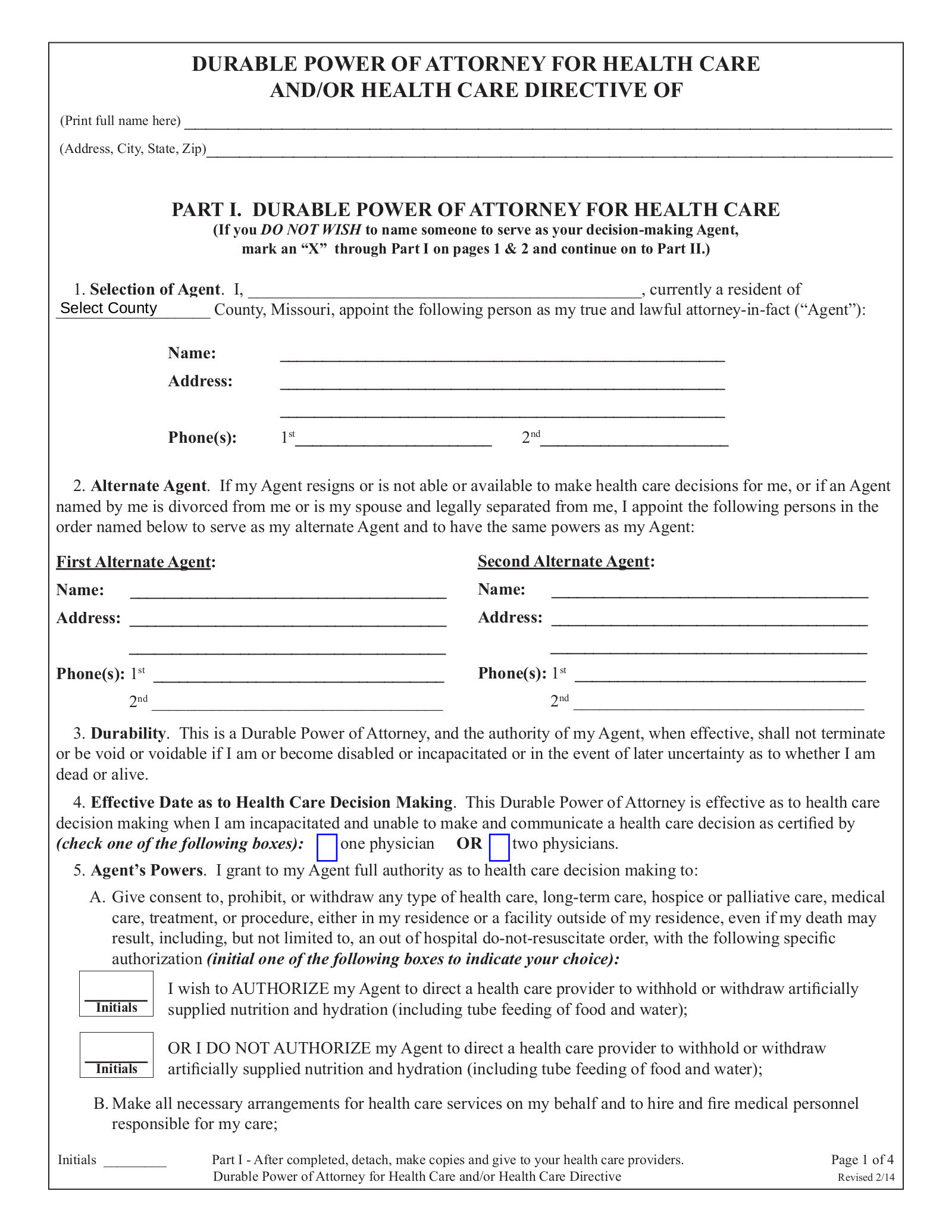

To complete the form, you'll need to:

- Fill in the agent's name, address, and phone number.

- Identify successor agents to act as the agent if the principal revokes the initial agent's authority or if the first-named agent resigns.

- Designate which categories of the principal's assets the agent has the power to manage.

How to enforce durable power of attorney?

Understanding and Using Powers of Attorney

- About the Power of Attorney. A Durable Power of Attorney may be the most important of all legal documents. ...

- Powers and Duties of an Attorney-in-Fact. What can I do as an Attorney-in-Fact? ...

- Using the Power of Attorney. ...

- Financial Management and the Liability of an Attorney-in-Fact. ...

- Relationship of Power of Attorney to Other Legal Devices. ...

Who can notarized a durable power of attorney?

Even though it is possible to get a durable power of attorney notarized by a physical notary, it is also possible to do this online. A lot of people prefer to get this form notarized online because it saves them time and money.

What do if your power of attorney isn't durable?

