Is a power of attorney created in WA State Vali?

The state of Washington allows individuals to grant authority to others through a power of attorney. This document authorizes an agent or agents to act on behalf of a principal. A “general” power of attorney gives broad scope to these actions, so such a document should be carefully drawn up and offered only to someone you trust.

Does power of attorney have to be notarized in WA?

Does my durable power of attorney document have to be notarized? The law does not require notarization. But, it’s a good idea to have your durable power of attorney for finances notarized because some banks and government agencies require it. Do I also need to get a legal guardian? No .

What is power of attorney and how does it work?

A power of attorney allows a person you appoint -- your "attorney-in-fact" or agent -- to act in your place for financial or other purposes when and if you ever become incapacitated or if you can't act on your own behalf. The power of attorney document specifies what powers the agent has, which may include the power to open bank accounts ...

What can I do with a power of attorney?

Use this LPA to give an attorney the power to make decisions about things like:

- your daily routine, for example washing, dressing, eating

- medical care

- moving into a care home

- life-sustaining treatment

What is a Power of Attorney?

Under Washington State law, a Power of Attorney allows you to choose a person to make medical and/or financial decisions on your behalf either while you still have capacity or later, in the event that you lose capacity.

What are the Washington Power of Attorney Requirements?

In 2017, Washington State revised its Power of Attorney requirements to clear up ambiguities in the prior law and to better protect residents from abuse by the designated agent. The requirements for a valid Power of Attorney are:

Washington State Power of Attorney Laws

The Washington Uniform Power of Attorney Act, RCW 11.125 became effective on January 1, 2017. Its goal is to eliminate ambiguity and to provide safeguards from possible abuse by agents.

Who Needs a Power of Attorney

A Power of Attorney is an essential aspect of estate planning, and along with a will, or trust and a healthcare directive, can make the decision-making process easier for your family.

Contact Evergreen Elder Law Today

Evergreen Elder Law is committed to helping you create comprehensive legal and financial security for you and your loved ones. Serving the Spokane, Tri Cities, and Coeur d’Alene regions, we have the knowledge, compassion, and professionalism to guide you in planning for the future, giving you peace of mind for your future.

What Are Washington State Power of Attorney Requirements?

