To write a limited power of attorney:

- Choose the limited power of attorney made for your state. ...

- Input personal information about both the principal and the agent or attorney-in-fact. ...

- Explain the powers of the agent. ...

- Include the date the limited power of attorney expires or will be revoked. ...

- List the state whose laws will be used to govern the agreement. ...

How can I become a financial power of attorney?

Establishing limited power of attorney means that a representative can legally conduct financial transactions, enter contracts, and make important decisions on your behalf. It ensures that someone can handle your finances and other important matters when you’re unable to do so.

Who needs a financial power of attorney?

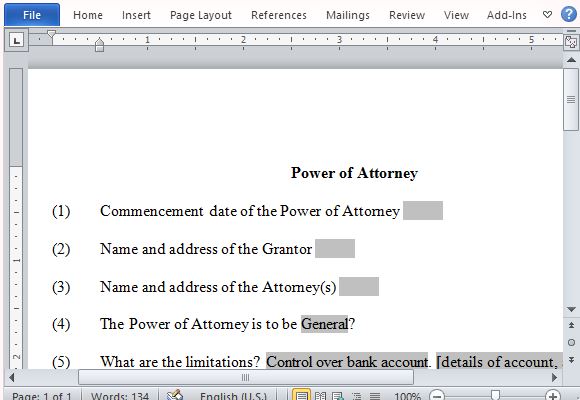

How to Write a Limited Power of Attorney (Step-by-Step) To write a limited power of attorney: Choose the limited power of attorney made for your state. As a legal document, a limited power of attorney is subject to the laws in the state of your residency. Input personal information about both the principal and the agent or attorney-in-fact.

What does a limited power of attorney mean?

How to Create a Limited Power of Attorney? 1. Use a Template; 2. Identify the Agent or Attorney-in-Fact; 3. Specify the Powers; 4. Set the Validity of the POA; 5. Notarize the Form. Frequently Asked Questions; Do I need to notarize my limited power of attorney? How long should a limited power of attorney be valid? Can a power of attorney supersede a will?

How to fill out a limited power of attorney form?

A limited power of attorney does not grant the broad powers of a general power of attorney and can restrict your Agent to handle only specified matters on your behalf. The financial power of attorney form on this page deals specifically with banking and money transactions. Banks or financial institutions will most often also have an additional form which must be completed to …

How do you write a special power of attorney?

How to Write a Special Power of Attorney LetterDraft a list of special powers. ... Decide what powers are springing. ... Pick an agent and a successor agent. ... Note the expiration date. ... Compile the information into one document. ... Execute the power of attorney letter.

What is the difference between power of attorney and limited power of attorney?

A general power of attorney gives an agent the power to handle your financial matters in your place. They can mostly do anything you could do, such as selling assets, transferring funds, or making gifts or investments. A limited power of attorney can handle a specific task or set of tasks for you.

What is another term for a power of attorney for property and financial matters?

In Alberta, the Powers of Attorney Act creates Enduring Powers of Attorney. An Enduring Power of Attorney (“EPA”), is a written, signed, dated and witnessed legal document. It gives someone else the right to act on your behalf with respect to your financial affairs while you are still alive.

What does limited POA mean?

limited power of attorneyUnder a limited power of attorney agreement, the agent can only act and make decisions on specified activities, and only to the extent that the principal authorizes. A principal does not need to choose a lawyer to be their agent; attorney in fact differs from an attorney at law.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can power of attorney be given for purchase of property?

In India, the power of attorney is used by many property buyers to assist them with transactions involved in buying a home. This could include a capital purchase of the land of home, leasing, selling the property or the mortgage. ... The POA is often used by NRIs looking to buy property in India.Aug 29, 2019

What is the difference between a personal directive and power of attorney?

Personal Directives apply only to personal matters. That is, anything of a non-financial nature that relates to the person, such as healthcare services and where you live. A Power of Attorney, or Enduring Power of Attorney, deals only with financial and estate matters during your life.

Is power of attorney valid for sale of property?

Is property sale through power of attorney legal? In 2011, the Supreme Court ruled that property sale through power of attorney (PoA) is illegal and only registered sale deeds provide any legal holding to property transactions.Nov 9, 2021

Do I need to notarize my limited power of attorney?

Most states do not require a notarized POA. Whereas in some states, you may choose to have your POA witnessed or notarized.

How long should a limited power of attorney be valid?

The validity of the POA depends entirely on you. You will be responsible for the starting and ending date of the POA. However, if no termination da...

Can a power of attorney supersede a will?

No. According to Legal Zoom, a power of attorney loses its effect once the principal dies. Whereas a will only becomes effective once the testator...

Can I appoint a family member as my agent?

Yes. Most individuals appoint their family members as agents when it comes to handling financial or health matters. This is because family members...

Are there any benefits to having a power of attorney?

Yes. You’ll have someone to make decisions for you, look after your assets, and handle your affairs for you in case you get mentally or physically...

What Is A General (Financial) Power of Attorney?

How to Execute A General (Financial) Power of Attorney

- Assigning someone to act and decide on your finances, on your behalf, allows you to have some extra time to attend to other important matters. And sometimes, handling finances by ourselves, along with other pressing matters, could be stressful and frustrating. Here, listed below are the steps on how to execute a general (financial) power of attorney.

Frequently Asked Questions

- A general (financial) power of attorney is a big help for people with hectic and schedules. However, executing such an instrument is not as easy as it seems. Thus, you need to make sure to give a general (financial) power of attorney to someone that holds your utmost confidence and trust.

Popular Posts:

- 1. how i know trial attorney update my id

- 2. how to request reduced hours at work attorney

- 3. how much can make the best attorney in usa

- 4. what do attorney levels mean wyoming

- 5. why did obama lose his attorney license

- 6. how to choose best criminal attorney

- 7. what is the reason for power of attorney

- 8. how long does a will take when attorney appointment

- 9. what happens when the person who has power of attorney dies?

- 10. how much is a good appeals attorney