The procedure for establishing power of attorney starts by getting the required forms from a local lawyer’s office, filling them out, having them notarized, and then making copies of the agreement for your records.

How do I file taxes with a power of attorney?

Jul 18, 2021 · Power of Attorney must be authorized with your signature. Here’s how to do it: Authorize in your online account - Certain tax professionals can submit a Power of Attorney authorization request to your online account. There you can review, electronically sign and manage authorizations.

How do I establish power of attorney?

How to Set Up Power of Attorney. The first step to setting up power of attorney is deciding who should receive that designation and the responsibility that comes with …

Can a power of attorney represent you before the IRS?

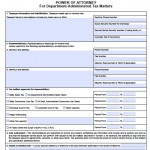

If you choose to have someone represent you, your representative must be an individual authorized to practice before the IRS. Submit a power of attorney if you want to authorize an individual to represent you before the IRS. You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the …

What can I do with a power of attorney?

Jul 16, 2021 · Setting Up a Power of Attorney For an Elderly Parent . It’s important to understand the basics of a power of attorney before you set one up. Read this guide carefully and look for other information from trusted sources such as government departments. Many states have elder law specialists available to give free or low-cost advice to seniors.

How do I submit power of attorney to IRS?

Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.Sep 2, 2021

Can tax returns be signed by POA?

The representative named in a POA cannot sign an income tax return unless: The signature is permitted under the Internal Revenue Code and the related regulations (see Regs.Apr 1, 2016

How long does it take the IRS to process a power of attorney?

During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

Can Form 2848 be filed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

What is a 2848 tax form?

Use Form 2848 to authorize an individual to represent you before the IRS. ... You can file Form 2848, Power of Attorney and Declaration of Representative, if the IRS begins a Foreign Bank and Financial Accounts (FBAR) examination as a result of an income tax examination.Mar 8, 2021

How do I file taxes for someone else on TurboTax?

Can I file taxes for another person?Sign out of TurboTax Online.Select the TurboTax Online product you want to use for the second return and proceed.On the Create your account screen, set up a new login for the second return. ... After you've created the new account, you can start working on the second return.Jun 6, 2019

How do you get a CAF number?

Centralized Authorization File Number You can get a CAF number by submitting Form 2848 or 8821 and writing “None” in the space designated for the CAF number. The IRS will send you a CAF number within a few weeks.

How do I register for IRS online?

Here's how new users get started:Select View Your Account on IRS.gov homepage.Select the Create or View Your Account button.Click Create Account.Pass Secure Access authentication. This is a rigorous process to verify the taxpayer's identity. ... Create a profile.Mar 3, 2021

How do I submit IRS forms online?

Visit the Free File Site. Select "Free File Fillable Forms Now” and then hit “Leave IRS Site” after reading the disclaimer.Start the Process. Select “Start Free File Fillable Forms” and hit “Continue.”Get Registered. ... Select Your 1040. ... Fill Out Your Tax Forms. ... E-File Your Tax Form. ... Complete Your Account. ... 123 - 45 - 6789.More items...

What is the difference between IRS form 2848 and 8821?

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.Aug 26, 2021

How do I fill out a 2848 tax form?

0:352:24Learn How to Fill the Form 2848 Power of Attorney and ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe name and address followed by the CAF. Number telephone number and fax number the form 2848.MoreThe name and address followed by the CAF. Number telephone number and fax number the form 2848. Allows the taxpayer to elect the scope of the power of attorney granted.

How long does it take for the IRS to process a 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.Jan 26, 2021

Can you Docusign for 2848?

Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed. Most Forms 2848 and 8821 are recorded on the IRS's Centralized Authorization File (CAF).Jan 25, 2021

Who can file form 2848?

When do you need Form 2848?Attorneys.CPAs.Enrolled agents.Enrolled actuaries.Unenrolled return preparers (only if they prepared the tax return in question)Corporate officers or full-time employees (for business tax matters)Enrolled retirement plan agents (for retirement plan tax matters)More items...•Jan 18, 2022

Who can be a power of attorney for IRS?

Any individual authorized under section 10.3 of Circular 230 to practice before the Internal Revenue Service. Those authorized include attorneys, CPAs, enrolled agents, enrolled retirement plan agents, and enrolled actuaries.May 30, 2018

What is a form 3903?

Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). If the new workplace is outside the United States or its possessions, you must be a U.S. citizen or resident alien to deduct your expenses.Mar 24, 2021

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

Popular Posts:

- 1. how to get ex to pay attorney fees

- 2. how to categorize for attorney spousal support payments

- 3. how much does an attorney make in florida

- 4. can an attorney discuss how he feels about a former client

- 5. where can i get a power of attorney form in ohio

- 6. what is astates attorney

- 7. how do my attorney get digital recordings

- 8. how to give ca judge information that attorney is not giving

- 9. who is the best intellectual property attorney in los angeles

- 10. why do i need a power of attorney'