Follow these steps to ensure the process runs smoothly and meets legal requirements:

- Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — ...

- Step 2: Determine the Preferred Signature Format.

- Step 3: Sign as the Principal.

- Step 4: Sign Your Own Name.

- Step 5: Express Your Authority as Attorney-in-Fact.

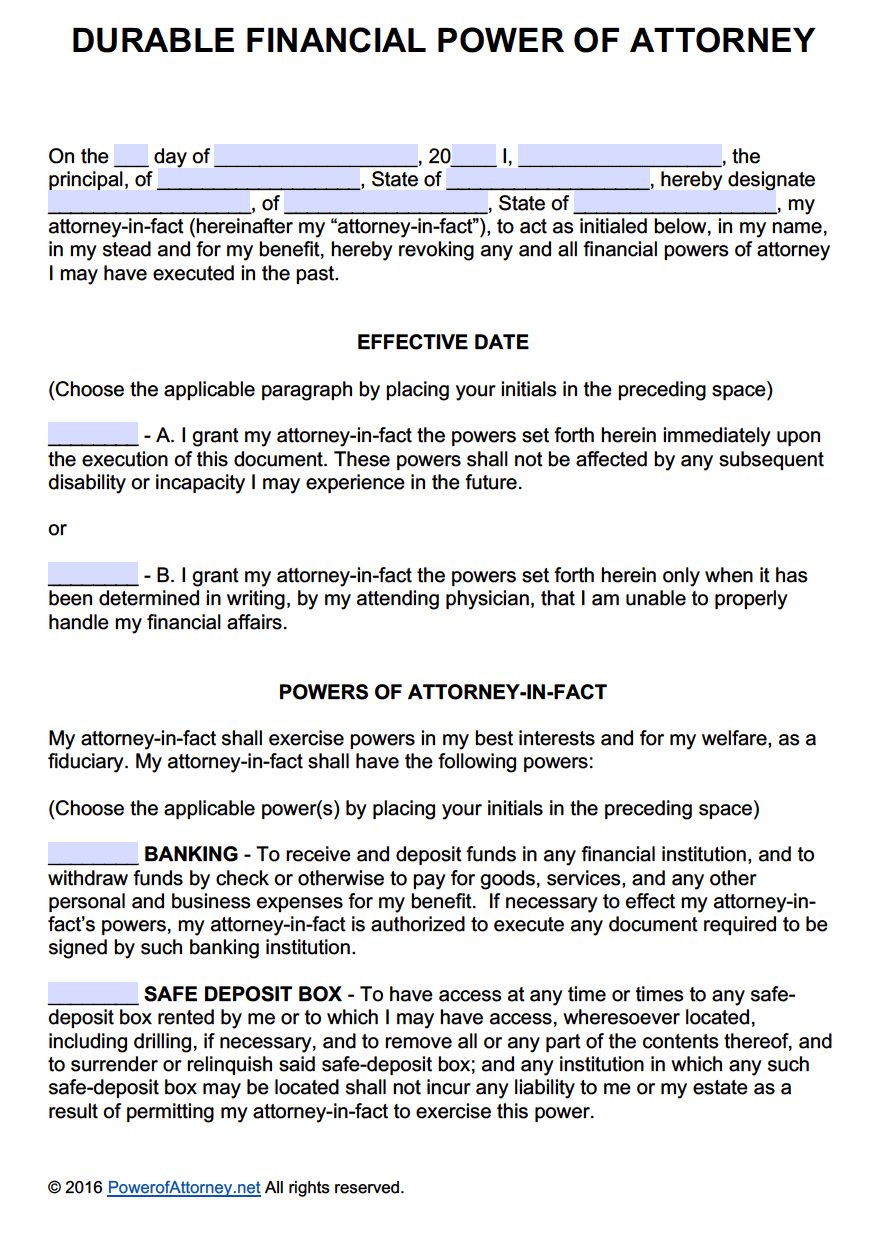

- Decide who you want to be your financial agent. ...

- Decide which financial decisions you want your agent to be able to make.

- Get a durable financial power of attorney form. ...

- Complete the form, and sign and witness it according to the laws in your state.

How can I become a financial power of attorney?

May 11, 2021 · Many states have an official financial power of attorney form. How Does a Power of Attorney for Finances Work? Once the power of attorney is executed, the original is given to your agent, who may then present it to a third party as evidence of your agent’s authority to act for you (such as withdrawing money from your bank account , or signing papers for you at a real …

Who needs a financial power of attorney?

