Full Answer

How to write a power of attorney letter sample?

From: Financial Consumer Agency of Canada. A Power of Attorney is a legal document. It gives one person, or more than one person, the authority to manage your money and property for you. You're not required to make a Power of Attorney. However, it's a good idea to have a Power of Attorney in case you become unable to manage your own finances.

Do I need a power of attorney in Canada?

Apr 16, 2019 · The General Power of Attorney is set up to allow a named person to handle all of your financial affairs. A Specific Power of Attorney is set up to handle a particular transaction. For example, if I was living overseas and needed somebody to sell my car for me back in Canada, I could create a specific Power of Attorney that would give my ...

Who is the attorney in fact of a power of attorney?

Oct 11, 2021 · name a substitute attorney (if applicable); state the event on which the power of attorney will become effective; state any restriction to the authority of the attorney(s) for property; state the compensation to be paid to the attorney(s). The document must then be signed by two witnesses, in the presence of each other and the grantor. Applicable Law

How to make a power of attorney enforceable?

An Ordinary Power of Attorney is only valid as long as the donor is capable of acting for him or herself. If the donor becomes mentally incompetent (loses capacity), the ordinary Power of Attorney ends. An Enduring Power of Attorney remains valid even if the donor later becomes mentally incompetent. The donor must be competent at the time an enduring Power of …

How do you write a power of attorney letter?

What do I write in a letter of power of attorney?Your name, address, and signature as the principal.The name, address, and signature of your Agent.The activities and properties under the Agent's authority.The start and termination dates of the Agent's powers.Any compensation you will give to the Agent.More items...•Sep 1, 2020

Do you need a lawyer to get a power of attorney in Canada?

A power of attorney is a legal document that you sign to give one person, or more than one person, the authority to manage your money and property on your behalf. In most of Canada, the person you appoint is called an “attorney.” That person does not need to be a lawyer.Oct 24, 2016

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How much does it cost to get a power of attorney in Ontario?

The legal fees of a power of attorney in Ontario are usually calculated based on the document you want to authorize to a lawyer. The price can range anywhere from $100 to $300 per document.

How much does a power of attorney cost in BC?

The cost of drafting just an Enduring Power of Attorney is $295. However, as part of a Will & Estate package which includes a Will, Advanced Health Care Directive, Representation Agreement and Enduring Power of Attorney, the fee is $1,495 for all documents plus applicable taxes.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Jan 13, 2022

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

Do spouses automatically have power of attorney?

If two spouses or partners are making a power of attorney, they each need to do their own. ... A spouse often needs legal authority to act for the other – through a power of attorney. You can ask a solicitor to help you with all this, and you can also do it yourself online. It depends on your preference.Mar 26, 2015

Who can get power of attorney?

The person appointed to act on behalf of the donor is called an attorney. Anyone can be an attorney, as long as: they are capable of making decisions, and. they are 18 or over.

What is a Power of Attorney?

A Power of Attorney form, also referred to as a POA, is a legal document that gives one or more persons the authority to make financial, property,...

What types of Powers of Attorney are there?

There are generally two types of Powers of Attorney used in Canada: ordinary and enduring. An ordinary Power of Attorney is valid while you are jud...

Who can you give powers to in a POA?

Powers can be given to your spouse, a family member, a trusted friend, a professional such as a lawyer or accountant, or any other capable adult. T...

What actions can my attorney take on my behalf?

Your attorney can generally perform all of the personal financial actions you are able to. They can do your banking, purchase or sell your real est...

What actions can't be performed by my attorney?

Your attorney can't make medical decisions for you. If you want to put that type of provision in place, consider creating a ProductLink code="HEALT...

When should I have a Power of Attorney?

You should consider making a POA form for these situations: You are going to vacation in another country for the winter. You want to ensure someone...

What is a living will?

A Living Will is a document that is also in effect while you are alive, but deals only with your health condition and medical treatment. It usually combines the naming of a Healthcare Proxy with an expression of the type of treatment you wish to receive through an Advance Directive.

When does a power of attorney come into effect?

General Powers of Attorney can be further classified into one that comes into effect immediately, and one that comes into effect only when a future event occurs (usually, if you are incapacitated). This is called a “ Springing Power of Attorney “.

Can a beneficiary be a witness?

