Steps for Making a Financial Power of Attorney in Oregon

- Create the POA Using a Form, Software or an Attorney. Some private companies offer forms or templates with blanks that you can fill out to create your POA.

- Sign the POA in the Presence of a Notary Public. As mentioned above, you should have your POA notarized.

- Store the Original POA in a Safe Place. ...

- Give a Copy to Your Agent or Attorney-in-Fact. ...

- Create the POA Using a Form, Software or an Attorney. ...

- Sign the POA in the Presence of a Notary Public. ...

- Store the Original POA in a Safe Place. ...

- Give a Copy to Your Agent or Attorney-in-Fact. ...

- File a Copy With the Recorder's Office.

How to get a power of attorney in Oregon?

Rule Rule 459-050-0310 Power of Attorney

- (1) Definitions. “Power of Attorney Document” means a written document expressly granting legal authority to another named individual (s) or agent (s) to act on behalf of and to manage ...

- (2) Designation of Power of Attorney. ...

- (3) Effective Date of Power of Attorney. ...

- (4) Revocation of Power of Attorney. ...

- (5) Permissible Actions Under A Power of Attorney. ...

Does Oregon require a durable power of attorney?

In Oregon, a power of attorney is presumed to be durable unless it’s specified to be non-durable on the form. To complete the paperwork, the agent and the principal sign and date the durable power of attorney form. 3. Storing and Using Your Form in Oregon

Who should get a power of attorney?

A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own or merely needs help with such tasks.

How to become power of attorney?

Part 2 Part 2 of 3: Obtaining Power of Attorney

- Check your state's requirements. Requirements for power of attorney are similar in most states, but some have special forms.

- Download or write a power of attorney form. In most states, power of attorney forms don't have to be government-written legal documents.

- Check your document for clarity. ...

- Gather witnesses. ...

Does a power of attorney in Oregon need to be notarized?

Sign your power of attorney document Unlike many states, Oregon does not require you to use witnesses or use a notary public. However, you should sign and date your power of attorney and ask a notary public to notarize it.

Does a power of attorney have to be recorded in Oregon?

