A statutory power of attorney short form is available on the Minnesota Attorney General’s Office website. This form is prepared according to statutory requirements. It allows a person to create a power of attorney, choose which powers they wish to delegate to their agent, and identify whether or not the power of attorney will be durable.

Full Answer

Who needs a power of attorney?

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters.A Power of Attorney is a legal form but is NOT a court form.A Power of Attorney cannot be used to give someone the power to bring a lawsuit on your behalf. Only licensed attorneys can bring lawsuits on behalf of the individuals they represent.

Who is the best personal injury attorney in Minnesota?

Jul 16, 2021 · What Are the Legal Requirements for Durable Power of Attorney in Minnesota? The state requires the document to have the following: In Writing Signed by the “Principal” (the Creator of the POA) in Front of a Notary Public Includes the Signature of Two Adult Witnesses (One of Whom Isn’t Related to the Principal or Acknowledged by a Notary Public

What powers does a power of attorney?

Email: [email protected]. Fax: 651-556-5210. Mail: Forms REV185i and REV185b: Minnesota Department of Revenue Mail Station 7703 600 N. Robert St. St. Paul, MN 55146-7703 Other power of attorney forms or documents:

Is power of attorney a legal document?

Tax Power of Attorney Minnesota Form – REV184 – Adobe PDF. The Minnesota tax power of attorney form (REV184) allows for an accountant or tax attorney to file taxes on behalf of the principal. Although a professional tax agent is recommended, this form can be used to appoint any third party as a representative.

Does a power of attorney need to be notarized in MN?

Under the Minnesota power of attorney statutes, the principal's signature on a Minnesota Power of Attorney document need not be acknowledged before a notary public. However, third parties may require it, and a Minnesota Statutory Short Form Power of Attorney document will look incomplete without such an acknowledgment.

What are the requirements for power of attorney?

In order to make a power of attorney, you must be capable of making decisions for yourself. This is called having mental capacity – see under heading, When does someone lack mental capacity? You can only make a power of attorney which allows someone else to do things that you have a right to do yourself.

How do you get power of attorney for someone who lacks capacity?

If you're sure the person hasn't got mental capacityStep one – check for an existing power of attorney. ... Step two – apply for the power to manage a person's financial affairs where there's no existing power of attorney. ... Step three – show the document to the relevant financial providers.More items...

How do I fill out a power of attorney in Minnesota?

0:082:35How to Fill Out a Minnesota Power of Attorney Form - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd there are six main forms for the state of Minnesota. So most popular being the durable financialMoreAnd there are six main forms for the state of Minnesota. So most popular being the durable financial which allows you to choose someone else to handle all your financial. Needs on your behalf.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

When should you appoint a power of attorney?

Putting in place a power of attorney can give you peace of mind that someone you trust is in charge of your affairs. If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future.

Do spouses automatically have power of attorney?

Spouses do not automatically have power of attorney. A spouse or other family member would still require legal authority to act on the behalf of the person. This means that without a power of attorney in place, there is the risk of strangers making decisions on their behalf.Dec 14, 2021

Do you need to register a power of attorney?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

Can you have 3 power of attorneys?

Yes, you can name more than one person on your durable power of attorney, but our law firm generally advise against it under most circumstances. First, there is no legal reason why you cannot name more than one person as your power of attorney - you can name 10 people if you want.

What is a durable power of attorney?

A durable power of attorney refers to a power of attorney which typically remains in effect until the death of the principal or until the document is revoked.

What is a Minnesota power of attorney?

The Minnesota general power of attorney form, also known as the “non-durable power of attorney,” allows for individuals to appoint representatives for monetary-related affairs. This type of arrangement is useful for individuals who are looking to have a third party handle any type of financial decisions or events on their behalf if they are not able or qualified to do so themselves. The representative is…

What is a power of attorney revocation form?

The Minnesota power of attorney revocation form, in accordance with § 523.11, allows individuals to cancel or void an existing power of attorney contract. In addition to completing and filing the revocation form, the principal must forward a copy to give notice to the agent whose authorization is being revoked. Until such notice has been received and all relevant third parties have been informed of…

What is a REV184 form?

The Minnesota tax power of attorney form (REV184) allows for an accountant or tax attorney to file taxes on behalf of the principal. Although a professional tax agent is recommended, this form can be used to appoint any third party as a representative. The agent will be authorized to access the principal’s confidential information, as well as request and execute financial documents. Once the form…

What powers can a power of attorney have?

A power of attorney may be a good idea for people who are unable or who may become unable in the future to manage their financial affairs or make other decisions for themselves. Examples of powers people can give to their agent are: 1 To use a person’s assets to pay their everyday living expenses. 2 To manage benefits from Social Security, Medicare, or other government programs. 3 To handle transactions with their bank and other financial institutions. 4 To file and pay a person’s taxes. 5 To manage a person’s retirement accounts.

What is the difference between a general power of attorney and a limited power of attorney?