Just as with your Last Will and Testament, a beneficiary cannot be a witness to the signing of the document, for a Power of Attorney your representative (sometimes referred to as your “attorney” although this is a confusing term so we try not to use it) cannot be a witness.

What is a healthcare power of attorney?

Also known as a Healthcare proxy. In this document, you name a person to make medical decisions on your behalf. Most people when they talk about a Power of Attorney are not meaning a Healthcare document.

What is springing power of attorney?

The term Springing Power of Attorney is also mixed up with a Durable Power of Attorney. This is a document that “endures” your loss of capacity. A Durable PoA can technically be general, specific, immediate or springing.

What is the legal requirement for a POA?

The legal requirement for a PoA is that it is signed in the presence of two witnesses, but you must think about the extent of the powers being granted by this document. It allows your representative to empty your bank accounts completely, so naturally, banks are keen to limit their exposure to PoA abuse.

What is a power of attorney?

A Power of Attorney is a document that is written while you are healthy and you have capacity, to come into effect after you lose capacity. The nice thing about this approach is that you can decide who will handle your affairs on your behalf. Trying to assume control of somebody’s finances is a recipe for family conflict.

What is a continuing power of attorney?

A Continuing Power of Attorney for Property is a legal document in which a person (the "grantor") gives someone else the legal authority to make decisions about their finances. The person who is named as the attorney does not have to be a lawyer.

How old do you have to be to get a power of attorney?

To make a valid power of attorney, the grantor must be 18 years of age or more and " mentally capable " of giving a continuing power of attorney for property. This means that the grantor: knows what property they have and its approximate value; is aware of their obligations to those people who depend on them financially;

