Here are the basic steps to make your New York power of attorney:

- Decide which type of power of attorney to make. If you’re using your POA for estate planning purposes, consider a...

- Decide who you want to be your agent. You should speak to this person beforehand and make sure they’re willing to serve...

- Decide what authority you want to give your agent. What financial...

- Decide which type of power of attorney to make. ...

- Decide who you want to be your agent. ...

- Decide what authority you want to give your agent. ...

- Get a power of attorney form. ...

- Complete the form, sign it, and have it witnessed and notarized.

How do you apply for power of attorney in NYC?

Here are the basic steps to make your New York power of attorney: Decide which type of power of attorney to make. If you’re using your POA for estate planning purposes, consider a... Decide who you want to be your agent. You should speak to this person beforehand and make sure they’re willing to ...

Does power of attorney need to be notarized in NY?

Sep 16, 2020 · Creating a power of attorney in New York by using the official form (both financial and medical) will increase the chances that it will be readily accepted by those with whom your agent will need to conduct business. A different form may be questioned if it appears different from the New York form that is familiar.

What is New York state power of attorney?

If you need a Power of Attorney in New York, call the elder law and estate planning attorneys at The Law Offices of Michael Camporeale at (718) 475-9639

How to get power of attorney in New York?

Mar 16, 2022 · Select Power of Attorney under the Services menu. Select File a power of attorney from the drop-down menu. Complete the required data fields. Print and sign the form. Scan and attach the signed form to submit.

Do you need a lawyer for Power of Attorney in New York?

No. You're not required to hire a lawyer. However, because a Power of Attorney is such an important legal instrument, the careful consumer will consult a lawyer who can: provide legal and other advice about the powers that are appropriate to be delegated.

How much does a Power of Attorney cost in NY?

between $200 and $500How much does a Power of Attorney cost in NY? The cost of finding and hiring a lawyer to create a Power of Attorney could be between $200 and $500.

Does a New York Power of Attorney need to be notarized in New York?

In New York, a Power of Attorney should be signed and dated by the principal with a sound mental capacity, and it is acknowledged in the same manner as a conveyance of real property, which means it has to be notarized (N.Y. General Obligations Law 5-1501B).Jul 1, 2020

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What expenses can I claim as power of attorney?

You can only claim expenses for things you must do to carry out your role as an attorney, for example:hiring a professional to do things like fill in the donor's tax return.travel costs.stationery.postage.phone calls.

How long is a Power of Attorney good for in New York?

In most estate plans, these POAs are what are known as "durable" POAs, which means that they retain their effectiveness even after you're incapacitated. It's a good idea for most people to create these two documents, as they help plan for the unexpected.

What is the best Power of Attorney to have?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

Who can be a witness for a Power of Attorney?

Witnessing the attorney's signature on a power of attorney Here are the rules on who can witness a lasting power of attorney this time: The witness must be over 18. The same witness can watch all attorneys and replacements sign. Attorneys and replacements can all witness each other signing.

What is a power of attorney?

A power of attorney is a legal document that allows you to appoint an individual or individuals to represent you before the department. If you are a legally appointed fiduciary, you must submit evidence of your authority to act for the taxpayer. For more information, see What you can file: Other documents.

Can you file a POA after you die?

You will need to file a new POA for the representatives that you want to retain. A POA is not valid after you (the taxpayer) die.

Can you revoke a POA on a 9/10?

If you file a POA on the (9/10) or earlier version of Form POA-1, you will revoke all POAs previously filed with the Tax Department for the same matters. If you file a power of attorney other than Form POA-1, you will automatically revoke a previously filed POA to the extent specified.

What is a power of attorney?

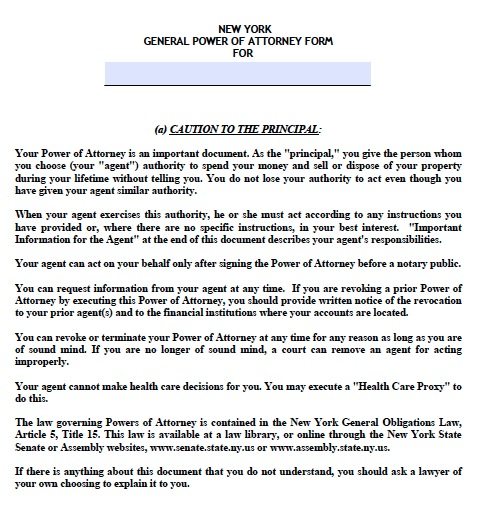

A Power of Attorney is a powerful document. Once you appoint someone, that person may act on your behalf with or without your consent. We strongly urge you to consult an attorney before you execute this document.

When is POA required in New York?

