Drafting a Notice to Rescind the Power of Attorney.

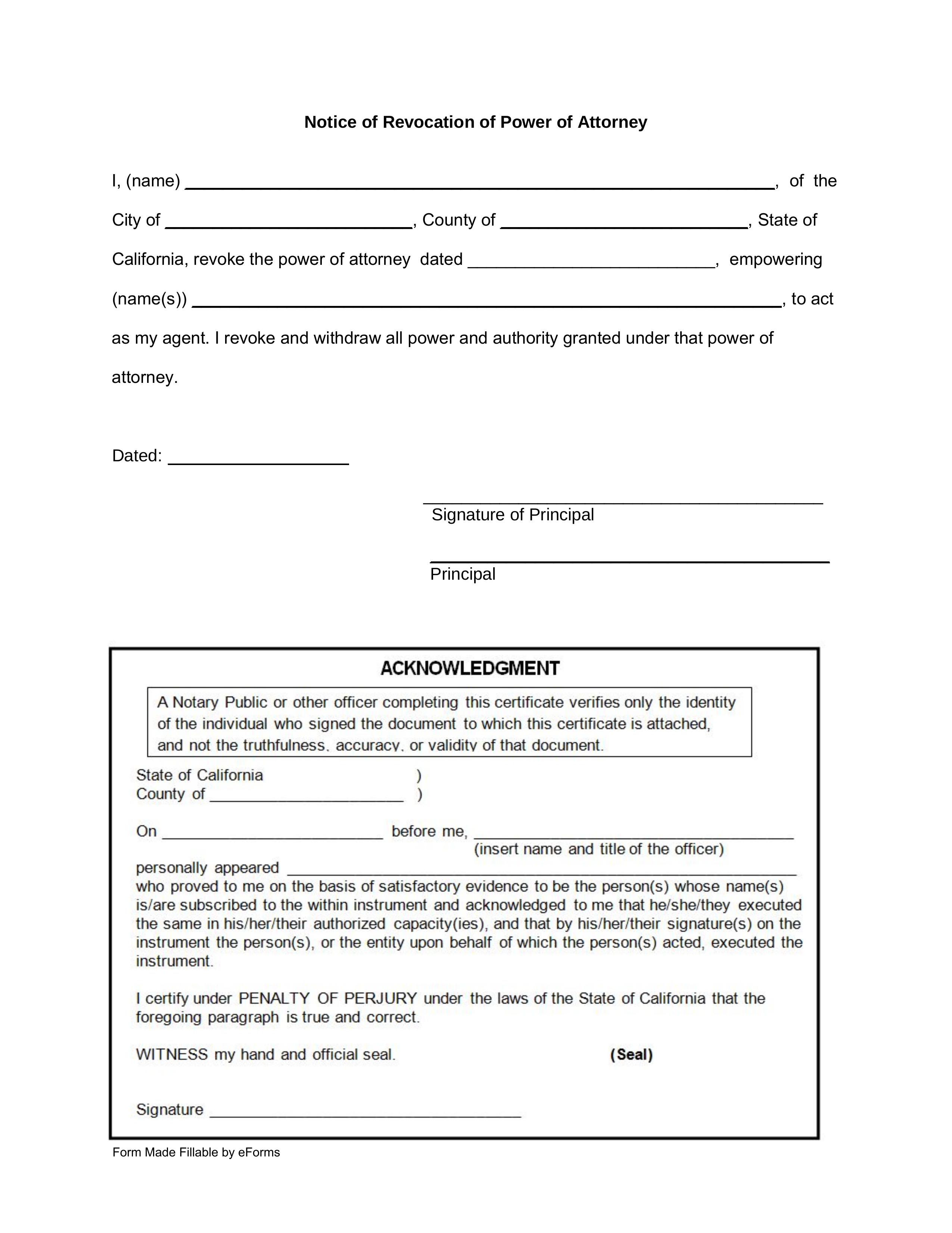

- 1. Write a clear statement revoking the power of attorney. There is no required form, application, or other document that you must use to revoke or ...

- 2. Include the date that you want the revocation to take place. Be specific and clear in wording this. If you are ambiguous or if you do not include a ...

- 3. Request the return of any documents or other property that accompanied the power of attorney. If, when you gave the power of attorney, you also ...

- 4. Get your signature notarized, if you wish. It is not a requirement to have your signature notarized on a letter revoking a power of attorney. If ...

How do I revoke a power of attorney?

Dec 27, 2021 · How to Write. 1 – Open The Form On This Page To Revoke A Previously Issued Authority. If revoking a Power of Attorney that has been issued in the past, then open ... 2 – Categorize The Power Of Attorney The Must Be Rescinded Through This Document. Before filling out this form, it will be necessary ...

How to change a power of attorney on a tax return?

Sign the document and send it to your old agent as well as any institutions or agencies that have a copy of the power of attorney. Attach your new power of attorney if you have one. You will also need to get the old power of attorney back from your agent. If you can’t get it back, send the agent a certified letter, stating that the power of attorney has been revoked.

What is a military power of attorney document?

To revoke the power of attorney, notify your attorney-in-fact in writing that the power has been revoked, and ask your attorney-in-fact to return any copies of the power of attorney document to you. You should also send written notification to any business or person that may have received a copy of the document, telling them that you have revoked the power of attorney.

When can I apply for a limited power of attorney?