A Financial Power of Attorney goes into effect whenever you appoint them. Often, language in the document will read as a safeguard to ensure someone is there to step in should you become incapacitated, but it could also be for a specific time period (for example, you will live abroad for 2 years, or you can’t make it to a signing for a real estate deal).

What is power of attorney for financial matters?

Making a Financial Power of Attorney To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages long. Some states have their own forms, but it's not mandatory that you use them. Some banks and brokerage companies have their own durable power of attorney forms.

What can you do with a power of attorney?

Aug 03, 2021 · Designating a power of attorney is crucial to creating a strong financial plan, but you might be surprised to learn many experts recommend that this power be named as soon as individuals turn 18 ...

When A Financial Power of Attorney Takes Effect

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of atto...

Making A Financial Power of Attorney

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages...

When A Financial Power of Attorney Ends

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your de...

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

What is a durable power of attorney?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

What happens if you don't have a power of attorney?

If you don't, in most states, it will automatically end if you later become incapacitated. Or, you can specify that the power of attorney does not go into effect unless a doctor certifies that you have become incapacitated. This is called a "springing" durable power of attorney. It allows you to keep control over your affairs unless ...

How to transfer property to a trust?

transfer property to a trust you've already created. hire someone to represent you in court, and. manage your retirement accounts. The agent is required to act in your best interests, maintain accurate records, keep your property separate from his or hers, and avoid conflicts of interest.

What do you do with your money?

buy, sell, maintain, pay taxes on, and mortgage real estate and other property. collect Social Security, Medicare, or other government benefits. invest your money in stocks, bonds, and mutual funds. handle transactions with banks and other financial institutions. buy and sell insurance policies and annuities for you.

When does a power of attorney end?

When a Financial Power of Attorney Ends. Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your death, such as paying your debts, making funeral or burial arrangements, or transferring your property to the people who inherit it.

When does a financial power of attorney take effect?

When a Financial Power of Attorney Takes Effect. A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of attorney for each other in case something happens to one of them -- or for when one spouse is out of town.) You should specify that you want your power ...

Where do you put a copy of a power of attorney?

If your agent will have authority to deal with your real estate, you must put a copy of the document on file at the local land records office. (In two states, North and South Carolina, you must record your power of attorney at the land records office for it to be durable.)

How to set up a power of attorney?

To get started, follow these basic guidelines for designating power of attorney: 1 How to set up power of attorney. 2 Consider durable power of attorney. 3 Limited vs. general power of attorney. 4 Immediately effective vs. springing power of attorney. 5 Power of attorney for health care.

What happens to a durable power of attorney?

That's where durable power of attorney comes in. A durable power of attorney continues after the individual is incapacitated. So if you are unable to make financial or medical decisions on your own after an accident or illness, the document will remain in effect.

What is a power of attorney?

Power of attorney is a written legal document that allows an agent or attorney-in-fact to take financial and legal actions for you.

When does a power of attorney go into effect?

A springing power of attorney goes into effect in a predetermined situation, such as after the principal becomes incapacitated. Typically, the legal document will specify the circumstances under which the power takes effect. An immediately effective or nonspringing power of attorney is in place once the paperwork is signed.

Can a power of attorney be used as a proxy?

Generally, power of attorney applies to legal and financial matters, but a separate document can also allow a proxy to make health care decisions for you if you are incapacitated. The rules for designating power of attorney vary from state to state, so it's important to know your own state's laws. Here's what to know about power ...

Is a power of attorney part of an estate plan?

Often, designating general power of attorney is part of a larger estate plan, so if you're visiting a lawyer to draft a will, trust or guardianship documents, you can roll this into the conversation.

Can you name a medical power of attorney?

You are generally also able to name a medical power of attorney, someone who knows your wishes and can make health care decisions for you as a proxy. This may also be called a health care proxy. "If you're unable to make decisions on your own, the health care proxy kicks in," Abelaj says.

How to make a POA?

A number of things can make a financial POA kaput: 1 The death of the principal 2 The principal choosing to revoke the power at any time 3 A court ruling it invalid 4 The principal’s agent becoming unable to fulfill their duties as financial POA (this can be avoided by naming a successor agent in the document) 5 In some states, when the principal has both 1) named their spouse as the agent, and 2) later divorced their spouse 6 And generally speaking, if the principal becomes incapacitated unless the POA is worded to say that the agent’s authority should continue anyway

What makes a POA kaput?

A number of things can make a financial POA kaput: The principal’s agent becoming unable to fulfill their duties as financial POA (this can be avoided by naming a successor agent in the document) In some states, when the principal has both 1) named their spouse as the agent, and 2) later divorced their spouse.