The law governing the requirements for a POA changed effective June 13, 2021. Any POA executed on or after June 13, 2021, must comply with the new requirements under New York’s General Obligations Law, Article 5, Title 15.

What is NYSSLRS POA?

The NYSLRS Special Durable Power of Attorney (POA) document allows someone else, referred to as the “agent,” (for example, a trusted friend or family member) to act on your behalf regarding retirement benefit transactions. You may choose to designate a power of attorney in case of emergency, hospitalization or unexpected illness, but keep in mind that it is not necessary to wait until an emergency occurs to file your NYSLRS POA form.

What happens if your NYS SLRS agent is not your spouse?

If your agent is not your spouse, domestic partner, parent or child, they will have “gifting authority ,” however, if you wish for this agent to have the authority to designate himself/herself as your beneficiary, you must grant this authority in the “Modifications” section of the NYSLRS form (page 4, section g).

What is gifting authority?

Special authority that you may grant to your agent. You may also intend for your agent to have “ gifting authority ,” which means they will be able to: Direct deposit money into a joint bank account; Elect a pension payment option that provides for a beneficiary; and.

When will POAs be reviewed?

POAs executed before June 13, 2021, will be reviewed in accordance with the laws in effect at the time the POA was executed. For example, for Statutory POAs executed between September 1, 2009 and June 12, 2021, an SGR needed to accompany, or be made a part of, your POA for your agent to have gifting authority.

When will POAs be executed in 2021?

POAs executed on or after June 13, 2021, that use an old Statutory POA form or otherwise do not comply with the requirements of the new law, will be invalid. If you have any questions about the execution requirements for a POA or the requirements of New York’s General Obligations Law, Article 5, Title 15, we suggest you consult an attorney.

What is a POA in New York?

Power of attorney (POA) is the legal authority for a person, business, or financial institution (the “agent”) to act in the place of another person (the “principal”). You need to a power of attorney form to grant this authority. Which New York State (NYS) power of attorney form you need depends on the powers you’re transferring.

What is a durable power of attorney?

A durable power of attorney is set up so the agent can act on the behalf of the principal when the principal is deemed mentally or physically incapacitated. These forms take effect immediately (unless noted otherwise) and remain in effect until they are revoked or the principal dies.

What is a notarized signature?

The dated and notarized signature of the agent (s) Specific language required by statute, which are already included on our state form. The principal or agent may authorize another person to sign and date the form. This is usually done in a fiduciary capacity, such as by an attorney.

Is a power of attorney durable in New York?

New York is one of several states in the US wherein a power of attorney is presumed to be durable. If you wish to create a non-durable power of attorney, you need to explicitly state so in the POA document.

What is a limited power of attorney in New York?

The New York limited power of attorney form is used to elect an attorney-in-fact for the purposes of representing the principal in one or a group of specific financial matters. Often this arrangement will terminate upon completion of the task (s) or upon the termination date contained in the agreement, whichever occurs first. An example of a useful limited power of attorney application would be if…

What is a durable power of attorney in NY?

The New York statutory durable power of attorney form authorizes an attorney-in-fact to manage a person’s financial matters in perpetuity after the document’s execution, even in the event of incapacitation. The appointed attorney-in-fact should be someone close to the principal, a person who is capable but also trustworthy. Once the power of attorney form is signed, the attorney-in-fact will be able to represent the principal when…

