How do you write a legal invoice for a lawyer?

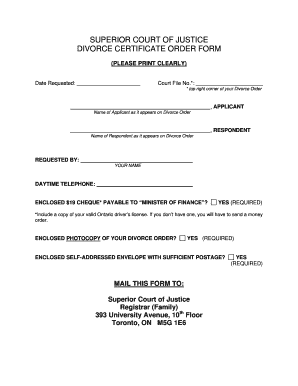

Nov 13, 2012 · The notice of acknowledgment of receipt can be used to serve any of the divorce documents, including the Divorce Summons and Petition which normally requires personal service. When you are using the notice of acknowledgment of receipt to serve the Summons and Petition of your divorce, you also need to file a proof of service of Summons, just the same way …

How do you write a receipt for a customer who paid?

Matter: Divorce File #: M -0234 Bill To: Shae Santiago Due Date: Due Upon Receipt Payments received after 04/01/2015 are not reflected in this statement. Description: $500 per month to be paid by 13th of the month Professional Services Details Billing Type Amount Divorce Fixed Fee $5,000.00 Total $5,000.00 Additional Charges

What to write in an email to an attorney regarding case?

Apr 12, 2021 · Sample Letter to Attorney Asking for Help in Court Case. Matt, and Murdoch Legal Services United States of America. Respected Staff, My name is William, and I am a stockbroker. I need some legal services. I have attached the details of …

What is a receipt?

Jan 09, 2022 · A receipt is a written record of a transaction between two (2) or more parties. A standard receipt will include the following transaction details: Date; Amount received ($); Payment type; Description of the service or goods; and; Who accepted payment. How Long to Keep a Receipt. According to the IRS, a business should keep their receipts for three (3) years.

What is an Acknowledgement of service in divorce?

An Acknowledgement of Service is a legal document that is used during divorce proceedings. The purpose of this document is for a person to tell the Court that they've received the divorce paperwork and they acknowledge that their spouse is seeking a divorce from them.Oct 2, 2019

How do I invoice an attorney?

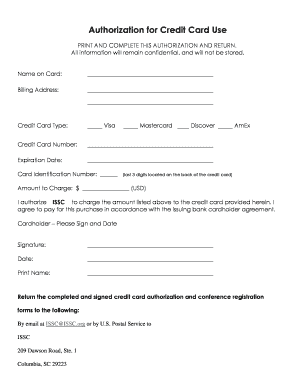

How to Create a Legal InvoiceDownload the free “Lawyer Invoice Template”Open the legal invoice template on your computer in your chosen format (.DOC, .XLS, or .PDF., Google Docs or Google Sheets)Name your invoice. ... Customize your invoice. ... Create your first client invoice. ... Add details to your client invoice.

What is a proof of service?

Proof of service is a document that functions like a legal “receipt” confirming the delivery of documents from one party to another in a legal matter. It is a written version of a sworn statement attesting to the completion of service of process.Dec 14, 2021

Can you serve divorce papers by email?

Well, the short answer is no. The Family Procedure Rules state that a civil partnership order or a matrimonial order such as a dissolution/divorce petition cannot be served on the Respondent (the person receiving the divorce papers) by email or fax.Mar 28, 2019

What is billing in law firm?

The law firm billing process Attorneys add notes and adjust costs as needed and approve the bill. A final version of the bill is created and sent to clients for payment. Clients pay via whatever payment methods are accepted at the firm.Dec 8, 2021

What is invoice copy?

Legal: invoice copy protects small businesses from fraudulent or small civil lawsuit as it is clear evidence that the goods or services were delivered at a particular time. Without this invoice copy, there won't be any record of that transaction.

How do I get proof of service?

A certificate of service must be signed by the person who made the service and must state: (1) the date and manner of service; (2) the name and address of each person served; and (3) if the person served is a party's attorney, the name of the party represented by that attorney.

What is substituted service in California?

Substituted service is similar to personal service, except the documents are served on someone other than the defendant at the defendant's residence or office, and then copies are mailed to the defendant at the place where the copies were left.

Can you serve court papers by email?

In the case of service by email, a specified method can be agreed so that the receipt of court documents may be managed and monitored properly. Service of documents by email is 'opt-in'. Simply because correspondence is sent by email between the parties does not mean a court document may be served by email.Dec 3, 2021

Do I need an address to serve divorce papers?

If they do not respond or are not advising your spouse, the Rules state that where an application cannot be served on the respondent personally or at an address which the respondent has given or on the solicitor, the divorce papers must be served on the respondent at their usual or last known address.Aug 24, 2015

Can I file for divorce without my spouse address?

If you cannot find your spouse, you can request permission from the court to publish a notice of the divorce in the newspaper or post a notice in the courthouse. This is called a Motion to Serve by Publication or Posting.

Can you send divorce papers to a work address?

In certain circumstances, a person seeking a divorce or dissolution may be able to get the Court to serve the petition on their spouse at their work address or at an address of a close family member or friend.Feb 20, 2020

What is an attorney invoice?

As an attorney, you may practice different areas of law. An attorney invoice allows you the flexibility to bill for a range of services. Download the attorney invoice template to get started.

Why is a legal invoice important?

Your legal invoice is an important document between you and clients. To make sure that all of your bases are covered, you will want a template that’s tailored to your business. That’s why we have create the legal invoice

Why do lawyers use timesheets?

Timesheet: Because lawyers often bill clients by the hour, a timesheet invoice can be helpful in tracking their billable hours for each job. Timesheet invoices list the number of hours worked and the hourly pay rate.

Why do we need an invoice?

An invoice allows you to keep a record of the work performed and the money collected. Then, you are able to easily calculate your profit at the end of the year when it comes time to file your taxes. You can even create a public notary invoice for your law office.

What is receipt in accounting?

A receipt is a written record of a transaction between two (2) or more parties. A standard receipt will include the following transaction details: Date; Amount received ($); Payment type; Description of the service or goods; and. Who accepted payment.

What is receipt in cash register?

A receipt is made after a transaction has occurred that details the price of the goods or services along with any taxes, discounts, shipping fees, or other line items. A receipt from a traditional cash register is made from thermal paper with heat being applied as the “ink”.

How long do you keep receipts?

How Long to Keep a Receipt. According to the IRS, a business should keep their receipts for three (3) years. If a business claimed a loss for any tax year, then the receipts for that year must be kept for seven (7) years. Source: IRS – How long should I keep records?

What is receipt in accounting?

Receipts serve as a document for customer payments and as a record of sale. If you want to provide a customer with a receipt, you can handwrite one on a piece of paper or create one digitally using a template or software system.

What is subtotal in accounting?

The subtotal is the cost of all the items before taxes and additional fees. Add up the cost of each of the items that you sold and write the total number under the list of item prices. To be accurate, use a calculator to add up the items. Add taxes and other charges to the subtotal for the grand total.

What is POS system?

A POS, or Point of Sale system, is a system that helps you track business expenses, sales, receipts, and can process payments like checks and credit cards.

Popular Posts:

- 1. a defendant who has been indicted has a right to an attorney at his lineup

- 2. who is the leflore county district attorney

- 3. all defendants.are given an attorney what case

- 4. attorney online how to change backgrounds

- 5. my sisters are fighting my dads will what kind od attorney do i need

- 6. who is michigan's new attorney general

- 7. how do request a letter an lop to an attorney

- 8. the great ace attorney how much cases

- 9. how much does it cost to get a power of attorney notarized

- 10. how to get emergency medical power of attorney