How to revoke power of attorney in the United States?

This power of attorney revokes all earlier power(s) of attorney on file with the California Department of Tax and Fee Administration or the Employment Development Department as identified above for the same matters and years or periods …

How do I remove power of attorney from a third party?

This Power of Attorney revokes all earlier Power(s) of Attorney on file with the California Department of Tax and Fee Administration or the Employment Development Department as identified above for the same matters and years or periods covered by this form, except for the following: [specify to whom granted, date and address, or refer to attached

How to fill out a power of attorney form?

Jul 01, 2021 · If you disagree with the Warning Notice or Notice of Violation issued to you, you can contest the violation (s) by filing a timely appeal. The procedures for requesting an appeal are outlined in the notices. The request must be mailed within 30 days from the date of the notice and must include your contentions and any supporting documentation.

What powers does the Attorney (s)-in-fact and/or authorized representative (s) have?

BOE-392 (BACK) REV. 10 (4-21) The attorney(s)-in-fact and/or authorized representative(s) (or any of them) is/are authorized, subject to revocation, to receive confidential tax information, and to perform on behalf of the taxpayer(s) the following act(s) for the tax matter(s) described above: [check the box(es) for the power(s) granted]

How do I submit power of attorney to cdtfa?

CDTFA-392, Power of Attorney, is available on our website. You can complete the form online, save it and either email the PDF version to us, or print a hardcopy and mail it to us at the address which follows. CDTFA-5226, Marine Invasive Species Fee – Agent Agreement, is available on our website.May 2, 2020

Where do I file Cdtfa 392?

Please note that a separate form must be completed and provided to each agency checked.CALIFORNIA DEPARTMENT OF.TAX AND FEE ADMINISTRATION.PO BOX 942879.SACRAMENTO, CA 94279-0001.1-800-400-7115 (TTY:711)EMPLOYMENT DEVELOPMENT DEPARTMENT.PO BOX 826880 MIC 28.SACRAMENTO CA 94280-0001.More items...

Where do I mail Cdtfa 345?

Please complete the applicable sections of this form and mail to: California Department of Tax and Fee Administration, ATTN: LRB/Registration Team, MIC:27, P.O. Box 942879, Sacramento, CA 94279-0027.

How do I change my address with Cdtfa?

State-Assessed Property Tax assessees should contact the State-Assessed Properties Division at 1-916-274-3270, to report a change of business information or address.

How do I contact Cdtfa?

For information on CDTFA's tax programs, please visit CDTFA's website or call 1-800-400-7115.

Can I file Cdtfa 65 online?

You can use our Online Services Portal to close your account(s) if you are registered in our Online Services system. However, if you use a Limited Access Code to file your returns or do not have an online account with us, then you would need to use the enclosed CDTFA-65, Notice of Closeout, to notify us.

Where do I mail Cdtfa?

Office Locations & AddressesNon Sales Tax OfficesAddressDriving DirectionsSpecial Taxes and Fees (This office offers limited services. For assistance, please call 1-800-400-7115 (CRS:711))450 N Street Sacramento, CA 95814-4311 PO Box 942879, MIC:88 Sacramento, CA 94279-0088Directions1 more row

What is Cdtfa Schedule B?

SCHEDULE B - DETAILED ALLOCATION BY COUNTY. OF SALES AND USE TAX TRANSACTIONS. DUE ON OR BEFORE.

How do I notify the IRS of an address change?

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party — Business and send them to the address shown on the forms.Jan 18, 2022

How do I find my CDTFA account number?

The Express Login Code is a unique eight digit alphanumeric code. This code can be located or obtained from the following sources: Correspondence received from the CDTFA. Contacting our customer service representatives at 800-400-7115, Monday through Friday, 8:00 a.m. to 5:00 p.m. Pacific time, excluding state holidays ...

How do I cancel my seller's permit in California?

In order to close your sales tax permit in California, you will need to contact California's customer service center at 1-800-400-7115 to begin the process of cancelling your sales tax permit.Jan 20, 2021

How much does a wholesale license cost in California?

between $3,000 to $10,000A wholesale license can cost anywhere between $3,000 to $10,000 depending on the type of license.Jan 24, 2020

What does it mean to be in appeals?

If you disagree with the Warning Notice or Notice of Violation issued to you, you can contest the violation (s) by filing a timely appeal.

What if I do not appeal?

If you choose not to file an appeal or if you file after the 30 days allotted, the Department will deem that you have waived your right to appeal. All violation (s) will be recorded in the license of record and all penalties will become final.

I requested an appeals conference, what happens next?

You will receive acknowledgement of your request for an appeals conference.