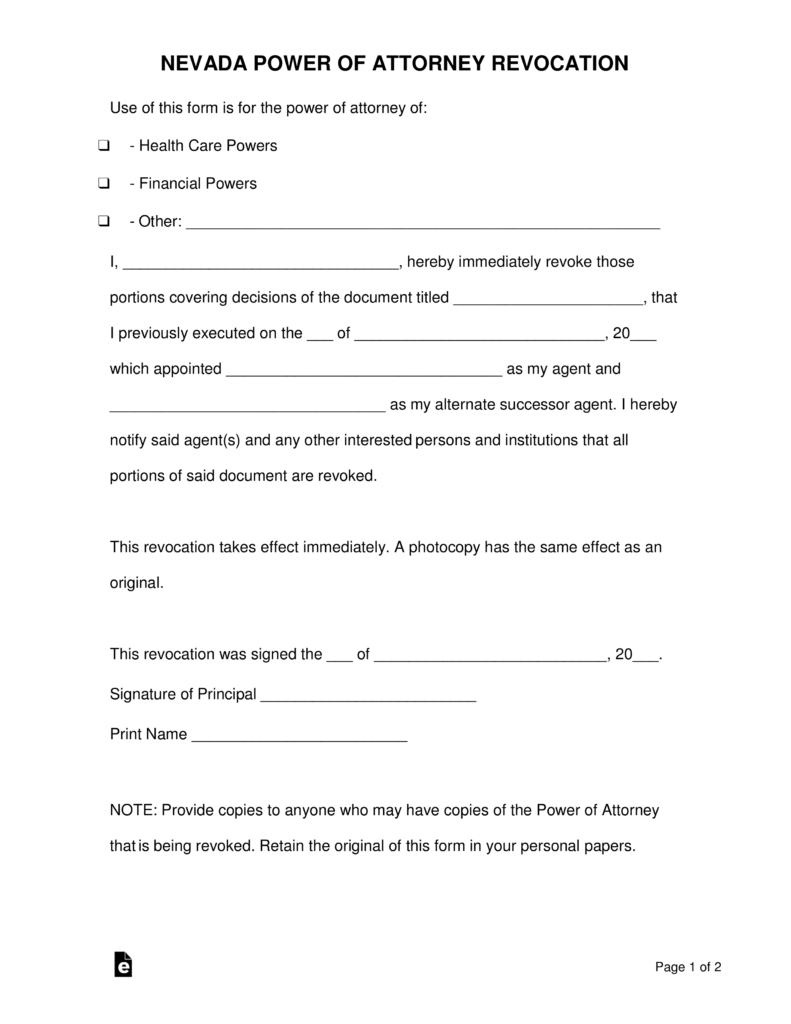

What is a NY revocation POA?

A New York revocation power of attorney form can be used to cancel an existing power of attorney form. Whether a durable, general, medical, or limited power of attorney is in place, this revocation form will immediately terminate the desired power of attorney, as long as it’s properly executed. The principal needs to send copies of this revocation POA to any and all individuals/entities who…

What is a NYS POA-1?

The New York tax power of attorney form, also known as Form POA-1, allows the principal to appoint someone to handle their tax matters with the New York Department of Taxation and Finance. Most likely, the appointed individual will be a certified accountant, attorney, or some other type of tax professional.

What is a minor power of attorney?

The New York minor power of attorney form is a document that parents can use to authorize a third party to temporarily have parental rights over their child. This type of arrangement is usually used during a period of a parent’s absence due to work, military deployment, illness, or education. The designated attorney-in-fact will be able to make decisions regarding the child’s education, health care,…

Is a power of attorney durable?

A general power of attorney is not durable, so this arrangement terminates if the principal becomes unable to make competent decisions for themselves; i.e., incapable of revoking an agreement. It would be best if the attorney-in-fact was close (both geographically…. 122,029 Downloads. Email PDF. Download PDF.

Why is a remedy for damages included in a POA?

Including a remedy for damages is intended to address the issue of financial institutions and other third parties rejecting POA forms for reasons not relevant to validity. The new legislation creates a presumption that a POA form is valid and permits courts to award damages.

What does an affidavit from an agent mean?

An affidavit from an agent should certify that the agent in question does not believe that that the POA is invalid or has been revoked or modified before the execution of the affidavit or has had any changes that may affect the agent’s authority in the transaction.

Can a power of attorney be invalidated in New York?

Under current New York law, to have a valid power of attorney or statutory gift rider, both forms must be written precisely with strict adherence to the statute . This has caused documents to be invalidated in practice due to insignificant errors, which could have severe repercussions. Strict adherence is especially damaging when a principal suffers ...

Does Allowing Damages apply to POA?

Allowing damages will apply only to unreasonable denial to accept an agent’s authority under a statutory short form POA that substantially complies with the statute. Thus, this change will incentivize third parties to accept valid POA forms, since there will be a repercussion for unreasonable rejection.

What happens if a third party refuses to accept a POA?

A third party’s refusal to accept the new POA could result in financial penalties. If a special proceeding is initiated to compel the third party to honor the POA, “the court may award damages, including reasonable attorney’s fees and costs, if the court finds that the third party acted unreasonably in refusing to honor ...

How long does it take to honor a POA?

After the POA is presented to a third party, they must honor the POA or reject it in writing within 10 days. If the agent replies to the third party’s rejection notice, then the third party has an additional 7 business days thereafter to either honor the POA or issue a final rejection letter.

Can a POA be executed by a person?

A huge win for senior advocates is that the POA can now be executed by a person signing at the direction of and in the presence of the principal . The principal still needs capacity, but this new provision is helpful for a principal who is physically unable to sign the document.

Popular Posts:

- 1. in what circumstance would the plaintiff have to pay the defendants attorney fees

- 2. patent attorney how to become

- 3. what is the job of the chief investigator of the state attorney

- 4. what can you do if you feel your chapter 13 attorney didn't do his job

- 5. who plays the district attorney in dark knight

- 6. where to find attorney ratings

- 7. what can attorney do if client doesnt pay legal fees

- 8. how do you sign as power of attorney in maryland?

- 9. tennessee when can district attorney get search warrant for blood tests refused implied consent

- 10. how many challenges may an attorney make to excuse jurrors for a just cause