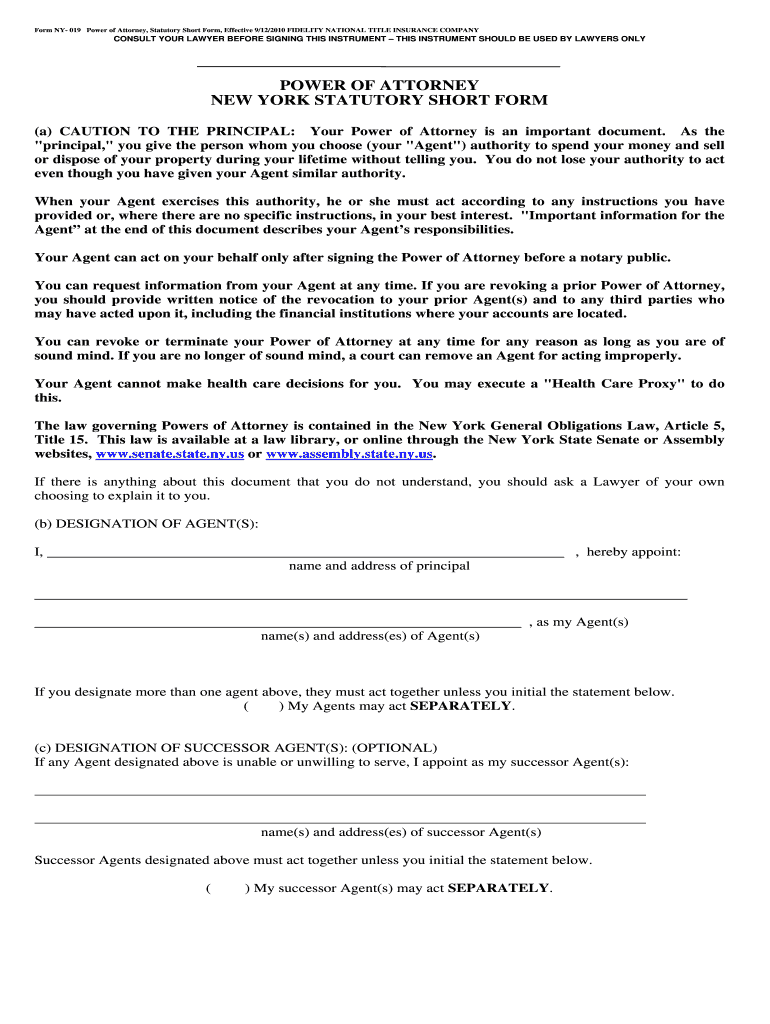

6 Steps for Signing as Power of Attorney

- Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even ...

- Determine the Preferred Signature Format. Most agencies or institutions require a specific format when signing under power of attorney. ...

- Sign as the Principal. ...

- Sign Your Own Name. ...

What is the tax form for power of attorney?

Dec 20, 2019 · The proper way to sign as power of attorney is to first write the principal’s signature. This shows that you’re acting on the principal’s behalf, and not your own. And remember to use the principal’s full legal name. If you see their name listed on any pre-existing paperwork at the institution, be sure to replicate its format.

How to remove power of attorney IRS?

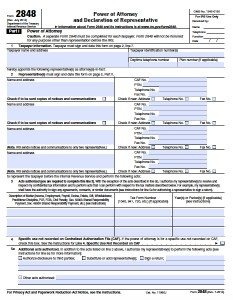

Mar 14, 2021 · To do this, you can use Form 2848. You would include a copy of the form 2848 if you are filing a paper version. If efiling, you would attach the form 2848 to the form 8453. Form 8453 has a specific box to check if you are attaching a POA indicating that the individual has authority to sign the tax return:

What is business power of attorney?

Sign Form 2848 in the following manner: “(Taxpayer name), by (attorney-in-fact name) under authority of the attached power of attorney.” The individual named as representativeon Form 2848, often the attorney-in-fact, must also sign and date Part II of the form. (Don’t forget to specifically authorize yourself to sign the tax return!)

Who must sign tax return?

Check the box on line 5a authorizing your representative to sign your income tax return and include the following statement on the lines provided: "This power of attorney is being filed pursuant to 26 CFR 1.6012-1(a)(5), which requires a power of attorney to be attached to a return if a return is signed by an agent by reason of [enter the specific reason listed under (a), (b), or (c) …

How do I sign a tax return for someone else?

When someone can sign for you If the spouse can't sign because of injury or disease and tells the taxpayer to sign for him or her, the taxpayer can sign the spouse's name on the return followed by the words “By (your name), Husband (or Wife).” A dated statement must be attached to the return.

Does the IRS recognize power of attorney?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

Can I sign my mom's tax return?

To sign a return for a parent who no longer is competent, you'll need to be your parent's power of attorney or court-appointed conservator or guardian. Even if you have either of these designations, you can't simply sign your parent's return. You must file a Form 2848 along with your parent's Form 1040.

Can I file taxes on behalf of someone else?

You can legally file a tax return for someone else The IRS says you can file a tax return for someone else as long you have their permission to do so. Here are a few important things to know before you begin offering your services to others: You can file tax returns electronically for up to five people.Aug 27, 2021

Can IRS power of attorney be signed electronically?

The process to mail or fax authorization forms to the IRS is still available. Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed.Jan 25, 2021

How long is a power of attorney Good for IRS?

