To revoke a previously executed power of attorney without naming a new representative, the taxpayer must write “REVOKE” across the top of the first page of the Form 2848, along with a current signature and date immediately below the annotation. A copy of the revoked power of attorney is then mailed or faxed to the IRS.

Full Answer

How to revoke an IRS power of attorney?

If you do not have a copy of the power of attorney you want to revoke, you must send the IRS a statement of revocation that indicates the authority of the power of attorney is revoked, lists the matters and years/periods, and lists the name and address of each recognized representative whose authority is revoked.

How to cancel form 2848?

Oct 04, 2016 · How to revoke an IRS Power of Attorney-From the IRS Form 2848 Instructions: Revocation of Power of Attorney/ Withdrawal of Representative Revocation by taxpayer. If you want to revoke a previously ...

How to revoke Poa IRS?

If you need to revoke an IRS power of attorney agreement or withdraw a representative, you must first write “REVOKE” across the top of the first page and include a signature and date below the annotation. Then, you will need to mail or fax a copy of the document to the IRS. If you need to file a Form 2848 with the IRS, Community Tax has the tools and resources to assist you. You …

How to complete form 2848?

Jul 18, 2019 · An IRS Form 2848 revocation is a fairly simple matter to take care of. There are two ways you can do this. If you have a copy of the IRS Form 2848, you can simply write the word “REVOKE” across the top. You also need to sign the form …

How do you revoke a form 2848 power of attorney?

How do I withdraw from power of attorney?

How long is a form 2848 valid?

Where do you file and withdraw forms 2848 and 8821?

Can power of attorney be changed without consent?

How do I change power of attorney from one person to another?

Which of the following is required for a taxpayer to revoke an IRS power of attorney?

If you want to revoke a previously executed power of attorney and do not want to name a new representative, you must write “REVOKE” across the top of the first page with a current signature and date below this annotation.

How far back can a 2848 cover?

Who can be a representative on form 2848?

Does an IRS POA expire?

What is the purpose of IRS form 8821?

Should I use form 2848 or 8821?

Why would a CPA give access to your tax information?

If you’re audited by the IRS, granting a CPA access to your sensitive tax information would be beneficial because they’ll handle the situation with the auditor. A family member could be given IRS POA to access your taxes if you have a medical condition that hinders your ability to communicate.

Can a lawyer sign a tax return?

Additionally, there are situations, such as being injured, experiencing a disease, or traveling outside of the United States, that would allow authorized tax professionals to sign your tax return.

What is Form 2848?

IRS Form 2848 is a document provided by the IRS that authorizes an individual to appear before them on your behalf. Due to federal laws, the IRS is required to keep your taxpayer information confidential, so Form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them.

Do you need to file Form 2848?

Due to federal laws, the IRS is required to keep your taxpayer information confidential, so Form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them. For an individual to be granted this authority, they must be an eligible representative. This includes:

Can a third party make financial decisions?

For example, a third party who is granted power of attorney to make medical decisions for the principal (someone who has granted power of attorney), cannot also make financial decisions unless specified in the IRS POA document.

What is a 2848 Power of Attorney?

For financial and tax-related purposes, an IRS Power of Attorney Form 2848 may be drafted so that an agent may make tax-related decisions on someone else’s behalf with the IRS.

Who can be a representative for the IRS?

Many people may be an authorized representative on IRS Power of Attorneys, including a family member. However, it’s a good idea to select a credentialed tax professional such as an attorney, CPA, or Enrolled Agent who can represent a client before any department of the IRS.

What to do when filing Form 2848?

There are certain instructions you have to follow when filing the IRS Form 2848: 1. Commit to Understanding Key IRS Concepts and Updates First. Even if someone else handles your filing for you, you still need to be updated with the latest revisions to avoid IRS penalties and other complications. 2.

Is 8821 a power of attorney?

Regardless of whether you file tax Form 8821 or Form 2848, you are ultimately responsible for any tax liability you might incur. Like other official IRS forms, these power of attorney forms are available on the IRS official site.

What is a 2848 form?

The IRS calls Form 2848 the Power of Attorney and Declaration of Representative Form. It allows you to authorize a tax specialist to represent you in negotiations with the IRS. Take note that you need to cede authority to a certified tax specialist and not just anybody. The IRS only allows you to give authority to an intern accountant ...

Can a woman hand a document to another woman?

A woman hands a document to another woman in an office. There might be cases when you want someone to be able to receive and/or inspect tax documents that would otherwise be confidential. You can file Form 8821 if the person you want to represent you doesn’t meet the requirements for the Form 2848 form as noted above.

