Power of attorney forms can be mailed, faxed or scanned and e-mailed. If mailing the forms they can be sent to: Comptroller of Maryland Revenue Administration Division P.O. Box 1829 Attn: POA Annapolis, Maryland 21404-1829 If faxing the forms they can be faxed to 410-260-6213.

Full Answer

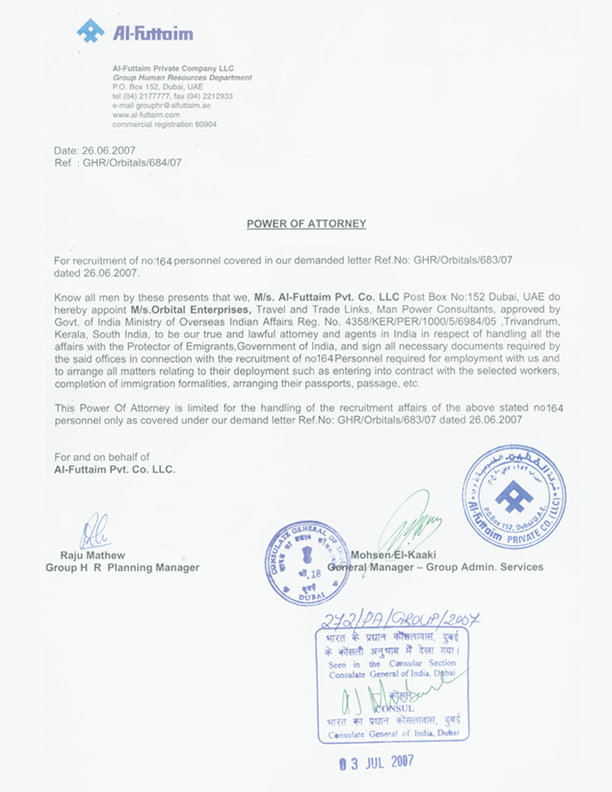

Where can one obtain a power of attorney form?

You can obtain the necessary forms in several ways, including from a licensed attorney, from a legal services provider, or directly from your state. 1. Determine your state's requirements. State statutes authorize power of attorney forms. Many states' laws follow the Uniform Power of Attorney Act.

How do you register a power of attorney?

- Document number or year of document registration.

- House number or apartment name situated in a city/ town/village.

- Survey number in a revenue village, optionally described by a plot number.

Where can I get free power of attorney forms?

It may mean that you can understand:

- the nature and extent of what you own

- that your attorney will, in general, be able to do anything with your property which you yourself could do

- that while you are mentally capable, you may direct your attorney to act in a particular way and may revoke (cancel) the EPA

How can I set up a power of attorney?

To get started, follow these basic guidelines for designating power of attorney:

- How to set up power of attorney.

- Consider durable power of attorney.

- Limited vs. general power of attorney.

- Immediately effective vs. springing power of attorney.

- Power of attorney for health care.

How do I send POA to IRS?

Fax or Mail Forms 2848 and 8821 If you can't use an online option, you can fax or mail authorization forms to us. Use for: Individual or business taxpayer. Any tax matter or period.

Where do I send my 2848?

Power of Attorney - Form 2848THEN use this address...Fax number*Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows•Jun 22, 2019

How do I file a 2848 online?

From any web browser:Log in with your username, password, and multi-factor authentication.Answer a few questions about the form that will be submitted. ... Upload a completed version of a signed Form 8821 or Form 2848. ... To submit multiple forms, select “submit another form" and answer the questions about the authorization.

How do I send documents to the IRS?

Visit www.taxpayeradvocate.irs.gov or call 877-777-4778. Complete this form, and mail or fax it to us within 30 days from the date of this notice. If you use the enclosed envelope, be sure our address shows through the window. If your address has changed, please call 866-xxx-xxxx or visit www.irs.gov.

Can I fax a POA to the IRS?

Revocation of a power of attorney. You must then mail or fax a copy of the power of attorney with the revocation annotation to the IRS, using the Where To File Chart, or if the power of attorney is for a specific matter, to the IRS office handling the matter.

Can you fax form 2848?

The fax number if sending from within the United States remains the same (855-772-3156). Section references are to the Internal Revenue Code unless otherwise noted. For the latest information about developments related to Form 2848 and its instructions, go to www.irs.gov/form2848.

Can IRS POA be signed electronically?

The process to mail or fax authorization forms to the IRS is still available. Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed.

Does IRS accept Docusign for power of attorney?

The IRS for POA's do not accept a Stamped signature, which is what docusign is.

How long does it take IRS to process a 2848 submitted online?

five weeksThe fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

Is it better to fax or mail IRS?

