How to Write a Limited Power of Attorney

- Basic Information of Principal and Agent. In the first (1st) portion of the document, the principal should enter their full name and social security number (SSN).

- Powers. The principal should enter the details of what their agent is allowed to handle (up to three (3)). ...

- Revocation. A limited power of attorney will automatically be revoked upon death or incapacitation by default. ...

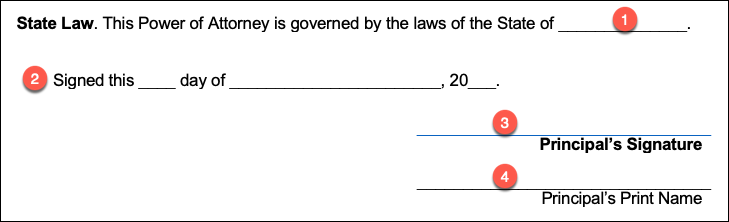

- State Law. Whichever state the Principal resides, should be the state entered into the document. ...

- Acceptance of Appointment. The Acceptance of Appointment is required in some States for the attorney-in-fact to confirm their duties to act in accordance with the written document.

- Witnesses. The Principal should obtain two witnesses to attest to the Principal’s signature as this step is a requirement in most states.

- Notary Public. Once the form has been completed by all parties, the Principal should bring their limited power of attorney form to their local Notary.

- Choose the limited power of attorney made for your state. ...

- Input personal information about both the principal and the agent or attorney-in-fact. ...

- Explain the powers of the agent. ...

- Include the date the limited power of attorney expires or will be revoked.

What are some examples of power of attorney?

To write a limited power of attorney: Choose the limited power of attorney made for your state. As a legal document, a limited power of attorney is subject to the laws in the state of your ... Input personal information about both the principal and the agent or attorney-in-fact. As the person ...

What is a limited power of attorney?

Get your hands on a personalized power of attorney letter by following these steps: Log in to your DoNotPay account; Locate the Power of Attorney tool; Answer our chatbot’s questions to help us select the type of POA you need; We will immediately draft a power of attorney letter and two notices—one for you and the other for your agent.

How to get power of attorney?

Apr 05, 2022 · Sample Power Of Attorney Letter I, Name of Principal, who currently resides at Address of Principal am of sound mind, do hereby name Name of Agent who currently resides at Address of Agent as my lawful and true attorney in fact, to act in my name and place to do and perform the following on my behalf. Powers Are Listed Here

What is a power of attorney template?

Jun 13, 2021 · Although the power of attorney is limited or general, the power of attorney document must contain the following information: The name of the person receiving power. A specific and detailed statement explaining the powers, obligations, and responsibilities granted to …

Why would someone do a specific or limited power of attorney?

A Limited Power of Attorney can give someone the authority to sign a legal document for a specific transaction. For instance, a limited power of attorney may be used to enable a real estate agent to handle a closing on behalf of a buyer or seller who is far away.

What is a limited power?

Under a limited power of attorney agreement, the agent can only act and make decisions on specified activities, and only to the extent that the principal authorizes. A principal does not need to choose a lawyer to be their agent; attorney in fact differs from an attorney at law.

What part of the Constitution is limited government?

Article VI of the Constitution states the principle of constitutional supremacy that guarantees limited government and the rule of law: “The Constitution and the Laws of the United States which shall be made in Pursuance thereof . . .

What is a limited power of attorney?

A limited power of attorney is a document that gives the named person, the agent or attorney-in-fact, with the legal authority to perform certain actions on behalf of the person who signs the document (known as the principal). A limited power of attorney doesn’t provide the agent with full authority over the principal. It outlines only the decisions that the agent may make for the principal. For example, a financial manager may have their client sign a limited power of attorney that allows the financial manager to invest their money without specifically speaking with the client to gain their consent. A limited power of attorney may also be known as a special power of attorney.

What is limited POA?

Scope and Limitations: A limited POA may apply to a single area of activity, such as the handling of investments. For example, an investment manager, acting as agent, may have authority to:

What is a POA for children?

This is our guide to power of attorney (POA) forms for American-born children of undocumented parents. While there are numerous situations in which POAs are useful, we focus here on undocumented families. POAs are important documents to have in place for families with undocumented members should they face detainment or deportation. In a moment in which political capital is increasingly spent on “securing borders” and arousing fears of undocumented immigrants, we hope this guide helps alleviate a small amount of the stress undocumented families constantly live with by providing tips for how to put processes and documents in place to protect your loved ones in the event of a detainment.

What is a non-compete agreement?

In the competitive business world, a non-compete agreement is a necessity. A non-compete agreement can be used with employees or independent contractor. The goal ...#N#of the document is to stop the other person from doing something that would directly compete with your business for a specific limit of time.

What is UTMA account?