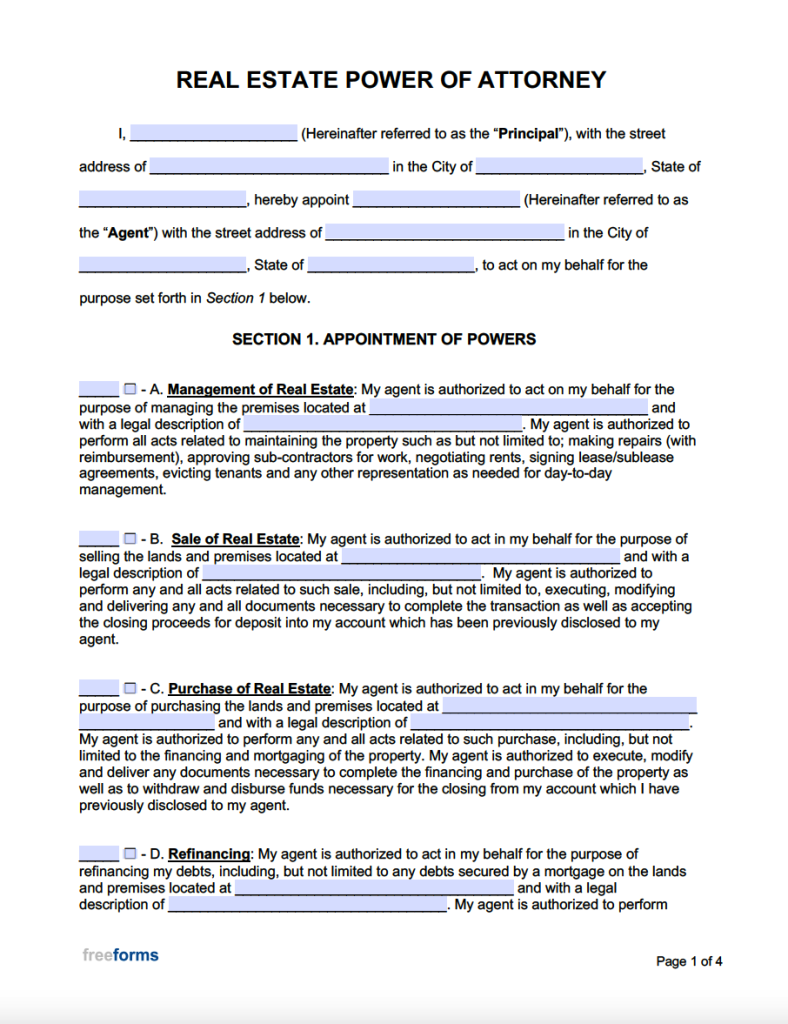

If your agent will engage in real estate transactions, the Power of Attorney must be signed before a notary public and recorded or filed with the county.

Does the agent for POA need to sign it?

In most states, an attorney-in-fact (or agent) does not have to sign a power of attorney to act under it. The exceptions to this rule are: California.

What is needed for power of attorney in Oregon?

Many people expect that a spouse or other family member automatically has the power to help with financial matters; but this is not true. Under Oregon law, someone must have special authority to act for another person. You accomplish this through a written document authorizing another person to act on your behalf.

Can a power of attorney transfer money to themselves?

Can a Power of Attorney Transfer Money to Themselves? No — not without good reason and express authorization. While power of attorney documents can allow for such transfers, generally speaking, a person with power of attorney is restricted from giving money to themselves.

What can I do with power of attorney?

A power of attorney gives the attorney the legal authority to deal with third parties such as banks or the local council. Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor.

How do you sign on behalf of someone?

The letters "p.p." before your signature on behalf of your brother indicate that the signature is under procuration (that is, on behalf of another with permission). You may type or handwrite the letters just to the left of your signature to indicate that you are signing under procuration.

How should a power of attorney sign a check?

After the principal's name, write “by” and then sign your own name. Under or after the signature line, indicate your status as POA by including any of the following identifiers: “as POA,” “as Agent,” “as Attorney-in-Fact” or “as Power of Attorney.”

How do I legally sign for someone else?

The proper way to sign as an agent is to first sign the principal's full legal name, then write the word “by,” and then sign your name. You may also want to show that you are signing as an agent by writing after the signature: Agent, Attorney in Fact, Power of Attorney, or POA.

What is a durable power of attorney in Oregon?

Updated January 03, 2022. An Oregon durable power of attorney form lets an individual, the “principal,” choose another person to handle their financial affairs on their behalf. The person selected, the “agent”, should be a trusted person and is required to make all decisions to the benefit of the principal.

How do I get a medical power of attorney in Oregon?

How to Fill in a Medical Power of Attorney in OregonStep 1: Choose an Agent. Your agent, also called your health care representative, is responsible for your medical decisions if you can't communicate. ... Step 2: Specify what healthcare decisions your agent can make. ... Step 3: Sign the form.

How do I fill out a durable financial power of attorney in Oregon?

Follow these steps to easily complete our blank durable power of attorney form for Oregon:Step 1: Designate an Agent. ... Step 2: Grant Authority. ... Step 3: Ensure Your Form is Durable. ... Step 4: Sign and Date the Form. ... Signing on Behalf of the Principal. ... Revoking a Durable Power of Attorney in Oregon.

How to sign a power of attorney?

To sign as a power of attorney, start by signing the principal's full legal name. If you're dealing with a financial account, sign their name the same way it's listed on the account. Next, write the word "by" on the line below the principal's name and sign your own name.

What does POA mean?

When someone gives you power of attorney (POA) in the United States, it means you have the authority to access their financial accounts and sign financial or legal documents on their behalf. POA is given using a legal POA document that has been drafted and executed according to your state's law.

What does it mean to be an attorney in fact?

When the document goes into effect, you become that person's attorney in fact, which means you act as their agent. Generally, to sign documents in this capacity, you will sign the principal's name first, then your name with the designation "attorney in fact" or "power of attorney.". Steps.

What happens if you don't check a POA?

This means if you don't check anything, the agent won't have any powers.

What to put after principal name?