Can I continue operating while the case is being settled?

Yes. You may continue to operate until you receive a Notice of Decision regarding the outcome of your appeal. You should receive your Notice of Decision approximately 4-6 weeks after your telephone conference.

Can I have someone represent me?

Yes. You may have your attorney, enrolled agent, Certified Public Accountant, accountant, bookkeeper, or representative participate on your behalf. Please submit a completed Power of Attorney (Form CDTFA-392) with your appeal,

Does CDTFA offer interpretive services for my telephone conference hearing?

Yes. Please call the Compliance Branch at (916) 327-4208 to make arrangements prior to your telephone conference hearing.

Can I postpone my telephone conference?

Yes. When you receive your Notice of Conference, you may ask for a postponement by marking the applicable box and providing your daytime phone number. Typically, you are only allowed one opportunity to reschedule your telephone conference.

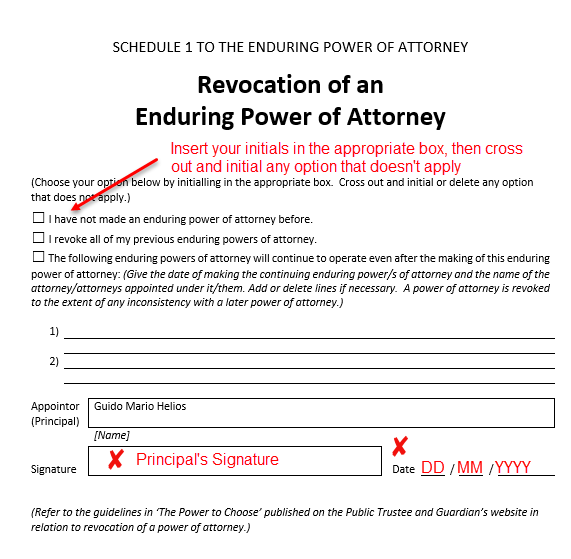

How to revoke a power of attorney?

To revoke power of attorney, start by checking the laws governing power of attorney in your state, since the procedure varies. In most states, the principal should prepare a revocation document saying that the power of attorney has been revoked, then take it to a notary to be signed.

Who can revoke a POA?

Learn who can revoke power of attorney. The person for whom the document provides power of attorney is known as the principal. The principal is the only one who can revoke the power of attorney (POA) while the principal is competent.

Why do people need a durable power of attorney?

Many seriously ill people choose a durable power of attorney because they want their agent to continue to make their decisions after they can no longer communicate their wishes, and, because of their illness, want the power of attorney to go immediately into effect.

Can a bank be held liable for a power of attorney?

Therefore, if your agent acts in accordance with the power of attorney document before the revocation reaches the third party (for example, a bank) the bank can not be held liable for any money taken or used by the agent in conjunction with the power of attorney.

Can a power of attorney be transferred?

Make sure that the principal and agent know that some powers cannot be conferred under state law. If the power of attorney pur ports to transfer a power under state law that cannot be transferred, the power of attorney is void as to that power.

Do you have to sign a document in front of a notary?

Some states require this document to be signed in front of a notary. Even if the state where you live does not legally require the signature to be notarized, signing in front of a notary eliminates any doubt as to the authenticity of the signature.

How to revoke a power of attorney?

A Power of Attorney is a legal document that grants power to an individual (the Agent) of your discretion, should you (the Principal) become incapacitated. A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document. The common reasons to revoke a Power of Attorney are: 1 The Agent is no longer interested in holding the Power of Attorney. 2 The Principal believes the Agent is not completing the requirements appropriately. 3 The Power of Attorney is no longer desired. 4 The Principal would like to change Agents. 5 The purpose has been fulfilled.

Can a power of attorney be revoked?

A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document.

File a Return & Pay Taxes

File a return or pay your taxes online by logging into our secure site using your Username and Password.

Register for a Permit

Online registration is a convenient, fast, and free way to register online for a permit, license, or account with the CDTFA.

Tax & Fee Rates

The California Department of Tax and Fee Administration is responsible for the administration of 37 different taxes and fees.

Popular Posts:

- 1. who is the winnebago county district attorney

- 2. what happens when you pay attorney fee and decide to not file for immigration

- 3. when an attorney falls below minimum ethical standards, they have committed

- 4. how can i file a dental complaint with the attorney general

- 5. who can be a power of attorney us

- 6. who was molly blooms attorney

- 7. when is attorney required to make appearance

- 8. what is an attorney for women's righst

- 9. what is the role of attorney general in usa

- 10. power of attorney for someone who cannot sign the document