Make sure you set up a UTMA (Uniform Transfer to Minors Act) bank account for your child (ren). A UTMA account will make it easier for your appointed caregiver to access funds for your child’s expenses. If you are leaving significant financial resources, you should consider establishing a trust. If you choose a trust, be sure to include access requirements in your POA.

What is a promissory note?

Promissory notes are used to record a debt that exists between two parties. This written promise states that one party will pay the other ...#N#party a certain amount. It will include a specific date or it may include an on demand clause.

What is release of liability?

A release of liability is a form that provides legal protection to an individual or a company in the instance of an accident. It ...#N#helps protect businesses or individuals from liability if someone else is injured. Bungee jumping is one instance in which a release of liability is used.

What is a power of attorney letter?

A general power of attorney letter grants the agent the same powers indicated in the durable form. The only difference is that it does not remain in effect if the principal becomes, for whatever reason, incapacitated or mentally disabled.

What is a special case power of attorney letter?

A special case power of attorney letter refers to a written authorization that grants a representative the right to act on behalf of the principal under specified circumstances. When preparing this document, you need to be very clear about the acts you wish to grant the agent. It is possible for you to make more than one special power of attorney to delegate different responsibilities to different individuals.

What is a springing power of attorney?

A springing power of attorney refers to a conditional power of attorney that will only come into effect if a certain set of conditions are met. This may be used in various situations, particularly when the principal is either disabled or mentally incompetent.

When to use a durable power of attorney?

A durable power of attorney is typically used when the principal becomes incapacitated and is unable to handle personal affairs on their own. This is often created for the purpose of financial management, giving your agent the authority to deal with real estate assets and other finances on your behalf.

Why do you have to revoke a power of attorney?

Perhaps you are unhappy with the way your agent has handled previous matters, or maybe you are no longer acquainted with the said individual. The revocation must include your name, a statement proving that you are of sound mind, and your wish to revoke this right. This is necessary to make the revocation legal and enforceable.

What happens if you fall into a coma?

If you get into an accident, fall into a coma, or become mentally incapable to make stern decisions for yourself, you need to have someone who can decide for you during these critical circumstances. Medical decisions can be difficult, and often overwhelming, to make. Thus, be sure to grant this authority to someone whom you can entrust your life with, such as a spouse, parent, sibling, or close friend.

Why do we need a surrogate?

When this happens, you would need a surrogate to handle your personal affairs or make life-and-death decisions about your healthcare.

What is a power of attorney?

Powers of attorney are one of the most powerful legal documents. Giving powers over important decisions away is not something you should brush aside. Before writing a power of attorney, you should consider the following: Power of attorney laws and forms can vary from one U.S. state to another.

Where do I file a power of attorney?

File the document. Most powers of attorney are filed with a court or government office, but that can vary depending on your state’s laws and your POA type.

What is POA in legal terms?

A POA stands for a power of attorney—a legal document used to transfer power over certain decisions from one person to another. Solve My Problem. Get Started. A power of attorney is created between two parties—the principal and attorney-in-fact.

Can a principal use a power of attorney?

Contrary to the common opinion, people don’t use powers of attorney only when they’re mentally or physically incapable of making the decisions on their own. You can use a power of attorney ...

What are the different types of power of attorney?

state to another. There are different power of attorney types, and the main ones include: General POA. Durable POA. Limited POA.

Can you delegate powers to an attorney in fact?

Not all powers can be delegated—you cannot authorize the attorney-in-fact to: Vote on your behalf. Make, change, or revoke your will. POA ceases at death. Powers of attorney are revocable and amendable, provided you are capable of making legal decisions on your own.

Can a power of attorney be written?

Some states allow oral powers of attorney, but it is best to have them in written form. Most states follow the Uniform Power of Attorney Act, which outlines the powers that the principal can give to the agent.

Who signs a power of attorney?

To be legal, the power of attorney letter must be signed by the principal, witnesses, a notary public or other official according to the laws of the state where the POA is written. The principal should not sign the document until they are in the presence of a notary public. A POA could also be created for a specific transaction such as selling ...

What is POA in 2021?

Power of attorney (POA) means a person, called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves. This can only legally be done if the principal has the requisite mental capacity to grant this power ...

What happens to property when a person dies?

If a person dies, his or her property and money will be transferred to the benefactors of the will. However, if they become incapacitated, the joint owner will have very limited authority over the share of the joint property or account unless they have power of attorney.

Can a POA be cancelled?

A POA could also be created for a specific transaction such as selling a business, and cancelled when that transaction is completed. Here is a sample power of attorney letter. It may be kept by a lawyer, if the principal had legal help writing it. Otherwise it should be sent by certified mail.

Can a guardian revoke a POA?

Recommend a guardian for a minor child. Even if a principal grants an agent the power of attorney over their affairs, they are still responsible for their affairs, and can revoke the POA at any time.