What is a financial POA?

Just as a medical POA only applies to medical choices someone makes for you, the financial POA extends no further than the right for someone else to make money decisions if and when you’re unavailable to do so yourself. (In case you’re wondering, you need both kinds of POA to have full protection.)

What is a financial power of attorney?

A financial power of attorney is just a document you need when you want to grant someone else the power to make money decisions for you. And it’s usually created alongside your will. This kind of POA is written specifically to let someone else act as your legal rep for financial matters. Much like other powers of attorney, ...

What is a POA in financial planning?

With a financial POA, your agent can keep everything moving smoothly with your money. Like most legal docs, the main purpose for creating a financial POA is to protect you and your family from a preventable legal battle.

Is POA effective immediately?

In general, the more closely related the agent is, the more likely you would be to choose to have the POA effective immediately. Making it immediately effective could also be a good option if you’re frequently on the road and you have lots of financial needs that require your official approval to get done.

Can a POA be tied to an incapacitating event?

Hopefully that’s not something you or your family ever have to deal with, but it’s within the realm of possibility. When a financial POA is tied to an in capacitating event, it can only happen when one or more doctors have certified that you’re in a state of being physically or mentally unable to make decisions.

What happens if a third party refuses to honor a power of attorney?

Under some circumstances, if the third party's refusal to honor the Power of Attorney causes damage, the third party may be liable for those damages and even attorney's fees and court costs. Even mere delay may cause damage and this too may subject the third party to a lawsuit for damages.

What is an attorney in fact?

An Attorney-in-Fact is looked upon as a "fiduciary" under the law. A fiduciary relationship is one of trust. If the Attorney-in-Fact violates this trust, the law may punish the Attorney-in-Fact both civilly (by ordering the payments of restitution and punishment money) and criminally (probation or jail).

Why should a power of attorney be written?

Powers of Attorney should be written clearly so that the Attorney-in-Fact and third parties know what the Attorney-in-Fact can and cannot do. If you, as Attorney-in-Fact, are unsure whether or not you are authorized to do a particular act, you should consult the attorney who prepared the document.

What is the purpose of an affidavit in Tennessee?

The purpose of the affidavit is to relieve the third party of liability for accepting an invalid Power of Attorney. In Tennessee, an affidavit that is similar to the one at the end of this Web page is acceptable to most third parties. Other states may have a different form. You may wish to consult your attorney.

What is an affidavit for power of attorney?

An affidavit is a sworn written statement. A third party may require you, as the Attorney-in-Fact, to sign an affidavit stating that you are validly exercising your duties under the Power of Attorney. If you want to use the Power of Attorney, you do need to sign the affidavit if so requested by the third party.

What is a power of attorney?

A Power of Attorney empowers an Attorney-in-Fact to do certain specified things for the Principal during the Principal's lifetime. A Living Trust also allows a person, called a "trustee," to do certain things for the maker of the trust during that person's lifetime but these powers also extend beyond death.

Can a person sign a durable power of attorney?

Yes. At the time the Durable Power of Attorney is signed, the Principal must have mental capacity. Although a Durable Power of Attorney is still valid if and when a person becomes incapacitated, the Principal must understand what he or she is signing at the moment of execution.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

What is the best document to prepare for an aging loved one?

There are two separate documents you’ll likely need as part of comprehensive planning for your aging loved one. The first is a financial POA , which provides for decisions regarding finances and for the ability to pay bills, manage accounts, and take care of investments. The second is an Advance Healthcare Directive, which is also known as a “living will” or a “power of attorney for healthcare.” This document outlines who will be an agent for healthcare decisions, as well as providing some general guidelines for healthcare decision-making.

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

Why do you need a power of attorney for an elderly parent?

Common Reasons to Seek Power of Attorney for Elderly Parents. Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations.

How to get a POA?

When you’re ready to set up the POA, follow these steps: 1 Talk to Your Parents: Discuss what they need in a POA and what their wishes are when it comes to their finances and health care. You must also confirm their consent and make sure they agree with everything discussed. 2 Talk to a Lawyer: Everyone who gets a POA has different needs and the laws are different in each state. It’s important to get legal advice so that your parent’s wishes are taken into consideration and the document is legal. 3 Create the Necessary Documentation: Write down all the clauses you need that detail how the agent can act on the principal’s behalf. This ensures your parent’s wishes are known and will be respected. Although you can find POA templates on the internet, they are generic forms that may not stand up to legal scrutiny and probably won’t have all the clauses you require. 4 Execute the Agreement: Sign and notarize the document. Requirements for notarization and witnesses differ, so make sure you check what’s required in your state.

