Steps for Making a Financial Power of Attorney in Kentucky

- 1. Create the POA Using Software or an Attorney ...

- 2. Sign the POA in the Presence of a Notary Public ...

- 3. Store the Original POA in a Safe Place ...

- 4. Give a Copy to Your Agent or Attorney-in-Fact ...

- 5. File a Copy With the Land Records Office ...

- 6. Consider Giving a Copy to Financial Institutions ...

Full Answer

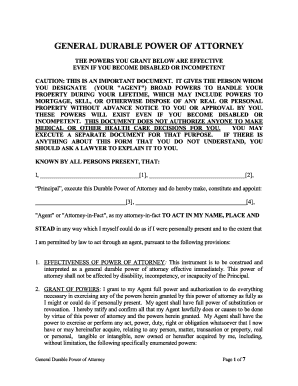

What is a durable power of attorney in Kentucky?

The Kentucky durable power of attorney form is used by individuals to appoint a third party as their attorney-in-fact to handle any and all monetary decisions on their behalf. The agent cannot compensate themselves and must act in the principal’s best interests in every transaction.

How to make your power of attorney?

You can create a power of attorney in multiple ways:

- Hire a lawyer to draw up a POA for you —Having a lawyer create a power of attorney for you is one of the most reliable options, but it is ...

- Write a POA letter on your own —If you have knowledge and experience in legal matters, you can try writing a POA on your own. ...

- Use a template —You can choose among a myriad of power of attorney templates online. ...

How to obtain a power of attorney?

Part 4 Part 4 of 6: Preparing Your Power of Attorney Document Download Article

- Download an appropriate power of attorney form. California makes it easy to access and create a power of attorney document.

- Name the parties. When filling out either form, the first step will be two identify each party to the power of attorney.

- Choose the powers you want the agent to have. ...

- Note powers that cannot or will not be conferred. ...

How to establish a power of attorney?

You can create a POA:

- By yourself —Make sure you meet your state legal requirements when preparing a power of attorney letter

- Use online templates —Pick an appropriate type of power of attorney and consult the state law to amend the downloaded sample accordingly

- Hire an attorney —Keep in mind that you might end up paying a hefty sum for this service

What powers of attorney are needed in Kentucky?

Kentucky Power of Attorney allow individuals to appoint third parties to act as their representatives. Most powers of attorney authorize the representative to make specific types of decisions (e. g., financial, medical, real estate, vehicle sale, etc.) on their behalf and are limited in their duration. Durable powers of attorney give the agent the authority to act for the principal if they become temporarily or permanently incapacitated. All power of attorney documents in relation to financial or medical matters must be signed with at least two (2) witnesses or be notarized.

What is a Kentucky limited power of attorney?

The Kentucky limited power of attorney form is used to appoint an agent to handle specific financial decision (s) on the principal’s behalf. The agent has a fiduciary duty to act in the principal’s best interests and the form usually cancels upon: Completion of the task of event At a specified time Incapacitation of the Principal In order for the form to be legal for use,…

What is a minor power of attorney in Kentucky?

The Kentucky minor power of attorney form permit s a parent to designate an agent to make health care and educational decisions on behalf of their child.

How many witnesses are needed for a power of attorney?

All power of attorney documents in relation to financial or medical matters must be signed with at least two (2) witnesses or be notarized. Laws – KRS Chapter 457 (Uniform Power of Attorney Act) Sort By : Title Newest Oldest Rating.

What is an attorney in fact?

The attorney-in-fact will be responsible for, among other things, dealing with banks, government departments, creditors, debtors, and investments on behalf of the principal. Unlike a durable power of attorney, this contract does not remain valid if the principal should become incapacitated or mentally disabled. It should….

Why is it important to have a power of attorney in Kentucky?

It is important for you and your loved ones to prepare a power of attorney document in case of a debilitating illness or injury that causes incapacitation. This document allows someone to manage your personal and financial affairs and handle important documents. In Kentucky, this is called “durable power of attorney.” If someone wants to grant you power of attorney in Kentucky, they must prepare a document granting you this right.

What should be included in a power of attorney?

It should contain the full name of the principal, his Social Security number, a list of personal and financial assets, your full name, your address and your phone number. It should list the duties granted to you and state that you have full authority to perform them on ...

Where to keep power of attorney?

An attorney should also have a copy and the originals. Additional copies should be kept in a safe place such as a portable fireproof box or a safe deposit box.

What Types of Power of Attorneys Are Available in Kentucky?

You can make several different types of POAs in Kentucky. In particular, many estate plans include two POAs that are effective even if you become incapacitated:

What Are the Legal Requirements of a Financial POA in Kentucky?

For your POA to be valid in Kentucky, it must meet certain requirements .

Who Can Be Named an Agent or Attorney-in-Fact in Kentucky?

Legally speaking, you can name any competent adult to serve as your agent. But you'll want to take into account certain practical considerations, such as the person's trustworthiness and geographical location. For more on choosing agents, see What Is a Power of Attorney.

When Does My Financial Power of Attorney End?

Any power of attorney automatically ends at your death. A durable POA also ends if:

What is a power of attorney in Kentucky?

Kentucky power of attorney forms let a person transfer authority to another individual to manage and transact their business or medical affairs. These types of forms can be useful if a person is expecting to be unavailable for a period of time, has a transaction that he or she would like someone else to handle for them, ...

What is durable power of attorney?

Durable (Statutory) Power of Attorney – The durable form allows a person to convey financial authority to another. Such power continues, unless revoked, even after the principal is declared incompetent.

Can you revoke a power of attorney?

Revocation of Power of Attorney – You can use a revocation form to revoke any type of power of attorney.

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

How many steps are required to get a power of attorney?

An individual may get power of attorney for any type in five (5) easy steps:

Why Have Power of Attorney?

Accidents happen. Any person who should become incapacitated through an accident or illness would need to make arrangements beforehand for their financial and medial affairs.

What does revocation of power of attorney mean?

Revocation Power of Attorney – To cancel or void a power of attorney document.

What is a general power of attorney?

General ($) Power of Attorney – Grants identical financial powers as the durable version. Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent.

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Popular Posts:

- 1. my new attorney forgot to file substitution of attorney the day of hearing, who do i serve?

- 2. who needs a tax attorney

- 3. what is the difference between living will and power of attorney

- 4. where to submit power of attorney michigan

- 5. what does it mean to be a medical power of attorney

- 6. how to request a court appoited attorney

- 7. how long does it take to get social security with an attorney

- 8. what type of attorney handles harassment

- 9. why are there non attorney spokespersons

- 10. when does a springing power of attorney become active