Full Answer

What happens to power of attorney when a parent dies?

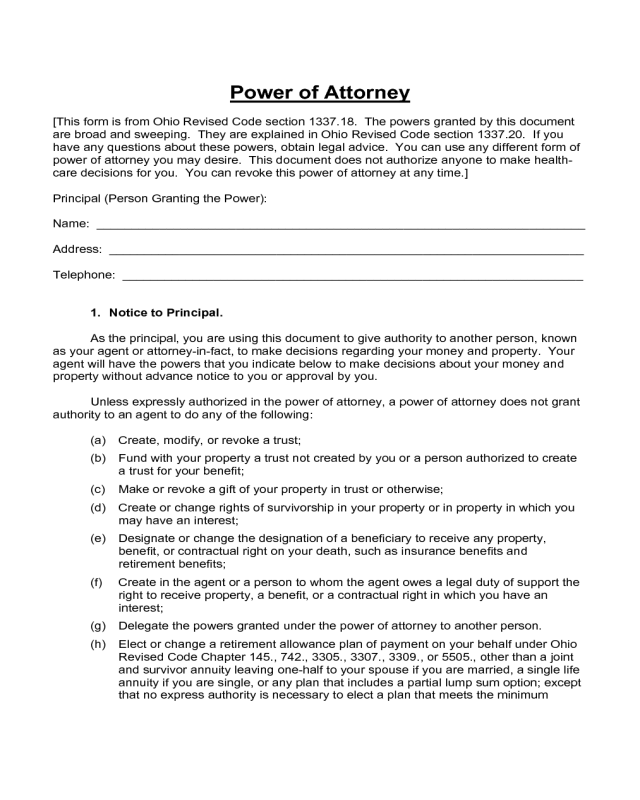

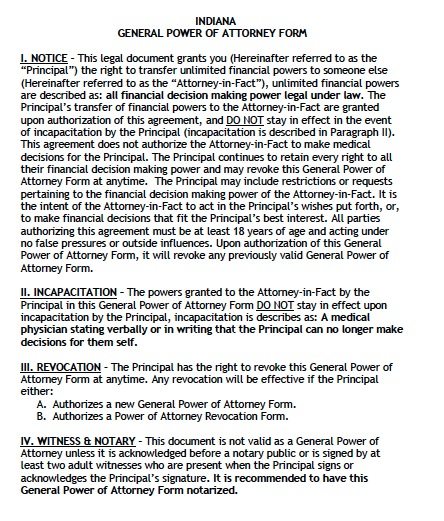

A Power of Attorney is a legal document that gives an adult the authority to act in your place. The person you appoint to act in your place is known as the "Attorney in Fact" or agent. It is very important that your agent is someone you trust. With a valid Power of Attorney, the trusted person you name will be legally permitted to take care

What are the different types of power of attorney in Arizona?

Feb 09, 2015 · General Power of Attorney – A General Power of Attorney is a person that is given complete authority to act upon another adult’s finances, property, business transactions, etc. The General Power of Attorney typically does not have the rights to make decisions on the person’s health care treatment.

What is a parental power of attorney?

Dec 14, 2017 · Small estates can go through informal or summary probate or avoid it altogether. For instance, Arizona law allows you to transfer up to $75,000 in personal property and up to $100,000 in real property if it is to a single individual or beneficiary by filing an affidavit. For personal property, you must wait 30-days after the property owner passes.

Who is responsible for probate in Arizona?

Power of Attorney has a beginning (effective) date, and ends either on the end date, when the Principal revokes it, or the Principal becomes mentally unable to handle their own affairs due to sickness or injury. A . Durable. Power of Attorney has no specified end date and ends on the death of the Principal, or upon revocation by the Principal.

Is a power of attorney valid after death in Arizona?

Powers of attorney can be “general” or “durable.” A general power of attorney ends upon your death or when you become incapacitated, unless it rescinded by you before that time. ... The power of attorney can be effective immediately upon signing, or “springing,” meaning it only takes effect upon a person's incapacity.Jan 28, 2021

What happens with power of attorney when someone dies?

On their death, it will be the responsibility of the late donor's Personal Representatives to manage this estate. Typically, this involves collecting in the estate assets, money and property, settling debts, and paying any remainder to the beneficiaries.

Which power of attorney is valid after death?

In the case of revocable power of attorney, the document is not valid after the death of a person, Who has given the authority to act on his behalf. A power of attorney is said to be revocable if the principal has the right to revoke power at any point in time.In this case Power of attorney is not valid after death.

Does power of attorney Stop probate?

Power of attorney and executor This is quite common, as often the person trusted to deal with someone's affairs during their lifetime is the person trusted to do the same after their death. ... So the fact that you had power of attorney has no influence over whether or not probate is needed.

Does power of attorney override next of kin?

No. The term next of kin is in common use but a next of kin has no legal powers, rights or responsibilities.

What happens to the bank account of a deceased person?

If the account holder established someone as a beneficiary or POD, the bank will release the funds to the named person once it learns of the account holder's death. After that, the financial institution typically closes the account.Sep 16, 2020

Can a family member override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

Can an executor of an estate give power of attorney to someone else?

Can an executor appoint another executor? If they are unable to act temporarily, for example, they live abroad; it is possible to give a Power of Attorney to another person to act on their behalf. The executor can delegate the functions he/she has to carry out to the attorney.

Can irrevocable power of attorney be Cancelled?

Such Power of Attorney may be revoked by the principal or the Power of Attorney holder by the procedure according to law. For revocation of irrevocable Power of Attorney, the principal is required to issue a public notice through local newspapers, without which, the revocation shall stand void.Feb 26, 2017

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

Can an executor override a beneficiary?