If you don't have a durable power of attorney, your relatives or other loved ones will have to ask a judge to name someone to manage your financial affairs. These proceedings are commonly known as conservatorship proceedings. You can make a power of attorney at any time.

How do I get a durable power of attorney in North Carolina?

You must be at least 18 years of age, mentally competent, and have capacity when the durable power of attorney is signed. North Carolina law states that a durable power of attorney must be registered at your local county office of the register of deeds to be effective after your incapacity.

Does a durable power of attorney need to be recorded in NC?

Recording. One of the most welcomed changes in the NC Uniform Power of Attorney Act is that it does not require durable POAs to be recorded with the Register of Deeds. In fact, the only POAs that have a recording requirement under the new law are POAs for real estate loan transactions.

What is different about durable power of attorney?

A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident.

Does a power of attorney have to be notarized in NC?

A. A power of attorney must always be signed in front of a notary public. If you wish, it can be recorded at the county register of deeds office in North Carolina where it is to be used.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

What is the difference between a general POA and a durable POA?

The difference has to do with whether the powers remain effective after the onset of a disability. That is, the regular power of attorney ceases to be effective if you become disabled, whereas the “durable” power of attorney continues to be effective despite your subsequent disability.

What type of power of attorney covers everything?

Enduring power of attorney (EPA) An EPA covers decisions about your property and financial affairs, and it comes into effect if you lose mental capacity, or if you want someone to act on your behalf.

What is the difference between power of attorney and lasting power of attorney?

The Lasting and Enduring Power of Attorney – how they differ The main differences between the two systems are as follows: The LPA holder no longer has to apply to the court when the person conferring the power is no longer mentally capable. The LPA is now only registerable with the Office of the Public Guardian.

How much does a power of attorney cost in North Carolina?

$400 (Individual); $750 (Couple) Our power of attorney package includes a 1) durable power of attorney; 2) health care power of attorney; and 3) living will for each person. Those services are explained in more detail above.

What is required for power of attorney in NC?

A power of attorney must be (i) signed by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name on the power of attorney and (ii) acknowledged.

How much does it cost to get a power of attorney in NC?

A power of attorney can be created without legal assistance and almost free of charge. In fact, one can find a free POA form online and simply print it and fill it out. One can also have a POA created online for as little as $35.

What is power of attorney?

Definition of “Power of Attorney”. A writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used ( § 32C-1-102 (9) ).

What does "durable" mean in a notary?

The form, unless otherwise stated, is durable, which means it will continue to be valid in the event the principal should become incapacitated. After the principal and agent sign in the presence of a notary public, the agent can use the form by presenting a copy to any third party when acting on the principal’s behalf.

What is the principal authority?

The Principal Authority required to authorize other people with the right to exercise the Principal Powers defined here on behalf of the Principal can be granted to the Agent once the Principal initials the fourth item (“Authorize Another Person…”).

Do notaries sign in the presence of a notary public?

If the optional Agent Certification is completed, then the agent must sign in the presence of a notary public ( § 32C-1-105 ).

Can a principal authority change rights of survivorship?

The Agent will be able to use Principal Authority to “Create Or Change Rights Of Survivorship” if the Principal initials the blank line that precedes the second item.

How To Revoke A Power of Attorney in North Carolina?

You may revoke your agent’s power of attorney designation in writing or stipulate specific conditions in the power of attorney document under which the authority is terminated.

What Does Creating a Power of Attorney Do for You?

The purpose of a financial power of attorney is to designate someone to handle your financial affairs if, for whatever reason, you become disabled for a period of time or incapacitated. A power of attorney can be temporary, for example paying bills while someone is on a long vacation, or lasting, such as making medical decisions after a car accident. Having a financial power of attorney drafted and executed is one of the principal documents in estate planning. However, the document must be carefully worded to address your specific needs.

What is an elder care attorney?

An elder care attorney at Brady Cobin Law Group, PLLC can answer your questions about advance care planning and designating powers of attorney to make medical and financial decisions on your behalf if you are unable to do so. Our attorneys also can determine whether your existing powers of attorney documents need to be updated in light of the new law, the N.C. Uniform Power of Attorney Act, which took effect in 2018. We can craft an advance care directive that reflects your values, outlines your end-of-life treatment preferences, and authorizes the person or persons you choose to make decisions on your behalf if you cannot do so.

What is the authority of an agent?

Your agent’s authority is limited to what is spelled out in the power of attorney document. Your agent’s general authority may include making decisions on your behalf regarding real estate, personal property, stocks and bonds, bank and financial accounts, insurance and annuities, retirement plans, Social Security retirement benefits, estates, and trusts and taxes.

What happens if a financial institution refuses to honor a power of attorney?

