How to write a power of attorney letter?

- Come up with a draft. At first, you have to create a list of the special powers you will assign to your Agent. ...

- Make decisions about springing powers. A springing power refers its conditional. ...

- Select your Agent and a Successor Agent. During writing the letter, assigning your Agent is the most significant step. ...

- Add the expiration date. ...

- Finalize your letter. ...

- Your name, address, and signature as the principal.

- The name, address, and signature of your Agent.

- The activities and properties under the Agent's authority.

- The start and termination dates of the Agent's powers.

- Any compensation you will give to the Agent.

How do you write up a power of attorney?

You can create a power of attorney in multiple ways: Hire a lawyer to draw up a POA for you —Having a lawyer create a power of attorney for you is one of the most reliable... Write a POA letter on your own —If you have knowledge and experience in legal matters, you can try writing a POA on your... ...

Can I write my own power of attorney letter?

Apr 05, 2022 · Sample Power Of Attorney Letter. I, Name of Principal, who currently resides at Address of Principal am of sound mind, do hereby name Name of Agent who currently resides at Address of Agent as my lawful and true attorney in fact, to act in my name and place to do and perform the following on my behalf.

How do I create a power of attorney?

Power of Attorney Letter Sample I, Name of Principal, who currently resides at Address of Principal am of sound mind, do hereby name Name of Agent who currently resides at Address of Agent as my lawful and true attorney in fact, to act in my name and place to do and perform the following the following on my behalf.

How do you fill out a power of attorney paper?

Follow these steps to draft the letter: Step I: Generate a draft Start by generating a draft of the letter you want to send out to the person to whom you... Step II: Decide on the springing powers Springing powers are so-called because they are conditional. …

What is a power of attorney letter?

A general power of attorney letter grants the agent the same powers indicated in the durable form. The only difference is that it does not remain in effect if the principal becomes, for whatever reason, incapacitated or mentally disabled.

What is a special case power of attorney letter?

A special case power of attorney letter refers to a written authorization that grants a representative the right to act on behalf of the principal under specified circumstances. When preparing this document, you need to be very clear about the acts you wish to grant the agent. It is possible for you to make more than one special power of attorney to delegate different responsibilities to different individuals.

What is a springing power of attorney?

A springing power of attorney refers to a conditional power of attorney that will only come into effect if a certain set of conditions are met. This may be used in various situations, particularly when the principal is either disabled or mentally incompetent.

When to use a durable power of attorney?

A durable power of attorney is typically used when the principal becomes incapacitated and is unable to handle personal affairs on their own. This is often created for the purpose of financial management, giving your agent the authority to deal with real estate assets and other finances on your behalf.

Why do you have to revoke a power of attorney?

Perhaps you are unhappy with the way your agent has handled previous matters, or maybe you are no longer acquainted with the said individual. The revocation must include your name, a statement proving that you are of sound mind, and your wish to revoke this right. This is necessary to make the revocation legal and enforceable.

Who signs a power of attorney?

To be legal, the power of attorney letter must be signed by the principal, witnesses, a notary public or other official according to the laws of the state where the POA is written. The principal should not sign the document until they are in the presence of a notary public. A POA could also be created for a specific transaction such as selling ...

What is POA in 2021?

Power of attorney (POA) means a person, called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves. This can only legally be done if the principal has the requisite mental capacity to grant this power ...

Is a power of attorney a letter?

The document must clearly state that the principal wants their agent to make decisions for them if they are unable to do so for themselves. A power of attorney letter is not really a letter in the conventional sense. It is a legal document that must have specific instructions.

Can a guardian revoke a POA?

Recommend a guardian for a minor child. Even if a principal grants an agent the power of attorney over their affairs, they are still responsible for their affairs, and can revoke the POA at any time.

Can a POA be cancelled?