Ways an Executor Cannot Override a Beneficiary An executor cannot change beneficiaries' inheritances or withhold their inheritances unless the will has expressly granted them the authority to do so. The executor also cannot stray from the terms of the will or their fiduciary duty.May 12, 2021

Can power of attorney spend money?

Unless the LPA states otherwise, you can spend money on: gifts to a donor's friend, family member or acquaintance on occasions when you would normally give gifts (such as birthdays or anniversaries) donations to a charity that the donor wouldn't object to, for example a charity they've donated to before.

What happens to a power of attorney when you pass away?

However, if you pass away a Power of Attorney loses all power making decisions for you specific to your assets, etc.

What is a general power of attorney?

General Power of Attorney – A General Power of Attorney is a person that is given complete authority to act upon another adult’s finances, property, business transactions, etc. The General Power of Attorney typically does not have the rights to make decisions on the person’s health care treatment.

How long does a power of attorney last?

A Parental Power of Attorney typically begins on a date and ends no more than six months later from the initial date. This is a temporary power of attorney that gives authority over your children in a specific situation and obviously with that, the person that you’ve chosen is willing to accept this responsibility.

What happens if a personal representative is not named in a will?

If a Personal Representative is not named in someone’s Will, Arizona law has an order of priority for who can serve: A personal representative must generally file a bond unless the Will specifically waives it or all of the heirs or devisees under the Will that did not provide for a waiver file a written waiver.

How long do you have to wait to transfer property in Arizona?

For personal property, you must wait 30-days after the property owner passes. For real property, the waiting period is 6-months.

What are the grounds for a will contest?

Will contests are more prevalent on television than in real life. Will contests generally occur in estates of substantial value where a disgruntled heir feels he or she was unjustly omitted from the Will or received far less than what the testator (person who made the Will) actually intended. The grounds upon which a Will may be contested include: 1 Did not meet validity requirements or there was a defect in the way the Will was signed or witnessed 2 There was undue influence on the testator when the Will was drafted 3 The testator lacked intellectual or testamentary capacity 4 The testator suffered from an insane delusion that affected the dispositive provisions 5 A provision was patently ambiguous (testator’s intention is unclear on the face of the Will)

What is the purpose of the Intestate succession law?

Intestate succession laws distribute assets pursuant to a priority list of possible heirs, such as surviving spouse, children, parents, and other relatives. Personal representatives are entitled to reasonable compensation for their services from the estate of the decedent.

What to do if a decedent left a will?

Assess the debts and claims made against the estate and to pay those that are valid. Distribute the remaining assets to the beneficiaries or heirs. If the decedent left a Will, then the personal representative will distribute particular assets to the designated beneficiaries. If there is no Will, then the assets are distributed to ...

How old do you have to be to contest a will?

The grounds upon which a Will may be contested include: A Will is valid if the testator is at least 18-years of age, signs the document, has two witnesses, and a notary. A handwritten Will is valid if it is signed and dated and all in the testator’s handwriting.

What is a beneficiary in life insurance?

Life insurance proceeds that named at least one individual as a beneficiary. Annuities that named at least one individual as a beneficiary. Retirement plans, pensions and IRAs that named at least one individual as a beneficiary.

What is a personal representative of a deceased person?

The personal representative of a deceased person's estate is a fiduciary, meaning they owe a legal duty to the estate and its beneficiaries. The personal representative must carry out those duties in a responsible manner, making decisions that are in the best interest of the estate as a whole rather than in their own best interest.

What is probate in a will?

Probate is a public proceeding. Even if you were not named in your parents' will (s), you have the right to read the will, any codicils (amendments) to it, and court filings. You also have the right to notifications about upcoming court hearings.

What are the duties of a personal representative?

Fiduciary duties of a personal representative include: 1 Representing the estate in court proceedings 2 Inventorying assets 3 Safeguarding assets 4 Notifying creditors, heirs, and interested parties 5 Paying valid debts and other claims 6 Handling tax filings and obligations 7 Distributing remaining assets as provided in the will 8 Providing a final accounting to heirs and interested parties

What happens if you don't name your heir in your will?

If you were not named as an heir in your deceased parents' wills or trusts or if you don't believe your sibling is managing estate administration appropriately, you have the right to contest the administration in court. Losing a parent or another loved one can be difficult emotionally.

Is probate required for a small estate?

Exemptions from Probate. In some states, probate is not required for certain small estates, even if the deceased person left a valid will. In other states, probate is required if there was a will, regardless of the size of the estate.

What does POA mean in a power of attorney?

The POA gave you the authority to act on his behalf in a number of financial situations, such as buying or selling a property for him or maybe just paying his bills.

What happens if you don't leave a will?

When There's Not a Will. The deceased's property must still pass through probate to accomplish the transfer of ownership, even if he didn't leave a will . The major difference is that his property will pass according to state law rather than according to his wishes as explained in a will. 3 .

Can a deceased person's bank account be frozen?

As a practical matter, most financial institutions immediately freeze the accounts of deceased individuals when they learn of their deaths. The freeze remains in place until they're contacted by the executor or administrator of the estate. If you were to attempt to use the POA, it would be denied.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

Popular Posts:

- 1. when does a special power of attorney expire

- 2. when an attorney commits malpractice

- 3. brn what happens when it goes to the attorney general

- 4. what is the average cost of a patent attorney

- 5. who pays for special attorney in bankruptcy case

- 6. who is florida's 5th judicial circuit state attorney

- 7. how to know if your wife is seeing a attorney

- 8. how to talk to loved ones about power of attorney

- 9. what type power of attorney for elderly parent

- 10. what doess the attorney general do