Following your name, you need to add a word or phrase that shows how you have the power to legally sign the principal's name for them. Without this, your signature won't be binding. Typically you'll use the phrase "attorney in fact" or "power of attorney.". For example: "Sally Sunshine, by Molly Moon, attorney in fact.".

When does a POA go into effect?

Your POA agreement should specify exactly when the POA will go into effect, how long it will last, and what duties and powers the agent has under the agreement. Some POA agreements go into effect when signed, while others are designed to go into effect only when a specified event happens.

Who can help with POA?

An attorney who specializes in trusts and estates can assist you if you need a POA for reasons not covered in the basic form. For example, in many states a basic POA document won't allow the agent to act on the principal's behalf in real estate transactions.

What is a power of attorney?

A power of attorney is a legal document that gives someone the authority to sign documents and conduct transactions on another person’s behalf. A person who holds a power of attorney is sometimes called an attorney-in-fact.

When to bring a power of attorney?

Always bring your power of attorney document with you when you transact business on someone else’s behalf and make sure the people you do business with know that you are acting under a power of attorney.

What does it mean when you sign a document as an attorney in fact?

When you sign a document as someone’s attorney-in-fact, your signature needs to make it clear that you—not they—are signing the document and that you are acting under the authority of a power of attorney. To understand how this works, let’s suppose your name is Jill Jones and you have power of attorney to act for your friend, Sam Smith.

What is a person who holds a power of attorney called?

A person who holds a power of attorney is sometimes called an attorney-in-fact. Many people sign a financial power of attorney, known as a durable power of attorney, to give a friend or family member the power to conduct financial transactions for them if they become incapacitated. People also commonly sign health care powers ...

What happens if you sign a document in your own name?

If you sign a document in your own name without indicating that you are acting under a power of attorney, you could be held personally responsible for the transaction. If you sign only the principal’s name, you could face criminal or civil penalties for fraud or forgery.

Why do people sign powers of attorney?

People also commonly sign health care powers of attorney to give someone else the authority to make medical decisions if they are unable to do so. Powers of attorney have other uses as well.

Who is a fiduciary under a power of attorney?

A person who acts under a power of attorney is a fiduciary. A fiduciary is someone who is responsible for managing some or all of another person’s affairs. The fiduciary has a duty to act prudently and in a way that is fair to the person whose affairs he or she is managing. An attorney-in-fact who violates those duties can face criminal charges ...

What is a limited power of attorney in Oregon?

An Oregon limited power of attorney form is executed for the purposes of completing one or a number of specific financial transactions or negotiations. When this document is signed by the principal, they acknowledge that their appointed attorney-in-fact is authorized to represent them in all matters pertaining to the task (s) assigned in the power of attorney document. A limited power of attorney is useful for…

What is durable power of attorney?

The Oregon durable power of attorney form appoints an attorney-in-fact to manage one’s financial affairs, personal and/or business-related. The appointed individual needn’t be an accredited attorney, they just need to be somebody that the principal (executor of document) trusts completely with important matters, such as asset management, property negotiations, banking transactions, etc. Once this form is executed, the principal can only revoke it when they…

Why do attorneys in fact work for minors?

Most often, an attorney-in-fact is assigned to care for a minor because the parent is required to travel due to reasons such as work, military deployment, or family commitments. The duration of the contract must be limited to a period no greater than six (6) months,…. 2,390 Downloads. Email PDF. Download PDF.

Can a principal execute a POA?

In some cases, a principal may wish to execute a document that allows an attorney-in-fact to gain (or maintain) control over financial or medical decisions (durable and medical POA, respectively) should they become disabled or incapacitated in any way.

Popular Posts:

- 1. how long do you have to cancel a contract with an attorney if no fees have been paid yet

- 2. what members of a business are covered by attorney client privilege? registered agent?

- 3. who was obama's attorney general in his second term

- 4. who was the first woman to serve as attorney general

- 5. what does order of court awarding fees to best interest attorney mean

- 6. how soon will my attorney file my divorce papers with the district courts

- 7. darreen fields attorney in what states

- 8. attorney general what they do?

- 9. how to stay foreclosure without an attorney

- 10. how are days after attorney review counting nj