How do you remove power of attorney?

If you do not have a copy of the power of attorney you want to revoke, you must send the IRS a statement of revocation that indicates the authority of the power of attorney is revoked, lists the matters and years/periods, and lists the name and address of each recognized representative whose authority is revoked.

How to revoke IRS 2848?

Jul 18, 2021 · There are 2 ways to revoke a Power of Attorney authorization: Authorize Power of Attorney for a new representative for the same tax matters and periods/years. A new authorization will automatically revoke the prior authorization. Send a revocation to the IRS. Follow Revocation Instructions, Form 2848, Power of Attorney and Declaration of Representative.

How to cancel a power of attorney?

Nov 19, 2021 · There are three ways to revoke a power of attorney: by preparing a written revocation letter; by destroying all existing copies of your power of attorney; and by creating a new power of attorney document that supersedes the old one.

Can Poa be revoked?

Apr 23, 2019 · Answer ID 4315 Updated 04/23/2019 12:19 PM. How can I revoke my power of attorney? If you have a power of attorney on file and you no longer want the individual you appointed to represent you, see Power of attorney: How to revoke. Please note: Only a taxpayer may revoke a power of attorney. If you are a representative, you cannot revoke a power of …

How do I revoke IRS power of attorney?

If you want to revoke a previously executed power of attorney and do not want to name a new representative, you must write “REVOKE” across the top of the first page with a current signature and date below this annotation.

Where do you file and withdraw form 2848?

Submit your Form 2848 securely at IRS.gov/Submit2848. Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart.Sep 3, 2021

How long is a POA valid IRS?

Length of POA Generally, a POA lasts for 6 years. To extend the POA for an additional 6 years, you must submit a new POA . Any POA declaration(s) filed on or before January 1, 2018 will stay on file until the listed expiration date or December 31, 2023, at which point it will expire.Dec 17, 2021

Does IRS recognize POA?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

How long is form 2848 Good For?

seven yearsThat mailing address or fax number depends on the state in which you live. You can find the address and fax number for your state in the 'Where to File Chart' included with the IRS Instructions for Form 2848. An IRS power of attorney stays in effect for seven years, or until you or your representative rescinds it.Jan 18, 2022

Does form 2848 expire?

Automatic Expiration: Form 2848 requires a manual cancelation but Form 8821 automatically expires. This makes it particularly useful for basic tasks like requesting your client's tax information that doesn't require full representation.Mar 23, 2021

How long does it take for IRS to process POA?

To reduce processing time, the IRS added resources from multiple sites other than the three CAF units to assist in processing. During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

How do I file a power of attorney with the IRS?

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.Jan 24, 2022

Can IRS form 2848 be signed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

What is an IRS Caf?

A CAF number is a unique nine-digit identification number and is assigned the first time you file a third party authorization with IRS. ... The Centralized Authorization File (CAF) allows the input of codified additional acts authorized on a Form 2848, Line 5a.

What is the difference between 2848 and 8821?

Whereas Form 2848 allows a power of attorney to represent a taxpayer before the IRS, Form 8821: Tax Information Authorization empowers someone to receive and inspect your confidential information without representing you to the IRS.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

What is an oral disclosure?

Oral Disclosure. If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

Why you received IRS Letter 2675C

You or your representative filed Form 2848, Power of Attorney and Declaration of Representative.

Want more help?

Your tax professional can deal with the IRS for you. Learn more about H&R Block’s Tax Audit & Notice Services.