A general power of attorney gives an agent the ability to act on a person’s behalf in all of their affairs, while a limited power of attorney grants an agent this authority only in specific situations.

What is the purpose of a retirement account?

To use a person’s assets to pay their everyday living expenses. To manage benefits from Social Security, Medicare, or other government programs. To handle transactions with their bank and other financial institutions. To file and pay a person’s taxes. To manage a person’s retirement accounts.

Do banks have power of attorney?

In addition, some banks and financial companies have their own power of attorney forms. Preparing additional, organization-specific forms may make it easier for an agent to work with certain organizations with which the principal does business. For general information (not legal advice) and sample forms, contact:

Can a principal revoke a power of attorney?

A principal can also revoke a power of attorney. For example, somebody facing surgery may complete a power of attorney on a temporary basis, but then revoke it once they are healed and out of the hospital.

What is a power of attorney in Minnesota?

A power of attorney is a legal document that authorizes another person to act on your behalf.

What is a general power of attorney?

The attorney-in-fact can be given the power to handle only a particular issue, thus creating a limited power of attorney, or to handle a wide array of legal matters, what’s known as a general power of attorney.

What are the different types of powers of attorney?

The following list contains a quick overview of three important varieties of powers of attorney: 1 Limited Power of Attorney: Limited powers of attorney are those that are created for a specific purpose. A good example would be if you are selling a house and want to designate a friend or family member to sign papers on your behalf. The power of attorney is situation specific and does not continue in the event that you become incapacitated. 2 Durable Power of Attorney: A durable power of attorney becomes effective when it is signed by the principal and will remain in effect until that person’s death. Durable powers of attorney remain effective even in the event of incapacity on the part of the principal, allowing the attorney-in-fact to continue carrying out their duties 3 “Springing” Power of Attorney: A springing power of attorney is different than a durable power of attorney in its effective date. Rather than going into effect at the time of signing, springing powers of attorney go into effect only once a principal is no longer able to make decisions for themself. Such documents wait in limbo until incapacity makes them “spring” to life.

When does a durable power of attorney become effective?

Durable Power of Attorney: A durable power of attorney becomes effective when it is signed by the principal and will remain in effect until that person’s death. Durable powers of attorney remain effective even in the event of incapacity on the part of the principal, allowing the attorney-in-fact to continue carrying out their duties.

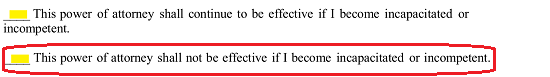

Is a power of attorney durable?

A power of attorney is durable when it remains valid after the principal becomes incapacitated. If you want your power of attorney to be durable, it’s important that you consult with a Minnesota estate-planning attorney that understands such matters and can ensure it is written in the required manner. In Minnesota, powers of attorney that do not ...

What Exactly is Power of Attorney?

When someone is granted Power of Attorney over another person, they are put in charge of making decisions for the specified, or in some cases all, legal and financial matters for that person. It is an actual document that must be signed, and there are a few different types of Power of Attorney that grant different decision-making abilities.

Can a Person be Paid for Power of Attorney?

In Minnesota, a person can generally be paid what is known as a “reasonable compensation” for the services they provide under Power of Attorney. However, you can draft up a POA document with an attorney that prohibits compensation.

Can Power of Attorney Ever Be Revoked?

A “mentally competent” person can revoke Power of Attorney in Minnesota at any time by submitting a written and notarized revocation. Your attorney can help you draft this.

What Types of Protection Are Available for Power of Attorney in MN?

Yes, there are forms of protection for people who are involved in Power of Attorney. If you would like to know more about your options, contact The Patrick J. Thomas Agency today.

How to prepare a power of attorney?

You don’t need an attorney to prepare a power of attorney. However, you should know that powers of attorney are required to be: 1 In writing; 2 Signed by you in front of a notary public; 3 Dated appropriately; and 4 Clear on what powers are being granted.

What is a power of attorney?

A power of attorney is a document authorizing someone to act on your behalf. You determine how much power the person will have over your affairs. Your power of attorney may be a general or limited power of attorney. A general power of attorney authorizes your agent to conduct your entire business and affairs.

What is the job of a social security agent?

Buy, sell, maintain, mortgage, or pay taxes on real estate and other property ; Manage benefits from Social Security, Medicare, or other government programs, or civil or military service; Invest your money in stocks, bonds, and mutual funds; Handle transactions with your bank and other financial institutions;

Popular Posts:

- 1. attorney client privilege is on what constitution right?

- 2. cases where client tells attorney he was guilty

- 3. what are normal closing attorney fees for nc

- 4. who is on the ballot in il for state's attorney

- 5. how much does a district attorney make in new york

- 6. attorney who played in pawn sacrifice

- 7. how to get a free attorney in florida

- 8. are attorney where to start

- 9. how much an attorney charge to.file an i-130 petition?

- 10. why an attorney when a death occurs