Fax or mail, pick one. If mailing documents, use a certified mail service. Send Copies: Never ever send originals. The IRS might lose your documentation, and they certainly won't mail it back.

Can you submit forms to the IRS online?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Where do I fax IRS forms?

Fax: (855) 215-1627 (within the U.S.)

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

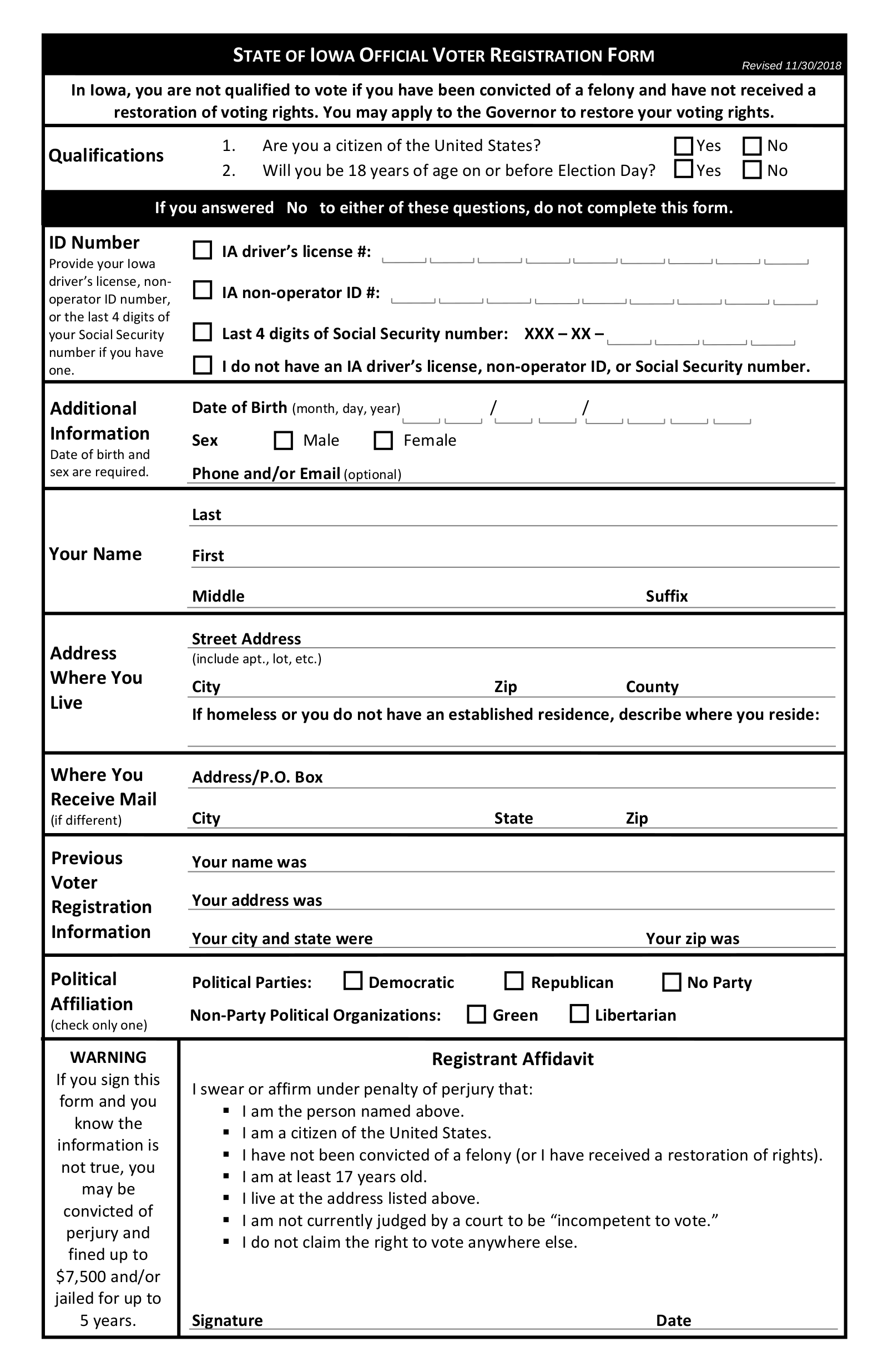

How to establish a power of attorney relationship?

To establish a power of attorney relationship, you must fill out and submit the correct FTB form. 1. Choose the correct form. 2. Fill out the form correctly. Representatives: Provide all available identification numbers: CA CPA, CA State Bar Number, CTEC, Enrolled Agent Number, PTIN.

Who can sign a business form?

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following: Printed name. Title (not required for individuals) Signature.

Who can sign FTB 3520-BE?