Why is Form 2848 used?

The IRS created and maintains the Tax Form 2848 to allow professionals to lighten your tax obligations by freeing you of the manual work of having to file returns and forms yourself, or negotiating for your best interests. To use it responsibly, remember it is just a tool and not an escape hatch from liability.

Can a specific specialist be a representative?

The specific specialist is only able to be your representative in front of customer services personnel and auditors. Another requirement when you use IRS Form 8821 is the person is only able to discuss tax returns they themselves have filled out and signed.

Where to mail Form 2848?

The completed Power of Attorney and Declaration of Representative Form (IRS form 2848) should be mailed to the appropriate regional IRS office. There are three national centers that receive paperwork – in Tennessee, Utah, and Pennsylvania.

Who is considered eligible to practice before the IRS?

This means people with appropriate formal credentials, such as lawyers, tax accountants, actuaries, and other professionals, family members of the primary filer, and those with appropriate tax-preparation training.

Who can be a stand in for the IRS?

This means people with appropriate formal credentials, such as lawyers, tax accountants, actuaries, and other professionals, family members of the primary filer, and those with appropriate tax-preparation training. Once granted power of attorney, the agent is empowered to act as a stand-in in dealings with the IRS.

What is Form 2848?

Form 2848 requires that the authority that is granted is time specific – so the agent will have the power to request and view tax records, prepare and sign agreements, consents, and waivers, and tackle other administrative matters for just the specified year or years.

How long can a primary filer have access to a future record?

And the representative may be granted advanced access to future records up to three years beyond the present filing year.

What is a 8821?

Form 8821. Form 8821, Tax Information Authorization, is used to obtain taxpayer information. It does not hold the same weight as Form 2848 (i.e., Form 8821 does not allow a practitioner to represent a client in any way).

What is a 8821 form?

Form 8821, Tax Information Authorization, is used to obtain taxpayer information. It does not hold the same weight as Form 2848 (i.e., Form 8821 does not allow a practitioner to represent a client in any way).

What is a 8821 authorization?

A benefit of a Form 8821 authorization is the ability to use less - expensive staff to call the IRS and obtain IRS account information. If a practitioner lists his or her firm's name as the appointee on Form 8821, anyone from the firm may call the IRS and obtain information about the taxpayer. For example, the firm's secretary ...

Who can call IRS for 8821?

If a practitioner lists his or her firm's name as the appointee on Form 8821, anyone from the firm may call the IRS and obtain information about the taxpayer. For example, the firm's secretary or bookkeeper, instead of the tax manager or partner, could call the IRS to obtain a client's transcript. Considering that call - wait times have ...

Can a 8821 be copied?

This is because Form 8821 allows the appointee to be copied on all IRS correspondence. The appointee will then receive a copy of a client's notice at the same time as the client—allowing the practitioner the opportunity to determine how the client should address the matter.

Can an appointee receive a copy of a client's notice?

The appointee will then receive a copy of a client's notice at the same time as the client—allowing the practitioner the opportunity to determine how the client should address the matter. After all, sometimes clients ignore an IRS notice or do not understand its severity.

What is a third party designee on a 1040?

A CPA can complete the "Third Party Designee" section on a client's Form 1040, U.S. Individual Income Tax Return (often referred to as "checkbox authority"). This allows the CPA to discuss the processing of the client's tax return, including the status of tax refunds.

What is a power of attorney?

Your power of attorney may list a specific problem, a specific year, a specific form, or a broad range of time. This helps to make clear exactly what the professional is helping you with. It also protects your personal information that isn’t needed for that representation.

Is a power of attorney enough for the IRS?

A general power of attorney is not enough. The substitute form must contain all of the information required on the IRS Form. Your representative must also attach a Form 2848 (without your signature) for IRS tracking purposes.

Do you need a signature for Form 2848?

You must use an original, handwritten signature for signing Form 2848. Because of the importance of this form, the IRS does not accept electronic signatures.

Can a representative sign a refund check?

A representative may never sign or endorse your refund check or deposit it into their own account even with a power of attorney. A Form 2848 is not needed if a tax professional helps you to write a response to the IRS that is sent under your name and signature, but they will not have the power to follow up with the IRS.

What is a 2848 form?

About Form 2848, Power of Attorney and Declaration of Representative. Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

What is a 2848?

You can file Form 2848, Power of Attorney and Declaration of Representative, if the IRS begins a Foreign Bank and Financial Accounts (FBAR) examination as a result of an income tax examination.