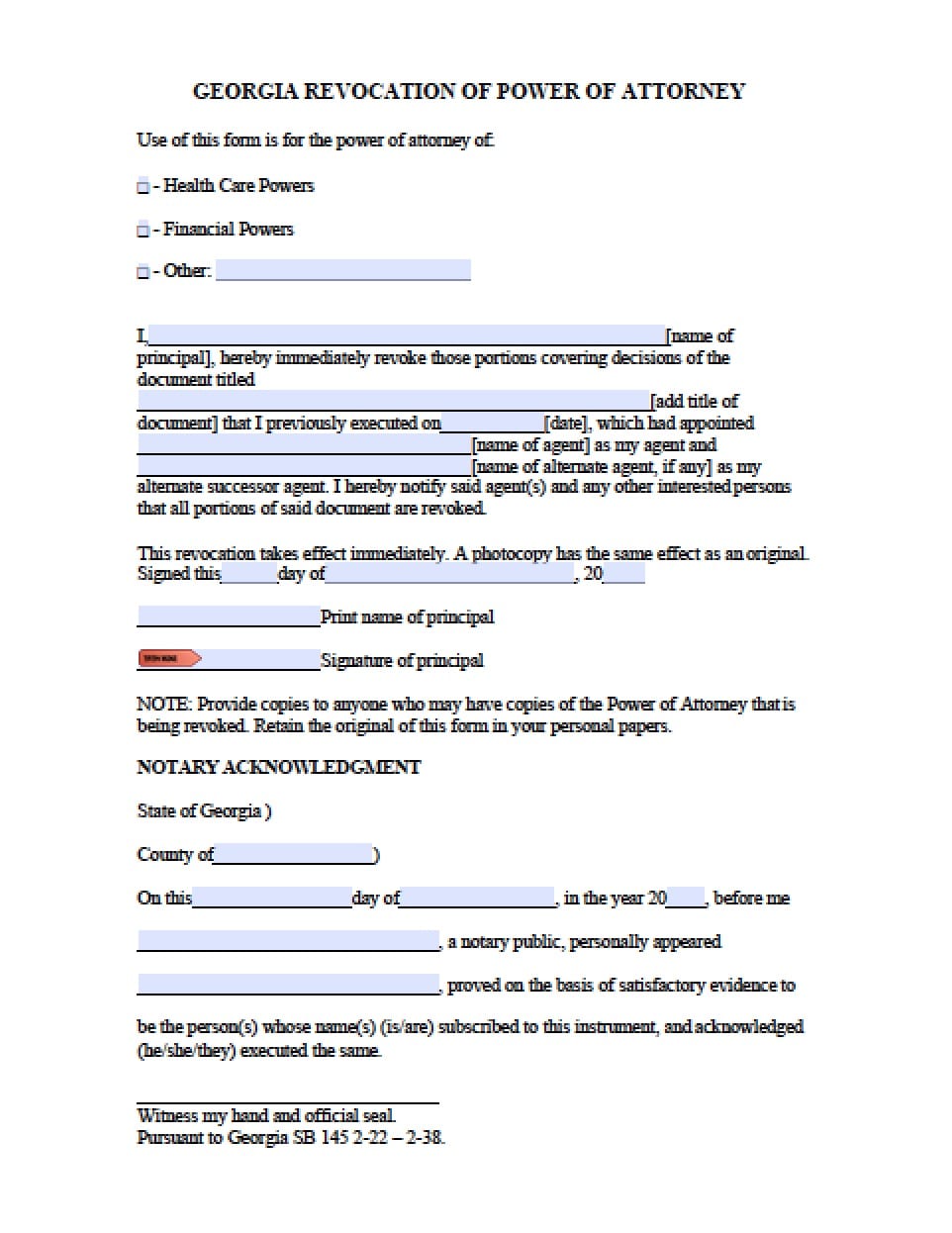

How to revoke a power of attorney?

To revoke power of attorney, start by checking the laws governing power of attorney in your state, since the procedure varies. In most states, the principal should prepare a revocation document saying that the power of attorney has been revoked, then take it to a notary to be signed.

Who can revoke a POA?

Learn who can revoke power of attorney. The person for whom the document provides power of attorney is known as the principal. The principal is the only one who can revoke the power of attorney (POA) while the principal is competent.

Why do people need a durable power of attorney?

Many seriously ill people choose a durable power of attorney because they want their agent to continue to make their decisions after they can no longer communicate their wishes, and, because of their illness, want the power of attorney to go immediately into effect.

Do you have to sign a document in front of a notary?

Some states require this document to be signed in front of a notary. Even if the state where you live does not legally require the signature to be notarized, signing in front of a notary eliminates any doubt as to the authenticity of the signature.

Can a bank be held liable for a power of attorney?

Therefore, if your agent acts in accordance with the power of attorney document before the revocation reaches the third party (for example, a bank) the bank can not be held liable for any money taken or used by the agent in conjunction with the power of attorney.

Can a power of attorney be transferred?

Make sure that the principal and agent know that some powers cannot be conferred under state law. If the power of attorney pur ports to transfer a power under state law that cannot be transferred, the power of attorney is void as to that power.

What is the first element of a trust?

The first element is the trust , and this can be a revocable trust or an irrevocable trust and it is the family trust . It tells what you want to happen while you are alive and also after you die for up to one or two generations after you.

What is the final document of a power of attorney?

The final document is the healthcare power of attorney and it basically works like the living will, only it goes into more detail as to how much nutrition and hydration you want to be given if you cannot make those decisions yourself.

What is a 2848 Power of Attorney?

For financial and tax-related purposes, an IRS Power of Attorney Form 2848 may be drafted so that an agent may make tax-related decisions on someone else’s behalf with the IRS.

Who can represent a client before the IRS?

However, it’s a good idea to select a credentialed tax professional such as an attorney, CPA, or Enrolled Agent who can represent a client before any department of the IRS.

What is Form 2848?

IRS Form 2848 is a document provided by the IRS that authorizes an individual to appear before them on your behalf. Due to federal laws, the IRS is required to keep your taxpayer information confidential, so Form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them.

Popular Posts:

- 1. what to do if someone sends you their power of attorney

- 2. when to issue 1099-misc to an attorney

- 3. how often should your attorney contact you regarding disability

- 4. how to get attention from district attorney

- 5. national attorney guild who funds it

- 6. who is miguel martinez san antonio defense attorney

- 7. how to write a legal memo from an attorney

- 8. how much does my attorney get when i win disability

- 9. how much money. can an attorney take for winning a disabiliy case

- 10. why would a attorney send a supeona to my work for child support custody case