Determine fair market salaries. Pay each individual on your team a fair market salary depending on factors such as their position, including your partners. Set firm and profit goals.

Full Answer

How do compensation schemes pay lawyers?

Most compensation schemes pay lawyers on the basis of the hours they’ve billed, rather than on the number of hours the firm collects. What a disaster. Collection realization rates are already taking a turn for the worse.

Are there any restrictions on compensation for an of counsel attorney?

In other states, ethics opinions have imposed some restrictions on methods of compensating "Of Counsel" attorneys. In California, for example, it is suggested that an "Of Counsel" attorney should be compensated on the basis of individual cases and should not share in the firm's general profit or expenses.

Are lawyer compensation systems hurting firms?

Jordan Furlong, international legal analyst at Law21 feels compensation, specifically lawyer compensation systems, are hurting firms. Is he right? When you hear what he has to say it certainly seems like he’s on to something. Are lawyers incentivized to work against their firms? Here’s what Furlong has to say about traditional compensation systems.

What is included in compensation for attorneys?

For employed attorneys, reported compensation includes salary, bonus and profit-sharing contributions. For owners, compensation includes earnings after taxes and deductible expenses before income tax. How much did attorneys earn overall in 2018? What was your 2018 compensation for providing billable legal services?

Are lawyers liable for mistakes?

Even where an attorney made an obvious mistake, that mistake must have injured the client. The classic example of negligence is the attorney who did not file a lawsuit before the statute of limitations expired.

How are attorneys regulated in the US?

There is no uniform national regulation of lawyers in the US. Lawyers are governed by rules of professional conduct and disciplinary commissions administered by their respective state supreme courts, which regulate the unauthorised practice of law, attorney liens and attorney office requirements, among other matters.

Which of the following is a factor in determining if a lawyer's fee is reasonable?

Factors to be considered as guides in determining the reasonableness of a fee include the following: (1) The time and labor required, the novelty and difficulty of the questions involved, and the skill requisite to perform the legal service properly.

What is it called when lawyers take clients money just to keep it?

Even If You Have Already Paid Your Lawyer, You May Be Entitled to Get Your Money Back. Fee disputes occasionally arise after the client has either (1) advanced money in anticipation of services to be rendered (often called a “retainer” or “advance”) or (2) tendered full payment for legal services already rendered.

Why do we regulate lawyers?

Public confidence in the administration of justice is served by ensuring lawyers abide by professional conduct rules and effectually permit clients to access and enforce their rights.

Are lawyers self-regulated?

Why are lawyers self-regulated? Self-regulation is a part of upholding lawyer independence. A lawyer's role is to provide advice on behalf of a client, sometimes in disputes involving the government or government institutions.

What is a reasonable fee?

Reasonable fees means transaction, rental, or other periodic charges which are directly related to the cost of furnishing a particular service, and which are proportionate to actual usage of the service by all persons using the service competing in the same market area and may include a return on invested capital and ...

What is a retainer fee for a lawyer?

The fixed retainer fee is a predetermined fee paid on a lump sum, in advance of any legal work to be performed. In corporations, for example, a general corporate retainer would include general corporate services such as drafting minutes and board resolutions, secretary's certifications, ant the like.

What is a true retainer fee?

In a “true” retainer fee arrangement, in exchange for the client's payment of an agreed-upon amount, the attorneys commit themselves to take on future legal work for the hiring client, regardless of inconvenience, other client relations, or workload constraints.

Why do attorneys keep two separate types of bank accounts?

Separate Client Funds Account The attorney trust account ensures the separation and security of client funds and helps law firms avoid accidently comingling client funds with law firm funds.

Can lawyers keep your money?

If there is a large sum of money involved or held for a long time, an attorney can hold the client's funds in an individual account, known as a Client Trust Account, and the interest earned will go to the client.

What are the minimum record keeping requirements for client funds?

