How do you register a power of attorney?

Apr 22, 2011 · Leave a Comment. A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized. However, once your agent is appointed via a valid Power of Attorney, he or she simply has to present the document at the institution where business is to …

Does power of attorney have to be recorded and?

Mar 09, 2022 · How to Get Power of Attorney (5 steps) Step 1 – Understanding Your Needs. Step 2 – Selecting Your Agent (Attorney in Fact) Step 3 – Creating the Document. Step 4 – Signing / Execution. Step 5 – Storing the Form (s)

How to create a power of attorney?

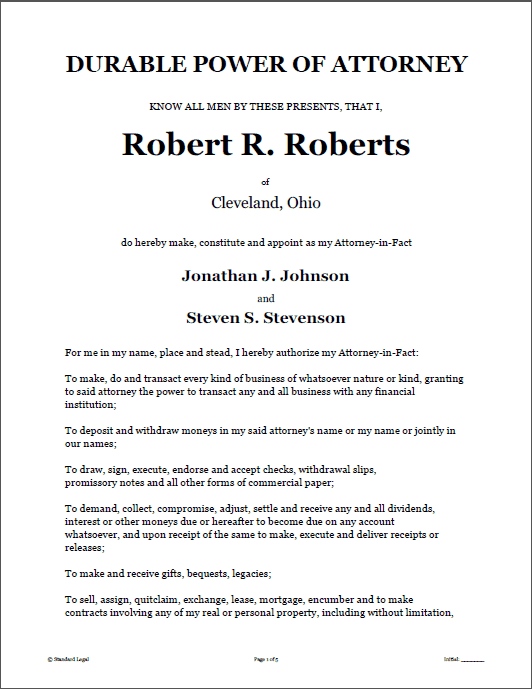

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters.A Power of Attorney is a legal form but is NOT a court form.A Power of Attorney cannot be used to give someone the power to bring a lawsuit on your behalf. Only licensed attorneys can bring lawsuits on behalf of the individuals they represent.

What can you do with a power of attorney?

How to fill out power of attorney form? o Idaho Legal Aid has an interactive online form (listed below). o Designate your “Agent.” o Record your Power of Attorney. II. Power of Attorney Forms and Idaho Statutory Law • https://courtselfhelp.idaho.gov/ • http://www.idaholegalaid.org/node/2232/parental-power-attorney

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is an agent in law?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent.

Does power of attorney matter in which state?

A: The power of attorney must be tailored for the state in which your parent resides. It does not matter which state you live in, as long as the power of attorney is applicable to the principal’s state of residence, which in this case is your parent, is what matters.

What is a power of attorney?

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters. A Power of Attorney is a legal form but is NOT a court form. A Power of Attorney cannot be used to give someone the power to bring a lawsuit on your behalf. Only licensed attorneys can bring lawsuits on behalf ...

Who is the principal of a power of attorney?

The "principal" is the person who creates a Power of Attorney document, and they give authority to another adult who is called an "attorney-in-fact.". The attorney-in-fact does NOT have to be a lawyer and CANNOT act as an attorney for the principal. The attorney-in-fact must be a competent adult (18 years or older).

Can a court order a conservatorship?

The courts generally are not involved with Powers of Attorney, however, if someone becomes incapacitated or is unable to make their own decisions ( e.g., in a coma, mentally incompetent, etc.) and needs another adult to make decisions for them, the court may get involved to order a legal Guardianship or Conservatorship for the incapacitated person. ...

How To Find Power Of Attorney Records?

Check the power of attorney records at the register or recorder of deeds in the county where the individual who created the instrument resides. In some states a power of attorney can be filed with the register or recorder of deeds.Dec 19, 2018

Do power of attorneys get recorded?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

What do I do if I lost my original Power of Attorney?

Hi, if it is lost file a police complaint for missing documents and also public notice through paper publication. If it is a registered Power of Attorney, then you can obtain certified copies from the jurisdictional Sub-Registrar’s Office.

What is proof of Power of Attorney?

A Power of Attorney is a document that gives one person (the attorney-in-fact) the legal authority to act on behalf of another person (the principal) and make decisions when the principal is unable to do so in areas such as real estate, business, finance, and more.

Who keeps the original Power of Attorney document?

Unless the power of attorney is to be used immediately, the original should always be retained by the principal in a safe place. The agent should be advised that he or she has been named as agent and should also be advised as to the location of the original and the number of originals that have been signed.

Is notarised power of attorney valid?

Notarising a power of attorney is as good as registration . Section 85 of the Indian Evidence Act applies to the documents authenticated by a notary. … A power of attorney attracts stamp duty which varies from State to State. Article 41 of the Karnataka Stamp Act prescribes the stamp duty leviable.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How to establish a power of attorney relationship?

To establish a power of attorney relationship, you must fill out and submit the correct FTB form. 1. Choose the correct form. 2. Fill out the form correctly. Representatives: Provide all available identification numbers: CA CPA, CA State Bar Number, CTEC, Enrolled Agent Number, PTIN.

Who can sign a business form?

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following: Printed name. Title (not required for individuals) Signature.

Who can sign FTB 3520-BE?

Examples: President. Vice President. Chief Financial Officer (CFO) Chief Executive Officer (CEO)

Popular Posts:

- 1. causes of action where attorney fees are recoverable by statute, new yorlk

- 2. how does the attorney general get appointed

- 3. when a states attorney is not right for the job

- 4. what documents are needed for power of attorney from incompetant person

- 5. hi by bus who pays -law -lawyer -attorney -legal

- 6. how many attorney generals served under obama

- 7. how to become a workers comp attorney

- 8. how to become a what's the difference in lawyer and attorney

- 9. how long does it take for someone to transfer power of attorney from jail

- 10. how long can an attorney try to collect on collections account