How to obtain power of attorney?

Mar 09, 2022 · How to Get Power of Attorney (5 steps) Step 1 – Understanding Your Needs. View and read the Types of Power of Attorney in order to get a better understanding... Step 2 – Selecting Your Agent (Attorney-in-Fact). An agent, also known as an Attorney-in-Fact, is the individual that... Step 3 – Creating ...

Why do I need a power of attorney record?

The attorney-in-fact does NOT have to be a lawyer and CANNOT act as an attorney for the principal. The attorney-in-fact must be a competent adult (18 years or older). The principal has the right to revoke or cancel the Power of Attorney at any time and may put a specific time limit in the document as to how long it is valid.

How do I revoke a power of attorney tax authorization?

Jun 23, 2015 · 4 attorney answers Posted on Jun 23, 2015 If they are your forms, you need to go to the attorney that drafted them. If they are not your forms, then it may be more difficult. Most POA forms are not "certified." The best option for a copy of a POA is to go to the drafter or the person that had them drafted, if it is not your POA form.

Where is my power of attorney on my tax return?

51 rows · An individual may get power of attorney for any type in five (5) easy steps: Step 1 – Choose an Agent Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

Does a power of attorney need to be recorded in California?

Where can I get a power of attorney form in Texas?

How do I get a power of attorney in Washington State?

How long is a power of attorney valid in Texas?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

Does a POA have to be recorded in Washington state?

What three decisions Cannot be made by a legal power of attorney?

Do you need to register power of attorney?

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

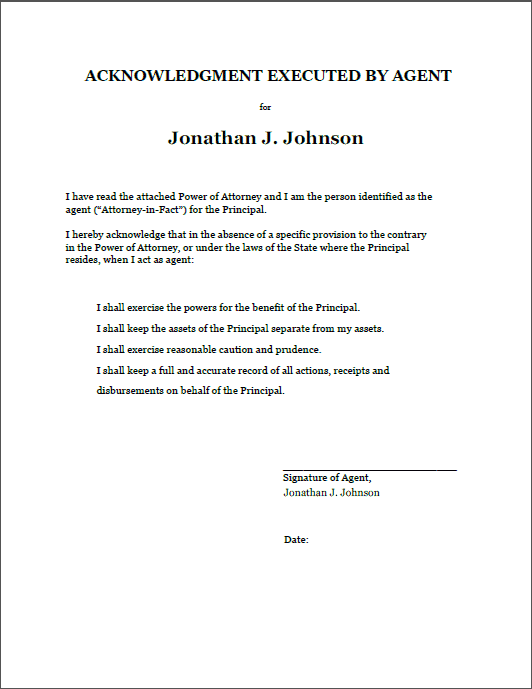

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

What is a power of attorney in Washington?

Create Document. A power of attorney form used by an individual (“principal”) to appoint someone else to handle their affairs (“agent” or “attorney-in-fact”). The agent is able to handle financial, medical, guardianship, or tax-related matters during the principal’s lifetime. If the form is durable, ...

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is banking banking?

Banking – To be able to deposit or withdraw funds in addition to conducting any type of financial transaction that the principal could also do themselves. Upon initials being placed on this line, the agent will have the full capacity to

What is a power of attorney?

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters. A Power of Attorney is a legal form but is NOT a court form. A Power of Attorney cannot be used to give someone the power to bring a lawsuit on your behalf. Only licensed attorneys can bring lawsuits on behalf ...

Who is the principal of a power of attorney?

The "principal" is the person who creates a Power of Attorney document, and they give authority to another adult who is called an "attorney-in-fact.". The attorney-in-fact does NOT have to be a lawyer and CANNOT act as an attorney for the principal. The attorney-in-fact must be a competent adult (18 years or older).

Can a court order a conservatorship?

The courts generally are not involved with Powers of Attorney, however, if someone becomes incapacitated or is unable to make their own decisions ( e.g., in a coma, mentally incompetent, etc.) and needs another adult to make decisions for them, the court may get involved to order a legal Guardianship or Conservatorship for the incapacitated person. ...

Michael Dominic Toscano

If they are your forms, you need to go to the attorney that drafted them. If they are not your forms, then it may be more difficult. Most POA forms are not "certified." The best option for a copy of a POA is to go to the drafter or the person that had them drafted, if it is not your POA form.

Jennifer Christine Vermillion

Usually a power of attorney is not required to be filed unless it is being used to sell real property. In that event, you can acquire a certified copy in the deed records of the County or Parish where the property is located.

