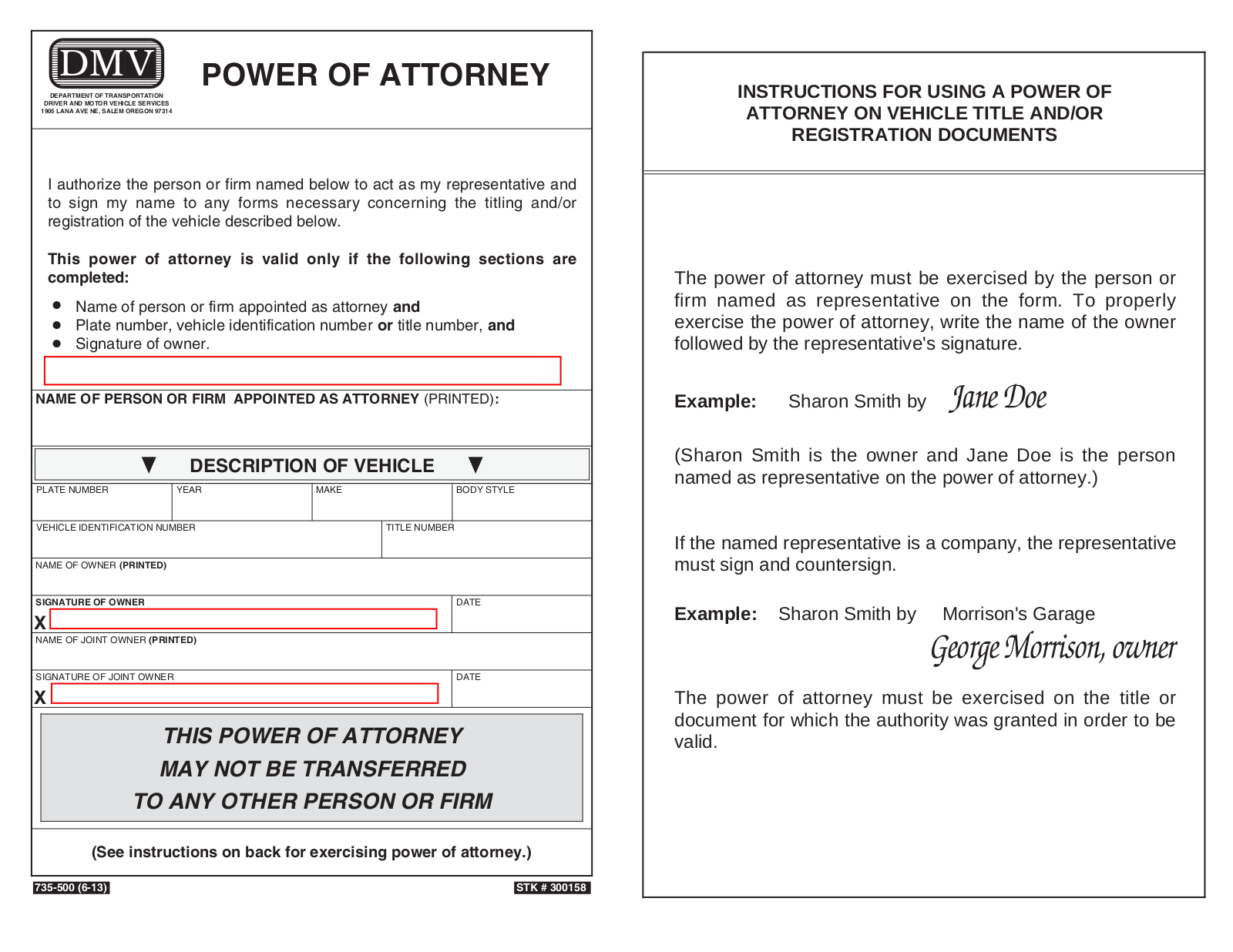

Sign your name below the principal’s name. Simply add the word “by” in front of your name to indicate you’re signing as POA on the principal’s behalf. Below your own name is where you make it clear that you have the authority to sign on the principal’s behalf.

How to become power of attorney?

Steps for Making a Financial Power of Attorney in Wisconsin 1. Create the POA Using a Statutory Form, Software, or Attorney. Wisconsin offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your POA.

How to get power of attorney in Wisconsin?

How To apply Sign Wisconsin Legal Limited Power Of Attorney. Check out signNow online tools for document management. Create custom templates, edit, fill them out and send to your customers. Speed up your business workflow.

What should we know about power of attorney?

Jan 25, 2022 · Family estate planning in Wisconsin (UW Extension) Look for the "View Publication" link to read online for free. WI Statutes: ch. 155 "Power of Attorney for Health Care" Parental. Power of Attorney Delegating Parental Power (Marathon Register in Probate) WI Statutes: s. 48.979 "Delegation of power by parent" (Parental Power of Attorney)

How to obtain power of attorney?