What are the drawbacks of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if they are ignorant of the principal’s wishes, or it may be intentional because they’re acting in bad faith.

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

What to do if you are called upon to take action as someone's agent?

If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions.

How long does a power of attorney last?

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

Why do you need a power of attorney?

Another important reason to use power of attorney is to prepare for situations when you may not be able to act on your own behalf due to absence or incapacity. Such a disability may be temporary, for example, due to travel, accident, or illness, or it may be permanent.

Why is a power of attorney important?

A power of attorney allows you to choose who will act for you and defines his or her authority and its limits, if any.

What are the qualifications to be an attorney in fact?

There are no special qualifications necessary for someone to act as an attorney-in-fact except that the person must not be a minor or otherwise incapacitated. The best choice is someone you trust. Integrity, not financial acumen, is often the most important trait of a potential agent.

What is a springing power of attorney?

The power may take effect immediately, or only upon the occurrence of a future event, usually a determination that you are unable to act for yourself due to mental or physical disability. The latter is called a "springing" power of attorney.

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

Who is Mollie Moric?

Mollie Moric is a staff writer at Legal Templates. She translates complex legal concepts into easy to understand articles that empower readers in their legal pursuits. Her legal advice and analysis...

About The Power of Attorney

- A Durable Power of Attorney may be the most important of all legal documents. This legal document gives another person the right to do certain things for the maker of the Durable Power of Attorney. What those things are depends upon what the Durable Power of Attorney says. A person giving a Durable Power of Attorney can make it very broad or can li...

Powers and Duties of An Attorney-In-Fact

- What can I do as an Attorney-in-Fact? Powers of Attorney can be used for most everything but an Attorney-in-Fact can only do those acts that the Powers of Attorney specifies. Powers of Attorney should be written clearly so that the Attorney-in-Fact and third parties know what the Attorney-in-Fact can and cannot do. If you, as Attorney-in-Fact, are unsure whether or not you are authorize…

Using The Power of Attorney

- When is a Power of Attorney effective? The Power of Attorney is effective as soon as the Principal signs it, unless the Principal states that it is only to be effective upon the happening of some future event. These are called "springing" powers, because they spring into action upon a certain occurrence. The most common occurrence states that the Power of Attorney will become effect…

Financial Management and The Liability of An Attorney-In-Fact

- What is "fiduciary responsibility"? As an Attorney-in-Fact, you are fiduciary to your Principal. A "fiduciary" is a person who has the responsibility for managing the affairs of another, even if only a part of that person's affairs are being managed. A fiduciary has the responsibility to deal fairly with the Principal and to be prudent in managing the Principal’s affairs. You, as an Attorney-in-Fa…

Relationship of Power of Attorney to Other Legal Devices

- What is the difference between an Attorney-in-Fact and an executor? An Executor, sometimes referred to as a "personal representative," is the person who takes care of another's estate after that person dies. An Attorney-in-Fact can only take care of a person's affairs while they are alive. An executor is named in a person's will and can only be appointed after a court proceeding calle…

Conservators and Powers of Attorney

- What is a Conservator? Conservators (called "Guardians" in some states) are appointed by the courts for people who are no longer able to act in their own best interests. A person who has a conservator appointed by the courts may not be able to lawfully execute a Power of Attorney. If you find out that a conservator had been appointed prior to the date the Principal signed the Po…

Affidavit by Attorney-In-Fact

- State of ____________ County of ___________ Before me, the undersigned authority, personally appeared ____________ (Attorney-in-Fact) ("Affiant") who swore or affirmed: Affiant is the Attorney-in-Fact named in the Durable Power of Attorney executed by _________________ ("Principal") on ______________, 20__. To the best of Affiant’s knowledge after diligent search and inquiry: The Pri…

Popular Posts:

- 1. durable power of attorney business what is a conservator

- 2. how to give someone power of attorney in tenn

- 3. who is the district attorney catawba county nc

- 4. who is allowed to administer attorney oaths in new york state

- 5. what do you do when you dont have the money for an attorney in a custody battle

- 6. family law attorney who is seeking work in sacramento ca?

- 7. who is assistant attorney general of maine james cameron

- 8. who is the district attorney in lufkin, texas

- 9. where di i take my living will/durable power of health attorney

- 10. do sellers frequently back out of contract when under attorney review