When the State Bar asks you how much money you're holding for the client or what you've done with it while you've had it, you must tell the State Bar. For at least five years after disbursement you have to keep complete records of all client money, securities or other properties that are entrusted to you.

How do compensation schemes pay lawyers?

Most compensation schemes pay lawyers on the basis of the hours they’ve billed, rather than on the number of hours the firm collects.

How much higher are client fees when served by three practice groups?

Research shows, when clients were served by three practice groups revenues were 5.7 times higher than those served by one. Clients who were served by five practice groups generated fees that 17.6 times higher than those served by one.

What percentage of a partner's income is based on the firm's financial health and performance?

With this system, individual performance takes a back seat to the firm’s performance. Fifty percent of a partner’s income would be based on the firm’s financial health and performance. Forty percent would be based on a practice group or departments performance. Finally, ten percent would be based on individual performance.

Do firms prefer client longevity?

Firms prefer client longevity. Yet, competition makes that all but impossible. While 75 percent of clients working with a single partner would consider switching firms if that partner left, 90 percent served by two partners would stay with their firm if one left.

Who created the incentive compensation scheme?

In the 1940s, Hale and Dorr created the first incentive-based compensation scheme. The firm divided partners into three categories. Finder, the rainmaker who brings in the client. Minder, who’s responsible for managing the client. Grinder, the partner/associate who’s responsible for doing client work.

Is competition harmful?

It’s not just the missed opportunities of collaboration, it’s the harmful effects of competition. Competition works against the interests of firms, lawyers and partners.

Do lawyers get paid for writing downs?

Lawyers are incentivized to bill beyond their client’s wants/needs. They’ll be paid for that bad habit but the consequences of the coming writedown won’t appear for some time.

How often should a lawyer separate the processes?

Separating the processes requires a consideration of lawyer performance and least twice per year, which provides an opportunity to offer positive reinforcement, identify improvement areas, and impact current year results.

What is compensation plan?

A well-developed compensation plan can provide a roadmap for law firms and lawyers to derive the maximum benefit from their association. To start, firms should devise written compensation policies, guidelines, and incentives to ensure lawyers are paid competitively and commensurate with individual contributions. When firms add progression policies and guidelines to this pay structure, their lawyer groups are usually found to be more productive and satisfied.

How are profit driven bonuses determined?

Profit-driven bonuses determined by a transparent formula or process allows lawyers to know their bonus amount as the year progresses. The end of year process can include a meeting to review the predetermined economic reward and to review financial health factors.

What is an "of counsel" attorney?

For an "Of Counsel" attorney functioning as a salaried consultant, there may be a variety of bonus configurations, including those based on billable hours, billed and collected revenue, or percentage of contingency awards. The "Of Counsel" attorney could be given profit participation in the firm, which is often coupled with a straight gross revenue share of the fees paid by the attorney's clients. You can hire "Of Counsel" attorneys as independent contractors, as well. Frequently "Of Counsel" attorneys are provided with office space, administrative assistance, and medical or other benefits.

What is the ABA model rule of professional responsibility?

Under ABA Model Rule of Professional Responsibility 1.5 (e), if two lawyers from different firms are going to split a fee, it must be divided in proportion to the services performed by each lawyer, unless, with written consent of the client, the lawyers have agreed to assume joint responsibility for the representation.

What is an affiliation of counsel?

An affiliation that amounts to no more than a referral relationship, or that involves only one case, does not merit "Of Counsel" designation.

Why is it important to have an "of counsel" relationship?

An "Of Counsel" relationship is often done to provide prestige or additional knowledge and skills for the firm, but it's important to make sure that your clients know about the special relationship and what it means for them. FindLaw's suite of Integrated Marketing Solutions can not only help to get the word out, but can also help you reach more clients by taking a more dynamic approach to your firm's marketing strategy.

Do attorneys get compensated on the basis of individual cases?

In California, for example, it is suggested that an "Of Counsel" attorney should be compensated on the basis of individual cases and should not share in the firm's general profit or expenses.