Wisconsin Power of Attorney for Finances and Property Page 4 F-00036 (Rev. 08/2016) RELIANCE ON THIS POWER OF ATTORNEY FOR FINANCES AND PROPERTY. Any person, including my agent, may rely upon the validity of this power of attorney or a copy of it unless that person knows that the power of attorney has been terminated or is invalid.

How do you activate Power of Attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.Apr 16, 2021

Does a Wisconsin PoA need to be witnessed?

If your agent(s) will manage real estate transactions, the Power of Attorney will need to be acknowledged by a notary public and recorded with the county. As a general principle, witnesses should be at least 18 years old, and none of them should also be designated as your PoA agent.

Who can sign a PoA form?

Someone needs to witness each attorney and each replacement attorney signing the power of attorney form. Here are the rules on who can witness a lasting power of attorney this time: The witness must be over 18. The same witness can watch all attorneys and replacements sign.

How do I activate my Power of Attorney for health care in Wisconsin?

To be legally effective in Wisconsin, a power of attorney for health care must be:Executed by one who is at least 18 years old and of sound mind;In writing;Signed;Dated;Witnessed by two people;Voluntarily executed;Triggered by a finding of incapacity by two physicians; and.More items...•Apr 11, 2019

What is Durable Power of Attorney in Wisconsin?

The Durable Power of Attorney is a signed and notarized document by which one person, the principal, gives another person, an agent, authority to act on the principal's behalf.

Can I do power of attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

What is the difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Jan 13, 2022

What happens if you don't have a durable power of attorney?

If you cannot manage your own affairs someone else must. A Durable Power of Attorney allows your agent to act even if you become incapacitated or incompetent. If you do not have a Durable Power of Attorney and you become incompetent, it may be necessary for your family to ask the court to appoint a guardian for you.

What does "incapacity" mean in medical terms?

on the occurrence of a specific event, for example, when two physicians have decided that the principal has regained the ability to act for himself or herself; when the principal becomes incapacitated, if the power does not state that it is durable (continues into incapacity);

Can you borrow money from a power of attorney?

No , unless the Power of Attorney specifically allows you to use any of the property for your own benefit. For example, unless the document specifically says so, you may not borrow money from the principal even if you are paying it back at the same or a higher interest rate you would pay a bank. Also, you should not sell any of the principal's property to yourself, your friends, or your relatives even at a fair price unless the Power of Attorney makes it clear that you can.

Can I give money to a principal?

No, unless the Power of Attorney specifically says that you can make donations or gifts. You are to use the money for the principal's benefit, and such donations and gifts are not considered to be for the principal's benefit. If, however, the document authorizes gifting or donating, you may make gifts or donations of the principal's property, but only as specified in the document. For example, the document may list certain family members or charities. It may permit gifting or donations only in amounts consistent with past giving, or only if the gifts or donations don't cause tax consequences or jeopardize eligibility for public benefits. Again, read the document carefully. Even with such a provision, however, you must still be mindful of your fiduciary responsibility. The principal's needs come first. Obtain a lawyer's advice if you have questions about a gifting power or its provisions.

Can you use the principal's money to reimburse yourself?

Unless the Power of Attorney prohibits it, you may use the principal's money to reimburse yourself for reasonable and necessary out-of-pocket expenses that you have incurred in acting as agent for the principal's benefit.

Should I be an agent?

Yes. You should get the help you need to carry out your duties as agent. For instance, if you are managing many assets, you should get investment advice or even make arrangements with a trust company to manage the investments through a custodial account. The reasonable costs of these services are expenses that should be paid from the principal's assets.

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

Who is Mollie Moric?

Mollie Moric is a staff writer at Legal Templates. She translates complex legal concepts into easy to understand articles that empower readers in their legal pursuits. Her legal advice and analysis...

What is a durable power of attorney in Wisconsin?

The Wisconsin durable power of attorney form grants an agent the authority to represent another individual and make financial decisions on their behalf. The individual executing the power of attorney is known as the “principal,” and the person they select as their financial representative is called an “attorney-in-fact” or “agent.”.

How long does a power of attorney last in Wisconsin?

The agreement will endure no longer than one (1) year, after which a secondary power of attorney document must…

What is a Wisconsin revocation power of attorney?

The Wisconsin revocation power of attorney form cancels a valid financial or medical power of attorney document. The process begins with filling out the desired revocation document; the financial and medical power of attorney forms have their own unique revocation documents, both of which are available below. After the document has been authorized, the agent should be notified of the cancellation, and all institutions that…

Popular Posts:

- 1. who is queens ny district attorney

- 2. how to get power of attorney already incapacitated ehow

- 3. why does my injury attorney need power of attorney for medical recorcs

- 4. who can hold power of attorney in az pharmacy

- 5. how to find an attorney bar number ca

- 6. why does a states attorney have a badge

- 7. how to endorse a check with multiple payees in case of attorney

- 8. who was state's attorney in peoria illinois be for jerry brady

- 9. how to remove attorney general from office

- 10. how to apply for medical power of attorney