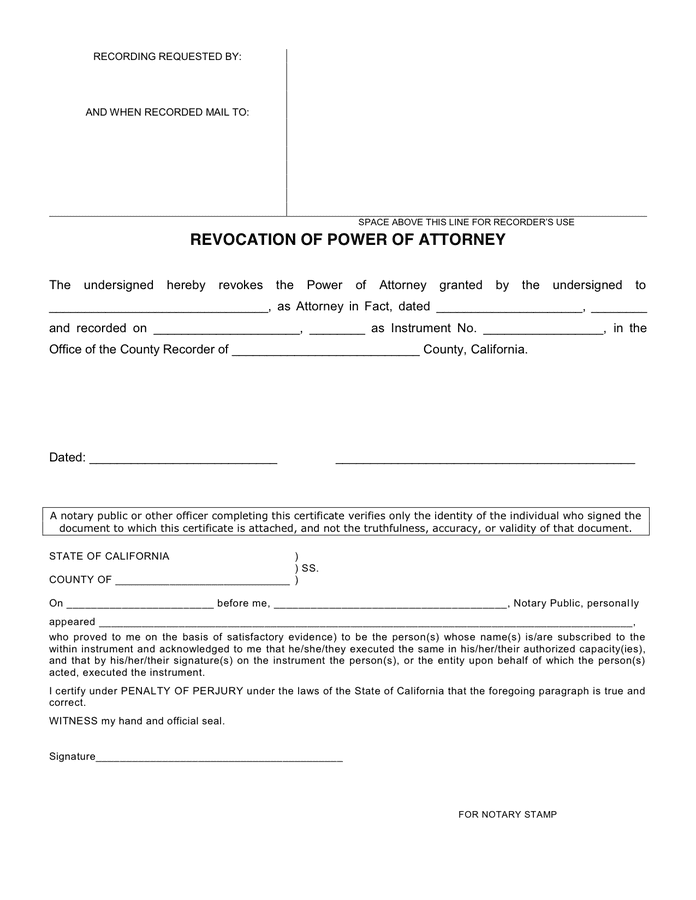

How to revoke a power of attorney?

A Power of Attorney is a legal document that grants power to an individual (the Agent) of your discretion, should you (the Principal) become incapacitated. A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document. The common reasons to revoke a Power of Attorney are: 1 The Agent is no longer interested in holding the Power of Attorney. 2 The Principal believes the Agent is not completing the requirements appropriately. 3 The Power of Attorney is no longer desired. 4 The Principal would like to change Agents. 5 The purpose has been fulfilled.

Who should be made aware of a Power of Attorney revocation?

Any third-parties that had copies of the previous Power of Attorney (i.e., financial institutions, healthcare or other agencies) should be made aware of immediately and a copy of the revocation should be supplied. Once all parties have been made aware, they are no longer legally able to complete business with the Agent.

Where should a revocation of a power of attorney be filed?

The revocation along with the new Power of Attorney, if applicable, should be filed in the same place the original Power of Attorney was filed (i.e., county clerk), to prevent it from not being recognized as a legal document in a court of law or other legal proceedings.

Can a power of attorney be revoked?

A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document.

Do I need a lawyer to revoke a power of attorney?

When revoking a Power of Attorney, a lawyer is not required. The legal consult can ensure all original Power of Attorney details (i.e. name, date, duties, statement of sound mind) are addressed in the revocation. Verbal revocations are not acceptable unless it was previously documented in the original Power of Attorney.

Can a power of attorney be revocable verbally?

Verbal revocations are not acceptable unless it was previously documented in the original Power of Attorney. Once the revocation of the Power of Attorney takes place, it will nullify the existing document and will serve as confirmation.

Can a principal be incapacitated?

However, a specific reason for revocation is not required. The Principal may not be incapacitated and must be of sound mind at the time of revocation. In the event the Principal is not in a competent state, the family may take measures in a court of law to complete the revocation.

Popular Posts:

- 1. how to oppuse a respond to an attorney request for attorney fees

- 2. rights to an attorney and when it attaches

- 3. how to find out if inmate has attorney

- 4. what does an attorney do when the defendant's amendment right are violated

- 5. what does it mean when an attorney is a councel in a firm

- 6. what if your attorney wants you to accept a crappy settlement in which he knows it is

- 7. what party is john mccormick coos county attorney

- 8. why does district attorney pay witness fee?

- 9. what does submit a review in an attorney page

- 10. who is the current attorney general for new york state