When did the ABA issue its landmark opinion on the "Of Counsel" relationship?

When the ABA issued its landmark opinion on the "Of Counsel" relationship in 1990, however, it took a more modern approach, stating that the method of compensation is not relevant to determining whether an affiliation may be designated "Of Counsel.". Some states such as Michigan and New York are in accord with the ABA approach.

Is an attorney a partner or associate?

But because the "Of Counsel" attorney is not a partner or associate of the firm, some authorities find it only logical that the rules regulating division of fees between lawyers who are not in the same firm apply to the "Of Counsel" relationship such as in Arizona, California, and Maryland.

What happens when an employee of an existing client becomes a client of the firm?

When an employee of an existing client (other than a principal) becomes a client of the firm, the presumption will be made that the employee is a client of the attorney to whom the employer is attributed. There may be extenuating circumstances calling for a different result, and these circumstances should be brought to the attention of the Attribution/Compensation Committee.

Who is attributed the dollar amount of a paralegal?

Paralegals. All dollar amounts resulting from the work performed by paralegals shall be attributed entirely to the attorney to whom the client is attributed.

What is a client resulting from prior clients?

Clients Resulting from Prior Clients. In the case of a client attracted to the firm by reason of a lawyer's prior representation of another client, the new client shall be presumed to be the client of the lawyer to whom the existing client is attributed unless the new client was demonstrably attracted by the lawyer representing the existing client.

Who reviews origination attributions?

Attribution/Compensation Committee . All origination attributions should be reviewed by the Attribution/Compensation Committee in the same fashion that it reviews new clients. Independent inquiry should be made of new clients where there may be some question as of the appropriateness of attribution.

Is a firm client a client?

Firm Employee or Employee Referral. Whenever the firm is employed by one of its non-lawyer employees or by a client referred by such employee, the client should be considered a firm client and no origination attribution aware should be made.

What is GATS in legal services?

The General Agreement on Trade in Services (GATS) applies to all trade in services, including legal services. In August 2006, ABA House of Delegates voted to adopt Report and Recommendation 105 submitted by the Standing Committee on Professional Discipline regarding General Agreement on Trade in Services (GATS) disciplines on domestic regulation. The policies: (1) support the efforts of the U.S. Trade Representative to encourage the development of transparency disciplines on domestic regulation in response to Article VI (4) of the GATS requiring the development of "any necessary disciplines" to be applicable to service providers; and (2) support the U.S. Trade Representative's participation in the development of additional disciplines on domestic regulation that are: (a) "necessary" within the meaning of Article VI (4) of the GATS; and (b) do not unreasonably impinge on the regulatory authority of the states' highest courts of appellate jurisdiction over the legal profession in the United States.

What is the Conference of Chief Justices National Action Plan?

Conference of Chief Justices National Action Plan on Lawyer Conduct and Professionalism. The 1999 Report makes recommendations regarding the courts, the bar and the law schools. The 2001 Implementation Plan adopted regarding the recommendations.

When was the ABA Commission on Ethics 20/20 created?

The ABA Commission on Ethics 20/20 was created in 2009 to address technology and global practice changes facing U.S. lawyers. Find out more.