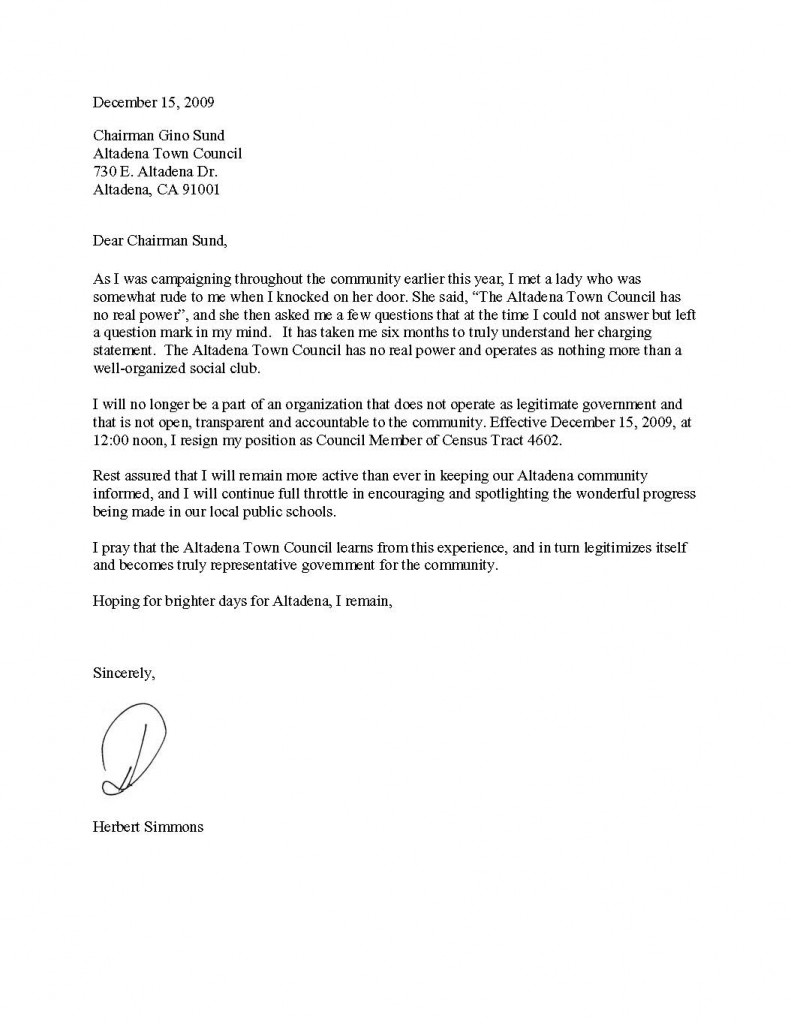

A POA could also be created for a specific transaction such as selling a business, and cancelled when that transaction is completed. Here is a sample power of attorney letter. It may be kept by a lawyer, if the principal had legal help writing it. Otherwise it should be sent by certified mail.

Who signs a power of attorney?

To be legal, the power of attorney letter must be signed by the principal, witnesses, a notary public or other official according to the laws of the state where the POA is written. The principal should not sign the document until they are in the presence of a notary public.

What is a POA letter?

Power of attorney (POA) means a person, called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves.

Can a POA be cancelled?

A POA could also be created for a specific transaction such as selling a business, and cancelled when that transaction is completed. Here is a sample power of attorney letter. It may be kept by a lawyer, if the principal had legal help writing it. Otherwise it should be sent by certified mail.

Can a POA be given to another person?

Once a person loses their mental faculties such as in an automobile accident or through a disease such as Alzheimer’s disease, they may no longer grant the power of attorney to another person. . There are many decisions a POA can be given the power to make such as the power to: Make gifts of money or property.

Is a power of attorney a letter?

A power of attorney letter is not really a letter in the conventional sense. It is a legal document that must have specific instructions. It can be put in formal, business letter format, if it has all of the legal requirements.

Can a principal revoke a POA?

Even if a principal grants an agent the power of attorney over their affairs, they are still responsible for their affairs, and can revoke the POA at any time. The main reasons it is recommended to designate a POA are: If property is owned by more than one person. If bank accounts have more than one name.

What Is a Power of Attorney Letter?

It is an official letter that confers the power to make far-reaching decisions and act on the behalf of another person in line with the terms that are stipulated in the letter.

How to Write

Start by generating a draft of the letter you want to send out to the person to whom you delegate the powers. The draft ought to contain a list of the special powers you intend to bequeath to a third party. This list ought to be explicit and detailed to avoid any doubts.

Types of Power of Attorney

Lasts longer and mainly comes in force when you are completely incapacitated such as when in a coma. This type is only applicable if you are completely incapable of making decisions on your own.

Does a Power of Attorney Need to be notarized?

YES, it has to be notarized. The notary public is the one to do this. It is only after it has been notarized that it is deemed legally binding. The rules and regulations differ per state. That means you have to check out your state laws to find out about the rules.

Does Power of Attorney Expire?

The ‘power of attorney’ is a very serious document that should never be handled recklessly. You need to treat it with the seriousness it requires to prevent the issues and problems that potentially arise with use. Reading in between the prescriptions we have stipulated above is a sure way of achieving this end.