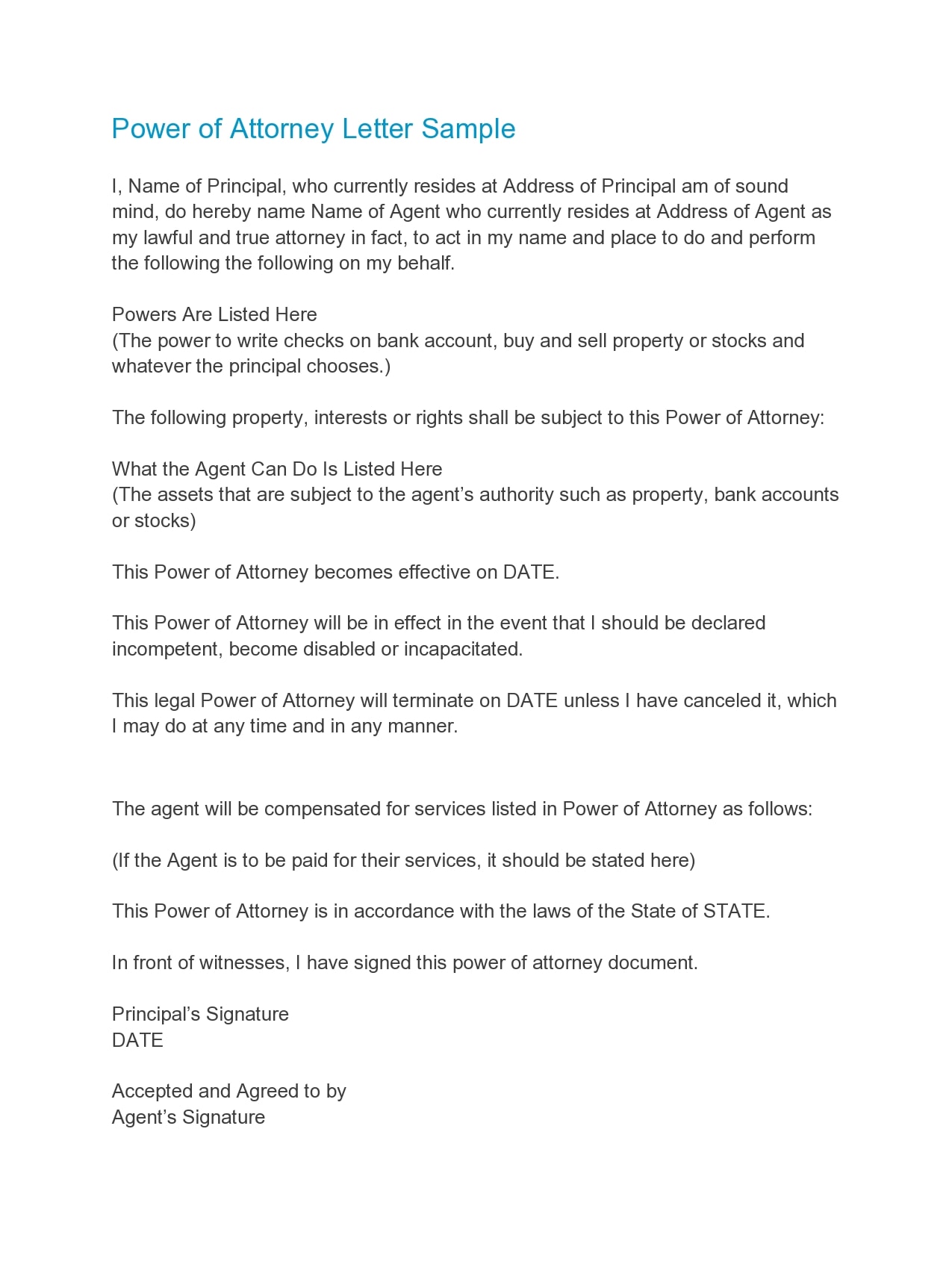

What Is a Power of Attorney Letter?

It is an official letter that confers the power to make far-reaching decisions and act on the behalf of another person in line with the terms that are stipulated in the letter.

How to Write

Start by generating a draft of the letter you want to send out to the person to whom you delegate the powers. The draft ought to contain a list of the special powers you intend to bequeath to a third party. This list ought to be explicit and detailed to avoid any doubts.

Types of Power of Attorney

Lasts longer and mainly comes in force when you are completely incapacitated such as when in a coma. This type is only applicable if you are completely incapable of making decisions on your own.

Does a Power of Attorney Need to be notarized?

YES, it has to be notarized. The notary public is the one to do this. It is only after it has been notarized that it is deemed legally binding. The rules and regulations differ per state. That means you have to check out your state laws to find out about the rules.

Does Power of Attorney Expire?

The ‘power of attorney’ is a very serious document that should never be handled recklessly. You need to treat it with the seriousness it requires to prevent the issues and problems that potentially arise with use. Reading in between the prescriptions we have stipulated above is a sure way of achieving this end.

Why do we need a surrogate?

When this happens, you would need a surrogate to handle your personal affairs or make life-and-death decisions about your healthcare.

What is a springing power of attorney?

A springing power of attorney refers to a conditional power of attorney that will only come into effect if a certain set of conditions are met. This may be used in various situations, particularly when the principal is either disabled or mentally incompetent.

When to use a durable power of attorney?

A durable power of attorney is typically used when the principal becomes incapacitated and is unable to handle personal affairs on their own. This is often created for the purpose of financial management, giving your agent the authority to deal with real estate assets and other finances on your behalf.

Why do you have to revoke a power of attorney?

Perhaps you are unhappy with the way your agent has handled previous matters, or maybe you are no longer acquainted with the said individual. The revocation must include your name, a statement proving that you are of sound mind, and your wish to revoke this right. This is necessary to make the revocation legal and enforceable.

What is a power of attorney letter?

A general power of attorney letter grants the agent the same powers indicated in the durable form. The only difference is that it does not remain in effect if the principal becomes, for whatever reason, incapacitated or mentally disabled.

What happens if you fall into a coma?

If you get into an accident, fall into a coma, or become mentally incapable to make stern decisions for yourself, you need to have someone who can decide for you during these critical circumstances. Medical decisions can be difficult, and often overwhelming, to make. Thus, be sure to grant this authority to someone whom you can entrust your life with, such as a spouse, parent, sibling, or close friend.

What is a special case power of attorney letter?

A special case power of attorney letter refers to a written authorization that grants a representative the right to act on behalf of the principal under specified circumstances. When preparing this document, you need to be very clear about the acts you wish to grant the agent. It is possible for you to make more than one special power of attorney to delegate different responsibilities to different individuals.

Why do you need a power of attorney authorization letter?

A power of attorney authorization letter is essential whenever you need someone to act on your behalf to complete tasks that you are unable to do due to certain valid reasons.

What is authorization letter?