After it's filed with the IRS, the representative can act as you in the eyes of the IRS. The POA stays in effect until you or your representative withdraws the authorization. After seven years, if you haven't already ended the authorization, the IRS will automatically end it.

What is the penalty for not signing a tax return?

The penalty is $50 for each failure to sign a return or refund claim when required, unless it is shown that the failure was due to reasonable cause and not willful neglect. The maximum penalty of $25,000, adjusted for inflation, is based on all documents filed during a calendar year.Feb 1, 2017

Does the IRS accept durable power of attorney?

The IRS will accept a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. But, the authorized agent will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.Jan 19, 2016

Can I call the IRS on behalf of a family member?

More In File You can grant a third party authorization to help you with federal tax matters. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization.Jul 18, 2021

Can I talk to the IRS on behalf of someone?

More In News If a taxpayer decides to call, they should know that IRS phone assistors take great care to only discuss personal information with the taxpayer or someone the taxpayer authorizes to speak on their behalf.Mar 4, 2019

Can anybody do your taxes?

Anyone can be a paid tax return preparer as long as they have an IRS Preparer Tax Identification Number (PTIN). However, tax return preparers have differing levels of skills, education and expertise. Learn about tax preparer credentials and qualifications.Jan 21, 2022

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

Who is Diana's representative on W-2?

Diana authorizes John to represent her in connection with her Forms 941 and W-2 for 2018. John is authorized to represent her in connection with the penalty for failure to file Forms W-2 that the revenue agent is proposing for 2018.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

What is an oral disclosure?

Oral Disclosure. If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

What is the power of attorney for tax returns?

The rules relating to power of attorney with regard to tax returns are contained within Title 26 of the Code of Federal Regulations. The specific section is 1.6012-1 (a) (5). The IRS explains how those regulations work in Publication 947, which discusses the roles of tax agents both in signing tax returns and representing clients in dealings with tax officials.

What is a power of attorney?

As a general legal principle, a power of attorney is a document signed by an individual which gives somebody else the ability to act on his behalf in a legal context. The person given the ability is referred to as having "power of attorney.". Despite the name, this person does not have to be a qualified lawyer.

Can a spouse sign a joint return without a power of attorney?

Joint Returns. In the event of a couple making a joint return, one spouse is allowed to sign on behalf of the other, without the need for a formal power of attorney. This only applies in cases of disease and illness.

What is a POA on a tax return?

Form 8453 has a specific box to check if you are attaching a POA indicating that the individual has authority to sign the tax return: Form 2848, Power of Attorney and Declaration of Representative (or POA that states the agent is granted authority to sign the return)

When is a power of attorney terminated?

A power of attorney is generally terminated if you become incapacitated or in- competent. The power of attorney can continue, however, in the case of your incapacity or incompetency if you authorize this on line 5a “Other acts authorized” of the Form 2848. Does this mean I should also add words like these to Line 5a:

What is Form 2848?

Form 2848 is the IRS’s own version of a POA. Form 8453 is needed whenever mailing a paper document related to an e-filed return. Of course, I would prefer to use Method (1).

How long do you have to file 1040?

3) Complete line 3; income, 1040, 2018-2020. You are allowed prospective years but I don't recommend more than 3 years.

What is EPTA form?

EPTA uses the practice of securing a form which provides written authorization from the employer that often designates specific personnel other then employees acting within the scope of their employment to: 1. furnish records and information; 2. discuss matters during preliminary stages; and 3. receive and/or negotiate proposed adjustments. The letter is on official corporate letterhead and signed by an officer of the corporation. It has been determined that the form is similar to Form 8821 and all of its attendant restrictions. In other words, the use of this form should be restricted to allow a third party to inspect or receive confidential information examined or generated during the course of the examination. Since the use of the authorization form is limited, it is necessary, therefore, to obtain a properly completed Form 2848 to address adjustments and issues pursuant to the guidance in this memo.

Who can be named as a representative on Form 2848?

Only individuals may be named as a Representative on Form 2848. Individuals, corporations, firms, organizations or Partnerships can be named as an Appointee on Form 8821. Each form should contain the full nine digit CAF number. If the individual designated as Representative or Appointee does not have a CAF number the Form 2848 or Form 8821 should reflect a response of “None”. All other information must be fully completed and the form should be faxed, by EP Examinations, to the appropriate Service Center before the examination is completed.

What is the 5500 exam?

There are three taxpayers in a Form 5500 examination—the sponsoring employer, the trust, and the plan participants or their beneficiaries. The instructions for both the Form 2848 and Form 8821 require that, for purposes of conducting a 5500 examination, Item 1 (Taxpayer Information) contain the plan name and number (if applicable) and the plan sponsor name, address and EIN. The plan and trust are two separate legal entities. The trust is an “accumulation of assets held in the name of the plan participants”. It is quite clear that unless the employer is also the trustee, it’s possible that a second POA will be necessary. This scenario applies equally to multiemployer and multiple employer plans which also have a plan sponsor and trust.

Popular Posts:

- 1. how to be an attorney with the aclu

- 2. how a criminal attorney will help me win my fraud case

- 3. who plays attorney on luke cage

- 4. who was the us attorney general in 2002

- 5. how can i get a divorce attorney in washington state without any money

- 6. what remedy for attorney general who refuses subpoena

- 7. how do you know if appellee is being represented by attorney in an appeal

- 8. who plays the attorney on lucifer season 3 episode 1

- 9. who is assistant attorney general in connecticut

- 10. what should i do if my attorney does not communicate with me