What is a power of attorney letter?

The power of attorney authorization letter is a legal document that gives another person the power to act and make decisions on behalf of someone else in accordance with the terms of the document. Usually, the party being granted this authority is referred to as the ‘agent’. Some of the activities an agent can undertake to include monetary transactions, property dealings, and even signing cheques. When the agent acts in the place of the original person, his activities are binding legally to the original person.

What is the difference between a power of attorney and a letter of authority?

These two letters are very similar, but the main difference comes in the scope. A letter of authority authorizes someone to act on someone’s behalf for a given specific purpose. The assignee of the letter of authority should cancel the letter upon completion of the tasks assigned. On the other hand, the power of attorney authorization letter gives the assignee powers to act over a wide range of transactions.

Why do you need a power of attorney authorization letter?

A power of attorney authorization letter is essential whenever you need someone to act on your behalf to complete tasks that you are unable to do due to certain valid reasons.

What is authorization letter?

An authorization letter is a written endorsement that gives another person the right, authority, mandate, or capacity to act on your behalf to enter into a contract, spend a certain amount, take action, delegate his or her responsibilities, and do other matters you want them to look into.

What is a durable power of attorney?

A Durable Power of Attorney. It is used to grant another person the authority to make important decisions and take actions on your behalf. It is more encompassing compared to the non-durable power of attorney. The decisions that the authorized person may resolve include financial, business, and real estate affairs.

Why do you need a power of attorney?

There are quite a several reasons to designate a power of attorney, and among the reasons are the following: In instances where bank accounts have two or more names. If brokerage accounts have two or more names. In situations where the principal is single and is out of town. If the principal is having or is scheduled to have major surgery.

What can an agent do?

Some of the activities an agent can undertake to include monetary transactions, property dealings, and even signing cheques. When the agent acts in the place of the original person, his activities are binding legally to the original person. Advertisements.

What is a power of attorney?

A power of attorney is an official document that bestows the power to make decisions and act on behalf of another person in accordance with the terms written in the letter. Typically, the person granted such a power is the “Agent.”. The activities that the Agent will undertake may include property dealings, monetary transactions, signing checks, ...

What are the elements of a power of attorney?

Generally, the main elements in an example of power of attorney letter include: Your name, address, and signature as the principal. The name, address, and signature of your Agent. The activities and properties under the Agent’s authority. The start and termination dates of the Agent’s powers.

How to finalize a letter?

After you have gathered all the information you need, you can now finalize your letter. Use non-ambiguous, clear language when outlining the details in the document. Include in your letter your complete name, the complete name of your Agent, and the complete name of your Successor Agent.

How to assign special powers to an agent?

The first step is to make a list of the special powers you will assign to your Agent . Because such special powers should be very precise, you should explicitly indicate the accounts, properties, and transactions that your Agent will have authority over. Make decisions about springing powers.

What are the qualities of an agent?

This is the person who makes decisions on your behalf. When choosing your agent, the most important qualities to consider are trust and accountability. Just make sure that your Agent is always available, especially in times of duress, and will execute your wishes faithfully.

Do you need a power of attorney letter?

Under certain circumstances, you might have to designate another person to act on your behalf when it is about legal matters. For this, you need a power of attorney letter. This is an official document that you as the Principal will complete to appoint another person to act on your behalf. This person is the “Attorney-in-Fact” or the “Agent.”

Can a power of attorney take away your power to act?

Although you can grant a person a power of authority to act on your behalf through a power of attorney letter, it doesn’t take away your power to act or decide for yourself. As a matter of fact, should there be a disagreement between you and your Agent, you still make the final decision.

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

What is an agent in law?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent.

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

Does power of attorney matter in which state?

A: The power of attorney must be tailored for the state in which your parent resides. It does not matter which state you live in, as long as the power of attorney is applicable to the principal’s state of residence, which in this case is your parent, is what matters.

Popular Posts:

- 1. attorney commits fraud in court who do i complain to

- 2. who is donald trump's attorney

- 3. how to negotiate a debt with the attorney general

- 4. how do i legally remove myself as power of attorney for my elderly mother?

- 5. attorney lead gen how much do they pay

- 6. how to get a court ordered attorney before your court date

- 7. how to becomee an attorney florida

- 8. how to file for child custody without an attorney in texas

- 9. what is a non practicing attorney

- 10. who is california state attorney general 2016