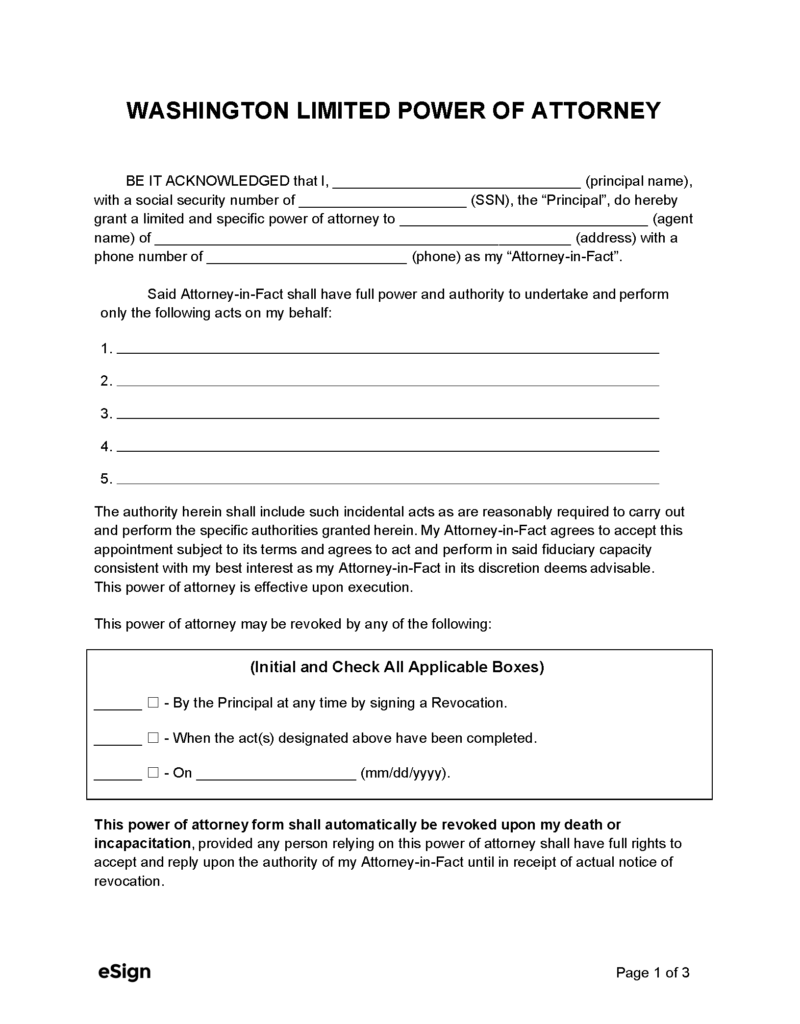

A power of attorney in Washington has to meet the requirements of a Washington Uniform Power of Attorney Act. The document must contain the following information:

How To Get a Power of Attorney in Washington State

Creating a power of attorney is not easy since you must ensure that the document:

Create a Durable Power of Attorney in Washington State With DoNotPay

Creating a durable power of attorney is a huge responsibility, but that doesn’t mean it has to be an expensive and complicated process.

Good Things Come in Small Packages

Siri and Google Assistant are great in their own right, but their skills leave a lot to be desired when it comes to the practicalities of our daily lives. DoNotPay is an app, a true pocket-sized assistant that has the power and the know-how to help you deal with navigating bureaucracy and fighting for your rights efficiently.

From Government Tests Preparation to Copyright Protection

Whether you are getting ready for your driving test or wish to protect your creative work, DoNotPay has something in store for you.

How to get a power of attorney in Washington?

How to Get Power of Attorney in Washington. To set up a power of attorney, both the agent and principal fill out and sign a power of attorney form. The form needs to meet the requirements in the Washington Uniform Power of Attorney Act. In Washington state, powers of attorney are not presumed durable. This means the agent’s powers will terminate ...

What information is needed for a power of attorney in Washington State?

Powers of attorney created in Washington state must contain the following information: The name and address of the principal and agent (s) What powers are granted to the agent. Any specific limitations on the agent’s powers. When the agent’s powers begin and end. The date of execution.

What is a real estate power of attorney?

A real estate power of attorney differs from other types of powers of attorney in that it allows the agent specified to act on the principal’s behalf only on matters related to real estate or property.

What is a POA?

Updated December 15, 2020. Power of attorney (POA) is the legal authority to make financial, business, or medical decisions on behalf of another person. It’s also the name of the document that gives this authority. The person assigning power of attorney is the “principal” and the person chosen to make decisions is the “agent.”.

Can you use a power of attorney for a minor in Washington?

If you need to assign temporary parental responsibility for a minor child to an agent, you may do so using a Washington limited power of attorney for a minor child.

Is a POA durable in Washington?

In Washington state, powers of attorney are not presumed durable. This means the agent’s powers will terminate if the principal becomes incapacitated unless the POA form includes language stating that the agent’s powers are not affected by the principal’s subsequent disability or incapacitation.

What is a power of attorney for a minor in Washington?

The Washington guardianship of minor child power of attorney form allows for a minor child to have a guardian in the event of a medical emergency or other circumstance where the parent (s) are not available to make decisions. The chosen guardian will have permission to arrange for transportation to medical facilities, ...

What is a limited power of attorney in Washington?

The Washington limited power of attorney form is used to select a representative to execute a specific financial act on behalf of the principal (individual creating the power of attorney).

What is durable power in Washington?

Under Washington law 11.125.040, the Principal may choose to have the form made durable, which means that the agent may continue to act even if the principal should become incapacitated.

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

Types of Power of Attorney in Washington

There’s more than one type of Power of Attorney in Washington and selecting the correct variant can be critical. Each kind offers different types of powers to an Attorney-in-Fact (also known as an Agent ). Therefore, you must create the right class of document, in order for your POA to work as intended.