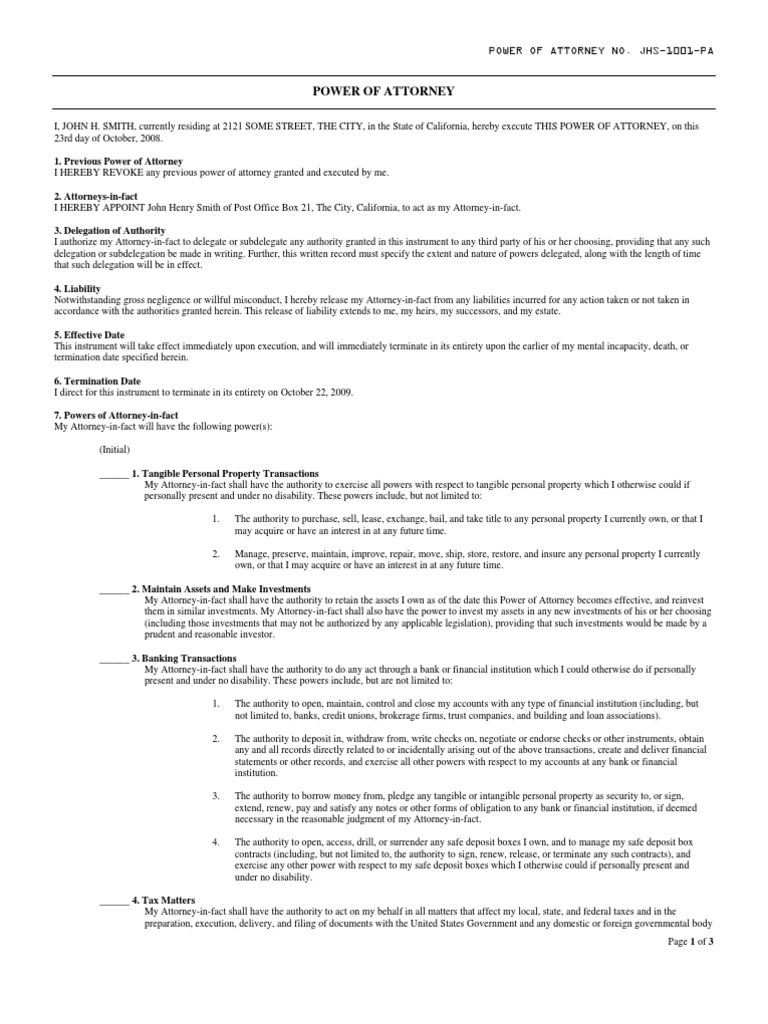

What is fair compensation for an agent?

What is Fair Compensation for Your Agent? As a general rule, it's best to provide for compensation in the document creating the trust or agency relationship. Michigan law provides that a trustee or an agent is entitled to "reasonable compensation" if provided for in the trust or power of attorney documents.

What is a trustee and an agent?

A trustee and an agent under a power of attorney are fiduciaries, meaning they are obligated to act honestly and ethically in the best interests of the person granting the power. Acting as someone's trustee or agent (also called an attorney-in-fact) is a great responsibility, and can be a fair amount of work depending on the circumstances. For this reason, trustees and agents are entitled to some compensation for their work. If the agent is a professional fiduciary, they usually set forth a fee structure for their work. But often, an agent is a family member, like an adult child. Under those circumstances, how much is it appropriate to pay one's agent?

How much does a trustee charge per year?

In Wayne County, Michigan, for instance, professional trustee companies might charge a fee between 1% and 1.5% per year of the assets managed. A personal representative of an estate who is not a professional might reasonably be paid $30-$40 per hour for their time spent on behalf of the estate. Paying a family member serving as an agent is a little trickier.

Do trustees get paid for their work?

For this reason, trustees and agents are entitled to some compensation for their work. If the agent is a professional fiduciary, they usually set forth a fee structure for their work. But often, an agent is a family member, like an adult child.

Who pays for court recovered compensation?

Court recovered compensation, is paid by the person or a company -- who is found to be responsible for the incident, or by their insurance company.

What is the purpose of civil litigation compensation?

Lawsuit compensation in a civil litigation is designed to redress the wrongdoing done to the plaintiff by way of financial help from the defendant. This compensation is the legal right of anyone who has suffered monetary losses or injury due to another person's actions.

What are the three types of damages awarded in a civil tort case?

There are three common types of damages awarded in a civil tort or wrongful death case: economic, non-economic and punitive ( Harvard Law ).

How are medical costs and lost wages calculated?

Both medical costs and lost wages can be calculated through receipts and a history of income. Determining how damages should be awarded for emotional distress is more complicated. Even so, these damages can play a major role in a personal injury suit. In some cases, the amount of damages recovered for pain and suffering dwarf the economic damages recovered.