Feb 09, 2021 · An attorney or an accountant that has been granted a power of attorney who then changes their place of employment must submit a new power of attorney reflecting that change. To revoke a power of attorney without filing a new Form M-2848, the taxpayer should submit a signed statement indicating his or her intention to revoke to DOR to the specific person the …

How do you cancel out a power of attorney?

Until an attorney-in-fact's powers are properly revoked, they can continue to legally act for the principal. To cancel a Power of Attorney, the principal can create a document called a Revocation of Power of Attorney or create a new Power of Attorney that indicates the previous Power of Attorney is revoked.

Who can revoke a Lasting Power of Attorney?

Office of the Public GuardianA donor, with the mental capacity to act, can revoke a lasting power of attorney (LPA) by sending a revocation notice to the attorney(s) and the Office of the Public Guardian (OPG).

How do I change power of attorney in Massachusetts?

There is no required form, application, or other document that you must use to revoke or rescind a power of attorney in Massachusetts. Just write a simple statement or letter to the person who previously held your power of attorney (this person is known as your attorney-in-fact).

Can we revoke power of attorney?

Although a PoA is something when granted is of an irrevocable nature, if there is gross mismanagement on part of the agent, if the agent breaches the terms of the contract or if the agent acts beyond the scope of the powers, then the PoA can be revoked.May 30, 2019

Does it cost to revoke power of attorney?

If you decide that you want to cancel / revoke a PoA that is registered with us, you will need to tell us. A PoA can only be cancelled / revoked by you, the granter, if you are capable of making and understanding this decision. We do not charge a fee to cancel a PoA.

Can you revoke an irrevocable power of attorney?

Such Power of Attorney may be revoked by the principal or the Power of Attorney holder by the procedure according to law. For revocation of irrevocable Power of Attorney, the principal is required to issue a public notice through local newspapers, without which, the revocation shall stand void.Feb 26, 2017

Can power of attorney be changed?

Can I change or cancel a power of attorney? Yes. You have the option of changing your power of attorney to specify new terms or canceling it altogether. Even after a power of attorney is created, your circumstances may change and you may not need a power of attorney any longer.

How long is a power of attorney good for in Massachusetts?

A power of attorney (POA) allows one person, the agent, to act on behalf of another, the principal. In the state of Massachusetts, like other states, a durable POA remains effective even after the principal is incapacitated.

Does a power of attorney have to be notarized in Massachusetts?

5. Do I have to have witnesses to my Durable Power of Attorney? Not to have it be legal in Massachusetts. ... A durable power of attorney should always be notarized, but just like with witnesses it would be legal without it, although it might be hard to use, and won't help with real estate.

What is the validity of power of attorney?

Except in cases where the power of attorney is coupled with interest (or executed for consideration), it is normally revocable at the discretion of the principal. Unless a time limit is prescribed in the document, a power of attorney is normally valid until the purpose for which the same was executed is fulfilled.Oct 29, 2021

What is revocable power of attorney?

A power of attorney is said to be revocable if the principal has the right to revoke power at any time. The agent can no longer act on the principal's behalf once the principal revokes the power.Feb 22, 2018

Can power of attorney sell property?

Provided there are no restrictions within the lasting power of attorney (LPA) or enduring power of attorney (EPA) you can usually do the following: Sell property (at market value) Buy property. Maintain and repair their home.

Limiting the power of attorney

You should consider how responsible and trustworthy someone is before making that person your attorney-in-fact. Talk to your lawyer about the different ways you can limit your power of attorney document to protect yourself and do not sign the document until you understand it completely.

Revoking the power of attorney

When you no longer need an attorney-in-fact, for example, after returning from deployment, you can revoke the power of attorney.

614.1. In General

To protect the confidentiality of tax records, Massachusetts law generally prohibits the Department of Revenue (“DOR”) from disclosing tax return information to anyone other than the taxpayer or his or her representative. G.L. c. 62C, § 21 (a).

614.2. Filing the Power of Attorney

There is no central power of attorney office within DOR. It is not necessary to file a power of attorney with DOR unless the taxpayer is currently involved in a matter requiring contact with DOR employees. Usually, the power of attorney will follow the taxpayer's file through the various offices of DOR.

614.3. Effect of the Power of Attorney

A taxpayer can use Form M-2848 to indicate the extent to which he or she authorizes disclosure (e.g., only certain tax types or periods) and can name one or more representatives. The powers granted extend to any matter affecting the tax type and period specifically referred to in the power of attorney unless the taxpayer limits the powers.

614.4. Revoking or Changing the Power of Attorney

To change a representative, alter the power given to a representative, or revoke a power of attorney, a taxpayer should file a new Form M-2848 and indicate these changes.

614.5. Alternative Power of Attorney Forms

While DOR generally requires Form M-2848, DOR may, in very limited circumstances, accept an alternative to Form M-2848 at its discretion if the alternative contains information similar to that requested on Form M-2848. Alternative power of attorney forms may be subject to additional review and may cause a delay in processing.

Popular Posts:

- 1. how to get someone lost the power of attorney that you gave them

- 2. "who is jennifer sturgeon buffalo ny attorney general"

- 3. what is it like to intern at district attorney office

- 4. when to hire an attorney to review your contracts

- 5. how old is loretta lynch, attorney gen eral

- 6. how do u get a power of attorney

- 7. i am in america how can i get a power of attorney notarized for the philippines

- 8. in ga what law governs power of attorney receiving compensation

- 9. what is the district attorney in tv show bull

- 10. how long does it take the irs to record power of attorney caf