Howard Clifford Hoyt

Did you go to a law office to sign the POA? If so, go to that office and ask for a copy. Somebody drafted them. Go to that person.

Benjamin James Borengasser

Your question is a little unclear. Powers of attorney are not generally publicly filed. If you need a copy of a power of attorney you signed, you should contact whoever had possession of the original and request a copy.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How many witnesses do you need to be a notary public?

In most cases, a Notary Public will need to be used or Two (2) Witnesses.

What is an advance directive?

An advance directive, referred to as a “living will” or “medical power of attorney”, lets someone else handle health care decisions on someone else’s behalf and in-line with their wishes. These powers include: Everyday medical decision-making; End-of-life decisions; Donation of organs;

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

What happens if you revoke a power of attorney?

When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization. Authorize Power of Attorney for a new representative for the same tax matters and periods/years.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

What is an oral disclosure?

Oral Disclosure. If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

How to verify a power of attorney?

Verify the authenticity of the power of attorney document presented to you. In many states, a power of attorney must be notarized. The presence of a notary's stamp and signature is usually enough evidence that the power is a legitimate document. If you're concerned, run an internet search for the notary and ask him or her to verify that the stamp on the document is the notary's official seal. Contacting witnesses is another avenue to explore. Often, powers of attorney bear the signature of an independent witness who watched the principal sign the power. See if you can contact the witness – the address should be written beneath the witness's signature – and ask if she remembers attending the signing.

What is a power of attorney?

A power of attorney is an instrument that a person uses to grant authority to an agent to act on his or her behalf. The two different types of instruments are health care and financial powers of attorneys. A third party preparing to transact business or take action in reliance on a power of attorney needs to verify who really does have authority ...

Where to check power of attorney?

Check the power of attorney records at the register or recorder of deeds in the county where the individual who created the instrument resides. In some states a power of attorney can be filed with the register or recorder of deeds. However, this is not the common practice today.

What happens if a power of attorney is not authentic?

If a power of attorney does not appear authentic to you, and you cannot independently verify its authentic ity, do not transact business with the purported agent. If the power of attorney turns out to be fraudulent, you can be held liable for any losses sustained by the alleged grantor through the transaction.

Who is Mike Broemmel?

Mike Broemmel began writing in 1982. He is an author/lecturer with two novels on the market internationally, "The Shadow Cast" and "The Miller Moth.". Broemmel served on the staff of the White House Office of Media Relations.

How to revoke a power of attorney?

A Power of Attorney is a legal document that grants power to an individual (the Agent) of your discretion, should you (the Principal) become incapacitated. A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document. The common reasons to revoke a Power of Attorney are: 1 The Agent is no longer interested in holding the Power of Attorney. 2 The Principal believes the Agent is not completing the requirements appropriately. 3 The Power of Attorney is no longer desired. 4 The Principal would like to change Agents. 5 The purpose has been fulfilled.

Can a power of attorney be revoked?

A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document.

Charles Adam Shultz

Im going to assume that your sister transferred the title to you and your sister under the power of attorney before your mom died. If not, the power could not be used to transfer title after your mother's death (the deed could be recorded after death, if executed during your mother's life). If not, probate is going to be necessary.

John P Corrigan

My colleagues are all correct as to the POA issues as will not help you now. You do not say whether Mom and Sister had a will or just one of them and not the other.

Joseph Michael Pankowski Jr

I agree with Attorneys Green and Sinclair. The power of attorney ceased to be effective at the time of your mother's death. Nevertheless, if the deed was executed prior to your mother's death, then the power of attorney was valid at that time.

Kelvin P. Green

I agree you need an attorney. The POA ceases to be valid on death. The title was set in 2005. Unless it was transferred prior to your Moms death, it must go through probate process....

Paula Brown Sinclair

Unless the POA granted your sister the authority to transfer real property and she did in fact execute a deed as attorney in fact for your incompetent mother, the POA is of no relevance now. Some form of probate procedure will almost certainly needed to bring the title to the house current.

Popular Posts:

- 1. how long is the term for attorney general of texas

- 2. how to pick the best workers comp attorney

- 3. how much does it cost for a estate attorney

- 4. how did jeff sessions become attorney general

- 5. how many extensions can attorney general file to respond to a brief

- 6. what is education attorney

- 7. the deputy attorney general has appointed a who reports

- 8. when was jaime alvarado attorney established in el paso tx

- 9. what kind of attorney is christopher h smith ponte vedra

- 10. how to be a housing attorney