What happens if someone is negligent?

If someones negligent or intentional actions resulted in your injury, loss or the death of a loved one, you have a legal right to pursue maximum compensation under the law. Depending on the circumstances a civil lawsuit may be filed by the victim, the victim's family, estate or heirs.

What is a financial award awarded by a plaintiff's personal injury attorney?

Any type of financial award won by a plaintiffs personal injury attorney, handed down from a judge or jury in a lawsuit, will be called compensation.

Why do we need a settlement conference?

For this reason, a settlement offer is often made early in litigation. If this settlement amount does not work for both parties, a settlement conference may be scheduled so each party can discuss their needs and reach an agreeable amount. Some courts even require this before a case will be heard by a judge.

What percentage of attorneys receive health insurance?

Three-quarters of attorneys receive some type of employment benefit. Liability coverage, health insurance and paid time off are most common. Ninety percent of attorneys who are employees receive at least some benefits, while more than half (56%) of solo attorneys reported receiving none of the benefits listed above.

How often do attorneys give back to the community?

Over half of attorneys give back to their community through legal pro bono work or financial donations. Men donate time to the community more frequently than women, with nearly half giving back once a week or more. Older attorneys engage in community service more often than younger attorneys, with 60% of those 55 or older giving back more than once a week.

How many hours do attorneys spend in court?

The majority of attorneys spend fewer than 20 hours weekly meeting with their clients or representing them in court or before other judicial bodies. Criminal defense/DUI attorneys continue to spend the most time meeting with clients – typically 20+ hours weekly – while intellectual property lawyers spend the least amount – less than 10 hours weekly. Attorneys representing businesses spent significantly less in-person time with clients, with a majority (61%) reporting that they spend fewer than 10 hours weekly.

How much do attorneys make?

The majority of attorneys are employed by firms; a third are solo practitioners. While the earnings of solo practitioners increased to an average of $159,000 in 2018, their counterparts in small firms still earned more with an average of $213,000.

How much time do attorneys spend on bills?

Most attorneys (76%) spend at least 20 hours on billable work weekly other than meeting with clients or representing them in court. This includes billable time spent on legal research, document filing, administrative/managerial work, etc. Attorneys who serve only businesses spend considerably more time on legal research, document filing, etc. than those serving only consumers.

How much do medical malpractice attorneys make?

Attorneys who identified medical malpractice as their primary area of practice reported earning the most in 2018 with an average $267,000 annual ly, up from $214,000 in 2017. Intellectual property attorneys, the highest earners in 2018, dropped 6.6% to $224 million. The largest drop was reported by probate attorneys, whose earnings decreased from an average of $171,000 in 2017 to an average of $137,000 in 2018. Immigration attorneys continue to earn the least with an average of $134,000, a small increase over 2017 reported average earnings of $131,000.

How much less income do female attorneys make?

A gender-compensation gap exists among solo practitioners and attorneys employed at small firms, with female attorneys reporting receiving 36% less income in 2018 than their male counterparts. Some of this disparity may be attributed to the number of years spent practicing law, with female attorneys reporting substantially fewer average years (16.3) in practice than their male counterparts (22.7). A higher proportion of female attorneys also represent consumers, where reported income in 2018 was less than that of attorneys primarily representing businesses. 20172018 Male Female $220˜

Popular Posts:

- 1. what happened to attorney kenneth bergers files

- 2. what are ususl attorney fees for will probate suffolk county ny

- 3. how much does attorney charge for chap 13 fee in el paso

- 4. how do you get advance directive or power of attorney on someone how has passed

- 5. what is it called when an attorney looks into your past

- 6. when is an attorney husband allowed to represent his wife in court

- 7. when you dont have an attorney for a collection summons

- 8. where did america get the right to an attorney

- 9. who was corrine brown's attorney

- 10. when was john ashcroft attorney general