If a financial institution refuses to honor the power of attorney, the recourse in generally through the court system. The bottom line is that powers of attorney are a necessary part of an estate plan.

When does a power of attorney become effective?

A power of attorney becomes effective when executed unless you specify in the document that the power of attorney will become effective upon some future event or contingent event.

Who can be your health care power of attorney?

You can choose as your health care power of attorney any competent person 18 years or older other than the doctor or health care professional who is overseeing your care.

What is a power of attorney in North Carolina?

The North Carolina legislature has created a Health Care Power of Attorney form. In addition to the general authority that is granted, there are specific provisions related to particular types of healthcare decisions, including nutrition, mental health, and organ donation.

What is a power of attorney?

A power of attorney is a legal document that gives one person, called the "agent," the power to take certain actions on behalf of another person, called the "principal.".

What is a POA in healthcare?

A healthcare POA gives your agent the power to make medical treatment decisions for you, but only if you are physically or mentally incapable of making your own decisions. By its very nature, a healthcare POA is both durable and springing.

Why is a power of attorney important?

Power of attorney is essential in the event that you're incapacitated or not physically present to make decisions on your own behalf. Learn more in our in-depth guide.

What is the inability to manage property or business affairs?

Incapacity is defined as the inability to manage property or business affairs because the principal "has an impairment in the ability to receive and evaluate information or make or communicate decisions even with the use of technological assistance"; or "is missing, detained, including incarcerated in a penal system, or outside the United States and unable to return."

How to give your agent the power to engage in all matters?

To give your agent the power to engage in all matters, you can initial the line in front of the phrase "All Preceding Subjects.". Otherwise, you need to initial the line before each type of power you do want your agent to have.

When does a POA end?

POAs traditionally ended if the principal became incapacitated, and gave the agent power the moment they were signed. Today, you can create a "durable" POA, which continues after the principal becomes incapacitated, or a "springing" POA, which gives your agent the power to act only if you become incapacitated.

What Is a Power of Attorney?

A Power of Attorney is a legal document whereby the Principal grants an Agent the ability to conduct certain transactions on behalf of the Principal such as bill paying or similar financial transactions or legal transactions.

What happens when a Power of Attorney is a contingent?

If the Power of Attorney is a “springing” or contingent (meaning that it comes into effect upon the occurrence of some future event), the named agent now has the authority to verify in writing that such event has occurred.

Do you have to register a durable power of attorney in the office of the deeds?

Except for in the case of real estate transactions, Durable Powers of Attorney no longer have to be registered in the office of the register of deeds in order to remain in effect if the principal is incapacitated.

Can a power of attorney be self-dealing?

In addition, the Statutory Short Form Power of Attorney Form may not adequately address the issue of self-dealing. For example, if you appoint your spouse or child as your Agent, they are prohibited from entering into transactions that they may benefit from (referred to as “self-dealing”).

Does a new power of attorney automatically revoke a prior power of attorney?

The Act clarifies when powers under a Power of Attorney are terminated. A new Power of Attorney does not automatically revoke a prior Power of Attorney. The new Power of Attorney must specifically reference an intent to revoke the prior Power of Attorney. The Act clarifies how to revoke a Power of Attorney that has already been recorded at ...

Can an out-of-state power of attorney be interpreted in Kansas?

If out-of-state Powers of Attorney are to be interpreted under the laws of the state that they originate from, this could require obtaining an opinion letter from an out-of-state attorney. For example, assume that a couple has moved to North Carolina from Kansas. They have Power of Attorney documents that were previously executed in Kansas. In order to verify that the Power of Attorney documents were validly executed under Kansas law or to determine how key provisions of the documents should be interpreted, the agent may ultimately be forced to hire a Kansas attorney to prepare an opinion letter. The Act actually even acknowledges such and that such opinion letter could be recorded in North Carolina with the Power of Attorney. Obtaining such an opinion letter could result in delays and additional costs. Ultimately, it seems that it would be more expedient and prudent to execute a new Power of Attorney upon moving to North Carolina.

Can you use a short form power of attorney?

Many of those powers have to do with the ability to make gifts, change beneficiary designations, delegate authority, or similar. As a result, most estate planning and elder law attorneys recommend that individuals not rely on the statutory short form power of attorney, but instead consult with an attorney to draft a power ...

What is a power of attorney?

A. A power of attorney is a document that allows someone else to act as your legal agent. Thus, a power of attorney can be used to allow a friend to sell your car, to let your spouse ship your household goods or to authorize a relative to take your child to the hospital. It can also be used to sell or buy property. It can create valid and legal debts in your name or it can authorize a person to pay off your debts.

How long does a power of attorney last?

