Relationships change, and sometimes people wish to revoke a power of attorney that they previously granted to their spouse. They can do so by following the instructions laid out in the power of attorney documentation or, if no instructions are given, by signing a written revocation.

What do I need to do to revoke a "power of attorney"?

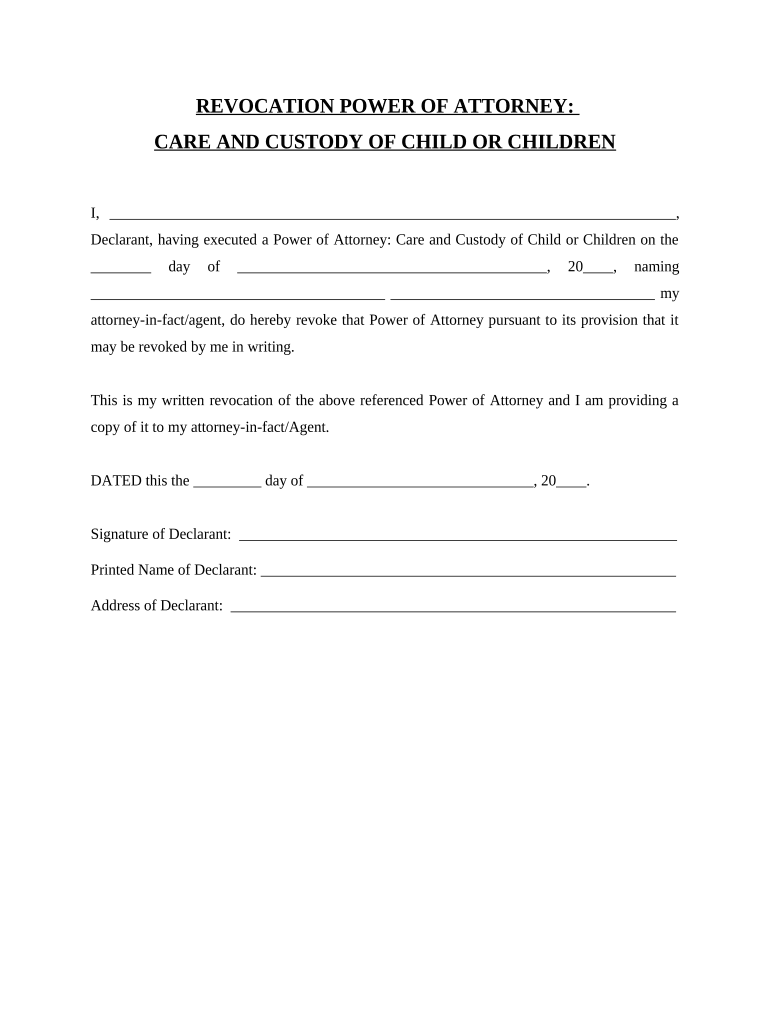

Nov 19, 2021 · Revoking a power of attorney is a relatively simple process. No court hearing is required, and there’s no long waiting period. It can be accomplished in one of three ways, the clearest of which is writing a letter to revoke the power of attorney you granted in the first place. 1. Prepare A Written Revocation Letter.

Can you change or revoke your power of attorney?

Jan 05, 2017 · Fill out a formal revocation form to cancel any existing powers of attorney. You’ll need a revocation form template specific to your state. Advise your attorneys that their powers have been revoked. To avoid any problems, make sure that all your attorneys have a copy stating your wishes to revoke their powers of attorney.

How do you reverse a power of attorney?

Aug 31, 2021 · The Process of Withdrawing Power of Attorney from an Agent. 1. Discuss the Revocation with the Attorney-in-Fact. 2. Put the Revocation in Writing. 3. Replace or Destroy the Now Annulled Document. What to Do if the Principal Cannot Act For Themself. Common Reasons Why People Revoke a Power of Attorney.

Can You verbally revoke a power of attorney?

Relationships change, and sometimes people wish to revoke a power of attorney that they previously granted to their spouse. They can do so by following the instructions laid out in the power of attorney documentation or, if no instructions are given, by signing a written revocation.

On what grounds can a power of attorney be revoked?

The death, incapacity or bankruptcy of the donor or sole attorney will automatically revoke the validity of any general power of attorney (GPA). GPAs can be revoked by the donor at any time with a deed of revocation. The attorney must also be notified of the revocation or the deed of revocation won't be effective.

How does power of attorney get revoked?

There are three ways to revoke a power of attorney: by preparing a written revocation letter; by destroying all existing copies of your power of attorney; and by creating a new power of attorney document that supersedes the old one.Nov 19, 2021

How do you take someone off power of attorney?

Verbal revocation: As long as you are of sound mind, you can revoke someone's POA privileges simply by telling them out loud and in front of witnesses that you no longer wish for them to retain power of attorney privileges over your property and/or affairs. It's that simple.Feb 28, 2019

Can a POA be rescinded?