An authorization letter is a written endorsement that gives another person the right, authority, mandate, or capacity to act on your behalf to enter into a contract, spend a certain amount, take action, delegate his or her responsibilities, and do other matters you want them to look into.

What is the difference between a power of attorney and a letter of authority?

These two letters are very similar, but the main difference comes in the scope. A letter of authority authorizes someone to act on someone’s behalf for a given specific purpose. The assignee of the letter of authority should cancel the letter upon completion of the tasks assigned. On the other hand, the power of attorney authorization letter gives the assignee powers to act over a wide range of transactions.

Why do you need a power of attorney?

There are quite a several reasons to designate a power of attorney, and among the reasons are the following: In instances where bank accounts have two or more names. If brokerage accounts have two or more names. In situations where the principal is single and is out of town. If the principal is having or is scheduled to have major surgery.

What is an agent in a transaction?

Usually, the party being granted this authority is referred to as the ‘agent’. Some of the activities an agent can undertake to include monetary transactions, property dealings, and even signing cheques. When the agent acts in the place of the original person, his activities are binding legally to the original person.

When is a power of attorney needed?

A power of attorney is necessary when bank accounts, properties, and brokerage accounts have two or more names, and when the principal is incapacitated or is unable to act due to valid reasons. There are five primary forms of power of attorney, and you can choose any depending on your current needs.

Can a principal revoke a power of attorney?

While the principal grants a power of attorney over their dealings to an agent, they can still be held accountable for their dealings. They can revoke the power of any attorney at any specific time. If the owner of the property dies, the money, shares, and property are transferable to the benefactors of the will.

What is a POA letter?

Power of attorney (POA) means a person, called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves.

Who signs a power of attorney?

To be legal, the power of attorney letter must be signed by the principal, witnesses, a notary public or other official according to the laws of the state where the POA is written. The principal should not sign the document until they are in the presence of a notary public.

Can a principal revoke a POA?

Even if a principal grants an agent the power of attorney over their affairs, they are still responsible for their affairs, and can revoke the POA at any time. The main reasons it is recommended to designate a POA are: If property is owned by more than one person. If bank accounts have more than one name.

What happens to property when a person dies?

If a person dies, his or her property and money will be transferred to the benefactors of the will. However, if they become incapacitated, the joint owner will have very limited authority over the share of the joint property or account unless they have power of attorney. Three Types of Power of Attorney. .

Can a POA be cancelled?

A POA could also be created for a specific transaction such as selling a business, and cancelled when that transaction is completed. Here is a sample power of attorney letter. It may be kept by a lawyer, if the principal had legal help writing it. Otherwise it should be sent by certified mail.

What is a power of attorney?

A power of attorney is an official document that bestows the power to make decisions and act on behalf of another person in accordance with the terms written in the letter. Typically, the person granted such a power is the “Agent.”. The activities that the Agent will undertake may include property dealings, monetary transactions, signing checks, ...

Can an agent act on your behalf?

The Agent can’t act on your behalf legally regarding a springing power until the condition or event occurs. This type of power doesn’t have to include a clause for this power but without it, then your letter becomes enforceable after you affix your signature. Choose your Agent and a Successor Agent.

What are the elements of a power of attorney?

Generally, the main elements in an example of power of attorney letter include: Your name, address, and signature as the principal. The name, address, and signature of your Agent. The activities and properties under the Agent’s authority. The start and termination dates of the Agent’s powers.

What are the qualities of an agent?

This is the person who makes decisions on your behalf. When choosing your agent, the most important qualities to consider are trust and accountability. Just make sure that your Agent is always available, especially in times of duress, and will execute your wishes faithfully.

How to finalize a letter?

After you have gathered all the information you need, you can now finalize your letter. Use non-ambiguous, clear language when outlining the details in the document. Include in your letter your complete name, the complete name of your Agent, and the complete name of your Successor Agent.

Popular Posts:

- 1. what does attorney llm mean

- 2. what kind of attorney represents movie directors

- 3. why would my attorney reject my review of him

- 4. what is a plaintiff's attorney called

- 5. how to do power of attorney of my estate

- 6. what is a contingent power of attorney

- 7. yahoo answers who to choose for power of attorney site:answers.yahoo.com

- 8. the white house attorney who oversees ethics for trump officials announced his resignation today.

- 9. what the fuck is a durable power of attorney

- 10. who serves as attorney to clerk of court in seminoke county