4) Make sure your expiration date is for a fairly short period of time. While this will vary from one person to another, periods of one, two or three years are not uncommon on powers of attorney.

Why is a power of attorney called a springing power of attorney?

If the grantor wants to prepare a power of attorney that only becomes valid upon his or her incapacity, that document can also be prepared by this office, and it is called a springing power of attorney because it "springs to life" upon the grantor's incapacity. 11.

How to make a power of attorney last longer?

2) If you feel you might need a power of attorney, have one prepared but don't sign it until you need it. 3) Always put an expiration date on your power of attorney; never make a power of attorney that lasts indefinitely.

Can a power of attorney be made permanent?

A. A power of attorney should never be made indefinite or permanent. The best course is to set a date for the power of attorney to expire, and this can be written into the power of attorney. That way, the power of attorney will be no good after the expiration date that you set unless, of course, you renew it by preparing a new power of attorney.

Can a business accept a power of attorney in North Carolina?

A. No. In North Carolina, every business or bank is free to accept or reject a power of attorney. Some businesses or banks require that the power of attorney be recorded while others do not. Some banks will accept only a special power of attorney.

Is a power of attorney a good document?

A power of attorney always has the potential for being a very helpful or a very dangerous document for those reasons . The important thing to remember is that you are going to be legally responsible for the acts of your agent. Therefore, you must exercise great care in selecting the person to be your agent. 7.

What Types of Power of Attorneys Are Available in North Carolina?

You can make several different types of POAs in North Carolina. In particular, many estate plans include two POAs:

What Are the Legal Requirements of a Financial POA in North Carolina?

For your POA to be valid in North Carolina, it must meet certain requirements.

When Does My Durable Financial POA Take Effect?

Your POA is effective immediately unless it explicitly states that it takes effect at a future date.

When Does My Financial Power of Attorney End?

Any power of attorney automatically ends at your death. A durable POA also ends if:

What is a POA in healthcare?

a health care POA, which allows someone to make medical decisions on your behalf.

What is a POA?

A POA is a simple document that grants specific powers to someone you trust —called an "agent" or "attorney-in-fact"—to handle certain matters for you.

Can you have multiple agents in North Carolina?

North Carolina allows you to appoint co-agents who are authorized to act at the same time, but it's usually advisable to stick to just one agent to minimize potential conflicts. However, naming a "successor" agent—an alternate who will become your agent if your first choice is unavailable for any reason—is always a good idea, as it creates a backup plan.

Durable Power of Attorney North Carolina Form – Adobe PDF

A North Carolina durable power of attorney is a document used to appoint an attorney-in-fact to make financial decisions, personal or business-related, for a principal (individual who executed the form). This type of power of attorney is used frequently as the arrangement continues even if the principal becomes incapacitated.

General Power of Attorney North Carolina Form – Adobe PDF

The North Carolina general power of attorney form establishes a legally binding arrangement between a principal and their attorney-in-fact in regard to the management of financial affairs.

Limited Power of Attorney North Carolina Form – Adobe PDF

The North Carolina limited power of attorney form allows a person in the State to hand over control of a specific task or transaction (usually financial in nature) to an appointed attorney-in-fact.

Medical Power of Attorney North Carolina Form – Adobe PDF

A North Carolina medical power of attorney has a two-pronged effect; it can be used to appoint a health care representative, and it can list the types of medical treatment and attention one wishes to receive in certain life-threatening circumstances.

Minor (Child) Power of Attorney North Carolina – Adobe PDF

The North Carolina minor power of attorney form is a document which enables parents to assign a trusted adult the right to make parental decisions regarding their child, usually for a limited duration. Sometimes, a parent may need to be away from their child due to obligations such as work, training, military deployment, or illness.

Real Estate Power of Attorney North Carolina Form – Adobe PDF

The North Carolina real estate power of attorney allows an individual (called the “principal”) to authorize an agent to manage, purchase, and sell real property on their behalf. In most cases, this type of contract is used to handle the closing of an individual real estate deal.

Revocation of Power of Attorney North Carolina Form – Adobe PDF

The North Carolina revocation of power of attorney form is a document that terminates an existing power of attorney. Some powers of attorney might be created with a termination date, whereas others will require the principal to download this form and sign it to revoke all powers their attorney-in-fact currently has.

Popular Posts:

- 1. how to know how my power of attorney has been used

- 2. who do i contact to investigatean attorney in wi

- 3. what is the difference between a special power of attorney and a general power of attorney

- 4. when does the client attorney relationship begin in texas

- 5. ohio what attorney has to turn over to client file

- 6. what papers are submitted to the district attorney

- 7. vanessa ramos attorney in utah how do i contact her

- 8. how an attorney can help dui

- 9. how coild an ex convict become an attorney

- 10. who is attorney mark richards