A principal can rescind a Power of Attorney at any time, even if the Power of Attorney has a specified end date, so long as the principal is competent and the attorney-in-fact is notified. Third parties (such as a bank or the Land Titles Office) should also be notified of the revocation.

How do you revoke an irrevocable power of attorney?

Such Power of Attorney may be revoked by the principal or the Power of Attorney holder by the procedure according to law. For revocation of irrevocable Power of Attorney, the principal is required to issue a public notice through local newspapers, without which, the revocation shall stand void.Feb 26, 2017

Can an attorney revoke power of attorney?

A power of attorney can be revoked at any time, regardless of the termination date specified in the document, as long as the donor is mentally capable. (Note: there are some exceptions, but these apply only to "binding" Powers of Attorney.

How to revoke a power of attorney?

To revoke power of attorney, start by checking the laws governing power of attorney in your state, since the procedure varies. In most states, the principal should prepare a revocation document saying that the power of attorney has been revoked, then take it to a notary to be signed.

Who can revoke a POA?

Learn who can revoke power of attorney. The person for whom the document provides power of attorney is known as the principal. The principal is the only one who can revoke the power of attorney (POA) while the principal is competent.

Why do people need a durable power of attorney?

Many seriously ill people choose a durable power of attorney because they want their agent to continue to make their decisions after they can no longer communicate their wishes, and, because of their illness, want the power of attorney to go immediately into effect.

Do you have to sign a document in front of a notary?

Some states require this document to be signed in front of a notary. Even if the state where you live does not legally require the signature to be notarized, signing in front of a notary eliminates any doubt as to the authenticity of the signature.

Can a bank be held liable for a power of attorney?

Therefore, if your agent acts in accordance with the power of attorney document before the revocation reaches the third party (for example, a bank) the bank can not be held liable for any money taken or used by the agent in conjunction with the power of attorney.

Can a power of attorney be transferred?

Make sure that the principal and agent know that some powers cannot be conferred under state law. If the power of attorney pur ports to transfer a power under state law that cannot be transferred, the power of attorney is void as to that power.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

Who is Diana's representative on W-2?

Diana authorizes John to represent her in connection with her Forms 941 and W-2 for 2018. John is authorized to represent her in connection with the penalty for failure to file Forms W-2 that the revenue agent is proposing for 2018.

Does John represent Diana on 1040?

Diana only authorizes John to represent her in connection with her Form 1040 for 2018. John is not authorized to represent Diana when the revenue agent proposes a trust fund recovery penalty against her in connection with the employment taxes owed by her closely held corporation.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

How to revoke a power of attorney?

Revocation. The principal of a power of attorney can revoke it at any time. The only caveat is that they must be competent at the time of revocation. They may revoke the POA in two ways: 1 Verbal revocation: As long as you are of sound mind, you can revoke someone’s POA privileges simply by telling them out loud and in front of witnesses that you no longer wish for them to retain power of attorney privileges over your property and/or affairs. It’s that simple. However, depending on the circumstances, simply verbalizing this wish leaves the matter open to question and interpretation. 2 Written revocation: In order to avoid any issues, executing a written revocation identifying the POA and sending it to your agent is by far the better option. It should be signed by you in front of a notary public and delivered to the attorney-in-fact – plus any third parties with whom your agent has been in contact on your behalf (your bank, doctors, nursing facility, etc.).

What is a POA?

A signed POA appoints a person – an attorney-in-fact or agent – to act upon behalf of the person executing the POA document when he or she is unable to do so alone . There are generally four ways these privileges may be granted: Limited Power of Attorney. Gives an agent the power to act for a very limited purpose. General POA.

How to revoke POA?

They may revoke the POA in two ways: Verbal revocation: As long as you are of sound mind, you can revoke someone’s POA privileges simply by telling them out loud and in front of witnesses that you no longer wish for them to retain power of attorney privileges over your property and/or affairs. It’s that simple.

What is a springing POA?

Springing POA. One effective only in the event the principal becomes incapacitated. Due to the powerful nature of POA privileges, sometimes situations arise in which it is necessary to remove appointed individuals from this role.

What is a power of attorney?

A power of attorney is a legal document that appoints a person, known as an agent, to have rights to make legal and/or financial decisions on your behalf.

What to do if you need a new power of attorney?

If you need to execute a new power of attorney, then proceed with naming an appropriate agent to act on your behalf regarding medical or financial matters. By confirming that you have destroyed all previous copies of your canceled power of attorney, you can eliminate any confusion.

Popular Posts:

- 1. how can i get power of attorney of my sibling's medical care if he's in a coma

- 2. what does an attorney on contingency mean

- 3. what happens to accused persons who cannot afford to pay an attorney to represent them

- 4. in florida when collecting an award can attorney fees be added?

- 5. how many law firms in california have less than 20 attorney

- 6. who is assistant attorney general rosenstein wife?

- 7. how to find out if an attorney has mal pracice insurance

- 8. what kind of power of attorney do i need for a leased car

- 9. how do i cancel my power of attorney while incarcerated?

- 10. what is the difference between guardianship and power of attorney?