How do I get a power of attorney to sign taxes?

Feb 26, 2022 · Line 7 – Taxpayer Signature: Your parent can sign the form if they are still competent and able to sign it. If not, you can sign as a power of attorney, then specify the power of attorney for [Parental Name] as the title, and then print your name and the name of your parent for whom you are signing.

How do I sign a tax return on behalf of someone?

The person signing on behalf of the taxpayer must include a copy of the power of attorney paperwork with the return. A taxpayer may give permission for somebody else, usually his tax agent, to sign a return on his behalf. While it is possible to give an agent power of attorney in dealing with tax officials, the ability to sign a return usually only applies if the taxpayer if …

Can a power of attorney represent you before the IRS?

Check the box on line 5a authorizing your representative to sign your income tax return and include the following statement on the lines provided: "This power of attorney is being filed pursuant to 26 CFR 1.6012-1(a)(5), which requires a power of attorney to be attached to a return if a return is signed by an agent by reason of [enter the specific reason listed under (a), (b), or …

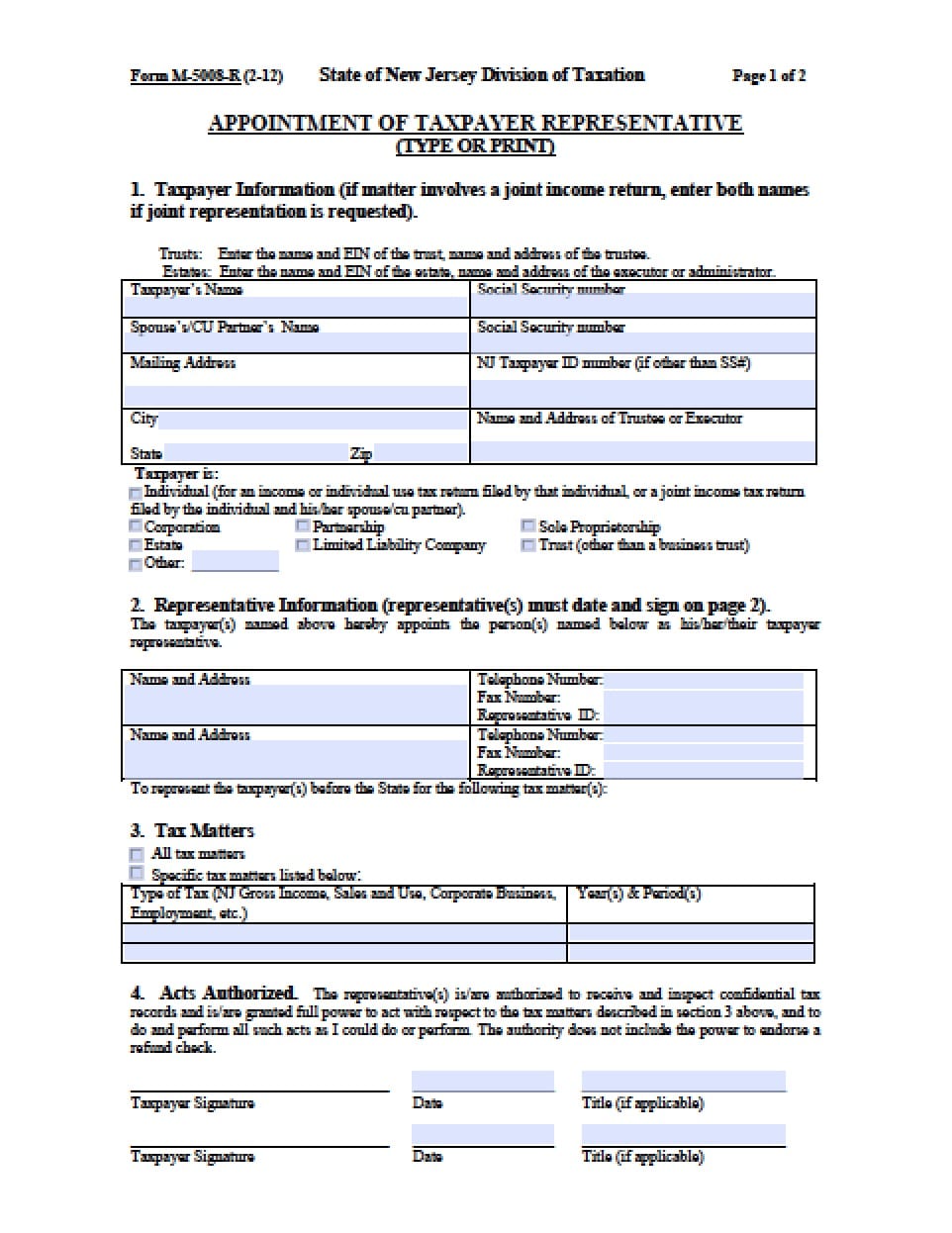

What paperwork do I need to file a power of attorney?

Jun 01, 2019 · How do I use Power of Attorney to submit a tax return for my incapacitated father? (1) For a return submitted by e-file, some people say that if the POA gives you authority to “prepare & sign” a person’s... (2) For a return submitted on paper, some people say that you can sign the return like this: ...

Does IRS accept power of attorney?

Substitute Form 2848 The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

Can POA sign IRS forms?

The representative named in a POA cannot sign an income tax return unless: The signature is permitted under the Internal Revenue Code and the related regulations (see Regs.Apr 1, 2016

Can I sign my mom's tax return?

To sign a return for a parent who no longer is competent, you'll need to be your parent's power of attorney or court-appointed conservator or guardian. Even if you have either of these designations, you can't simply sign your parent's return. You must file a Form 2848 along with your parent's Form 1040.

Who can sign income tax return?

WHO CAN VERIFY AND SIGN THE INCOME TAX RETURN ? Individual : The individual filing his Income Tax Return has to sign the return. In case the individual is mentally incapable, then the return may be signed by his Guardian or by any other person competent to act on his behalf.Sep 9, 2020

Can you sign tax return electronically?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO).Nov 4, 2021

How do I sign a tax return for someone else?

When someone can sign for you If the spouse can't sign because of injury or disease and tells the taxpayer to sign for him or her, the taxpayer can sign the spouse's name on the return followed by the words “By (your name), Husband (or Wife).” A dated statement must be attached to the return.

Who gets a deceased person's tax refund?

If a person dies being owed an income tax refund (as thousands of people do every year), what happens to the money? Obviously, the decedent cannot cash a check made out to him or her. A refund in the sole name of the decedent is an asset of the decedent's estate.Oct 9, 2020

Can a POA sign a W9?

Although only an authorized corporate officer can sign some tax forms, a W9 form is not one of them.

Do I have to sign my tax return?

When you file your individual tax return electronically, you must electronically sign the tax return with a personal identification number (PIN) using the Self-Select PIN or the Practitioner PIN method.Jan 24, 2022

Is CA sign required to file ITR?

The new personal income tax regime, with lower rates, is expected to be so simple that you will not require the help of a chartered accountant (CA) or any other professional from next year for filing of income tax return (ITR).Feb 8, 2020

Popular Posts:

- 1. what is te difference between notice of appearance of counsel and designation of attorney in charge

- 2. what do you need to become a patent attorney

- 3. how to attorney withdraw from federal case criminal

- 4. how to testify bully attorney

- 5. ace attorney who killed hammer

- 6. state of nj how do you get power of attorney

- 7. how to disbar a district attorney in nc

- 8. where do you report attorney misconduct

- 9. where is office of attorney of general in san antonio texas

- 10. who is the del norte county district attorney