How to Get a Power of Attorney in Washington

A Washington Power of Attorney can be filled-in fully online with our step-by-step form completion survey. All you need to do is answer the questions and add in your own information to create a fully complete POA tailored to your necessities.

Washington Power of Attorney Requirements

In order to make sure your POA is fully valid upon completion and signing, you must make sure that you follow the right steps to prepare your WA Power of Attorney document before successfully putting it into action.

Washington Power of Attorney Sample

Before starting your own Washington Power of Attorney, it can help to look over an example document to understand how your final draft will look and what it will say. Simply view our POA sample now to get a feel for how these documents are written and appear once completed.

FAQs About Washington Power of Attorney Forms

It is important to have a good understanding of what Washington Power of Attorney forms can do before filling in your own. Read through our FAQs below to get a better idea of the key information needed as well as any other special considerations.

What is a power of attorney in Washington?

Washington power of attorney forms lets a person select an agent to act as their representative to act in their place. The person giving authority (“principal”) will need to choose which forms to complete depending upon the powers being given. The most common being the durable financial and health care forms which allow an agent to handle all ...

What is a durable power of attorney?

Durable (Financial) Power of Attorney – This type is generally used for long term estate planning as it remains in effect even if you become incapacitated. It allows you to grant general financial powers to another.

Do you need to sign a power of attorney in Washington?

Signing Requirement: No legal signing requirement; however, it is recommended that the document is notarized. Tax Power of Attorney Form – The State of Washington recognizes the Federal Tax Form 2848 for all power of attorney tax purposes. Signing Requirement: Agent (s) only.

What happens if you lose power of attorney?

If you lose capacity to make decisions about your property and finances and you have not made an Enduring Power of Attorney, there may be no one with the legal authority to manage your financial affairs.

What does it mean when an attorney loses capacity?

But it means if you want your attorney to be able to start doing certain financial tasks for you, they will have the legal authority to do so, under your guidance. Then if you lose capacity in the future, your attorney will be able to step in and start making these decisions for you.

What is the purpose of a public trustee as an attorney?

Appointing the Public Trustee as your attorney, using an Enduring Power of Attorney, gives you peace of mind that your financial and legal affairs are being handled with proven experience and sound judgement.

What to do if you lose capacity?

If you have lost capacity and someone is concerned that your attorney is acting inappropriately with your finances, they should make an application to the Tribunal, who has the power to intervene to stop any abuse of an EPA.

Can an EPA come into effect immediately?

While an EPA which is made to come into effect immediately means an attorney can start making decisions even if the person has capacity, but may be physically unable to manage their finances , an administration order does not work this way.

Does an EPA give an attorney the authority to make personal decisions?

An EPA does not give an attorney the authority to make personal and lifestyle decisions, including decisions about treatment and medical research. The authority of the attorney is limited to decisions about property and financial affairs. If you want to give authority to a person/s to make personal, lifestyle, treatment ...

Who can prepare an EPA?

Alternatively, a solicitor or the Public Trustee may prepare an EPA for you. The Public Trustee will only prepare an EPA if: you appoint the Public Trustee as the sole attorney under an immediate EPA (conditions apply); or.

What is a durable power of attorney?

A durable power of attorney allows you to choose someone to handle your medical and financial needs. It remains valid and in effect, if you become incapacitated and ends when you die or otherwise end the POA. There are two types of durable power of attorneys.

Can you choose a person to handle a durable power of attorney?

You can choose a person (known as your agent) to handle both the durable power of attorney for healthcare and the durable power of attorney for finances. You may also choose different agents for each as long as they can work together (separate adult children for example).

Popular Posts:

- 1. what do i do of my attorney does a loisy job

- 2. what is a nolo attorney

- 3. what is a bar license for attorney

- 4. what types of cases does a district attorney try

- 5. how to send power of attorney to india

- 6. how to avoid common problems with an entertainment attorney

- 7. what is the role of a state’s attorney general?

- 8. who pays attorney fees in a divoorce va

- 9. who won staten island district attorney?

- 10. louisiana how to collect support judgment and attorney fees granted