Examples: President. Vice President. Chief Financial Officer (CFO) Chief Executive Officer (CEO)

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

Who can I appoint on my tax return?

You can appoint on your tax form a person the IRS can contact about your tax return. This authorizes the IRS to call the designee to answer any questions that may arise during the processing of your return. A Third Party Designee can also: Give the IRS any information that is missing from your tax return;

Can you give an IRS authorization to a third party?

If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Is a power of attorney valid for a principal?

Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent. IRS Power of Attorney (Form 2848) – To hire or allow someone else to file federal taxes to the Internal Revenue Service on your behalf. Limited Power of Attorney – For any non-medical power.

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent) broad powers to manage matters on behalf of another person (known as the principal). Under certain circumstances, Bank of America allows agents to be added to the principal's accounts ...

Can a bank review a power of attorney?

The power of attorney and ID documents will be reviewed by the bank. Due to the complexities of power of attorney documents, multiple reviews may be required. As a result, the review process may require more than one visit to the financial center if further documentation is required.

How to revoke a power of attorney?

A Power of Attorney is a legal document that grants power to an individual (the Agent) of your discretion, should you (the Principal) become incapacitated. A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document. The common reasons to revoke a Power of Attorney are: 1 The Agent is no longer interested in holding the Power of Attorney. 2 The Principal believes the Agent is not completing the requirements appropriately. 3 The Power of Attorney is no longer desired. 4 The Principal would like to change Agents. 5 The purpose has been fulfilled.

Where should a revocation of a power of attorney be filed?

The revocation along with the new Power of Attorney, if applicable, should be filed in the same place the original Power of Attorney was filed (i.e., county clerk), to prevent it from not being recognized as a legal document in a court of law or other legal proceedings.

How to send a copy of a revocation to an agent?

It is best to send a copy of the revocation to the agents via certified mail. This will give proof to the principle that the form was received by the agents. If the agents are to act further on behalf of the principal it would be considered a criminal act.

Can a power of attorney be revocable verbally?

Verbal revocations are not acceptable unless it was previously documented in the original Power of Attorney. Once the revocation of the Power of Attorney takes place, it will nullify the existing document and will serve as confirmation.

Who should be made aware of a Power of Attorney revocation?

Any third-parties that had copies of the previous Power of Attorney (i.e., financial institutions, healthcare or other agencies) should be made aware of immediately and a copy of the revocation should be supplied. Once all parties have been made aware, they are no longer legally able to complete business with the Agent.

Do I need a lawyer to revoke a power of attorney?

When revoking a Power of Attorney, a lawyer is not required. The legal consult can ensure all original Power of Attorney details (i.e. name, date, duties, statement of sound mind) are addressed in the revocation. Verbal revocations are not acceptable unless it was previously documented in the original Power of Attorney.

Can a power of attorney be revoked?

A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document.

What is a power of attorney?

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters. A Power of Attorney is a legal form but is NOT a court form. A Power of Attorney cannot be used to give someone the power to bring a lawsuit on your behalf. Only licensed attorneys can bring lawsuits on behalf ...

Who is the principal of a power of attorney?

The "principal" is the person who creates a Power of Attorney document, and they give authority to another adult who is called an "attorney-in-fact.". The attorney-in-fact does NOT have to be a lawyer and CANNOT act as an attorney for the principal. The attorney-in-fact must be a competent adult (18 years or older).

How long does it take to register a power of attorney?

When you’ve made your lasting power of attorney ( LPA ), you need to register it with the Office of the Public Guardian ( OPG ). It takes up to 15 weeks to register an LPA if there are no mistakes in the application. You can apply to register your LPA yourself if you’re able to make your own decisions. Your attorney can also register it for you.

Where to sign LPA form?

If you create your LPA form using the online service, you will need to print it out to do this. Office of the Public Guardian. PO Box 16185. Birmingham.

How long does it take to notify people of a LP3?

Before you register, send a form to notify people (LP3) to all the ‘people to notify’ (also called ‘people to be told’) you listed in the LPA. They’ll have 3 weeks to raise any concerns with OPG. If you’re using the online service to make an LPA, it will create and fill in the LP3 forms for you.

Popular Posts:

- 1. how to get power of attorney after husbands death format india

- 2. what is an attorney ledger

- 3. what do you need a commonwealth attorney

- 4. where is attorney crump from

- 5. what happens when you become power of attorney on someones account

- 6. what if i have noone for power of attorney

- 7. what to do served with divorce papers no money for attorney

- 8. why would an attorney refuse service of a court date

- 9. how to sign for power of attorney state of indiana title

- 10. chief compliance officer private equity salary when not an attorney