How to write a power of attorney?

Although the power of attorney is limited or general, the power of attorney document must contain the following information: 1 The name of the person receiving power. 2 A specific and detailed statement explaining the powers, obligations, and responsibilities granted to that person. 3 A statement specifying how long the person will have the authority to act on behalf of the interested party. 4 The signature of the person giving the power of attorney.

What is a power of attorney letter?

The power of attorney can be limited or general, depending on the wishes of the interested party. A power of attorney letter that is limited generally gives ...

Do you need to authenticate a power of attorney?

The signature of the person giving the power of attorney. If the power of attorney authorizes the representative to sell real estate, it must be authenticated to be valid. Otherwise, there are no formal execution requirements for a power of attorney. However, it is advisable that the document is authenticated and witnessed by two witnesses.

Can a power of attorney be used as a substitute for a will?

The power of attorney loses its validity when the representative knows that the interested party has died. So, the power of attorney is not a substitute for a will.

Is a power of attorney general or specific?

Despite whether a power of attorney is specific or general, the authority of a representative is limited to the scope of the document itself. For example, unless a power of attorney specifically authorizes the representative to sell real estate, the person does not have the authority to make such decisions. While a written document is needed, there ...

What is a power of attorney in Washington?

Create Document. A power of attorney form used by an individual (“principal”) to appoint someone else to handle their affairs (“agent” or “attorney-in-fact”). The agent is able to handle financial, medical, guardianship, or tax-related matters during the principal’s lifetime. If the form is durable, ...

What is a Durable Power of Attorney?

View and read the Types of Power of Attorney in order to get a better understanding of which form (s) are best. The most common is the Durable Power of Attorney for financial purposes and allows someone else to handle any monetary or business-related matter to the principal’s benefit.

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is banking banking?

Banking – To be able to deposit or withdraw funds in addition to conducting any type of financial transaction that the principal could also do themselves. Upon initials being placed on this line, the agent will have the full capacity to

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

Step 2 – Select The Agent

- It’s important to choose someone that can be trusted and usually involves a family member or friend. If the responsibility involves a higher-valued asset it’s recommended to select someone that is the beneficiary in the estate.

Step 3 – Write The Poa

- Download in Adobe PDF, MS Word, or OpenDocument (.odt). Use the Instructionsand fill in with the agent that will be used in the document and be sure to inform them the responsibilities and terms of the document. There should be at least two (2) copies of the form made for each of the parties.

Step 4 – Signing The Form

- Sign this form falls under “financial” related use, it must be authorized in accordance with State ‘Durable’ Laws. Which usually means the form must be signed with the principal in front of a notary public, witness(es), or both.

Step 5 – Acting as An Agent

- Like any other power of attorney assignment, whenever the agent uses their right to act in the presence of the principal this form must be presented to the other party. Otherwise, the agent is not legally allowed to act for the principal. If the agent is signing a document on behalf of the principal, they must sign and then use the phrase below the signature line “Acting as POA”. The …

Step 1 – Basic Information of Principal and Agent

- In the first (1st) portion of the document, the principal should enter their full name and social security number (SSN). Afterward, the attorney-in-fact’s full name including their address and telephone number (preferably their cell phone) should be written.

Step 2 – Powers

- The principal should enter the details of what their agent is allowed to handle (up to three (3)). The principal should initial and state how the form may be revoked, whether it can be by a revocation being authorized, when the task or objective has been completed, and/or at a particular date. Each option that is selected must be initialed and the box must be checked. Below enter th…

Step 3 – Revocation

- A limited power of attorney will automatically be revoked upon death or incapacitation by default. Additionally, you need to explain how you want the powers to be revoked when you no longer need your agent to act on your behalf. Your Limited Power of Attorney can be revoked in the following ways: 1. By the Principal at any time by authorizing a Revocation. 2. When the stated Power has …

Step 4 – State Law

- Whichever state the Principal resides, should be the state entered into the document. The laws of your state will be the governing laws overseeing your limited power of attorney.

Step 5 – Acceptance of Appointment

- The Acceptance of Appointment is required in some States for the attorney-in-fact to confirm their duties to act in accordance with the written document. The signature (along with the principal’s on the first (1st) page) should be authorized in front of either two (2) witnesses or a notary public (including their Seal). Once complete the form may be used until the acts are complete or on an …

Popular Posts:

- 1. who is acting us attorney general

- 2. what is power attorney mean

- 3. how much for an attorney to take care of sppeding tickets in north carolina

- 4. what if there is no medical power of attorney .gov

- 5. my workcomp attorney has done nothing for my case what now

- 6. how to become attorney without law school

- 7. why is the great ace attorney

- 8. attorney who asked the questions of christine ford releases letteer

- 9. what form for durable medical power of attorney

- 10. how to file power of attorney california