How to establish a power of attorney in California?

Submit a power of attorney. To establish a power of attorney relationship, you must fill out and submit the correct FTB form. 1. Choose the correct form. Individuals (includes sole-proprietors), estates, and trusts: Individual or Fiduciary Power of Attorney Declaration (FTB 3520-PIT) Form. 8.

How do I file a power of attorney?

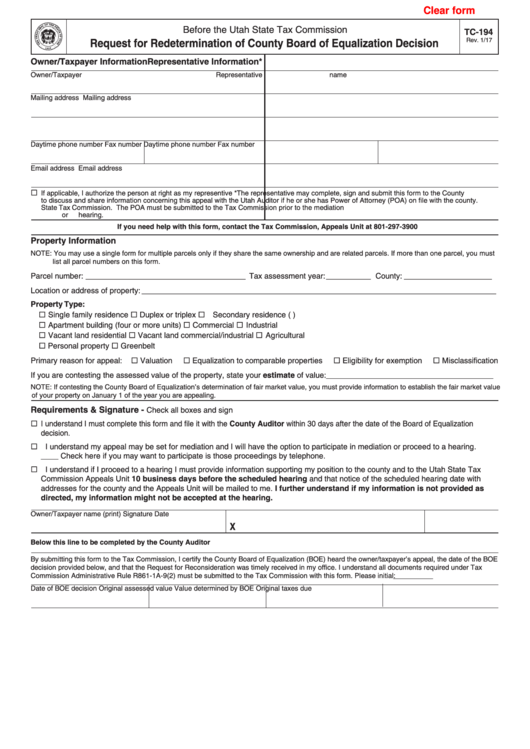

STATE OF CALIFORNIA POWER OF ATTORNEY / BOARD OF EQUALIZATION . GENERAL AUTHORIZATION . Check the appropriate Board division below. Please note that a separate form must be completed and provided to . each. Board division checked. BOARD OF EQUALIZATION BOARD OF EQUALIZATION . BOARD PROCEEDINGS DIVISION COUNTY-ASSESSED …

Who can sign a power of attorney form?

The Board of Equalization administers California's sales and use, fuel, alcohol, tobacco, and other taxes and collects fees that fund specific state programs and plays a significant role in California property tax assessment and administration. It also acts as the appellate body for corporate franchise and personal income tax appeals.

Who can sign the POA declaration?

POWER OF ATTORNEY BOARD OF EQUALIZATION FRANCHISE TAX BOARD EMPLOYMENT DEVELOPMENT DEPARTMENT. APPOINTEE NAME APPOINTEE NAME APPOINTEE BUSINESS NAME (if applicable) APPOINTEE BUSINESS NAME (if applicable) APPOINTEE ADDRESS (street and number) APPOINTEE ADDRESS (street and number) (city) (state) (zip code) (city) (state) …

Where do I send my NYS POA 1?

Fax to:518-435-8406Mail to:NYS TAX DEPARTMENT POA CENTRAL UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0864Feb 2, 2022

Where do I send my MD POA?

Filing the Power of Attorney You must file the original, a photocopy or facsimile transmission (fax) of the power of attorney with the Comptroller of Maryland, Revenue Administration Division, P.O. Box 1829, Attn: POA, Annapolis, Maryland 21404-1829.

Does a power of attorney need to be recorded in California?

Powers of attorney concerning real property must be acknowledged (notarized). There is no statutory requirement that the power of attorney be recorded with the County Recorder in the county where the real property is located.

How do I submit a POA to the IRS?

Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.Sep 2, 2021

Does a Maryland power of attorney need to be notarized?

The form requires the signatures of two witnesses. The form does not need to be notarized. Do not file this form with the court.

Do you have to file power of attorney in Maryland?

If you want an agent to make decisions regarding both finances and healthcare, you must have two separate power of attorney documents; under Maryland law, a single document that purports to grant both types is not legally valid.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How do I notarize a power of attorney in California?

Complete your journal entry (when notarizing a power of attorney document in California, Notaries are required by law to take the signer's thumbprint for the journal entry); Make a commonsense judgment that the signer is willing and aware; If an acknowledgment, have the signer acknowledge their signature.Sep 25, 2014

How do I record power of attorney in California?

A general or limited POA must be signed by the principal and two witnesses or a notary. If the POA gives your agent the right to handle real estate transactions, the document must be notarized so that it can be recorded with your county. The agent listed in the POA cannot be a witness to the document.

Can I file form 2848 online?

Secure Access Yes. If you already registered for a Secure Access account for IRS online services such as e-Services, Get Transcript or Get an Identity Protection Personal Identification Number (IP PIN), you may use the same account to log in to Submit Forms 2848 and 8821 Online.Nov 15, 2021

Can I upload documents to IRS?

Depending on the situation, the acceptable types of documentation may include copies of pay statements or check stubs. You take a picture of your documentation and the Documentation Upload Tool enables you to upload the image. And just like that, the IRS can access the data and continue working the case.Aug 26, 2021

How long does it take for the IRS to process a power of attorney?

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer. We'll send a letter to the taxpayer when we approve or deny the POA.Sep 23, 2021

Popular Posts:

- 1. how to bill attorney for depositions

- 2. attorney how to see my filings on line miami dade

- 3. who played britteny the attorney on y & r

- 4. how to file for a divorce in washington state without an attorney

- 5. who is the court appointed attorney for madison county, ms

- 6. why does a settlement attorney want to know if you are in bankruptcy

- 7. is there a limit to how many potential jurors an attorney can reject during vetting process

- 8. who is attorney that sued white county tn

- 9. how to remove a power of attorney when abuse is suspected

- 10. ethics with attorney sex when representing a femaile